anyaberkut/iStock via Getty Images

Investment Thesis

Workday (NASDAQ:WDAY) has a lot going for it, but one thing stands out above the rest. This is no longer a high-growth business. Meanwhile, investors continue to crowd into the stock as they perceive the safeness of Workday’s blue-chip status.

Workday’s recent Analyst Day dangles a carrot for investors that it will reach $10 billion in revenues. But Workday fails to contextualize when.

For my part, I contend that paying 29x next year’s operating profits for a business that’s evidently growing at 20% CAGR is simply too much and doesn’t afford investors enough margin of safety.

No Longer a High Growth Business

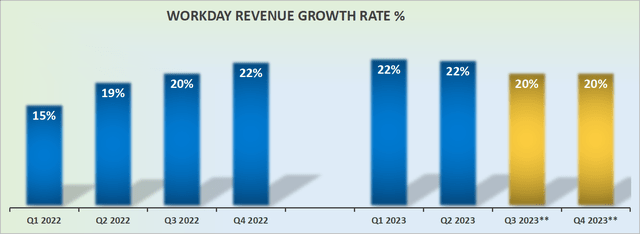

WDAY revenue growth rates

The graph above speaks for itself. We are facing a company that is clearly growing at 20% CAGR and no faster. Indeed, it’s now a good number of years since Workday was a high-growth company.

And while the bull case here is that Workday is highly entrenched in the workplace and will be able to continue to raise prices in an inflationary environment, I question just how much of that thesis has already been priced in.

What’s Next for Workday

Workday is a human resources, finance, and planning solutions platform. Workday’s platform is used by over half of the Fortune 500. This is really a blue-chip company servicing the leading blue-chip enterprises.

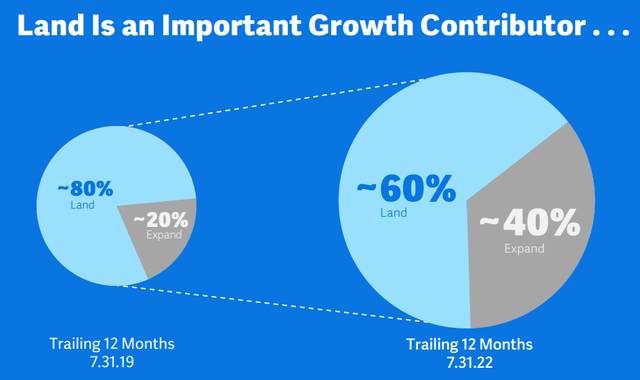

WDAY investor day

The main problem facing Workday is succinctly summarised above. What we can see here is that the majority of its growth is coming from its ability to expand and cross-sell to its customer base.

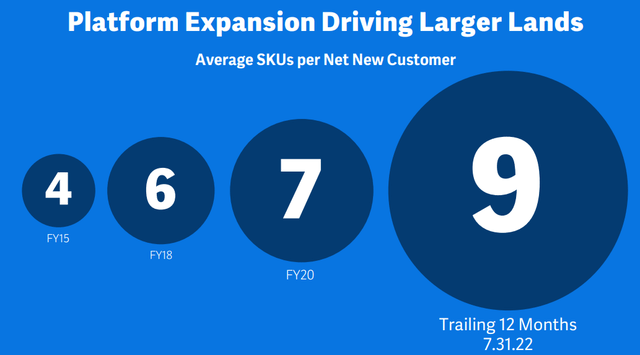

WDAY investor day

Again, you can see this from another angle. The number of products per customer continues to be the driving force here, rather than a significant uptick in customers.

Hence, I argue that this means that Workday is saturating the reach of its platform with potential customers.

