antorti

Dear Readers/Followers

I’ve reviewed Coca-Cola Consolidated (NASDAQ:COKE) twice before, each time considering the company a “BUY”. The company has more or less followed the market since, and we’re down double digits in the meantime, around 10% since my last article, but not significantly worse than the overall index.

Nonetheless – COKE represents a fundamentally safe “bottler” that’s not just Coca-Cola – but other beverages as well. This, to me, is safety at a level that’s hard to replicate given the company’s operational geographies and segments.

In this article, I’ll crystallize the upside and positive thesis for the company even further.

Revisiting Coca-Cola Consolidated

COKE has been a better investment than Coca-Cola (KO) over the past 20 years. This is not in dispute. KO has given investors a 20-year RoR of just south of 200% – which is of course very nice, even if it’s slightly below market.

COKE has yielded returns of close to 1,400%, turning an initial investment of $10,000 into almost $140,000. So over the past 20 years, COKE has been the better investment – by quite a margin.

And in the same timeframe, COKE has pivoted and improved its overall operations substantially. The company is looking to grow its earnings going forward, and current expectations are for impressive growth. The current valuation allows for a substantial upside even in a conservative scenario.

A common misconception is that the company only bottles and distributes Coca-Cola and company products. This is not the case. 83% of the company’s sales are to KO, yes, but they also distribute products for competitors, such as Keurig Dr Pepper (KDP) and the Monster Beverage Corporation (MNST).

KO does not have a majority stake in the company. It owns around 5% of the voting power. Through various trusts and legal structures, the company’s voting power is controlled by 86% by the Harrison family. This shareholder structure may prove the company to be an unattractive investment to most investors, given that this structure means that the company’s yield is likely to remain relatively low. There is little motivation for the business to become a high DGR stock.

So, it’s all about that capital appreciation when we look at COKE as a business.

The company does cans, plastic bottles, as well as post-mix products for retailers such as food chains, that allows for the fountain mixing of sodas by the addition of carbonated water with syrup. The company has the allowance of KO to distribute, promote, market, and sell KO products according to specific agreements. The company makes quarterly sub-bottling payments to Coca-Cola for this set of rights. The company has similar agreements with all of the companies for which the company bottles and distributes beverages, including KDP and MSNT.

This makes the company very attractive in its market, and specifically, it’s five main markets, which is “The Carolinas”, Central, Mid-Atlantic, Mid-South and Mid-west, totalling 10 plants, 60 distribution centers across vast areas of the US.

COKE is a raw-material heavy business – it needs plastic bottles, metal cans, sweeteners, carbon dioxide (due to it working with syrups) as well as the obvious masses of packaging materials. Plastic bottles come from cooperatives co-owned with other Coca-Cola Bottlers. Aluminum cans are sourced domestically from two main suppliers, though the company has recently started to include international sourcing in the company’s operations.

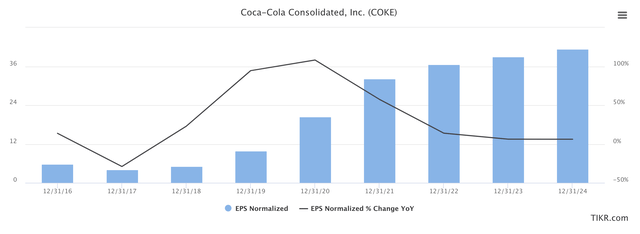

COKE Earnings/growth (S&P Global/TIKR)

Keeping an eye on margins and costs is crucial when looking at COKE – thankfully, these are looking pretty damn impressive here. Furthermore, the expectation is for COKE to improve these even further going forward.

The fact is, that EPS is expected to grow at a rate of double digits percentage-wise per year until 2026, at which point analysts currently expect COKE to realize annual GAAP EPS of closer to $40 per share. However, the dividend is expected to strictly stay at that $1 level per share.

The company’s main customers remain hypermarkets and supermarkets. Walmart (WMT) is by far the biggest here. The hypermarket buys a fifth of the company’s annual sales volume, with Kroger (KR) at another 13% for the full year of 2021. These two customers together are close to 25% of total net sales for COKE.

The latest quarterly trends confirm the overall upside for Coke. Net sales increased 11% YoY, with physical case volume growth of 1%. Pricing actions have been crucial for the company during this year, with pricing increases being a rule across most of the company’s beverages for this year. The fact that the company managed to completely protect itself from inflation and cost impacts is visible through the flat gross margin – despite an overall double-digit sales increase, with a less than 1% adjusted margin increase.

Despite flat margins, these results can actually be considered quite excellent given what sort of struggles the company has been facing in terms of Labour, SD&A, input and other factors. Demand has stayed high despite price increases, and the company is focusing on affordable packaging solutions to keep product pricing down as much as they can.

COKE isn’t a hard-to-understand business. It’s a play on popular soft drinks and sodas with very specific geographies. These geographies are likely to remain attractive, as they hold significant populations, and the company sells products that are considered attractive.

In short, COKE is the producer and distributor of KO products, as well as a number of other beverages and drinks, across 5 specific regions in the US. It’s a more boots-on-the-grounds investment than is KO given its exposure to raw material inflation, equipment, and distribution as well as some counterparty/customer risk.

