piranka

Datadog, Inc. (NASDAQ:DDOG) recently reported a very strong Q2 with revenue, margins, and EPS all coming in much higher than consensus expectations. With a Rule of 40 score in excess of 90, it’s no surprise DDOG continues to hold one of the richest valuations in the market. The combination of market leading revenue growth and consistent operating margin profitability around 20-25% are unparalleled and deserving of a premium.

However, the company is seeing some impact from the more challenging macro environment and while their 2022 guidance was raised, it was raised less than the Q2 beat, implying a potentially slowed second half of the year.

Longer-term, management has reiterated their confidence in the growth and profitability trajectory of the business, as the ongoing digital transformation and transition to the cloud are industry tailwinds for many years to come.

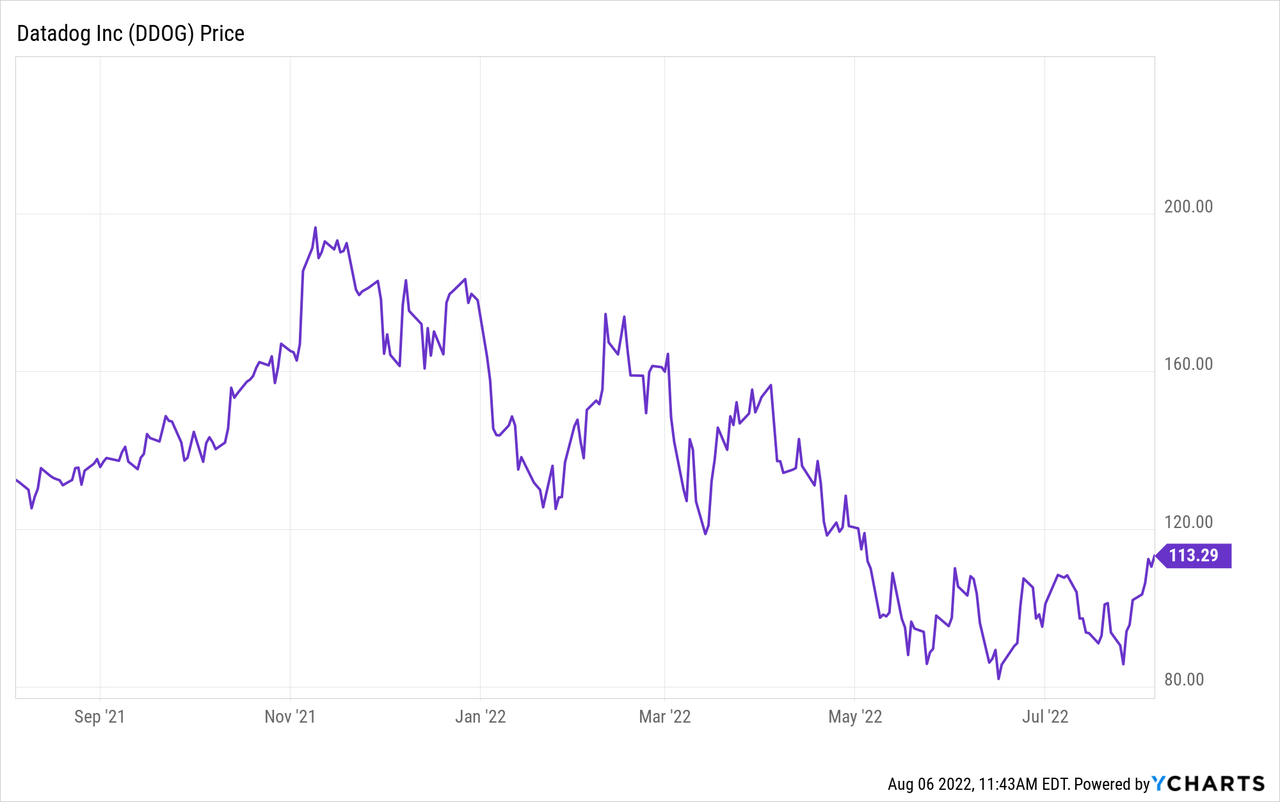

The stock remains down over 30% year to date and is currently over 40% below their all-time high. As with many software stocks over the past 12 months, DDOG was prone to the investor rotation out of fast-growth, high-valuation names as fears around a potential recession increased.

