Sundry Photography/iStock Editorial via Getty Images

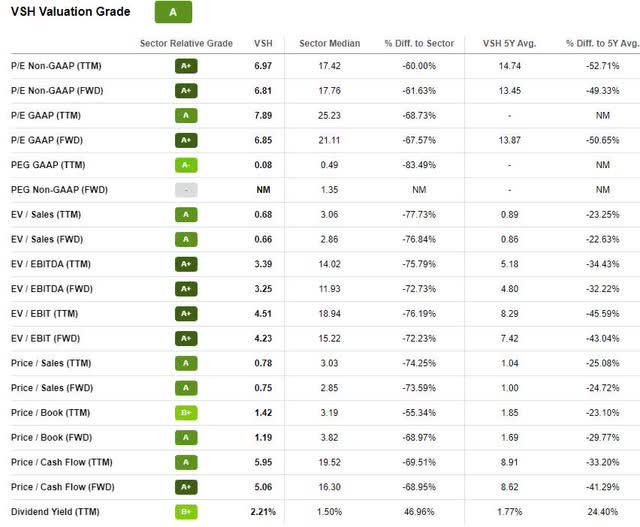

Vishay Intertechnology, Inc. (NYSE:NYSE:VSH) first came on my radar while I was screening for value stocks using pre-defined parameters. So, even before I begin my thesis on the company, it is imperative, though unconventional by SA standards, to present some of its valuation metrics right at the start.

Regardless of how you want to price it, Vishay looks cheap among all pricing metrics, be it price-to-book or EV-to-EBITDA. Considering these metrics, cheap actually looks like an understatement. But is the company really “cheap” or just another “value trap”? To really know the answer, I decided to dig into its financials and will be sharing some of my findings that stood out over the rest. But, before that, would like to point out something obvious – in the rest of the article whenever I use “Vishay,” I mean “Vishay Intertechnology, Inc.” and not “Vishay Precision Group, Inc.” which is a former subsidiary of Vishay Intertechnology, Inc. that was spun-off more than a decade ago and designs, manufactures, and markets specialized sensors, weighing solutions, and measurement systems.

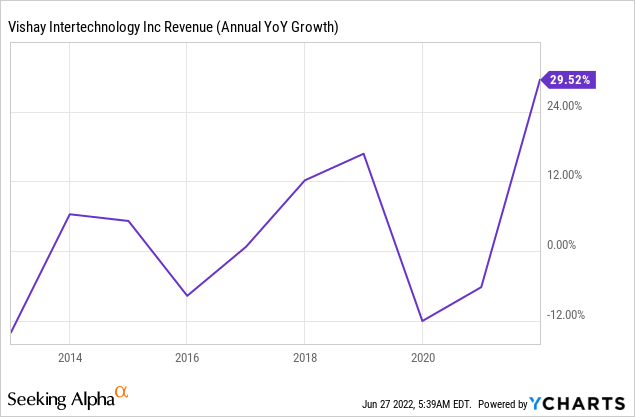

Historical Revenue Growth

Vishay’s annual revenue pre FY2021 stayed mostly in the range of $2.2-2.3 billion. Something that gets highlighted even more if we use the annual revenue growth chart.

As you can see, in the last 10 years, pre FY2021 y-o-y revenue either increased by 0-12+% or declined by the same magnitude. However, FY 2021 was a watershed year for Vishay as it was for most firms in the electronic component manufacturing and semiconductor business. Here’s how Vishay’s current CEO, Dr. Gerard Paul, described the year 2021 for the company and the industry during Vishay’s Q42021 earnings call:

The year 2021 in our industry will be remembered as a fairly unique year of a strong recovery, real, may I say, boom year, characterized by record orders, record backlogs, and lead times, and very low inventory levels in the supply chain. Virtually all market segments globally were flourishing, except for the automotive sector that suffered from shortages of supply which for sure will be temporary. Sales of the component manufacturers in 2021 more or less, were limited by the manufacturing capacities; shortages of supply continue to exist. Increased inflationary pressures on the cost commanded broad price increases, which were widely accepted by the markets. All regions remained exceptionally strong, showing a continued robust demand.

