unomat/iStock via Getty Images

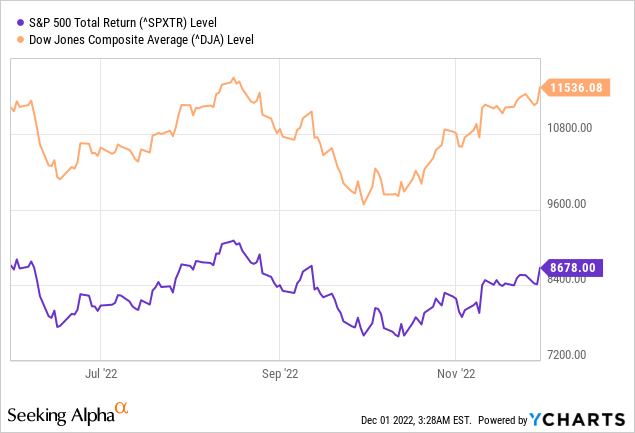

The month of October was a tumultuous one with a lot of trades taking place. In fact, several readers pointed out that it seemed a little excessive. I think it’s important to remember that during times of volatility that is when trading should take place and during times when volatility is minimal when there should be less trading based on the strategy that we follow.

During the month of July, we also saw an abnormally high number of trades. We then entered another period of relatively stable markets that resulted in fewer trades during the month of August and rolling into September.

I also want to clarify that we are not day traders and we never buy stocks with the intent of turning them for a big profit. We only turn a profit when the stock price gets to the point that it doesn’t make sense to continue holding it because the downside risk is so high that it doesn’t make sense to continue holding shares.

If you are following this type of strategy it’s important to be thoughtful about the trades that you are making and the reason/intent behind them. It’s also important to remember that you don’t need to trade to be successful but trading is an important part of the strategy that allows us to recycle capital from higher-cost shares to ones that are more attractive. It also allows us to solidify a lower cost-basis which has a psychological benefit that feels good knowing during a downturn that we could potentially sell shares if needed at a smaller loss than we would have with a higher cost position.

Account Transactions – Why I Write These Articles

For those of you who have followed my work, this is a change I decided to make for several reasons. The articles require quite a bit of manual work to update spreadsheets and track dividends coming into the accounts. In recent years I have added more charts/graphs with the hope that it adds value for readers and provides clarity for what I am trying to do.

In the process of doing this, I have made it harder for myself to continue producing consistent articles and ensure that the quality doesn’t suffer. Here are some additional reasons for separating out trades in their own article.

- If I have a week where no trades take place I can simply skip writing this article because there is no point in providing an update if nothing happens.

- My articles currently talk about trades done as long as 60 days ago, for example, if I do a trade on the 1st of June but the article gets published at the end of July. Producing a separate article allows me to provide actionable trades that are more likely still within a buy/sell range after seven days.

- My articles have gotten way too long. A busy month can result in a 4,000+ word article and that distracts from the purpose of the updates.

I would love to receive feedback in the comments about things you like, don’t like, or even ideas that I haven’t yet considered/thought of. Constructive feedback is something I truly appreciate and many of my regulars can attest to the fact that I try to follow up on these ideas whenever possible. Many of the images in my articles are the direct result of tracking that feedback.

October Articles

I have included the links for John and Jane’s Retirement Account articles at the end of this article.

November 1st – November 27th Trades

My original goal was to write these articles more regularly but that has been a challenge going into the winter months with my outside project list continuing to get longer. I originally planned for articles every two weeks but have found that monthly seems to be more reasonable for me to handle.

Taxable Account

2022-11-27 – Taxable Account Transactions (Charles Schwab)

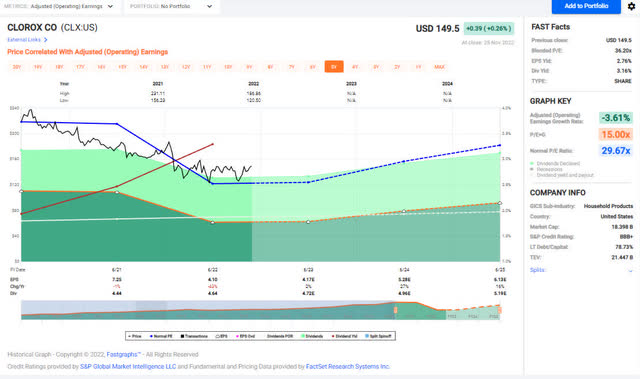

Clorox (CLX)

Clorox has been on the chopping block for quite some time and the recent price improvement makes no sense in my opinion. COVID was a huge boost for the stock but there are major challenges in maintaining margins because of inflationary pressures. SA Author Trapping Value makes a great point in his article Clorox: Big Downside Ahead, Dividend Cut Likely In The Next 12 Months that current earnings don’t cover the dividend until fiscal 2023. I agree with him that the investment thesis for CLX makes no sense whatsoever and is at minimum a sell at the current price. I think it would take quite a bit for a dividend cut but it’s not out of the realm of possibility.

