fcafotodigital/E+ via Getty Images

Those who can forget the past are way ahead of the rest of us.”― Chuck Palahniuk, Choke

Today, we take an in-depth look at a name that has had a wild ride recently. The company is in the process of a major transition and the stock has seen insider buying of late. A full analysis follows below.

Company Overview:

Perrigo Company plc (PRGO) is an Ireland domiciled provider of private label and branded OTC health and wellness offerings to consumers predominantly in North America and Europe. The company has experienced a eventful 2021, selling its generic pharmaceutical business, announcing the acquisition of self-care company HRA Pharma, winning a claim surrounding a 2015 acquisition, and settling a tax dispute with the Irish authorities. Perrigo was formed in Michigan during 1887, eventually going public more than a century later at $5 per share in 1991, when giving effect to a two-for-one stock split in 1993. The company executed a corporate tax inversion to Ireland in 2013 that coincided with its $8.6 billion purchase of Elan Corporation. Shares of PRGO trade right for just over $40 a share, translating to a market cap of just under $5.5 billion.

With the recent divestiture of its drug operations, Perrigo is now a pure-play consumer self-care concern, disaggregating its functions into two geographic reporting segments: Consumer Self-Care Americas (CSCA – North America), which accounts for ~65% of the company’s top line; and Consumer Self-Care International (CSCI – Europe and Australia). Consumer self-care currently consists of oral self-care, nutritional supplements, pain relief, cold and allergy medication, smoking cessation products, as well as personal care goods, amongst others.

Tax and Legal Issues:

Perrigo’s stock traded over $200 a share in 2015 after acquisition overtures by Mylan Pharmaceuticals became public. The company’s board and shareholders ultimately rejected the offer in November of that same year, which proved to be a mistake. Not only did its top line erode from $5.3 billion in 2016 to $4.7 billion in 2018, but also Perrigo was informed by the Irish Office of the Revenue Commissioners in late 2018 that it owed back taxes equaling ~$1.9 billion relating to Elan’s sale of its multiple sclerosis drug Tysabri, a transaction that occurred a couple of months prior to the former’s purchase of the latter in 2013. After this news became public, shares of PRGO plummeted below $35.

However, that tax issue was not the only legal dispute dogging Perrigo. It has multiple tax matters with the IRS – the largest of which are 2011-2013 audits of its Athena Neurosciences subsidiary that could cost it up to $843 million. The company is dealing with sundry shareholder lawsuits arising out of its 2015 acquisition of Belgium-based Omega Pharma – and how it represented the synergies – as well as over a dozen price fixing claims for certain generic drugs and the company’s accounting for its Tysabri asset before 2017. Furthermore, it is now named in 57 talcum powder and 280 Zantac cancer lawsuits, as well as a recent charge of mispricing infant acetaminophen. On top of that, its insurers have filed suit that they should not have to pay certain claims concerning legal issues pertaining to the 2015-2017 policy periods. The company has accrued liabilities of $96.9 million for these claims, which are currently offset by expected insurance payouts of $83.4 million.

Regarding Omega, Perrigo in turn sued its sellers alleging fraud – more on that outcome shortly.

In total, the company’s 3Q21 10-Q dedicates 19 pages to tax disputes, securities litigation, price-fixing lawsuits, and other pending issues.

Transition to Pure-Play Consumer Self-Care Concern

By mid-2019, with its image already sullied by mostly drug-related lawsuits, Perrigo’s management made the decision to transform the company into a pure-play consumer self-care concern, delivering less-volatile results that would include 3% organic net sales growth, 5% Adj. operating income growth, and 7% Adj. diluted EPS growth (3/5/7), in line with its peers that trade at much higher multiples.

The first step in this transition occurred with the purchase of Ranir Global and its oral-care assets for $750 million in 2019. The defining move was the company’s disposition of its generic pharma business to Altaris for a total consideration of $1.55 billion in July 2021.