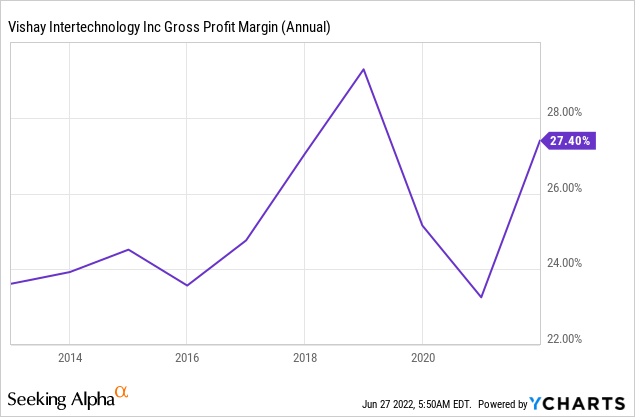

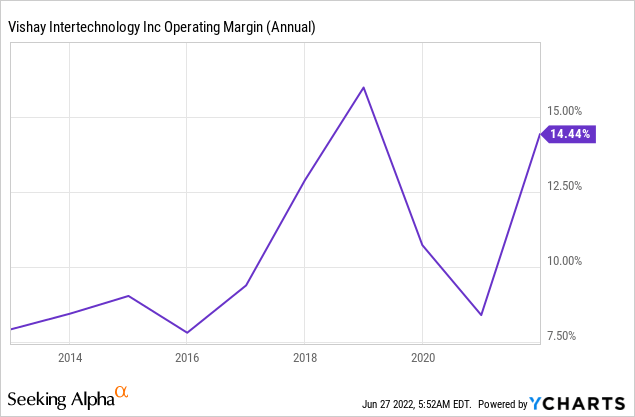

Historical Gross & Operating Margins

Apart from the effect of operating leverage, what becomes clear through these charts is, historically, the company has had gross margins of around 25% and operating margins close to 10%.

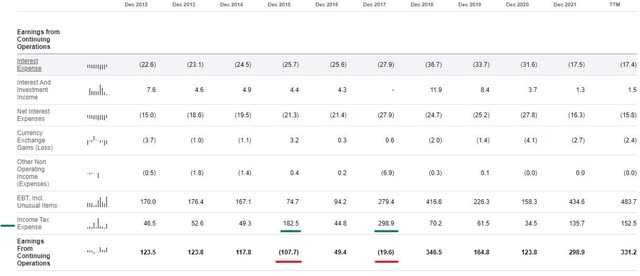

When we go further down the income statement, two years – FY 2015 and FY2017 – stick out like a sore thumb because, in both those years, Vishay reported huge losses primarily due to tax expenses.

Although I had an inkling that the huge income tax expense in FY2017 would primarily be because of the impact of the enactment of the Tax Cuts and Jobs Act (the “TCJA”), I also wanted to probe the reason behind the $182.5 million tax expense that was reported in FY2015. While going through the FY2015 10-K, here is what I found:

As part of the amendment and restatement of the revolving credit facility in December 2015, we completed an evaluation of our anticipated domestic cash needs over the next several years and our most efficient use of liquidity, with consideration of the amount of cash that can be repatriated to the U.S. efficiently with lesser withholding taxes in foreign jurisdictions. As a result of that evaluation, during the fourth quarter of 2015, we recognized income tax expense of $164.0 million, including U.S. federal and state income taxes, incremental foreign income taxes, and withholding taxes payable to foreign jurisdictions, on $300 million of foreign earnings which we expect to repatriate to the U.S. over the next several years.