Let’s Discuss Workday’s Profitability Profile

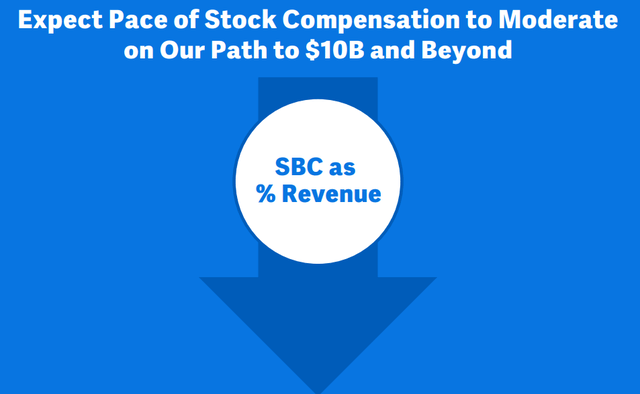

The graphic that follows is from Workday’s Investor Day too. It is a signal to investors that SBC expense is something that Workday is mindful about.

WDAY Investor Day

What you see highlighted above is that once Workday reaches $10 billion in revenues, its SBC will moderate. Needless to say that to go from $5 billion in revenues to $10 billion is a long way away.

In fact, it’s interesting to note that even though Workday highlights to investors its non-GAAP margins in Q2 2023 reached 20%, its clean GAAP margins were negative 2%. A substantial discrepancy.

WDAY Stock Valuation – 29x Next Year’s non-GAAP Earnings

Let’s make some assumptions. We know that Workday is guiding for approximately $6.2 billion in revenues this year. And if we assume that Workday continues to grow its revenues at 20% CAGR into next year, it’s likely that revenues reach $7.5 billion.

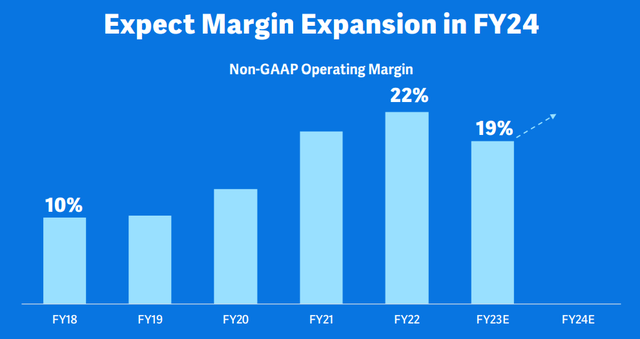

WDAY Investor Day

Next, if we assume 20% as Workday’s non-GAAP operating margins next year, emphasized in the slide above, that would put its operating profits at approximately $1.5 billion.

Then, on top of that, we should consider around 10% dilution to its diluted number of shares outstanding.

Altogether the stock is priced at 29x not this year’s but next year’s non-GAAP operating profits. A figure that comes before taxes and interest.

The problem with Workday’s valuation is that it’s not entirely cheap for what’s on offer. That being said, let’s be honest, tech has seen a dramatic re-rating lower of multiples across the board.

And with Workday priced at 5x next year’s revenues, it’s essentially an interest rate bet at this point. If interest rates continue to move higher, we should expect further compression in the multiple.

While if interest rates somehow positively surprise investors by stabilizing quicker than many expect, there could be some multiple expansion driving the stock higher.

The Bottom Line

To be clear, there’s a lot to like about Workday. It’s a steady-as-you-go company, that’s not going to provide investors with much in the way of negative surprises.

My only contention is that I believe that the stock is already pricing in ”that safety” perception.

And if we have learned anything in the past 18 months, it is that even in tech, it’s absolutely crucial to invest with a margin of safety.

Indeed, I’ll go further, I have come to believe that the market is going to remain choppy for longer and that in this context it’s even more important to have a wide margin of safety.

Back in 2020, one could buy a high-quality secular grower, and even if the entry price was elevated, the stock could grow into intrinsic value. Today, I don’t believe that still holds water.

Investors can no longer rest on the laurels of a compelling secular grower such as Workday and expect that everything will be OK. Investors right now are having to sharpen their pencils a little more and demand a wider margin of safety.

Be the first to comment