CLX – FastGraphs – 2022-11 (Fastgraphs)

Jane’s Traditional IRA

2022-11-27 – Jane Traditional IRA (Charles Schwab)

Agree Realty Preferred Series A (ADC.PA)

In the last article, we mentioned the coupon rate of 4.25% wouldn’t normally be attractive but the current share price pushes that yield up to 6.25% at current prices. We were able to purchase these shares at an even better price that resulted in a 6.64% yield. These shares pay monthly which is an added benefit.

Jane’s Roth IRA

2022-11-27 – Jane Roth IRA Transactions (Charles Schwab)

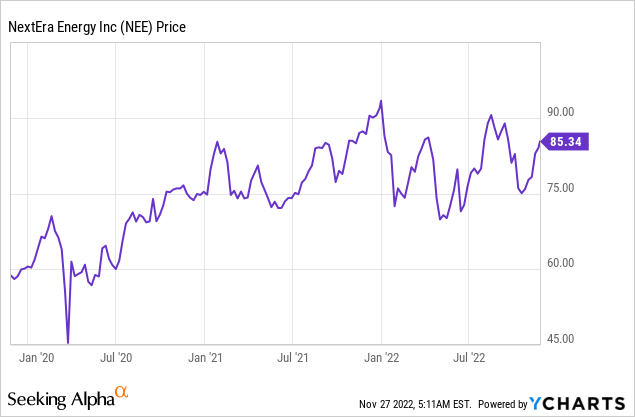

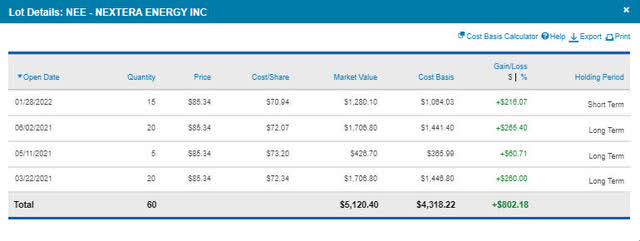

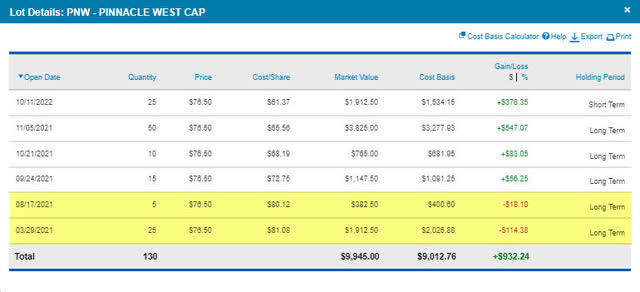

NextEra Energy (NEE)

This trade was set up as a limit sale to reduce the high-cost shares and trim back an overvalued stock. $85/share was a ceiling that was set because it represents the point where the stock is fully valued. We are willing to add more shares on pullbacks into the low $70/share range. NEE is a great dividend growth stock (especially for a utility company) that has a 27-year history with a five-year growth rate of 11.6%.

NEE – Lot Details – 11-27 (Charles Schwab)

John’s Traditional IRA

2022-11-27 – John Traditional IRA Transactions (Charles Schwab)

