sasirin pamai/iStock via Getty Images

Introduction

Roughly a year ago, I published an article with the title “Love the company, hate the price” concerning Texas Instruments Incorporated (NASDAQ:TXN). Despite being an extremely well-run company, the valuation was simply too step. Since then, the price of Texas Instruments, has declined by 16.7% in comparison to 6.3% for the S&P 500.

I’ve been long TXN since 2019 at a price of $104.90 per share and wanting to add more in the most recent years as long-term demand in the industry has picked up its pace, despite already expected to grow strongly over the coming many years. Having seen the stock trade in the range of $170-200 per share since then, the price has finally buckled some, causing me to give the stock another look, as this is one of the management teams around that I have the highest faith in, when it comes to taking care of my interest as a shareholder. Additionally, this is one of the most shareholder-friendly companies around.

Financial Status – Making It To The Next Plateau

My biggest argument with Texas Instruments has been the lack of growth over the past decade, but that just changed.

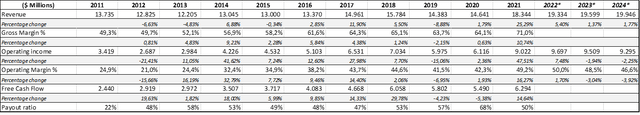

Author’s own creation: Sources, annual reports, Seeking Alpha, MarketScreener.com

As can be seen from the table above, revenue grew only 6.6% between 2011 and 2020, but then the lack of semiconductors struck the market in conjunction with ongoing investments conducted by the company, meaning revenue took a step up, growing 25% YoY from FY2020 to FY2021. Revenue between 2011 and 2021 have therefore grown 35.9% due to that one significant jump between FY2020 and FY2021.

The FY2021 revenue broken down looks the following. 77% of revenue from its analog business, 17% from embedded and 6% from other. Analog technology provides the power to run devices and is fundamental to how technology interfaces with human beings, the real world and other electronic devices. Therefore, every time a system is “digitized,” there is growing need and opportunity for analog chips. The embedded processor technology carries the role of acting as digital brains for electronic equipment. Further digesting the revenue and the split across customer segments look the following. 41% of revenue towards industrials, 24% towards personal electronics, 21% towards automotive with the remaining 14% across several smaller categories.

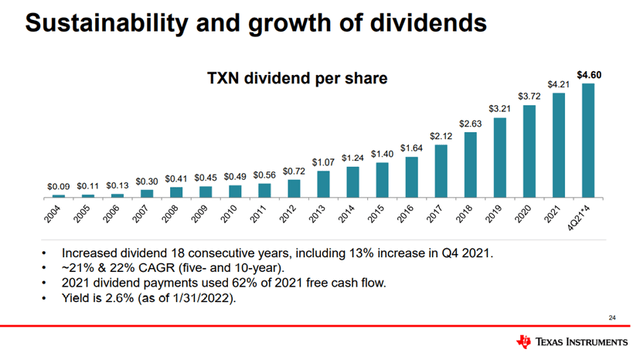

Due to the gross margin expanding from 64.1% to 71%, operating income increased by a staggering 47.5% YoY from FY2020 to FY2021. Management has done an excellent job at expanding margins over the past decade, but gross margin has never made it past 65%, meaning that 71% was quite a jump. As a result, the payout ratio also took a significant plunge, coming down from 68% to 50%, a much more comfortable level for those who are looking at Texas Instruments from a dividend growth perspective. With an 18-year dividend hiking streak and a 5-year 18.9% CAGR for its dividend, that does weigh a lot for many shareholders, including myself.

Looking ahead, and consensus expectations are for TXN to increase its revenue by 5.4% this year, before succumbing to the usual 1-2% annual growth as has been the usual performance on average over the past decade. Further, the operating margin is also expected to trend downwards towards the average of the past five years, albeit a bit higher, which appears fair, at least not unreasonable.

We are getting a bit of mixed signals from its peers early on in this earnings season. Taiwan Semiconductor (TSM) delivered a smashing performance, beating on both revenue and EPS, while even providing a guidance for the coming quarter well ahead of prior expectations. However, they did cite a beginning understanding of some customers cooling their demand due to growing inventories. So, while TSM responded positively intraday, many peers saw their stock decline. Similarly, Intel (INTC) has begun informing customers of rising prices as a need to combat input inflation.

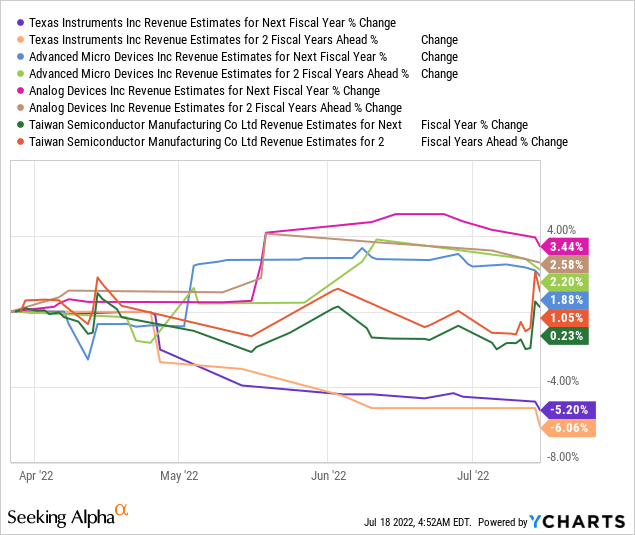

It shall be interesting to see how TXN fared in the most recent quarter when it reports on July 26th, and even more interesting to hear their guidance, as especially the forward earnings expectations could impact the stock price as the forward expectations are to the positive side. When it comes to the forward revenue footprint, management has a plan to connect the new revenue plateau with future growth.

The Longer Perspective

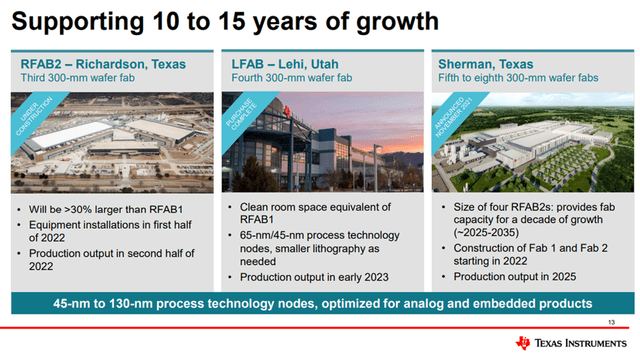

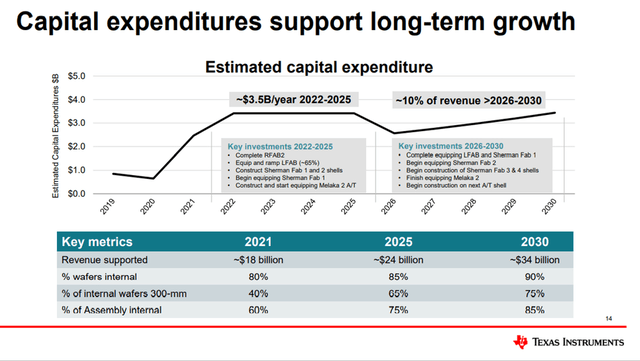

Texas Instruments have some of the best margins in the industry, and management continues to invest in their low-cost manufacturing advantage, in order words, investing for the long-term benefit of the company. As recently as April, management announced another expansion in their upcoming second 300mm analog foundry, originally a $3.1 billion investment expected to drive growth through 2022-2025 as it is expected to generate output from end of this year.