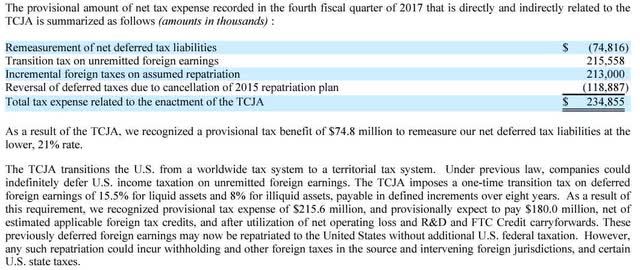

Furthermore, in its FY 2017 10-K, Vishay reported that it has terminated its 2015 cash repatriation plan as a result of the TCJA-

We repatriated $38 million and $46 million to the U.S. pursuant to this plan in 2017 and 2016, respectively. This 2015 repatriation program was expected to occur over a multiple year period in the most tax-efficient manner, considering U.S. tax laws and the impact of withholding taxes in foreign jurisdictions, and was designed to be adaptable to the extent necessary or prudent, based on changes in law, tax rates, or other regulations. As a result of the Tax Cuts and Jobs Act (“TCJA”), and as further described below, we have terminated the 2015 cash repatriation plan and replaced it as described below.

The company also provided a provisional amount of net tax expense recorded in the fourth fiscal quarter of 2017 that was, directly and indirectly, related to the TCJA.

Although most multinationals were impacted one way or the other by the enactment of TCJA, the impact in the case of Vishay seemed disproportionate, which leads me to my next point.

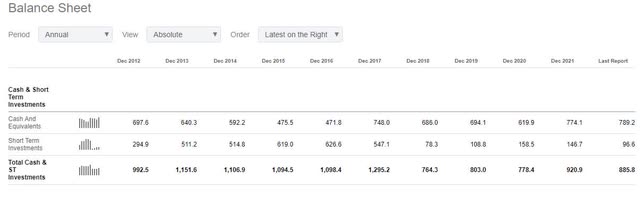

Cash (and loads of it)

Why does a company with ~ $2.5 billion market-cap sit on almost $800 million in cash, and short-term investments of almost $100 million, totaling close to $900 million? And, this is not something new, Vishay has been hoarding cash and ST investments for too long. Isn’t there an activist und or investor who can come and unlock close to $1 billion in shareholder value by pushing the company to distribute all that money to shareholders, to whom it rightfully belongs? Well, that leads me to my next few points.

Corporate Governance & Company History

Vishay was started in 1962 by a competent scientist with several patents to his name, late Dr. Felix Zandman, with a loan from a successful businessman and his paternal cousin, late Alfred P. Slaner. The company grew and strengthened its business both organically and through strategic passive component acquisitions beginning in 1985 and semiconductor acquisitions beginning in the late 1990’s. Dr. Zandman, apart from being an accomplished scientist, was also a holocaust survivor and the subject of a 2005 documentary “The Last Victory – the Story of Felix Zandman.” After Dr. Zandman passed away in 2011, his share of the company’s Class B stock got transferred to his family directly and via a family trust.

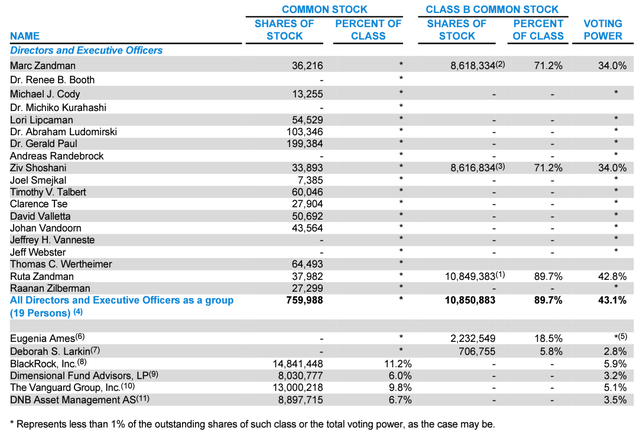

So, Vishay basically has two classes of stock – common stock and Class B stock. As of March 28, 2022, the company had 132,487,282 shares of common stock (excluding treasury shares) and 12,097,148 shares of Class B common stock outstanding. Each share of common stock outstanding and eligible to vote entitles the holder to one vote, and each share of Class B common stock entitles the holder to ten votes. Here’s how much voting power, the founder’s family (and friends) have currently:

Over 45% of the voting power of the Company’s board is in the hands of the founder’s family, which means that an activist investor can do zilch about what the company (or the family) decides to do with the money on the books.

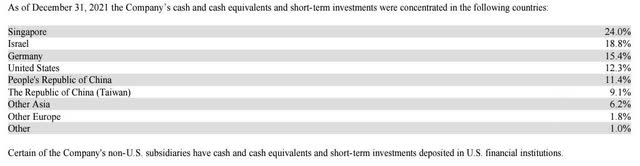

So, Where is All This Cash?

In its latest 10-K, Vishay provided this breakdown:

The 10-K also mentioned, that as of December 31, 2021, $895,363 of the Company’s cash and cash equivalents and short-term investments were held by subsidiaries outside of the United States.

Does the company have any plan to return cash to holders of common stock?

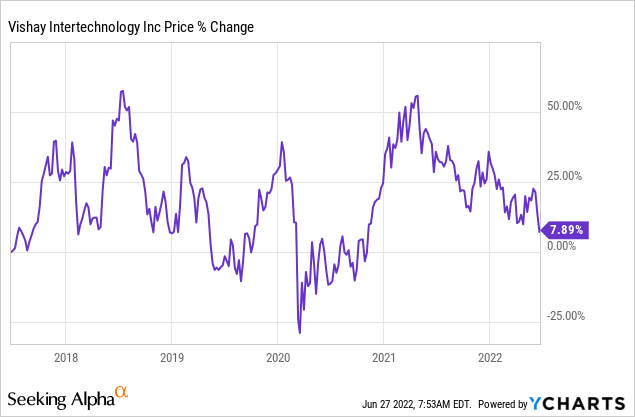

Well, if I was writing this a few months ago, I would have answered this differently, and the long-term shareholders of Vishay’s stock would have probably agreed with that, as the stock has gone up only ~8% in the last 5 years and dividends paid during that time is nothing worth mentioning.

However, this year on February 8, 2022, Vishay announced that its Board of Directors has adopted a Stockholder Return Policy that will remain in effect until such time as the company’s Board votes to amend or rescind the policy.

The new policy entails:

The Stockholder Return Policy calls for us to return at least 70% of free cash flow, net of scheduled principal payments of long-term debt, on an annual basis. We intend to return such amounts directly, in the form of dividends, or indirectly, in the form of stock repurchases. For 2022, we expect to return at least $100 million to stockholders consisting of approximately $58 million through our existing quarterly dividend program and at least $42 million through share repurchases. The distribution of earnings from Israel to the United States will initially be used to fund our Stockholder Return Policy. Over the long-term we expect to fund the Stockholder Return Policy from our historically strong cash flows from operations.

So, the company finally has decided to return cash to shareholders, albeit again conservatively. I mean, “at least 70% of free cash flow, net of scheduled principal payments of long-term debt” doesn’t sound too appetizing considering free cash flows (FCF) are called FCF because they are calculated after subtracting reinvestments(CapEx) from operating cash flows. Is Vishay acting too conservative because it has lots of debt it plans to pay down or because it has plans to do massive acquisitions in the future? Let’s see.

