georgeclerk

Introduction

What does Amazon’s Lord of the Rings series have to do with Costco? More than we think. In fact, I would like to show how Amazon’s huge $1 billion investment just for the rights and the first season makes sense if we look at how Amazon was influenced by Costco in earning money.

This article can also be seen as the third episode of my research, coming after an article on Costco’s (NASDAQ:COST) business model and an in depth-analysis on the value of the “Lord of the Rings” series for Amazon (NASDAQ:AMZN).

I will try to show Costco’s influence on Amazon and why this is key to understand what kind of investment Amazon is undertaking with this series.

I am having a lot of fun researching business models and understanding the way they help a company make money. Hopefully, this article too will offer some valuable insight while giving also a bit of entertainment.

When Bezos met Sinegal

In his biography on Bezos, Brad Stone writes that in 2001 Jeff Bezos met Jim Sinegal, the founded and then CEO of Costco. While they talked Sinegal explained to the found of Amazon the secret of Costco that built – and still builds – strong customer loyalty.

“Though the selection of products in individual categories is limited”, said Sinegal, “there are copious quantities of everything there – and it is all dirt cheap. Costco buys in bulk and marks up everything at a standard, across-the-the-board 14 percent, even when it could charge more. It doesn’t advertise at all, and earns most of its gross profit from annual membership fees.”

At first, the fee seems somewhat unreasonable and customers stir away from it. But once they pay it and get access to the advantages Costco offers them, they start perceiving that they are getting a much greater value compared to the feed they had to pay.

Bezos was impressed by Costco’s focus on delivering value and it is said that after this meeting he met with Amazon’s senior management and told them that Amazon would have started cutting prices by 20-30%. And it is during this period that he is said to have observed the famous sentence that even Mark Zuckerberg reported:

“There are two kinds of retailers: there are those folks who work to figure how to charge more, and there are companies that work to figure out how to charge less, and we are going to be the second, full-stop.”

Costco’s Business Model

Costco is a one-of-a-kind company and a unique stock. It trades at very high valuations, comparable to those of fast-growing stocks. Yet, it has a low beta and every time it dips it is among the quickest stocks to recover. No wonder it has a very low short interest, since not many investors are willing to bet against this profit-making machine.

The way Costco operates is somewhat counter-intuitive. Instead of focusing on high margins, Costco keeps its margins as low as possible on purpose. In addition, as Sinegal explained to Bezos, Costco doesn’t focus on having a wide a variety of goods, but rather offers well-known products that consumers are familiar with and that have great demand.

In its annual report, Costco explains this strategy, writing that its business is run

based on the concept that offering our members low prices on a limited selection of nationally-branded and private-label products in a wide range of categories will produce high sales volumes and rapid inventory turnover. When combined with the operating efficiencies achieved by volume purchasing, efficient distribution and reduced handling of merchandise in no-frills, self-service warehouse facilities, these volumes and turnover enable us to operate profitably at significantly lower gross margins (net sales less merchandise costs) than most other retailers. We generally sell inventory before we are required to pay for it, even while taking advantage of early payment discounts.

But, if margins are not Costco’s focus, how does Costco earn money? Here is the key to keep in mind: membership fees. As Costco states:

The membership format is an integral part of our business and has a significant effect on our profitability. This format is designed to reinforce member loyalty and provide continuing fee revenue. The extent to which we achieve growth in our membership base, increase the penetration of our Executive members, and sustain high renewal rates materially influences our profitability.

It is easy to understand why Costco considers itself more like a buyer than a seller. The company, in fact, conceives its operations as representing so many members that it can obtain absolute bargains on their behalf from the companies whose products are the most wanted. While Costco sells goods almost at cost because of its low margins, the money that pours in from membership fees goes directly down to the bottom line as it requires almost no additional costs to be earned.

No surprise Costco keeps on reporting increasing comparable sales growth, achieved both through increased shopping frequency and increasing average ticket. Comparable sales growth is indeed a goal of Costco because the more the number grows, the less fixed costs impact on profitability. Now, Costco releases monthly its sales reports and this helps investors know that Costco keeps on reporting a low-double digit growth.