Additionally, in May this year, Texas Instruments broke ground on its new 300mm wafer fabrication plant in Sherman, Texas. First output from this facility is expected sometime during 2025, complementing the existing 300mm fabs including DMOS6 in Dallas and RFAB1 supported by the ongoing RFAB 2 in Richardson, the foundry mentioned above expected to launch by end of this year as well as LFAB in Utah, expected to begin production by early 2023.

Texas Instruments Investors Centre

In my original piece concerning Texas Instruments, I allocated a lengthy part of the article detailing the complexity of being a semiconductor manufacturer, containing some of the strictest requirements and complex manufacturing processes amongst all industries, even including pharma where the requirements for cleanrooms and sterility are amongst the strictest. Highly specialized assets coming at steep costs, already creating a significant moat. Additionally, Texas Instruments have gone the route of focusing on niche leadership, causing me to conclude the following in my earlier article.

Already being the largest operator when it comes to the analog chip platform, Texas Instruments may very well strengthen its hold and advantage from having the second foundry, also expecting to drive state of the art cost levels. This also ties together with my initial point concerning the very wide moats surrounding the industry. It will be very difficult for new entrants to challenge the niche that management has established…The industry has experienced a consistent upwards moving global demand and Texas Instruments niche is expected to experience healthy growth rates for 2021 and the coming years. If that does materialize, it would solve the one major problem I can identify when looking at the company’s historical and expected future performance. The question remains, whether it is just a new plateau for Texas Instruments, or whether they may enter a phase of sustained growth, but it would be very welcome news after having struggled for so long to increase its revenue which will be the driver for future value for shareholders.

Indeed, I feel more confident checking off future growth expectations as a year has gone by since I last looked at the company.

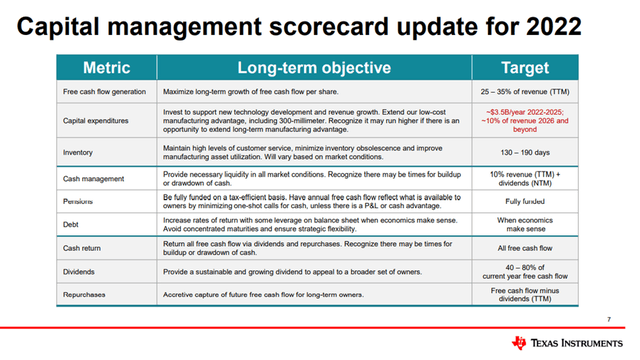

Texas Instruments Investors Centre

Management is dedicating vast amounts of capital towards investing in the future, already at $3.5 billion annually until 2025 and then an expected 10% of revenue annually going forward, which would correspond to roughly $2.5 billion annually, trending upwards as revenue expands.

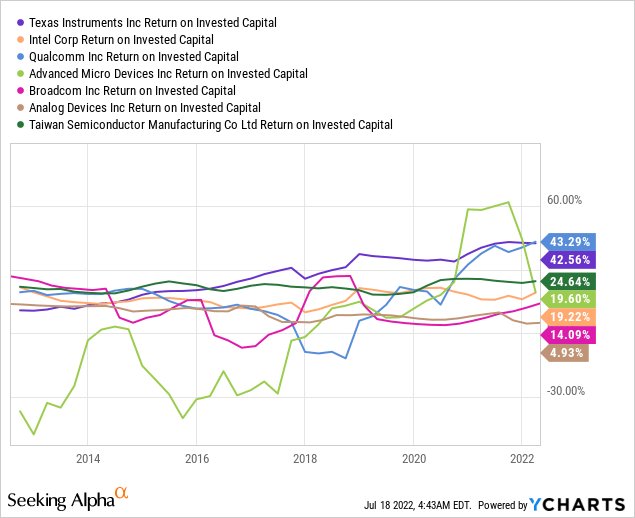

Now, that is a lot of capital, raising the question whether I as a shareholder should feel confident that management is prioritizing the right roadmap on behalf of the company?