The best way to invest in COKE is trying to do so at an appealing, cheap valuation. Let’s look at what sort of valuation we have at this particular time.

Updating COKE’s valuation

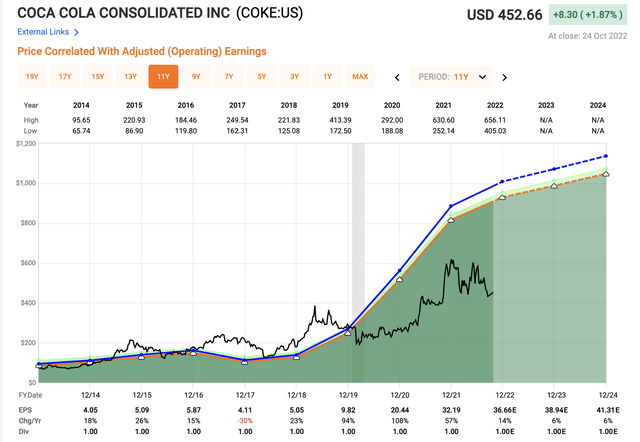

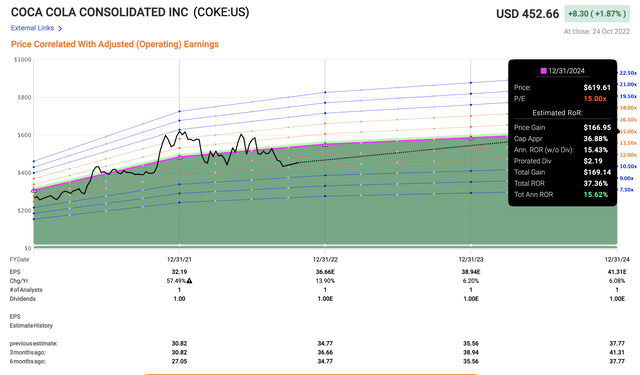

I previously characterized COKE as an investment at a 17-19x P/E multiple, which is where the company was when I began covering the ticker. Now we’re at a multiple that’s around 5-6x below this, with a normalized P/E of around 12.5x, which is actually cheap for this company.

Being able to buy COKE cheap is a great thing – because on a premium basis, we’re now at an upside that’s going into triple digits – well up into triple. A normalized 28.5x P/E upside, which is the 5-year average, gives us an upside of 160% or 54.7% annually.

COKE is BBB rated, it’s yielding around 0.22% (which is low, but you’re not getting much better), and above all, there’s a ton of safety to the stock here. ‘

The expansion has been absolutely massive here.

We don’t even need to consider the company at those sorts of premiums anymore to find upside at this point. Even only looking at a 15x forward P/E, we’re now at a market-beating conservative upside of around 37.5%.

And this is extremely conservative for this company. I estimate the company to be able to grow EPS at double digits or very close to it for this year, dropping off to around 6-8% for the coming few years.

This is what I wrote in my first article.

I am unwilling to assign COKE a higher premium than a 20X P/E, even though the 20-year average comes to 24X. I believe there’s a bit too much of that growth exuberance baked into assumptions there, and past performance is sometimes not as indicative of future performance as we might like for it to be.

(Source: COKE article, Seeking Alpha)

We’re extremely far from that premium today. While I would still be willing to consider 20x P/E as an acceptable level in a different sort of market, and for the safety this company represents, the level we’re seeing today is far more appealing.

It’s my stance that this starts to represent a significant undervaluation to COKE at this time. What was previously a 15% premium upside is now more than twice that upside, showcasing just how crucial valuation is when you look at these sorts of things.

There continues to be something to be said for taking shelter from the storm in a safety enhanced by Maslow’s Hierarchy of Needs. Certainly, drinks are at a very foundational level of that pyramid.

Even if you can’t argue that people “need” coke or similar soft drinks to actually survive, I will continue to argue with you that these products are much more foundational than say investing in an e-automotive company, or something similar. On that basis, there is an argument to be made for investing in the company.

What I said before – I like a 15x P/E here – is still accurate. And when I see 12.5x, I obviously consider this to be far more attractive than previously.

I maintain my “BUY” stance here, but I would say that the relative upside is far better than any time we’ve seen for quite a while.

Thesis

My thesis for COKE is relatively simple:

- COKE is an advantageous soft drink/beverage investment with bottling and manufacturing capacity across 5 attractive US regions. This makes the company a “guaranteed cash cow”, “with exposures to things like input inflation, CapEx and risks associated with companies like this – including customer concentration.

- However, the company has a superb track record of delivering value to its shareholders, almost quadrupling KO 20-year returns, and is well managed, even if its dividend leaves something to be desired.

- At a slight premium, I still view COKE as a worthy “BUY” with a 20X P/E long-term target, indicating a PT of $650/share. I’m not shifting my price target for the company here.

- Because of that, I’m going with a “BUY” here.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation but hovers within a fair value or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

COKE is currently a “BUY”, in accordance with this approach.

Here are my criteria and how the company fulfills them (italicized), with now all 5 fulfilled by COKE.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment