Fritz Jorgensen

For a background on the various EV market trends you can read our past articles:

The 6 trends from the Oct. 2021 article were:

- EV sales are booming and 2021 sales look likely to grow ~100%+ on 2020.

- Electric vehicle wait lists grow bigger and production delays, Tesla has the biggest backlog of reservations.

- Junior lithium miner takeovers or buy ins (especially in Argentina brine projects).

- EV metals shortages and price rises (especially lithium). Direct Lithium Extraction has gained momentum as the search for lithium widens to lower grade sources.

- A faster shift to lithium iron phosphate [LFP] battery chemistries is occurring in China, plus Tesla announced this week to shift all global production of standard range vehicles to LFP batteries.

- 2022 EV sales should be another boom year boosted by new EV factories.

The 4 trends from the Dec. 2021 article were:

- New EV and battery megafactories are on the way, led by Tesla (TSLA).

- The battle to secure lithium and key EV metals has begun – Led by China, but now the Russians are coming.

- USA plays catch up – President Biden’s policies likely to boost U.S EV sales in 2022 and beyond.

- Battery prices may actually rise in 2022 or 2023 due to dramatically higher EV metal costs.

A lot has happened since the above 2021 EV market trends articles. All of the above trends have continued to play out; however supply chain disruptions have slightly negatively impacted EV production and hence sales.

10 of the latest EV, battery and EV metal miner trends

1. Despite EV supply chain disruptions plugin EV sales remain strong, gaining significant market share in a weak conventional auto market

As shown in the table below global electric plugin car sales have been doing quite well, despite the supply chain (chips, materials), manufacturing and macro-economic concerns (Covid-19 lockdowns in China, war in Ukraine, interest rates rising etc.).

H1, 2022 global sales were 4.149m. Assuming the macro-environment does not get any worse, then H2 2022 is likely to add a further 6m sales, for a 2022 total of ~10m global plugin electric car sales.

Note: H2 EV sales are always stronger than H1.

Actual global plugin electric car sales reported so far in 2022

Source: Trend Investing model

Note: ~72% of electric car sales YTD were 100% battery electric vehicles (BEVs), the balance being hybrids.

Note: April 2022 global EV sales were quite severely impacted by China Covid-19 lockdowns, notably in Shanghai.

Note: 2021 global light electric car sales were 6.75m and 8.3% global market share.

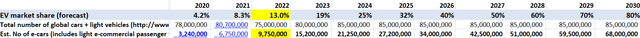

Our updated 2022 EV sales and market share forecast

As shown below our forecast is for 9.75m global plugin electric car sales in 2022 for 13% market share. 9.75m sales would equate to a 44% gain on 2021, a slowdown on 2021 sales gain of 108%, mostly due to supply chain and manufacturing constraints.

End 2025 market share forecast remains at 32% and end 2030 at 80%.

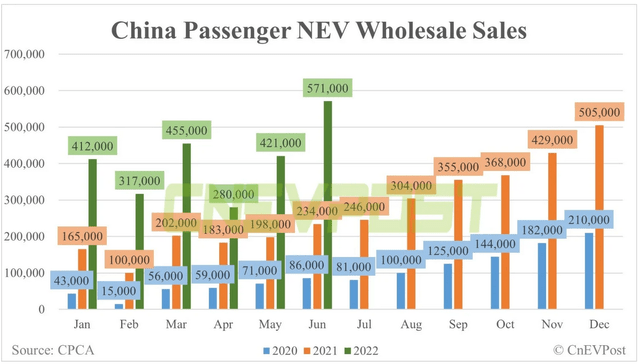

As shown below China electric car sales continue to go from strength to strength and lead the world.

On July 8, 2022 CNEVPOST reported:

China’s wholesale sales of new energy passenger vehicles reached 571,000 units in June, surpassing last December’s 505,000 units and setting a new historical record, according to data released today by the China Passenger Car Association (CPCA).