The answer lies in the graph above and is a resounding yes. No peer has consistently been churning out so strong returns on invested capital as done by Texas Industries. The management team, led by CEO Richard Templeton, has year-on-year secured staggering returns on invested capital. The point of this financial metric being, that it gives shareholders an understanding of whether management is deploying capital in a value adding manner. In essence, it illustrates management’s ability to secure profits from their investments, naturally, I’m on the lookout for top performers on an industry basis – Texas Instruments is one such company.

Texas Instruments Investors Centre

While focusing on a niche comes at a risk, should the growth opportunities dry up, I believe the management team at Texas Industries have earned their shareholders trust and know that their capital prioritization today, will drive considerable value for the company and its shareholders tomorrow. Flipping that coin, and Texas Instruments is also benefitting from long-term customer relations creating a mutual dependency. Management concludes they are in a position to continue driving growth long-term, securing roughly $34 billion of annual revenue by end of this decade.

An Extremely Shareholder Friendly Company

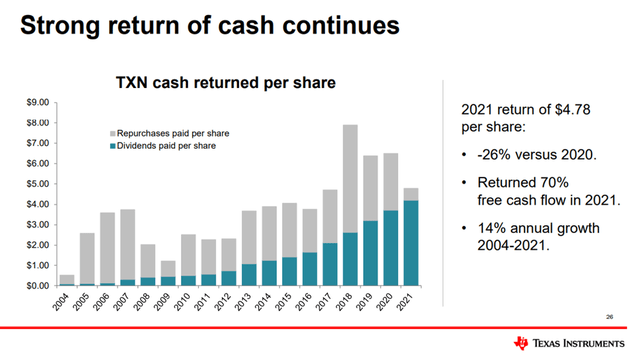

I invest in Texas Instruments because it consistently has driven strong returns while carrying a strong dividend growth track record with no slowdown in sight. Texas Instruments has beaten the S&P 500 on a 3-year, 5-year, 10-year and 20-year total returns perspective, and here we aren’t talking about a small margin. On a 20-year comparison, TXN has delivered total returns of 867% compared to the S&P 500 of 481%. On a 10-year horizon, TXN delivered 683% compared to S&P 500 with 247%.

I’ve snipped the following highlights from their own investor overview

- We run the company with the mindset of being a long-term owner.

- We believe that growth of free cash flow per share is the primary driver of long-term value

- 12% free cash flow per share annual growth (2004-2021)

- 18 consecutive years of dividend increases, 25% CAGR (2004-2021)

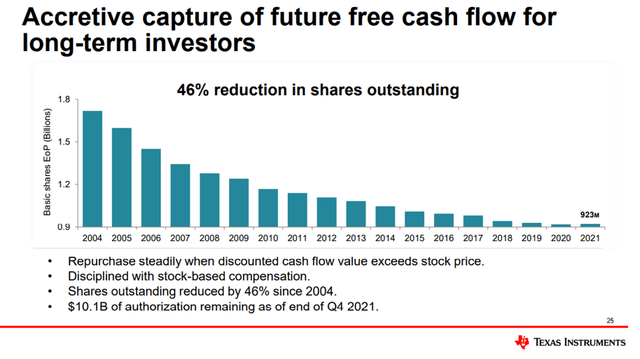

- 46% share count reduction (2004-2021)

- 89th percentile in S&P 500 free cash flow margin (2021)

- 87th percentile in S&P 500 cash returns as percent of revenue (2021)

- 97th percentile in S&P 500 return on invested capital (2021).

Texas Instruments Investors Centre

The illustration provided by the company above says it all, and I’m banking on the graph to continue its incredible development when looking back in ten years. In many ways, I perceive TXN as a “set it and forget it” kind of investment.