Costco will report its Q4 and full year results next week. Up until then, in order to get a grasp of how this model translates into numbers we can use the data from last year’s annual report.

Last year, the company’s net income was $5 billion, which, compared to a $196 billion revenue. This makes the net income margin just 2.55%. However, Costco also disclosed that the revenue from membership fees was $3.88 billion. For sure, this revenue has some costs. However, we can assume they are a tiny part compared to total amount because. This means that 77.6% of Costco’s net income comes from membership fees. It is quite remarkable: the less Costco earns on goods sold, the more its membership becomes valuable and makes members renew it consistently.

How Amazon Prime works

We have seen how Costco focuses on making most of its money from membership fees that are perceived very valuable by customers.

Amazon, over the years, has been inspired by this model and has taken it even further. At first, Amazon started lowering its prices. But over the years, Amazon has been building the Prime ecosystem that is quite unique.

The core idea of Amazon Prime is that it offers to its members a greater value compared to the annual fee. In exchange, Amazon knows that each Prime member is worth much more than its annual membership fee. In fact, Amazon has repeatedly pointed out in its earnings calls this point. For example, David Fildes (Director of IR at Amazon), explained during Q4 2017 earnings call:

We continue to see that as Prime members sign up and engage into the program, their purchasing patterns of change and they do spend more as they move into the program.

A few years later, in the midst of the pandemic, Amazon repeatedly stressed this point, stating during the Q4 2020 earnings call that:

Prime members continue to shop with greater frequency and across more categories than before the pandemic began. Prime members also continue to expand their usage of Prime’s digital benefits including Prime Video and Prime Video channels.

These words help us grasp another aspect. Prime members usually sign up for the membership program because of free shipping. However, once they have Prime, they start seeing that they have many more benefits in addition to free shipping, Prime Video being among the most used ones. Now, we could think that Prime Video is just a huge expense with no return for Amazon. This is not true as David Fildes, in the Q1 2021 earnings call, explained that the role of Prime Video is becoming more important to gain new customers for Prime and increase the already high retention rate:

Just in terms of strategy, I think there’s probably nothing new or surprising, but just to reiterate it, we look at Prime Video as a component of the broader Prime membership and making sure it’s driving adoption and retention as it is.

Amazon knows that at first free shipping was the most wanted benefit. Now, it has realized that Prime Video is a strong channel to increase conversion rates of free trials and membership renewals. This is why Amazon is spending more and more on Prime Video.

Brian T. Olsavsky, Amazon’s CFO, during the Q3 2017 earnings call said something interesting about the things I just highlighted (bold is mine):

We’re going to continue to invest in video and increase that investment in 2018. And why are we going to do that? It’s because the video business is having great results with our most important customer base, which is our Prime customers. It continues to drive better conversion of free trials, higher membership renewal rates for existing subscribers and higher overall engagement. We’re seeing the engagement go up year-after-year in video and also music and a lot of the other Prime benefits. We also know Prime members who watch video also spend more on Amazon.

And we have a lot of data where that’s the advantage we have is that we see the viewing patterns, and we also see the sales patterns, so we can tie the two together and understand which video resonates with Prime members, which video doesn’t, and make mid-course corrections. So we always do that. We’re always changing the emphasis and looking for those more impactful shows, more shows that resonate better with our customer base, and things they want to see. So that will always be an important part of our Prime offer, and we’ll continue to use the data that we have to make better and better decisions about where to invest our dollars in Prime Video.

Amazon has an advantage over Costco. Its ecosystem is completely online and the company gathers a huge amount of data about customer behaviors and interests that it can leverage to execute better its business. Thanks to this data, Amazon has learned that Prime members who use Prime Video spend more and are thus more valuable for the company.

Amazon Prime subscriptions

We know that at the end of 2021 there were more than 200 million members, as said in the shareholder letter. According to some estimates, about 175 of these members use Prime Video. More than 75% of Prime members are in the U.S., with around 160 million American users. The remaining 40 million are international users.

