4kodiak/iStock Unreleased via Getty Images

I recently authored an article discussing a strategy to deal with stocks that are near all time highs and the investor is nervous about adding. On the other hand, these stocks may portend the future and staying pat may be the wrong move.

So, it just seems to make sense that I follow that article with one covering stocks that have been punished and the investor is trying to make sense of what to do.

So …

It’s no secret that mega-cap Tech stocks have taken quite a beating so far this year. Apple (AAPL), Alphabet (GOOG, GOOGL), and Amazon (AMZN), to name just a few, have certainly earned the moniker “Fallen Angels.”

This precipitous drop has many investors wondering what to do. Go to any analyst or “Talking Head” and they all offer up one of three choices:

- Buy more hoping for a rebound;

- Sell hoping for a further drop to re-enter; or

- Hold awaiting hoped for clarity.

Maybe we should consider more “adventurous” alternatives. But not just any alternative, alternatives that offer potential rewards without adding risk. Fit the task to the times.

Before I get started offering alternatives, I think it’s a good idea to take a reality check. I say this, because after experiencing large losses, investors tend to lose objectivity and replace diligence with hope. Many of my conversations with investors that relied on these “Fallen Angels” act as if they are “Loss Chasing”. Losing sense of reality, frantically hoping to “get even.”

So, here’s my version of a “reality check”:

- These are all good companies, dominant in their field and unlikely to go away any time soon

- We seem trapped in a volatile market punctuated by violent moves in both directions. Bull or bear sentiment can be granted then erased in a matter of days

- We are likely headed for slow growth or a recession over the next year, maybe longer.

- It is likely that the “Fallen Angels” will regain previous highs at some future point, it is unlikely that they will be reached within the next year

- Whether these “Fallen Angels” will out-perform the market, going forward, is probably the bigger issue.

So, if my “reality check” holds water, the next step is to put forth an action plan that fits my perceived reality. That is, increase returns without exposing further downside

The Bull Ratio

This is probably one if the easiest “no brainer” strategies out there. It is based upon two objectives:

- No additional risk to the downside

- The selected stock is unlikely to go up more than 50% in a year’s time

Now, no one can really argue with point # 1, but point #2 does present a problem for some. One needs to jettison the idea that, given the market and economic uncertainty we currently face, that a quick rebound to prior highs is realistic. If one really believes that such a rebound is likely, all I can say is “STOP reading and go out and buy more stock”.

Enough chatter, here’s the details. For purposes of this illustration, I’ll simplify by just using AMZN, though other stocks, such as AAPL and GOOG, will have very similar results.

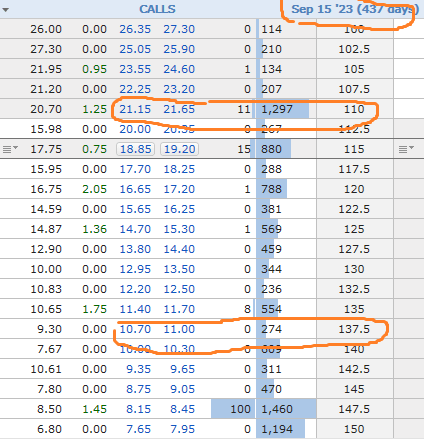

Let’s start by looking at an option chart for AMZN (supplied by Fidelity). Please note that the expiration is Sept 2023 … over one year away… which is chosen as part of my “slow growth” reality check. Also note that AMZN is trading right around $110 as I “lift” this chart.

Call Option Table (Fidleity Investments)

Instituting the Bull ratio is quite simple and only takes two steps:

- Buy one at-the-money (ATM) call with a strike of 110 for each 100 shares owned. This costs around $21.50 per option

- Sell TWICE as many calls out-the-money (OTM) at such strike that it ZEROES out the cost of the ATM long call. In a perfect world, it would be $21.50/2 = $10.75. We can get an approximate match at strike= 137.5

So, we now own 1 long call and 2 short calls, and it has cost us nothing. That begs the question “What does this do for me?”

Well, let’s see. If:

- AMZN lands at or below its current level of $110, all the options expire worthless and there is no gain, no loss. Everything ended up a “nothing-burger”

- AMZN lands above $110 but below $137.5 In addition to the stock appreciation via the rebound, the option position also increases dollar-for-dollar. This means that one receives TWICE the actual move. If AMZN went from $110 to $120…the stock made $10 and so did the Bull Ratio.

- AMZN lands at precisely $137.5 (a 25% up move from today). The Bull Ratio makes $27.50 (137.5-110) and the overall return has doubled from 25% to 50%

- AMZN lands above $137.5 Inasmuch as there is one long call and twice as many short calls, any move above $137.5 results in a GIVE-BACK of $1 for each dollar above $137.5 This cancels out any more gain on the stock. In effect upside is frozen at 50% gain, even if AMZN goes above $165, no further gains ensue.

- That means if AMZN rebounds above 50% by next September, one would have been better off having NOT engaged this strategy.

- So, take the reality check… do you think, given the climate we’re in, that a 50%+ rebound (to pre-split $3,300) is likely. If so, pass.

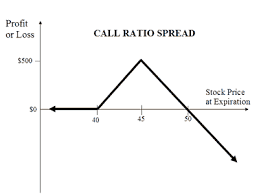

Here’s a generic graph from theoptionsguide.com. The graph does not include the underlying stock which plateaus the gains at the apex.

Bull Call Ratio (theoptionsguide.com)

Variations

The Bull ratio has many potential variations.

One could be more conservative and believe that 137.5 is optimistic on the upside. They can lower the upper bound and the ratio will show a net credit … as the 2x OTM premium more than offsets the ATM call. This will work better up to the 2x strike and worse, thereafter

One could also be more optimistic and raise the OTM strike for a net debit. Once again, it will work better only above 137.5

Summary

We are in uncertain times where yesterday’s winners have turned into today’s losers. But today’s losers aren’t necessarily tomorrow’s losers.

It is my sense that these dominant “Fallen Angels” will not disappear. The real threat is that they will underperform going forward. The Bull Ratio offers a methodology wherein one can “juice up” modest returns.

There is no downside risk and all one can lose is growth more than 50% over the next year.

So, one needs to ask themselves if they are willing to take the potential downside risk for the opportunity to double returns less than 50%.

Be the first to comment