Texas Instruments Investors Centre

Texas Instruments has long since earned shareholders trust when it comes to delivering that annual hike for a growing dividend. Last year, shareholders were gifted with a 13% increase. While well below the five and ten-year CAGR levels, it still easily combats the current inflation, and I’d be surprised if we don’t see a double digit hike this year as well. Using my own starting point as an example, I bought my first stocks with a forward yield of exactly 3%. While having held the stock for just a couple of years, my forward yield on cost has already grown to 4.4%. Observe the graph and it’s evident the dividend has plateaued several times, only for a major leg upwards to appear suddenly. During the financial crisis, management hiked the dividend with one cent á quarter for two years straight. I’m sure long-term holders have forgotten that a long time ago.

Texas Instruments Investors Centre

When it comes to share repurchases, management doesn’t go blindly into action, they pick their moments as also explained here. Considering the lofty valuation of Texas Instruments over the past year, I’m pleased to see management having held back during 2021, as can also be seen in the first illustration of this section. That is despite a double-digit billion authorization having been active at that time. Now, that is taking care of shareholders and being prudent with your capital.

You have probably read between the lines at this point but let me just say it anyway. This management team is one of my absolute favorites when it comes to taking care of their shareholders. If you are a long-time follower of my articles, you will see I hold other management teams in much smaller regard, for instance that of Cisco (CSCO).

Risk

Speaking of management teams, this might come off as an unusual risk, but Texas Instruments has an incredibly experienced, and old, management team in place. Out of the twelve-person large board of directors, only four are below the age of 60. Those three individuals are 54, 56 and 59 years of age. I’m particularly aware of the potential impact of Richard Templeton, 63, nearing his retirement. He has been the CEO since 2004 except for a short stint in 2018 when he originally resigned his position, however remaining chair at the time, before reassuming the role of CEO.

The day-to-day leadership team, run by Richard Templeton, is of course a different story, but I would like to see a more diverse setup in terms of age, so as to avoid seeing the higher echelons of senior management having to be replaced all at once.

Haviv Ilan, COO, is 52 while Ahmad S. Bahai, CTO, is 57. The younger members of the team consist of Rafael R. Lizardi, CFO, 48, and Krunali Patel, CIO.

The current strategy in terms of capital deployment and shareholder prioritization goes back a long time, but with new senior management comes the need to assert oneself in shape of new plans and visions. I don’t know how senior management will look down the road, but the potential need to execute major leadership changes is a risk for me as a shareholder.

Valuation

The stock has been on an absolute tear in recent years, delivering total returns of 31.8% in 2020 and 18.1% in 2021. At the time I published my article last April, the stock had a YoY total return of 77%, having caused a significant multiple expansion as the fundamentals hadn’t been able to keep track. However, the company eventually delivered on the investor consensus expectations for 2021, and then some.

Having already established this company is in a strong position with a clever management team at the helm, the only remaining obstacle is the valuation.

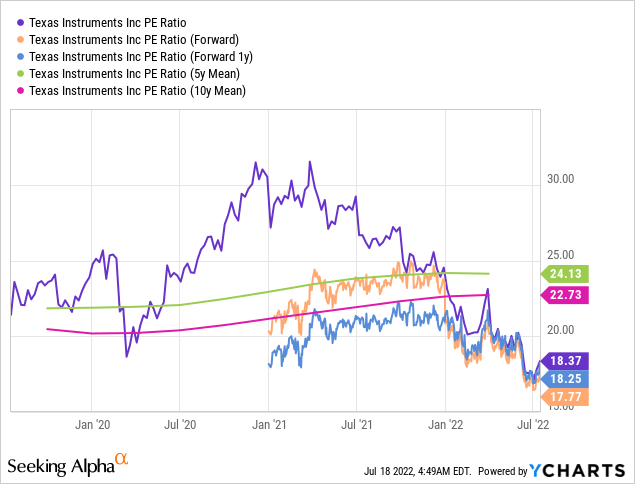

As can be seen, during April of last year, the company traded with a forward P/E of almost 30, a significant overvaluation seen from my perspective, as such levels are reserved for high growth companies, and TXN wasn’t one such company over an extended period. Today, the company trades with a forward P/E of roughly 18, well below both the 5y and 10y mean levels. At the first glance, the stock therefore appears much better valued, but let’s have a look at how it comes off compared to its peers.