China NEV sales surge higher in H1, 2022 despite supply disruptions

2. Growing waiting lists and higher EV prices

Current electric car waiting lists (reservations) are hard to determine an exact figure as not all the information is made publicly available. Our best guesstimate is the global waiting list for electric cars is now somewhere towards 3m. The number would potentially be higher if several OEMs re-opened their ordering, having closed due to excess demand.

Unofficial site, Tesla Cybertruck reservation tracker is at 1,545,355, BYD Co (OTCPK:BYDDY) (OTCPK:BYDDF) is rumored to have over 500,000 reservations, Ford (F) Lightning is at least 200,000+, and then there are hundreds of EV brands in China to consider.

The total of the leading U.S EV manufacturers in the table below comes to 1.865m.

Recurrent Auto quoted reservations as of June 11, 2022

|

Tesla Cybertruck |

Rivian R1 |

Ford F150 Lightning |

GM Hummer |

GM Chevrolet Silverado |

Lucid Air |

Fisker Ocean |

Aptera |

| 1.27m | 90,000 | 200,000 | 65,000 | 140,000 | 30,000 | 45,000 | 25,000 |

Source: Recurrent Auto website

In terms of electric car prices, virtually all companies have significantly raised their EV prices to counter rising input costs, especially higher EV metal prices.

3. The latest electric car designs are following Tesla and improving aerodynamics and efficiency. Manufacturing improvements and autonomous driving/safety features are also key trends

Car manufacturers globally have continued to copy market leader Tesla with ideas such as panoramic sunroof, large center screen display, and more recently improved aerodynamics.

In terms of manufacturing improvements Tesla and BYD Co have been leading with structural body packs that lessen weight by using the battery cells as a structure. Other improvements by Tesla have been larger giga presses, less parts and manufacturing steps, and faster manufacturing output. Of course, Tesla has also opened two new state of the art gigafactories (Berlin & Texas) in H1, 2022.

The Mercedes EQS has a sleek design to improve aerodynamics

Tesla Model S Plaid

4. Solar electric cars are making quite good progress

Lightyear recently showcased the production version of its Lightyear 0 SEV, which plans to begin production late 2022.

Sono Motors is at the prototype stage for its flagship Sion EV, planning for production in 2023.

The Tianjin solar EV was jointly developed in 2022 by 42 companies and three universities. The car solar module area is 8.1 square meters, far more than the Lightyear 0 with 5 square meters.

Aptera Motors is another leading solar EV company. It plans to bring a 3 wheel vehicle to market. It is said to have a range of 1,000 miles and the solar panels are capable to add up to 40 miles of solar powered driving per day.