DDOG has a current forward revenue multiple in excess of 20x, however, 2022 revenue growth is still expected to be around 57% yoy, despite the ongoing macro challenges. In addition, DDOG has maintained their strong operating profit margin of 20%+, which is pretty unique given their significant top line growth.

I continue to believe long-term investors will see a lot of value creation over the coming years, though they will need to hold onto the stock through a lot of volatility. Especially if we were to enter into a recession and interest rates continue to climb higher, high-valuation stocks may have a difficult time outperforming the market.

Nevertheless, DDOG provides a consistently strong combination of industry leading revenue growth and ongoing margin strength, giving me continued confidence in the long-term trajectory of the business, despite the premium valuation they rightfully deserve.

Financial Review and Guidance

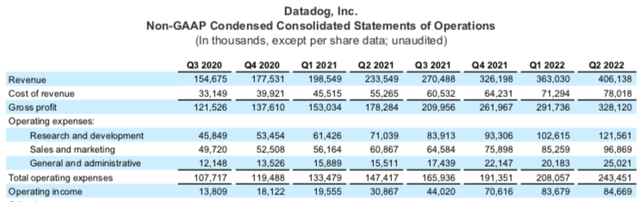

Datadog reported Q2 revenue growth of 74% yoy to $406 million, which handily beat consensus expectations for $381 million, or a near 7% revenue beat. While the company’s revenue growth did decelerate from the 83% yoy growth last quarter, it remains very impressive for revenue to be growing this quickly, even as the company scales and approaches a $2 billion run-rate.

Datadog

On top of the ongoing strong revenue growth, they reported non-GAAP operating income of $84.7 million, reflecting a 21% margin. This gives the company a Rule of 40 score of 95. What continues to impress me the most from DDOG is their ability to maintain strong operating margins, even as they continue to significantly expand their revenue base.

Not surprisingly, the better than expected revenue combined with strong margins led to non-GAAP EPS of $0.24 during the quarter, easily beating expectations for $0.09.

Datadog

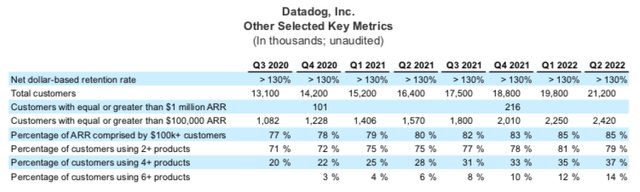

In addition, the company continues to see success as they move further up market and serve larger enterprises. At the end of Q2, the company had 2,420 customers with >$100k of annual recurring revenue, which is up from 1,570 in the year-ago period, reflecting a 54% yoy increase.

This becomes extremely important during more challenging macro economic conditions as larger enterprises (or larger deals) tend to be more recurring and very sticky. If the macro environment continues to deteriorate, even as enterprises look to reduce their investments, they are not likely to cut large, highly-critical work contracts, such as DDOG. While smaller customers may be at more risk during a downturn, the strength of DDOG’s enterprise/larger customers give me ongoing confidence in their recurring revenue.

In addition, net dollar-based retention rate continues to remain very healthy at >130%, which essentially means revenue would be growing >30% just from the company’s existing clients.

Another interesting metric that continues to impress me is the company’s ability to cross-sell products, enabling customers to increase their product usage. At the end of Q2, 14% of customers used 6+ products, which is up from just 6% in the year-ago period. Typically, the more products a customer uses, the less likely they are to churn.