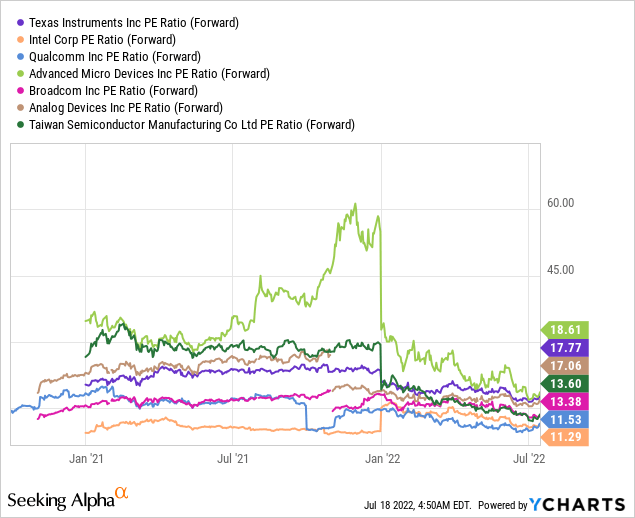

The entire semiconductor peer group has come down from prior years lofty valuations. TXN is valued higher than most of its peer group still, and the forward consensus estimates only indicate minor growth for the company. However, Texas Instruments doesn’t stick out too significantly when observing the peer group.

If we look at the three highest valued companies of the prior graph, Advanced Micro Devices (AMD), Texas Instruments, and Analog Devices (ADI) as well as Taiwan Semiconductor, we see all are expected to grow in the coming two years, except for Texas Instruments. This weighs on the fact, that Texas Instruments comes with the second-highest valuation of its peer group, and not in a positive manner. In general, when holding a P/E of roughly 18, I would expect the company to have a short-term growth runway, while growth in the case of TXN, is more on the mid- to long-term. It is difficult to imagine TXN appreciating substantially in the coming years if top- and bottom-line doesn’t provide growth, as it would require a multiple expansion, and TXN is already in a place where the multiple is on the edge of being valued too high.

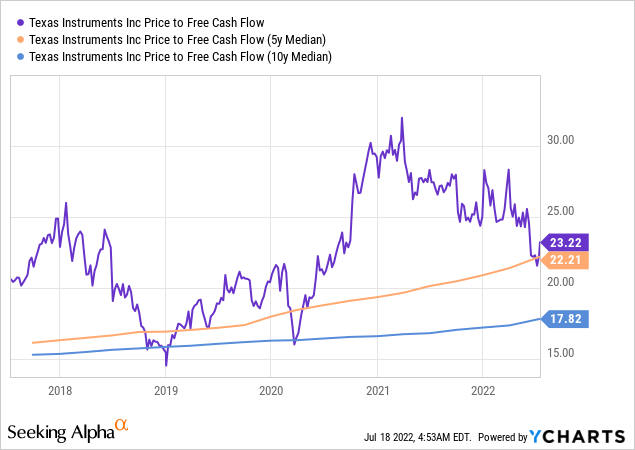

If we look at price to free cash flow, it becomes evident that the stock still has to trend lower to really enter buy territory. The current multiple is well above its 5-year and 10-year mean levels, especially the 5-year as the valuation had expanded in conjunction with the broader market and its sector. In the optimum scenario, the multiple would trend down all the way to its 10-year average, but we must also ask ourselves if that’s realistic given how hot of a topic semiconductor shortage has become in recent years, causing investors to drive up valuations.