The Tianjin solar EV – China’s first pure solar powered vehicle

The Tianjin solar EV – China’s first pure solar powered vehicle

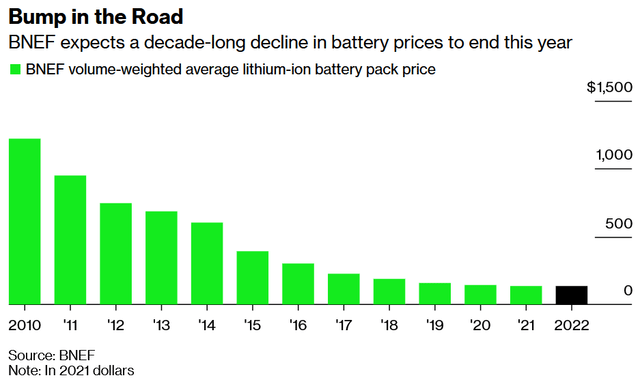

5. Lithium-ion battery prices increase after declining the past decade

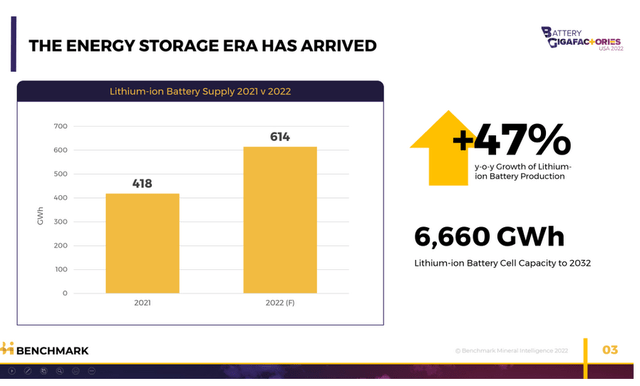

Despite the rising number of new gigafactories in the pipeline to 2032 (as of May 2022 sits at 304 gigafactories and 6,387.6 GWh of Li-ion battery capacity), battery prices have been increasing due to the increased cost of the EV raw materials; particularly, lithium, cobalt, and nickel.

On June 1, 2022 Bloomberg quoted:

Before the rally, battery prices were nearing levels that would make upfront costs of EVs competitive with traditional cars without state subsidies, BNEF said in a report Wednesday. But that’s now starting to change. Battery pack prices are set to rise this year for the first time in more than a decade, and broader inflation could severely delay a crucial tipping point where average battery prices fall below $100 a kilowatt-hour.

Bloomberg’s Li-ion battery pack price chart shows prices forecast to increase in 2022 to US$135/kWh (from US$132/kWh in 2021)

BMI is tracking a major demand wave and supply response for lithium-ion battery gigafactories – A massive 47% YoY growth is forecast to 2032

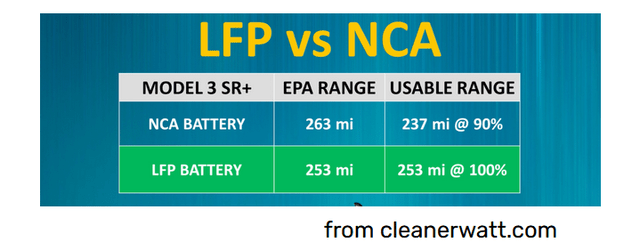

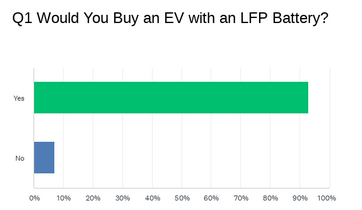

6. LFP chemistry is forecast to continue to gain market share, with new LFP batteries improving battery density and lasting longer than NMC/NCA. Structural battery pack also helps

Lithium Iron Phosphate (“LFP”) batteries have several advantages over NMC/NCA batteries, notably safety and cycle life (~3x longer), as well as being able to be regularly charged to 100%. LFP energy density has been improving as we have seen from recent news and is now not too far behind NMC/NCA:

- “Gotion High-Tech begins serial production of 210 Wh/kg LFP batteries… Gotion plans to bring LFP cells with an energy density of 230 Wh/kg to series production by the end of this year.”

- “China’s CATL to produce next-generation EV battery in 2023… CATL’s new battery, called Qilin, will boost volume utilisation rate to 72%, the world’s highest, versus 50% for its first generation launched in 2019, the firm said, and increase the battery system’s energy density to 255 Wh/kg.”

Note: Re CATL: The LFP version of the Qilin has an energy density of 160Wh/kg. CATL stated in June 2022: “The CTP 3.0 battery can increase the energy density to 255Wh/kg for ternary battery systems, and 160Wh/kg for LFP battery systems. With the same chemical system and the same pack size, it can deliver 13% more power than the 4680 battery, accomplishing an all-round improvement in range, fast-charging, safety, service life, efficiency and low-temperature performance.” Note CATL is planning a better ‘LMFP’ battery with up to 230 Wh/kg soon. AutoEvolution stated in July 2022: “The theoretical energy density of the Lithium Manganese Ferro-phosphate (LMFP) batteries can reach up to 230 Wh/kg, which is closer to actual NCM batteries.”