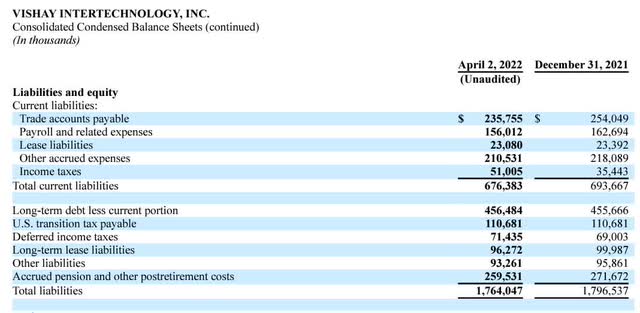

Debt

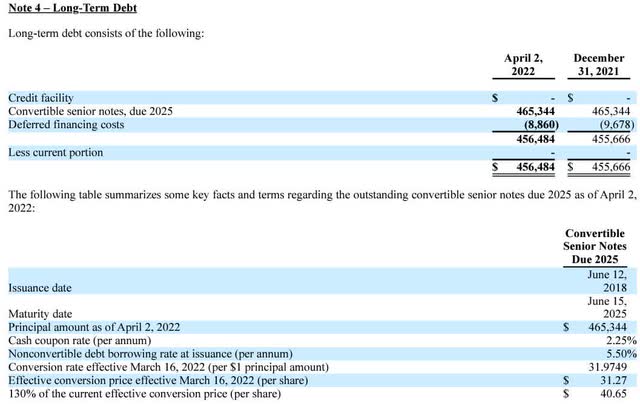

Ok, so according to Vishay’s latest 10-Q, the company had long-term debt of $456.48 million, and had no “current portion of long-term debt.” Moreover, its long-term lease liabilities also accounted for just $96.27 million. The only significant liability worth noting apart from these were the pension obligations of almost $260 million.

The debt seems pretty manageable, especially considering the fact that all of it is convertible debt. The company also has a revolving loan facility of $750 million which it rarely uses.

The convertible senior notes due 2025 have a coupon rate of only 2.25% and can be converted to common shares only if the stock trades above $40.65 for some time, which means the stock will have to go up by more than 120% from the current price before the bondholders can convert their debt to equity.

As one can see, debt doesn’t seem to be the reason Vishay’s management is so conservative in returning cash to shareholders. So, is future acquisitions the reason that’s holding them back?

Acquisitions

Early in its life, up until a few years ago, Vishay made several acquisitions, which mostly have been accretive to shareholders. These include Dale Electronics, Draloric Electronic, Sfernice, Sprague Electric, Roederstein, Vitramon, BCcomponents, the Semiconductor Business Group of TEMIC (Telefunken and Siliconix), the infrared component business of Infineon Technologies, General Semiconductor, selected product lines from International Rectifier, Huntington Electric, HiRel Systems, MCB Industrie, Holy Stone Polytech, and Capella Microsystems.

However, in the last few years, the company has found very few candidates that seemed reasonably valued and at the same time value accretive for Vishay’s shareholders. This can be gauged from both – 1) fewer acquisitions; 2) small ticket size of those acquisitions.

On January 3, 2019, Vishay acquired Bi-Metallix, Inc. (“Bi-Metallix”), a U.S.-based, privately-held provider of electron beam continuous strip welding services for $11.86 million. Then on October 1, 2020, the Company acquired the worldwide business and substantially all of the U.S. assets of Applied Thin-Film Products, a California-based, privately-held manufacturer of custom, build-to-print thin film substrates for the microwave, fiber optic, and life science industries for $25.82 million. And, its latest acquisition was on December 31, 2021, when it acquired substantially all of the assets of Barry Industries, a Massachusetts-based, privately-held manufacturer of resistive components for $20,847.

Looking at those acquisitions, it doesn’t make sense why Vishay’s management, apart from conservatism, chooses to return only 70% of FCF to shareholders.

Business & Operations

Vishay is one of the largest electronic component manufacturers in the world when it comes to the broad range of the number of products it sells and their applications in various industries. Broadly, the company’s products can be divided into two segments: semiconductors and passive components. Because it manufactures low-end semiconductors like MOSFETs and diodes, sometimes investors, club and also confuse it with other conventional semiconductor stocks that are more cyclical in nature. This is not to say that Vishay’s business is not cyclical, just that it is less cyclical than other pure-play semiconductor companies.