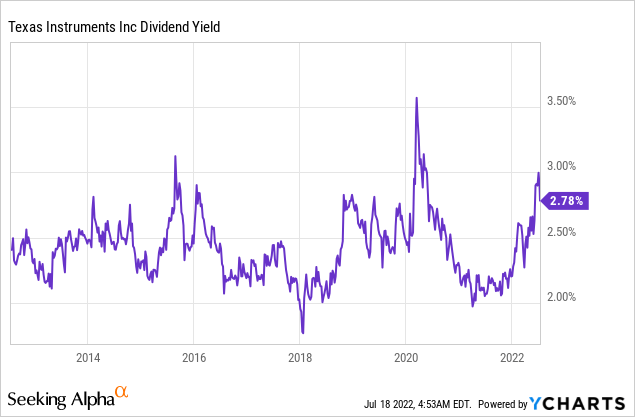

Lastly, I want to observe the dividend yield. My personal threshold for buying companies who belong in the mature dividend grower basket, is at a 3% forward yield. The company is fairly close to this point, but I also reckon that other investors may feel differently about this. Observed over the past decade, and the current yield is around the area where it doesn’t get much better.

Concluding on my observations, and Texas Instruments is in territory where it’s worth nibbling at the stock. It’s a fair opportunity to go long a great company, but not a great buy. For that to happen, the stock would have to trend down into the $140-$145 per share range. Below that, and I’d be very interested in adding to my existing position.

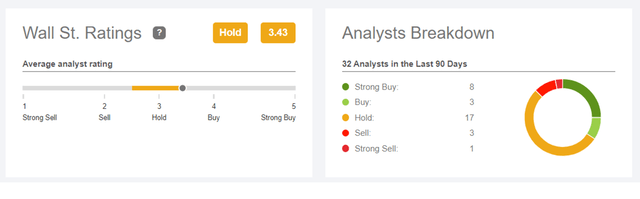

The Wall Street consensus is a price at $182 per share, but the main observation is, that they are also on the fence with a substantial part of analysts having the stock marked as a hold.

Given where the stock is currently at, it’s difficult for me to conclude that Texas Instruments will be the vessel for market beating returns in the coming years, as the valuation is already on the edge, while investors most likely have to be patient to experience the next leg up in terms of growth.

For new shareholders interested in obtaining exposure towards semiconductors, Texas Instruments remain one of the industry greats, but I would build my position over time as especially weakness in forward guidance can pressure the stock in the short-term. If guidance gets cut, the valuation becomes less attractive than initially perceived. We are after all bracing for a delicate earnings season.

With a well-run company such as Texas Instruments, short-term weakness is typically a great long-term opportunity, and Texas Instruments is all about letting the long-term compounding work in your favor.

In essence, I think one can nibble here, but for the stock to be attractive, it would have to trend lower as the valuation is at best, fair in its current form.

Conclusion

Texas Instruments has an immaculate track record of driving very strong returns on its invested capital, well ahead of its peers, having benefitted shareholders immensely by beating the S&P 500 on both a 10-year and 20-year horizon. Holding 18 consecutive years of dividend growth with a 25% CAGR from 2004-2021, while having reduced its share count by 46% during the same period. This management team is aligned with its shareholder base, and the returns speak for themselves, while never being a promise in terms of future returns.

The stock was due for a pause, as the valuation had bloated to a P/E close to 30 for the greater part of 2021 with the forward P/E at times close to 25. Now, the P/E is just above 18, with the forward P/E just below 18, still higher than the S&P 500 long-term average, but not significantly overvalued, and in territory where it can be justified to dip one’s toes, but not deserving of a buy rating. Should the stock retest the prior July low of $140-$145 per share, I would consider it an obvious buy opportunity. When observing the valuation from multiple angles, P/E ratios, P/FCF ratios and its historical average yield, it’s evident the company is at best, fairly valued and falls short of a buy rating.

Texas Instruments have for long struggled with growing its top line, but has successfully managed to reach the next plateau, while having a plan for the future, expected to grow the revenue mid- to long-term, helping drive further shareholder returns. My prime concern being, the date of necessary management transition coming ever closer as the old guard can’t be expected to steer the ship when looking just five years down the road, causing some uncertainty as to what Texas Instruments will look like after that transition given how successful the current management team has been.

Be the first to comment