Note: Forbes quoted in Sept. 2021: “Tesla’s current 2170 cells in the form of the Panasonic 6752 units supplied in US-manufactured Tesla Model 3 cars have an energy density of 260 Wh/kg.” Tesla plans to improve on this significantly with its new 4680 batteries. Battery Design quotes the 4680 as having an energy density of 276 Wh/kg.

The main negative of LFP batteries can be slower charging times in cold weather. Tesla SR vehicles overcome this by preconditioning (warming) the LFP battery in cold weather prior to charging.

Comparison of battery range for Tesla SR (LFP v NCA)

In March 2022, Energy Storage News reported:

…Lithium iron phosphate (LFP) will be the dominant battery chemistry over nickel manganese cobalt (NMC) by 2028, in a global market of demand exceeding 3,000GWh by 2030. That’s according to new analysis into the lithium-ion battery manufacturing industry published by Wood Mackenzie Power & Renewables……..CEA said LFP outsold NMC among batteries sold by Chinese manufacturers, with its market share growing through the year: of 100GWh of lithium batteries used for EVs and ESS, 44% were NMC and the majority of the remainder LFP.

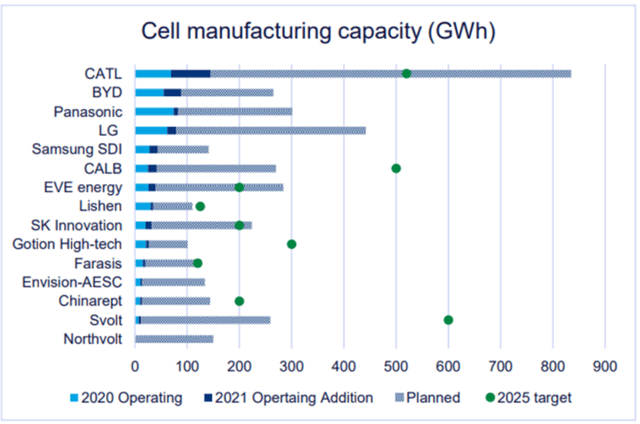

As shown below the Chinese battery manufacturers (CATL, BYD, CALB, EVE, Gotion), who are leaders in LFP batteries, have by far the largest growth plans. Tesla’s move to LFP batteries for all their global standard range smaller vehicles (Model 3, Model Y) is being followed by other auto OEMs.

Energy Storage News courtesy Wood Mackenzie

7. OEMs and Battery manufactures are increasing charging speeds using improved batteries and faster charging infrastructure.

Faster charging is a key trend in 2022 as companies initially moved from 250 kW fast chargers and are now heading towards 500 kW chargers. Generally speaking faster charging also requires an improved battery anode, which typically uses more silicon in the anode to accept electrons quicker.

In July Electrek reported:

NIO Power Day 2022: New 500 kW fast chargers coming to China and the EU this year……The 500 kW fast chargers have peak currents of 650 amps – easily some of the most impressive power in the current industry and a clear response to competitors in China. In August of 2021, GAC Aion launched a 480 kW fast charger… Just last week, chairman and CEO of fellow EV automaker XPeng He Xiaopeng said the company would be gradually rolling out its own 480 kW/800V charging network later this year to support high-voltage charging on its upcoming G9 SUV. According to He, XPeng’s new superchargers can deliver 200 km (124 miles) of range in five minutes and can replenish an 800V battery pack from 10-80% in 12 minutes.

On June 28 SupChina reported:

CATL’s new battery is a leap forward but also a precursor of something radical to come. The Qilin 3.0 represents the latest evolution of a lithium battery… The Qilin uses cell-to-pack [CTP] technology… With an energy density of 255 watt hours [WH] per kilogram, the Qilin features CATL’s large surface cooling technology, with the cooling component located between the cells (instead of at the bottom of the cells), thus greatly increasing the area where heat can escape. The Qilin can… charge up to 80% battery capacity in 10 minutes, all of which outperforms the Tesla 4680 battery cell that was launched in 2020… the Qilin has four main advantages: safety, long life span, high energy, and fast charging ability.