Datadog

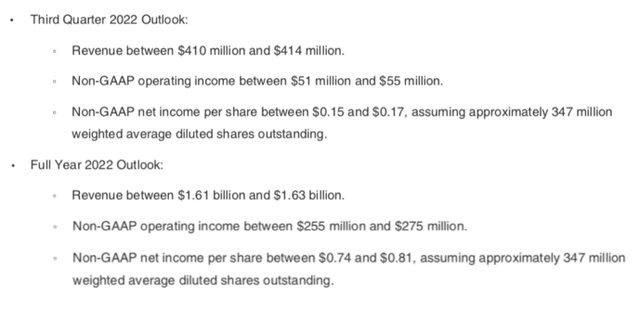

For Q3, DDOG is expecting revenue of $410-414 million, which was lower than consensus expectations for $425+ million. Non-GAAP operating income of $51-55 million implies a margin around 13%, which would be a little weak relative to recent quarters.

For 2022, the company now expects revenue of $1.61-1.63 billion, or 57% yoy growth, and while this is up from their prior guidance of $1.60-1.62 billion, Q2 revenue beat by $25 million. This essentially means that the company lowered the guidance for the remainder of the year as the Q2 beat was not fully passed through to higher guidance. In addition, non-GAAP operating income is expected to be $255-275 million, which is up a little bit from the prior guidance of $240-260 million.

The disappointment from the quarter largely stemmed from weaker than expected guidance metrics. While not surprising that the company is being a little more cautious around their growth expectations given the current macro environment, investors were expecting more from this fast-growth company.

We recognize the macro environment is uncertain as we look into the back half of 2022. But we also see no change to long-term trends towards cloud-based services and modern DevOps environments, and observability remains critical to that journey.

So we plan to continue to invest in our strategic priorities to execute on these long-term opportunities. At the same time, we will continue to closely monitor the demand environment and recalibrate further if necessary to balance our long-term investments with financial strength.

Longer-term, management remains confident in their ability to execute and sees the macro environment as current growth headwinds, but nothing that will fundamentally change their business over the coming years. The company is also experiencing some margin pressures, which is another reason why their updated guidance was a little underwhelming.

Now, as regards to our margin guidance, I wanted to point out, first, gross margins have recently been at the top of our historical range. In operating expense, we have returned to in-office attendance, travel and events. We estimate that this was a 300-basis point sequential margin impact in Q2, and we expect an additional 100-basis point sequential margin impact in Q3. As Oli mentioned, in Q4 we will hold our Dash user conference, and we will participate in the AWS re:Invent, our largest trade show event of the year. The cost of these events will be approximately 400 basis points of margin impact.

While we plan to continue to invest, we will remain judicious and disciplined in our cost structure given macro uncertainties. As indicated by the guidance, we expect non-GAAP operating margins in the second half of 2022 to be in the low double-digits.

Overall, while the guidance update was a little disappointing, nothing is changing in the company’s longer-term trends. And the near-term pressures will likely subside over the coming quarters as the global macro environment improves. The secular shift in favor of digital transformation and moving to the cloud far outweighs these near-term headwinds.