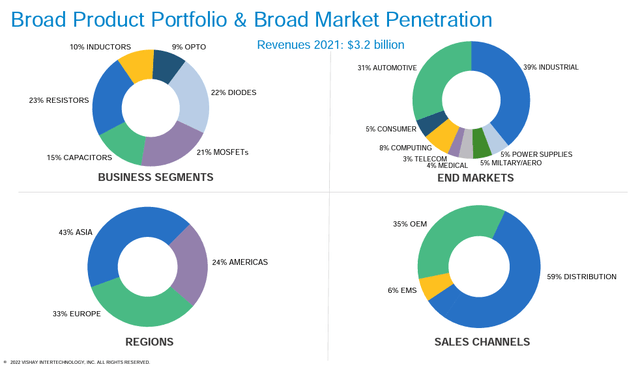

Vishay’s semiconductor segment is further divided into MOSFETs, Diodes and Optoelectronic Components segments. While its passive component segment constitutes of the Resistors, Inductors and Capacitors segment. Here is a breakdown of Vishay’s annual revenue by individual segments, end-markets, regions where those revenues are generated and sales channels-

Source- Vishay’s May 2022 Investor Presentation

Because its product mix is so fast, Vishay competes with several companies, mostly based in Asia. In some of its segments, it does compete with industry leaders like ON Semiconductor Corporation (NYSE:ON) and Broadcom Inc. (NASDAQ:AVGO) but largely its competition is diverse, which is a good thing.

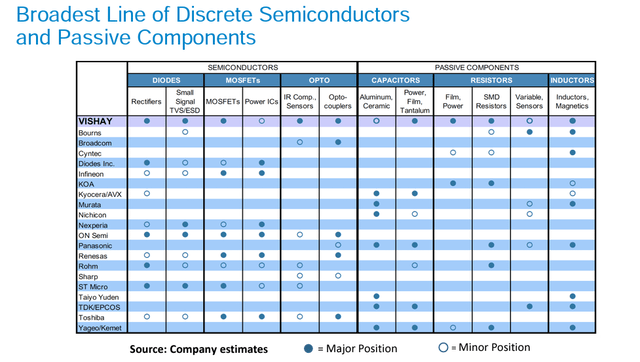

Source- Vishay’s May 2022 Investor Presentation

One interesting thing about Vishay, which I really like, is that it not only breaks down its product by segments. It also provides a breakdown of which products it classifies as ‘commodity’, “noncommodity,” and “custom products.” This breakdown is done both at an aggregate level and at an individual segment level. Any product which is completely interchangeable with a competitor’s product is classified as a “commodity product.”

Commodity products serve many markets. At an aggregate level, commodity products generally comprise about 35% to 40% of Vishay’s annual revenues. Any of Vishay’s standard products that may be sold to multiple customers, which is not completely interchangeable with a competitor’s product, is classified as a “non-commodity” product. Non-commodity products generally have a small number of competitors who have similar, but not exact, products. Non-commodity products typically serve a particular end-use market. Non-commodity products generally comprise about 40% to 45% of Vishay’s annual revenue at an aggregate level. Vishay also sells several custom products.

Usually, a custom product is designed for a specific customer, and such part number is sold to only that customer. Custom products generally comprise about 20% to 25% of Vishay’s annual revenues.

Cost Management

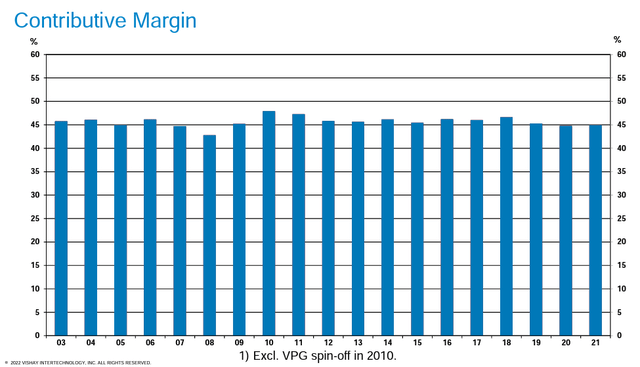

Source- Vishay’s May 2022 Investor Presentation

The company has maintained a contribution margin of 45-47% for almost two decades, which is nothing short of spectacular considering it operates in the electronic component manufacturing industry where the ASP (Average Selling Price) of semiconductor components have a history of gradual erosion over time. Vishay’s cost management strategy not only includes keeping its variable costs in check, but also a focus on controlling fixed costs recorded as costs of products sold or selling, general, and administrative expenses and maintaining the company’s breakeven point (adjusted for acquisitions). The company tries to limit increases in selling, general, and administrative expenses to the rate of inflation. At constant fixed costs, one could expect each $1 million increase in Vishay’s revenues to increase its operating income by approximately $450,000 to $470,000.

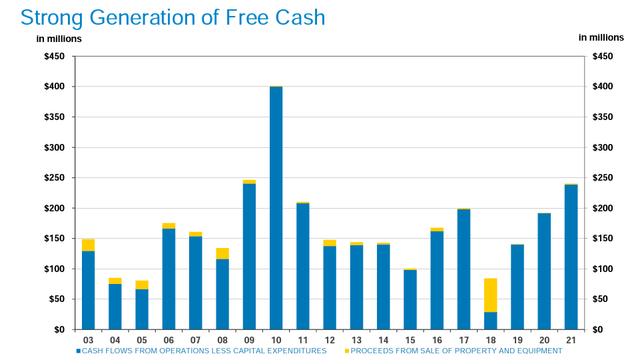

Cash Flows & Free Cash Flows

In each of the last 20 years, Vishay has generated cash flows from operations in excess of $200 million and in each of the last 27 years, cash flows from operations have been in excess of $100 million. When it comes to FCF, Vishay has generated positive “free cash” in each of the past 25 years, and FCF in excess of $80 million in each of the last 20 years.

Source- Vishay’s May 2022 Investor Presentation

In FY2021, the company generated cash flows from operations of $457.1 million and FCF of $240.0 million. Even if one considers 2021 to be an abnormal year for Vishay, on a normalized basis the company can easily generate FCF of $150 million yearly based on its historical FCF.

Latest Quarter & Forward Outlook

On February 22, 2022, Vishay announced that Dr. Gerald Paul, who has been Vishay’s CEO since 2005 will retire as President and CEO effective December 31, 2022. Joel Smejkal, another Vishay veteran and currently executive VP, of corporate business development, has been appointed to succeed Dr. Paul as president and CEO.

For its most recent quarter ending April 2 (Q12022), Vishay reported EPS of $0.71 on revenue of $854 million, both beating analysts’ expectations by $0.13 and $9.86 million respectively. For the same quarter in the previous year, Vishay had reported revenue of $764.6 million and EPS of $0.49, which means a y-o-y growth of 11.7% and 45%, respectively. EBITDA for the period was $181 million or 21.2% of revenue.

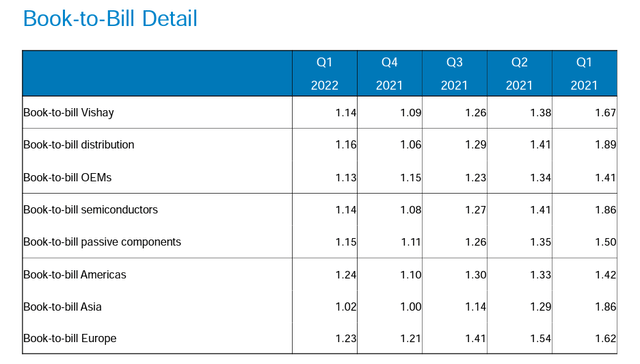

Vishay’s backlog during the quarter reached a new record of 8.5 months after 8.2 months in the previous quarter. The breakdown of backlog was- 9.3 months after 8.9 months in Q42021 in semiconductors and 7.6 months after 7.5 months in the previous quarter in passive components. This consistent strong demand was also visible in the company’s book-to-bill ratio.

Source- Vishay’s May 2022 Investor Presentation

Although the book-to-bill has come down from previous quarters, but it still remains above 1, which means that the strong demand for electrical components and semiconductors last year hasn’t totally died down and the current inflationary environment isn’t going to impact Vishay’s sales in near future as was being feared by the Street previously.

Here’s what the CEO, Dr. Gerald Paul, had to say about Vishay’s demand and Q2 outlook during Vishay’s most recent earnings call:

But at this point. There is absolutely no sign of a short-term, midterm slowdown. Backlogs are extremely high and still growing. Lead times remain long, supply chains are fairly lean and the important automotive sector is just at the beginning of recovery.

Trusting in a bright future, Vishay has accelerated expansion – it’s expansion programs of production capacities aiming at a 2% to 3% increase by quarter. Taking into account the present pandemic related disturbances in Shanghai, which in the second quarter will cost us at least $35 million of sales, we had Q1 rates guide to a sales range for Q2 of $830 to $870 million at a gross margin of 28.1% plus-minus 50 basis points.

Summing it All Up: Valuation & Takeaway

When I think of Vishay, I think of an old conservatively-run family business, which it is. But, not of an old conservatively-run family business that is in decline, which it is not. For individual investors, there are some – and very valid – concerns when it comes to the company’s corporate governance, capital structure and capital allocation decisions. However, the management seems to be making promising moves on those aspects, which is visible through its recently announced stockholder return policy and appointment of the successor of the current CEO.

Vishay’s stock has been a dud for the past 5-years, colloquially a ‘value trap’. However, I don’t think with recent changes, the stock will remain cheap for long. I started this article by providing all valuation (pricing) metrics at which the company’s stock currently trades. So, be it a forward price-to-book of 6.85 or a ttm EV-to-EBITDA of 3.29, the company will look cheap to an old-school value investor on all parameters. But is it really cheap?

To answer that I finally decided to do a DCF valuation of Vishay. I don’t think the company has enormous growth going forward, which entails not projecting FCF for many years. When I thought of a DCF model for Vishay the most accurate approach, according to me, was to value it like a growing perpetuity (terminal value). For my discount rate, instead of using the company’s 24-month market beta of 1.17, I took the electronics industry cash-adjusted unlevered beta of 1.3 and then also took into account that Vishay has more cash and ST investments, which brought its beta down and closer to 1. Based on that beta and the fact that Vishay operates globally (Revenue breakdown – 24% Americas, 33% Europe, 43% Asia) my estimate for Vishay’s current cost of equity was 10.14%.

My bear case for Vishay is that the company’s normalized FCF to equity investors is $200 million (less than the $240 million reported last year and taking input from previous years). In that same bear case, I have assumed that the company’s FCF to equity investors will only grow by 3% long-term. Taking both those things into account, the current value of equity I get for Vishay is around $2.85 billion, which after taking out the impact of SBC translates to a per-share value of close to $20. Even in my bear case the stock currently trading at $17.92 is trading at more than 10% to its value. It is not hard to see that if one plays with the discount rate or FCF even a little bit, the stock will look considerably undervalued and an upside potential of 30-50% cannot be ruled out.

A note on risk – The current macroeconomic environment is volatile, which means concerns about interest-rate risks can dwarf fundamental improvements in any asset class. Vishay’s fundamentals can also be negatively impacted if an adverse macroeconomic environment persists.

Be the first to comment