8. Lithium supply struggles to meet surging demand resulting in high lithium prices with no price collapse in sight.

The current very high (and remaining high) lithium price is testament to the surging demand with supply battling to keep up. Pilbara Minerals [ASX:PLS] recently achieved a staggering ‘pre-auction’ bid equivalent of US$7,017/DMT at their BMX auction for 5,000 tons of spodumene.

Despite Goldman Sachs controversial report suggesting a collapse in lithium prices in 2023, very few specialist analysts in the industry agree, unless of course we get an EV sales collapse.

More on our latest lithium demand v supply forecast in the exclusive Trend Investing article here.

On July 7 Investing News reported:

Lithium producers bullish on demand, cooperation key for global supply growth……”The executive from SQM, which operates its primary lithium business in the Salar de Atacama in Chile, said the market is growing and will need new supplies of 200,000 to 300,000 metric tons [MT] of lithium every year. That was about the size of the market in 2018. “That means that you need roughly 8 to 10 new projects coming on stream every year,” he added.”

9. Big oil and auto OEMs are finally moving towards achieving ‘secure’ supply of critical materials, especially lithium.

Tesla has been leading the pack with its efforts to secure EV metals off-take deals from multiple sources.

However, the latest trend has been for auto OEMs (Stellantis (STLA), Ford) and now an oil company to invest directly into lithium companies or projects. This way they can achieve ‘secure’ off-take and also reap some of the profits via their share ownership.

In April 2022 Bloomberg stated (reported by Mining.com):

Elon Musk said this month that lithium had gone to “insane levels” and is the “fundamental limiting factor” for EV adoption, adding the car giant might consider mining or refining it directly.

We also saw majors such as Rio Tinto (RIO) [ASX:RIO] make a large lithium project purchase in Argentina for US$825m, and Ganfeng Lithium (OTC:GNENF, OTCPK:GNENY) [SHE: 002460] recently reported to be buying Lithia Inc. for US$962m, who has lithium projects in Argentina.

10. Western governments have finally woken up to the need to secure critical EV metals and build ‘local supply chains’

The U.S, Canada, and Australia have all been making some significant moves the past year towards building local EV and battery factories and/or EV supply chains. This has accelerated in 2022 as the EV supply chain shortages have exposed the West’s critical shortages in key EV metals and their processing.

Further reading

Conclusion

The trends of 2021 continue to play out in 2022 and in the case of supply chain concerns have increased significantly. Lack of EV supply is being met with surging demand from consumers hit by record high oil (gasoline/petrol) prices. This has led to electric car waiting lists blowing out to a number somewhere around 3m globally, with many auto OEMs closing order books for certain models and in certain countries.

2022 is a whole new world where demand for EVs has surged, just as supply has been constrained. The experts warning of EV metal shortages and the money and time required to build EV metal mines (5-10 years+) are finally a shock reality to many legacy auto OEMs, who have spent years with their heads in the sand. Many of these will not survive the decade. In June we did see Ford support Liontown Resources (OTCPK:LINRF) [ASX:LTR] and this will likely become a new trend.

For investors the current climate watching lithium prices exceed record prices in 2022 month after month, while the lithium miners stock prices have fallen, has become a huge disconnect. This will only further exacerbate the lithium shortages later this decade, and the subsequent EV waiting lists will likely grow longer and longer. At least the past month with the ~US$370b from the U.S Gov. approved to support climate change (Inflation Reduction Act) we are starting to see EV metal miners stock prices do very well again.

Assuming we avoid a severe global recession then 2023 should potentially again see spectacular returns for the quality and growing companies from EV OEMs, battery manufacturers, and EV metal miners. Given lithium is largely essential and the huge time lag to bring on new supply, the quality lithium stocks should potentially again shine bright in 2023, if not sooner.

As usual all comments are welcome.

Be the first to comment