in-future

The importance of foreign exchange risk for a company

The importance of the currency market in the world has become increasingly relevant in recent decades since the process of internationalizing a company has become the norm. When a company becomes quite established there is often a tendency to expand its production abroad as well, thus diversifying its revenues into multiple currencies. The goal is not to be dependent on the economy of one country, however, it is necessary to be able to manage foreign exchange risk as well as possible, otherwise substantial losses may be incurred.

To better understand this concept, here is an example. A German company used to sell cars in the United States at an average price of €10,000 each. In January 2021 the EUR/USD exchange rate was 1.23, so the German company would make $12,300 from the sale of a car, while at the current exchange rate located at 1.019 it will only make $10,190. What follows then is that those who sell in this case get less dollars in exchange, while for those who buy it will turn out to be more advantageous. This process obviously extends throughout the country, and therefore, again considering this example, U.S. companies that were making money from abroad will experience a negative exchange rate effect, while for those who were importing from abroad to sell on U.S. soil a strong dollar will have an overall positive effect.

U.S. dollar never so strong in 20 years

U.S. Dollar index (Trading View )

With such a strong dollar, the U.S. will be able to import foreign goods at a lower price, but at the same time it will be the volume of exports that will be impacted. But how is it possible that the U.S. dollar index has appreciated so much in such a short time? The answer lies in the strong appreciation of the dollar against the euro.

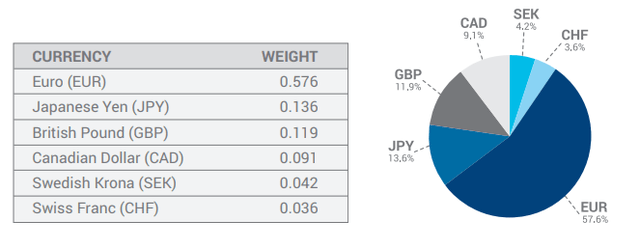

U.S Dollar index composition (www.theice.com)

As can be seen from this chart in the composition of the U.S dollar index the exchange rate with the euro plays a prominent role since it has a weight of 57%. From the highs of January 2021 where the exchange rate was at 1.23 we have moved to an exchange rate almost at par, but how was this possible?

This has been greatly affected by the difference in monetary policy between the FED and the ECB. The FED’s monetary policy has been much more tightening than that of the ECB, in fact it has already been months that interest rates have been rising, while for the ECB the first rise is expected this month. If initially the inflation rate was lower in Europe to date they have reached the same level, mainly due to European difficulties related to the supply of oil and natural gas from Russia. The ECB unlike the Fed seems clearly behind in the fight against inflation, so the strength of the euro is failing. On the other hand, the U.S. has been raising interest rates rather rapidly, and as a result, government bond yields have also spiked. With rather reasonable U.S. government bond yields, investors have rushed to buy them, increasing demand for dollars.

The same cannot be said for government bonds of European countries, with the German 10-year bond still showing a very low yield of 1.11% per annum despite a sharp rise in the short term. The ECB is losing control of inflation, and as a result the odds of a recession are much more likely in Europe than in the United States. With commodities traded in dollars and an increasingly weak euro the situation seems to be getting worse and worse for Europe, also considering that a good part of inflation comes precisely from higher energy prices. Being affected by a strong dollar, however, is not only Europe, but also emerging countries. An emerging country indebted in dollars will have a harder time repaying the loan, and the same goes for those companies that finance themselves through eurodollar bonds.

Summary on the consequences of dollar appreciation

A dollar as strong as it is today has both positive and negative implications:

- The positive implications concern U.S. imports, which will be more advantageous, as well as greater purchasing power in other nations. This principle, trivially, also extends into everyday life: it will be less expensive for U.S. citizens to travel abroad (especially to Europe).

- Negative implications include reduced export volume, as well as lower profits for companies exposed to high geographic diversification of revenues. Often to remedy this problem, companies purchase derivative instruments to mitigate exchange rate risk, but all this is an additional cost to the company.

Be the first to comment