Perrigo has earmarked the proceeds from that sale for the purchase of HRA Pharma, a European concern that derives ~85% of its revenue from its consumer self-care products. HRA owns the number one foot blister and number two cold sore treatments under its Compeed brand, as well as market-leading scar care and stretch mark products with its Mederma-branded offerings. Furthermore, it owns the best-selling morning-after contraception on the continent. These products and three rare-disease drugs are expected to produce FY23 revenue of ~$460 million and synergies of ~$35 million, which will generate $1 a share in extra earnings for Perrigo. In return for these expected outcomes, the company is paying an all-cash consideration of ~$2.1 billion, translating to an FY22 EV/Adj. EBITDA multiple of 18x, or 14x if anticipated FY23 synergies are factored into the algebra. The deal is expected to close by the end of 1H22.

Positive Developments

While the company was deliberating the purchase of HRA, it was able to negotiate a $307.5 million settlement with the Irish tax authorities, which was lower than expectations and paid in October 2021. Just prior to that remittance, Perrigo was awarded $417.6 million by a tribunal in its lawsuit against Omega’s sellers in August 2021.

3Q21 Earnings & Outlook

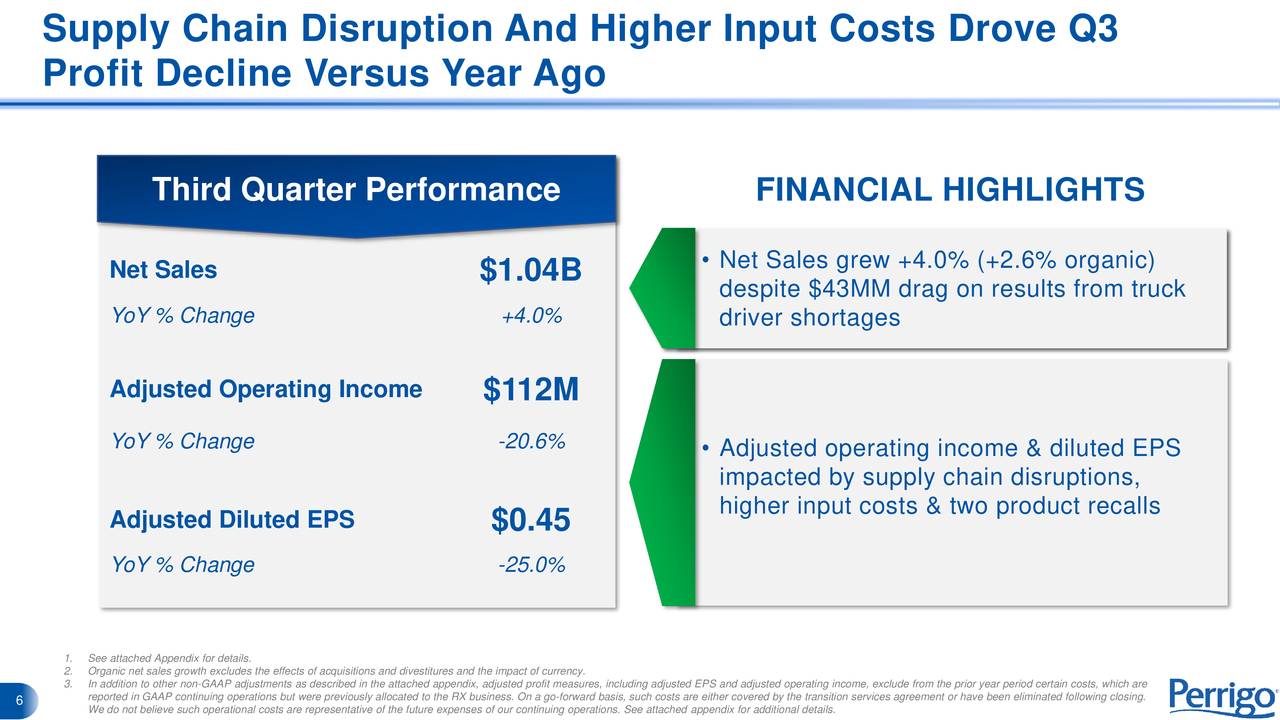

With its legal counsel extremely busy, the company announced earnings on November 10, 2021, badly missing Street estimates. Perrigo reported 3Q21 Adj. EPS of $0.45 on revenue of $1.04 billion versus $0.60 a share on revenue of $1.00 billion in the prior year period. In addition to being down 25% from 3Q20, the Adj. earnings fell $0.20 a share short of consensus expectations as higher material and freight costs, supply chain disruptions resulting in unfulfilled orders, and two product recalls were blamed.