Valuation

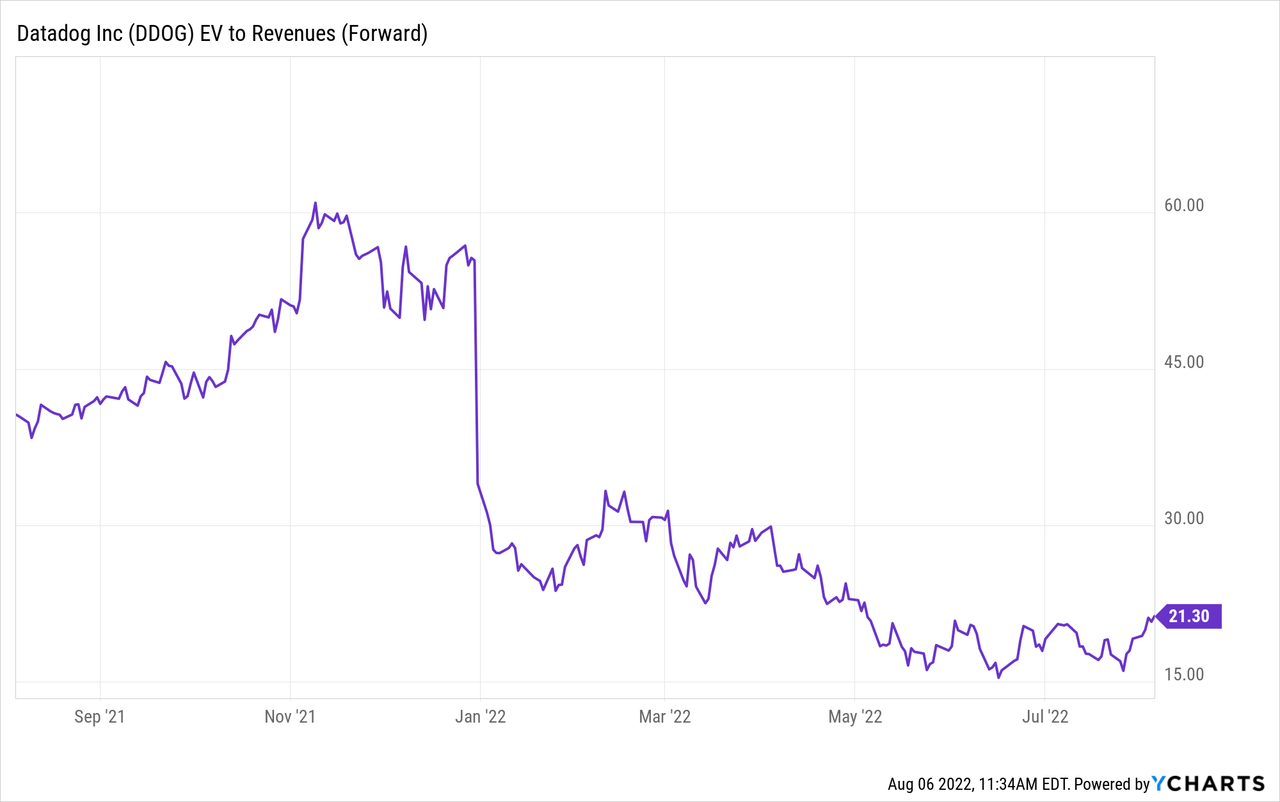

While the stock was up a little bit after earnings, the stock does remain down over 30% year to date. Like many other stocks in the software industry, investors rotated out of these fast-growth names in favor of more stable, recession proof companies. Not surprisingly as seen in the chart below, Datadog’s valuation has significantly pulled back this year and still remains quite expensive relative to other software stocks.

However, Datadog has some of the best financial performances of any software stock in the market, with the company nearly reporting a Rule of 100 score over the past two quarters.

Currently, the company has a market cap of $35.7 billion and with around $1 billion of net cash, enterprise is around $34.7 billion.

2022 revenue guidance of $1.61-1.63 billion implies growth around 57% yoy, which implies a current 2022 revenue multiple of ~21.5x, which remains at a high premium relative to the broader market.

Assuming the macro environment persists at the current pace and the company only comes in at the midpoint of their guidance range, we can start to forecast out a potential 2023 scenario.

Revenue growth next year will likely slow down due to the law of large numbers, and even if we assume a significant growth deceleration to 45% yoy, 2023 revenue could end up being around $2.4 billion. This would imply a 2023 revenue multiple of around 14.5x. While this is more attractive than the current forward revenue multiple above 20x, investors will need to be comfortable holding onto this stock for a multi-year period.

With the stock currently over 40% below their all-time high and the combination of ongoing revenue growth strength and operating margin profitability, I believe long-term investors should continue to like the outlook for Datadog.

Admittedly, the current challenging macro environment and premium valuations are big risks for the company, but investors who look out beyond 2023 are likely to find an attractive return potential.

Be the first to comment