Kunakorn Rassadornyindee/iStock via Getty Images

Investment Thesis

Atkore Inc. (NYSE:ATKR) is a manufacturer and provider of electrical, safety and infrastructure equipment. In this thesis, I will be analyzing the multiple acquisitions done by the company to expand its operations and improve its existing product line. The company has already acquired four new businesses in FY2022, and the benefits of these acquisitions will be reflected in the second half of FY2022. I believe the company will greatly benefit from this acquisition strategy, which will be a primary growth factor for the company in FY22 and FY23.

Company Overview

ATKR is a well-known manufacturer of safety and infrastructure equipment for the building and industrial sectors and electrical products, especially for non-construction and restoration markets. Conduit, cable, and installation accessories are among the high-quality products produced by the Electrical section for use in the construction of electrical power systems with the assistance of the electrical wholesale channel, this segment provides services to contractors. The Safety & Infrastructure business develops and produces solutions for the security and dependability of vital infrastructures, such as metal frames, mechanical piping, perimeter security, and cable management. Contractors, original equipment manufacturers (OEMs), and end-users are the target markets for these solutions. The company generates 77% of its revenue from electrical products and 23% from the Safety & Infrastructure segment. The company’s 90% of customers are from the United States. The company generates approximately 37% of net sales from the top ten customers. The customer list includes global electrical distributors such as Electrical Distributors, Graybar Electric Company, Rexel, Sonepar S.A. and Wesco International, Inc, Crescent Electric Supply, U.S. Electrical Services, and United Electric Supply Company.

Products from the electrical segment include electrical cable and flexible conduit, plastic pipe and conduit, metal electrical conduit and fittings, and international cable management systems. Products from the MR&R markets and Safety & Infrastructure segment also include mechanical pipe, metal framing and fittings, and perimeter security.

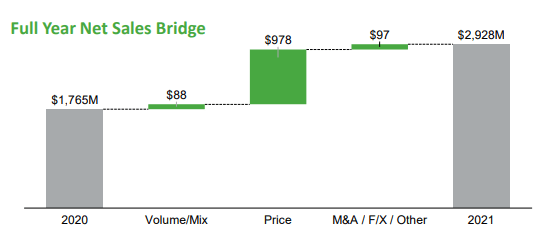

Since last year the demand for all the products of the company has been continuously increasing, which has led to an increase in selling prices and a 65% increase in net sales. The net sales for FY2021 is $2.93 billion.

Investor Presentation: Slide 5

The company has also reported an EBITDA of $897.5 million for FY2021, a growth of 174.8% compared to the $570.9 million of FY2020. Improving margins is a good sign for the company’s future prospects as I believe the demand for the product will stay strong in the current and next fiscal years.

Acquisition Strategy for Growth

The strategic acquisition is the most important component of the growth strategy of ATKR. The primary goal of the company’s acquisition policy is to maximize market share by expanding into end markets and adding synergistic goods to the existing portfolio. Since 2019, the business has spent $145.0 million on acquisitions. It has acquired many companies in the past, which aligns with the company’s business model. In FY2021 results, the company reported a net sales increase of $79.1 million due to the acquisitions of Queen City Plastics and FRE Composites Group, of $79.1 million due to the acquisitions of Queen City Plastics and FRE Composites Group of $79.1 million due to the acquisitions of Queen City Plastics and FRE Composites Group, which was 4.5% of the total change of the net sales. I believe the company will continue to follow the same strategy to extend its market share. Till this date, the company has already announced four acquisitions: Four Star Industries, Sasco Tubes & Roll Forming Inc., Talon Products, and United Poly Systems.

Four Star Industries: The company is a provider of ½” – 6″ High-Density Polyethylene (HDPE) conduit, specializing in the datacom, utility, and telecommunications markets. This acquisition is the opportunity to capture customers in developing markets such as renewable energy and broadband.

Sasco Tubes & Roll Forming Inc: The company offers metal framing-related products, particularly to the construction, mechanical, electrical, and solar industries. ATKR can offer a wide range of services and solutions to the consumers with this acquisition.

Talon Products: The company has non-metallic, patented, injection-molded cable cleats for power distribution purposes. This acquisition has aligned with ATKR’s existing product portfolio, which has given robust solutions.

United Poly Systems: The company is a producer of High-Density Polyethylene (HDPE) pressure pipe and conduit, primarily serving telecom, water infrastructure, renewables, and energy markets.

The company spent $250 million on mergers and acquisitions in FY2022. I believe the benefits of all these acquisitions will be reflected in the upcoming quarters of the company. The benefits of all acquisitions will turn out as a primary growth factor in the long term as the company is increasing its presence in many interlinked markets. The company also has a strong cash position and credibility, which can make funding available for future acquisition.

Financials

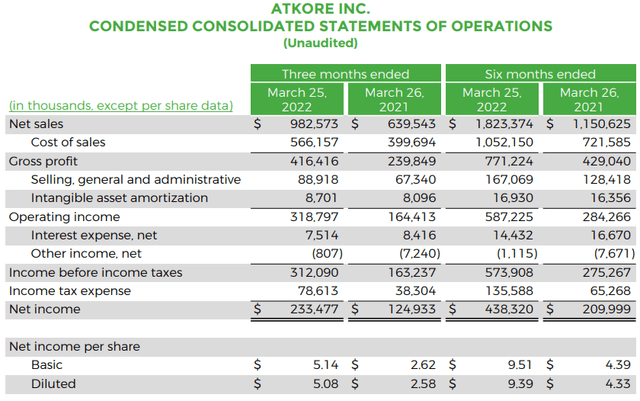

ATKR declared strong Q2 2022 results, beating the market estimates both in terms of revenue and EPS. The company reported net sales from the electrical business at $759.8 million compared to $487.5 in Q2 2021, a stellar 56% jump. The net sales from the safety and infrastructure segment stood at $224.2 million, a 47% jump from $152.7 million in the year-ago period. The total net sale was reported at $982.5 million, a solid 53.6% increase from Q2 2021 net sales of $639.5. The main reason for this growth was a robust demand coupled with an increased average selling price of products. The net income saw a significant 87% increase to $233.4 million compared to $124.9 million in Q2 2021. On the other hand, the cost of sales saw a rise of just 41.8%, the main reason behind the high net income increase. The company reported a diluted EPS of $5.08 as compared to $2.58 in Q2 2021, a magnificent $2.5 increase. Overall, the company reported an excellent quarter with an increase across all business segments.

The company provided a strong outlook for FY22, with net sales estimated to be up 25% to 30% and the adjusted EPS to be in the range of $19.65-$20.45. I believe the company estimates are conservative, and we can see a revenue increase in the range of 30%-40% as compared to FY21 revenues.

Bill Waltz, ATKR President and Chief Executive Officer, said,

Atkore continued to build on its momentum in the second quarter, generating a significant increase in sales year-over-year and growing profitability. Both segments contributed to the strong second quarter results, with positive trends across multiple product categories in each segment partially offset by declines in certain steel related product categories in the U.S. Our results in the first half of 2022 reflect our team’s dedication to serving our customers and the resilience of the Atkore Business System, which continues to successfully guide our operations through pricing volatility, labor shortages across the value chain and other macro factors.

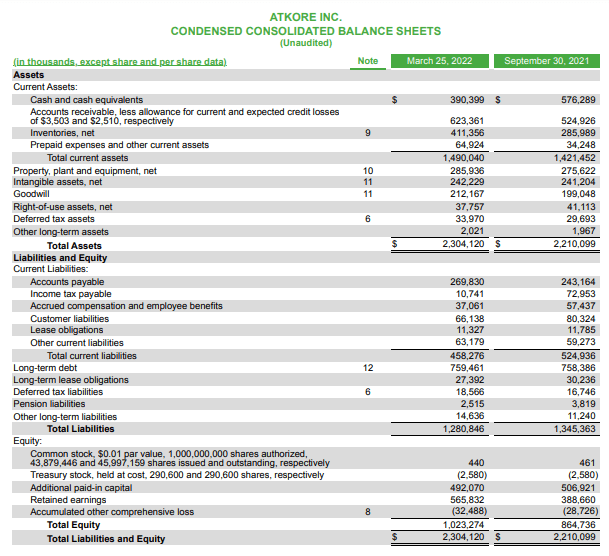

SEC:10Q ATKR

The company has cash and cash equivalents of $390.3 million and long-term debt of $159.4 million. The asset quality looks good and the inventory turnover has improved over previous quarters. Overall, the balance sheet looks well balanced and there are no real alarming factors.

Risk Factor

Commodity price fluctuations: The company’s product pricing highly depends on the commodity prices, mainly copper, steel and PVC resins. The majority of ATKR’s products are subject to price fluctuations because they are mostly made of steel, copper, or PVC resin, three industrial commodities with highly volatile prices. This volatility can have serious adverse effects on the profitability of the firm. The company sells its products on a spot basis and has no long-term contracts to mitigate this price volatility. This is a serious risk that needs to be considered before making any positions in ATKR.

Quant Ratings and Valuation

Seeking Alpha

The Quant Ratings has a strong buy rating on ATKR, which aligns with my thesis and strengthens it further. As per the Quant Ranking, ATKR is ranked 2 out of 57 companies in the Electrical Components industry. Wall Street also has a positive view on ATKR, and even they have assigned a buy rating for the stock.

ATKR has a market cap of $3.67 billion and is currently trading at a price of $85.24, a YTD decline of 22.82%. ATKR is trading at a P/E multiple of 4.9x. When compared to its peers like Eaton Corporation plc (ETN) at 17x, Hubbell Incorporated (HUBB) at 19.4x, and Emerson Electric (EMR) at 15.88x, ATKR is trading at a significantly lower P/E multiple of 4.9x. I think the company is undervalued at its current price, with tremendous upside potential from current levels. With the EPS estimates of $20.45 for FY22 and P/E multiple of 6.7x, I believe the stock has a target price of $137, a 60% upside from current levels.

Conclusion

ATKR is on an acquisition spree to expand its operations and improve its existing product line. I believe the company is maintaining a significant growth trajectory and we will see the positive effects of these acquisition on the revenue and profit margins in the coming quarters. I believe the firm is currently undervalued and has a great upside potential from current levels. The company faces the risk of commodity price fluctuations but I believe the risk-reward profile is very attractive. After taking into consideration all the growth and risk factors, I assign a buy rating for the stock.

Be the first to comment