Source: November Company Presentation

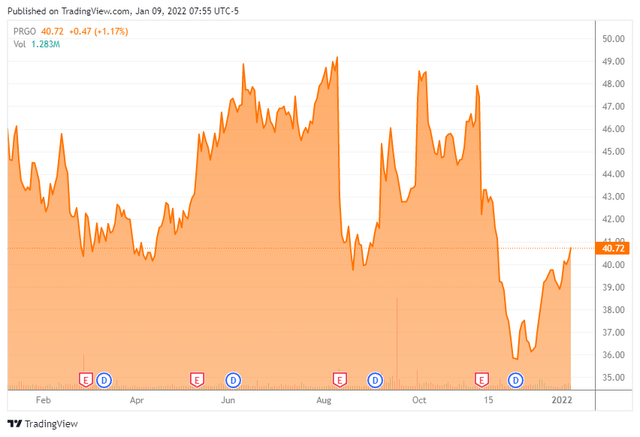

Owing to these negative undercurrents and a weak flu season in 1Q21, management was compelled to lower its FY21 Adj. EPS outlook from $2.60 to $2.05. The third quarter of 2021 marked its second consecutive bad miss after falling $0.11 per share shy of 2Q21 Adj. earnings expectations. Its stock, which had rebounded into a range of ~$45 to ~$60 per share after the initial reaction to the late-2018 Irish tax levy news, has lost 25% of its value since reporting its last two quarters after closing at $48.55 on August 10, 2021.

Balance Sheet & Analyst Commentary:

To finance its $2.1 billion acquisition of HRA, Perrigo held cash of $2.1 billion, offset by total debt of $3.5 billion, consisting of notes and bonds totaling $2.9 billion and a term loan of $600 million due August 2022. Despite its highly disappointing YTD21, the company has generated operating cash flow of $261.7 million through the first nine months of 2021 versus $525.8 million in the prior year period, which is still plenty of cash to cover its $0.24 quarterly dividend for a 2.6% yield.

Raymond James (to an outperform) and Jeffries (to a buy) upgraded shares of PRGO subsequent to the tax settlement news. However, they are the only two bullish outlooks of analysts proffering commentary over the prior twelve months, with the other three recommending holds. Also, Raymond James has already lowered its price objective on the company from $59 to $55 after its poor 3Q21. Analysts’ median price target is currently $59 a share. After the company revised its outlook for FY21, the Street followed suit, now expecting it to earn $2.03 a share (non-GAAP) on revenue of $4.1 billion followed by $2.66 a share (non-GAAP) on revenue of $4.5 billion in FY22.

A half dozen insiders, led by CFO Raymond Silcock’s 27,500-share investment, purchased just under $2 million in aggregate of their company’s stock in early to mid-December.

Verdict:

In the jackpot justice milieu, there is some concern as to all the impending lawsuits against Perrigo, but the likely single biggest hit (with the Irish tax authorities) has already been settled. The Athena IRS negotiation, which has the potential to have a similar or larger impact, will take several years to settle. That said, the company has experienced some serious execution issues that need to be addressed before investors are compelled to get on board with management’s 3/5/7 objective. HRA is a solid acquisition and an exclamation point on its pivot to a pure-play consumer self-care concern; however, it is not being picked up on the cheap and the closing of that deal is still six months away.

Source: November Company Presentation

The insiders see a price to FY22 Adj. earnings ratio of approximately 15 and a current yield of 2.4% and believe that the current issues (cold and flu season, higher costs, and supply chain issues) are transient. I thought when I first started researching this name it might make a good covered call candidate and insiders might be signaling it was time to buy. Unfortunately, there are still too many uncertainties around this name. Therefore, the recommendation here is to sit on the sidelines until the company can prove that its recent operational challenges are actually fleeting, deliver an in-line quarter – all while the stock confirms a bottom.

The past was but the cemetery of our illusions: one simply stubbed one’s toes on the gravestones.”― Émile Zola, The Masterpiece

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum.

Be the first to comment