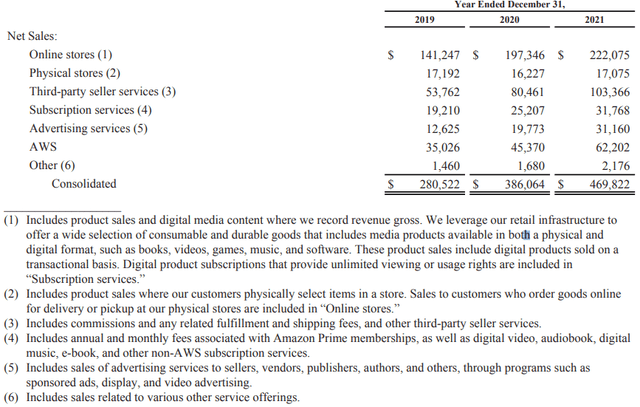

Let’s take a look at some numbers. In 2021, Amazon reported a total subscription net sales of $31.77 billion, even though we don’t know exactly the percentage that comes from Prime. However, we know that subscription services excluded AWS. So, I think it is pretty fair to consider that the majority of the subscription services revenue comes from Prime, since there are not many people who subscribe only to e-book or audible or digital music without being Prime members, too.

We have to try to understand how much Amazon really earns from a Prime subscription. The key is not only the annual fee paid, but the real value a Prime member has for the company. A recent survey reached the results that a Prime member spends on average $1,400 on Amazon, versus the $700 spent by non-Prime members. If we do a little math, we see that every time Amazon gains a Prime member it is gaining its annual fee plus an extra $700 in spending that will be deployed during the year. We know that the retention rate is high and this means that a Prime member has a lifetime value of more than its $700+fee that Amazon obtains during the first year of subscription.

What is really interesting is that Jeff Bezos is aware that Prime is sticky because it creates value for its members too. In his last letters to the shareholders before resigning as CEO, Bezos estimated that Amazon created a $630 value for every Prime member, after subtracting Prime costs. This means that, even if the U.S. fee is $139/year, Prime members are obtaining a net value of $590 per year. It is a win-win situation: customers save money and Amazon earns more.

Amazon Prime members lifetime value

Amazon is not focused on quick profits, as Josh Tarasoff explained ten years ago in a key essay I use to understand Amazon. In fact, the company is not yet focused on profits, since it is investing heavily into different bets. Amazon has an outstanding track record to deploy capital that is able to generate huge returns over the long-term. As we said, Amazon doesn’t think about a Prime member as a new revenue for one year, but it values the subscription for its lifetime value.

As per statista.com, Amazon’s Prime member retention rate after 1 year is 93%, 98% of which renew for a second year. This means that, for every 100 new members, Amazon will still have 91 subscriptions after two years, which are then likely to become loyal Prime members.

Now, with the available data from Amazon annual report, I tried to give an estimate of the value of a current Prime member and the one for a newly added member. I shared my calculations in my previous article on the value of the Lord of the Rings series for Amazon. Here, I just want to share my results, which is that the lifetime value for Amazon of a present Prime member is $1,317.14 while the present value of a new member is a bit lower at $930 due to the cost of acquisition that needs to be discounted.

Just to get an idea of what this means, if Amazon grows and adds another 200 million subscriptions in the next decade, the total value that new Prime members will bring to Amazon will be around $190 billion. In any case, the real value of a new Prime member is about 11.6x its first annual fee paid. This is the key to understand how Amazon works and how Amazon has learned its lesson from Costco developing into a real ecosystem.

Conclusion

I am long both Costco and Amazon. A big part of the bull-thesis I have on these stocks comes from understanding their subscription-based business model that provides both companies with recurrent revenue. I think that with a huge and diversified company like Amazon, it is sometimes useful to understand its way of operating rather than breaking down the company into many different branches in order to analyze them.

Be the first to comment