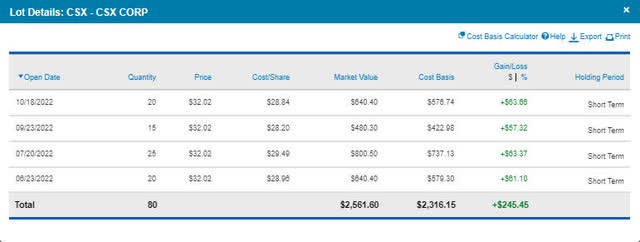

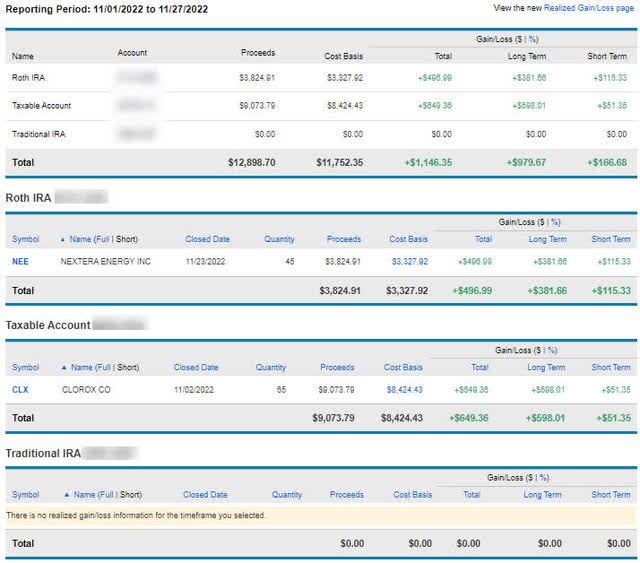

CSX (CSX)

In the last article, we made multiple purchases in the months of September and October. We sold off shares when they pushed above the highest cost basis shares we have and decided it was best to put the funds back into reserves. The potential for rail strikes is a real concern and has removed much of the upside that exists. It also doesn’t help that we are seeing a fairly sizeable drop in rail traffic compared to 2021.

CSX – Lot Details 11-27 (Charles Schwab)

John’s Roth IRA

2022-11-27 – John Roth IRA Transactions (Charles Schwab)

Sun Communities (SUI)

We initiated the position in SUI a little too soon back when the price began to drop initially. We were able to add more shares close to the bottom and now that it has stabilized we added a few more shares. SUI is a great stock and we have avoided it due to the premium pricing shares have been selling at (the 52-week-high is $211/share). The FastGraphs shows this pricing premium that SUI normally carries and just how far the price has dropped. SUI is still a compelling value considering that there were no events that would have warranted such a significant drop in the share price.

SUI – FastGraphs – 2022-11 (FastGraphs)

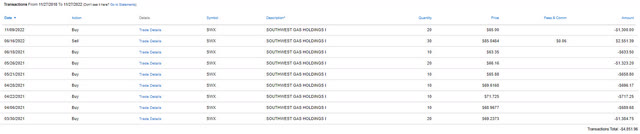

Southwest Gas Holdings (SWX)

We have avoided SWX (and even sold some shares as the price reached its while back) because the stock price was driven to record highs after announcing a formal sale process. The stock price has since become much more attractive and we set a limit trade purchase of 20 shares @ $65/share. We will consider adding shares at around $65/share in the future and will definitely consider selling on any major spikes in share price. SWX is a reasonable dividend play but it would be hard to justify any sort of premium valuation. The shares we sold are highlighted in red below.

SWX – Transaction History (Charles Schwab)

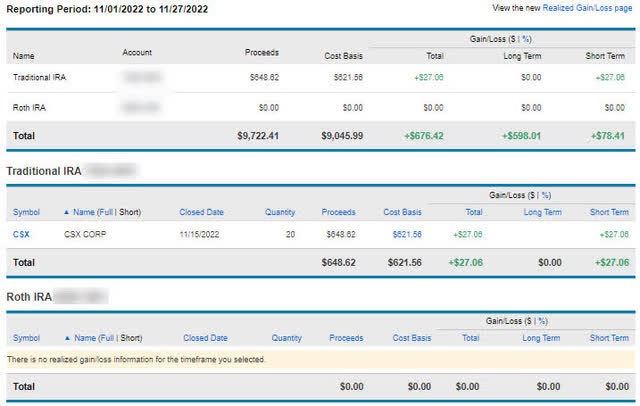

Pending Limit Trades

We have a number of limit orders that remain open. All of these limit orders are used to address reduction of high-cost positions or add shares when they reach an attractive price. Many of the limit trades coincide with the notes provided, however, I will add explanation if reasons have not been given previously.

John and Jane’s Taxable Account Limit Trades

2022-11-27 – Taxable Account – Limit Trades (Charles Schwab)

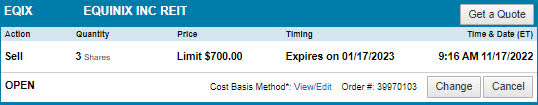

Equinix (EQIX) has seen a strong rebound and we are looking to sell off John and Jane’s high-cost shares now that we have purchased some that represent the lowest cost portion of the position.

Jane’s Retirement Account Limit Trades

2022-11-27 – Jane Traditional IRA – Limit Trades (Charles Schwab)

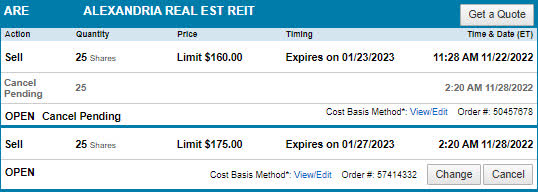

We changed the limit order for Alexandria Real Estate (ARE) because there is a lot more upside available for these shares. ARE is a great quality REIT so we are ok to hold shares and see if we can get more of a premium to reduce the high-cost position.

2022-11-27 – Jane Roth IRA – Limit Trades (Charles Schwab)

American Tower (AMT) limit sale was reinstated for the next after a handful of purchases were made in October. This will eliminate the highest cost shares shown in the lot details below.

AMT – Lot Details 11-27.jpg (Charles Schwab)

We recently got added to Main Street Capital (MAIN) recently and considering MAIN is one of the largest positions held in John and Jane’s portfolio. This sale also eliminates the high-cost position and $42 tends to be a solid sale price that the stock price has been above (but doesn’t stay for long). The lot details show the shares that this will eliminate.

MAIN – Lot Details 11-27 (Charles Schwab)

John’s Retirement Account Limit Trades

2022-11-27 – John Roth IRA – Limit Trades (Charles Schwab)

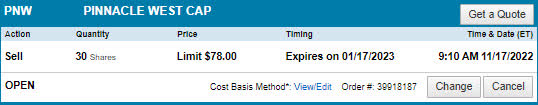

Pinnacle West’s (PNW) follows the same theme as many of the trades mentioned before. This trade would eliminate the high-cost basis shares and drop the cost basis from $69.33/share down to $65.85/share. We are choosing to sell below the price these shares were purchased at because the stock is already priced at a premium that is not warranted in my opinion.

PNW – Lot Details – 11-27 (Charles Schwab)

Realized Gain/Loss

As always, my goal is to be transparent and to provide as many screenshots as possible to validate what I am doing. The screenshots below should serve as confirmation as to the reason why we sold certain shares.

Capital Gains – There comes a point where the upside for any stock is minimal and that is when we need to consider selling shares to lock in gains and redeploy the cash elsewhere. CLX is a great example of this because the only direction I see the stock going in the near term is down. NEE is another example of a great company that we sold a small tranche of shares when it reached peak pricing (even though we maintained 80% of the original position).

Capital Loss/Wash Sales – All remaining stocks fall into this category with the purpose of selling shares were to eliminate a high-cost position. Stocks like MAS, PM, or PNW have slightly larger losses associated with them which was due to the fact that we didn’t see higher upside available and still wanted to reduce exposure to that position.

2022-11-27 – Jane Realized Gain-Loss (Charles Schwab) 2022-11-27 – John Realized Gain-Loss (Charles Schwab)

The images above represent the same window of time as the transactions in this article. This is the realized gain/loss figures for all of John and Jane’s accounts that I am involved with.

Readers should note that John and Jane are more willing to take capital gains in their Traditional IRA or Roth IRA compared to their Taxable Account. With the Taxable Account being primarily investments that are a buy-and-hold, it reduces the amount of shares that are sold. We always do our best to limit John and Jane’s tax exposure.

Conclusion

As you can see, from the images above, the amount of trading activity has dwindled in comparison to the prior month article. This is intentional because during periods of market growth we are looking to take advantage of a few opportunities whereas when the market is in free-fall there are significantly more opportunities to capitalize on.

I can’t predict which way the market is going to go but I have followed this strategy over the last five years and it has consistently provided opportunities regardless of what state the market is in.

Additional Articles For November

The following links are my updates for November and the previous article that covers the transactions for the month of October (it’s a really long one for anyone who is interested!).

The Retirees’ Dividend Portfolio: John And Jane’s October Taxable Account Update

John’s recap for October will be posted Saturday December 3rd.

The Retirees Dividend Portfolio – Account Transactions Through October 31st

John and Jane are long all stocks mentioned in this article.

Be the first to comment