M. Suhail

One of the largest and most successful retail chains in the history of the world is none other than The Home Depot (NYSE:HD). As a major player in the home construction and repair markets, Home Depot has developed itself into a rather successful enterprise with thousands of stores spread across North America. Due to its large size, the company is not exactly growing at a rapid pace. But year after year, management is creating additional value for its shareholders. Although the stock of the company may not be viewed as cheap by some, it is cheaper than its largest rival. On top of this, paying a bit of a premium for an industry leader with a great track record is not the worst idea in the world. Sure, the company is unlikely to make you rich. But for investors who want steady growth over the long haul, this is a great play to consider.

A quality business at an attractive price

It has been a little over a year since I last wrote an article about Home Depot. In that article, published October 7th of 2021, I expressed that management continued to demonstrate that the firm was a quality operator that was, at the time, benefiting from a surge in demand for the firm’s services. I also said that if recent financial performance represented a new normal for the company, that shares looked attractively priced. In fact, I even went so far as to say that if we saw some pullback in its fundamental condition, it would be difficult to imagine the company being overvalued. Ultimately, I ended up rating the company a ‘buy’, reflecting my belief that it should outperform the broader market for the foreseeable future. So far, the company hasn’t done that. But with shares down 15.5% compared to the 14.4% achieved by the S&P 500, I don’t consider the outcome so far to be all that awful. This is especially true when you consider the extreme volatility and uncertainty we have seen over the past 12 months.

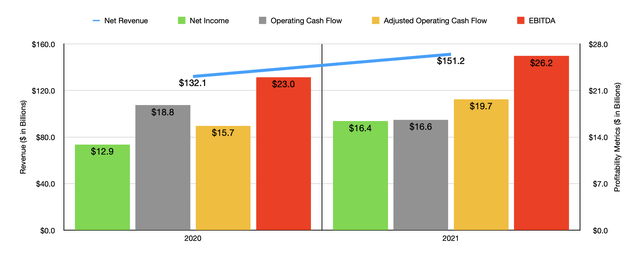

Despite the pain that investors have seen, I do think that there exists some attractive upside for shareholders moving forward. To see what I mean, we need only look at the most recent financial performance reported by the company. Let’s consider how the business ended its 2021 fiscal year. For that year, management reported revenue of $151.2 billion. That was 14.5% higher than the $132.1 billion generated in 2020. Some of this growth undoubtedly came from the fact that the company opened some additional stores throughout its 2021 fiscal year. This included five openings in the US and two in Mexico. On top of that, the company also acquired 14 stores from a small acquisition completed in the second quarter of 2021. In all, the firm ended the 2021 fiscal year with 2,317 stores spread throughout North America. But the biggest change for the company came not from an increase in store count, but instead from rising comparable sales. Comparable sales jumped by 11.4% during the year, driven by a 0.2% Increase in customer transactions and an 11.7% rise in the average ticket price per transaction. Comparable customer transactions decreased by only 0.1%.

On the bottom line, the company also performed well. Net income jumped from $12.9 billion in 2020 to $16.4 billion in 2021. Other profitability metrics also came in nice. Operating cash flow actually fell from $18.8 billion to $16.6 billion. But if we adjust for changes in working capital, the metric would have risen from $15.7 billion to $19.7 billion. We also saw a nice increase in EBITDA, with the metric jumping from $23 billion in 2020 to $26.2 billion last year.

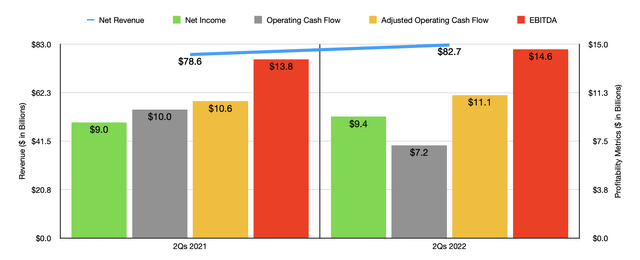

Strength for the company has continued into the 2022 fiscal year. Revenue of $82.7 billion in the first half of the 2022 fiscal year came in 5.2% higher than the $78.6 billion reported in the first half of 2021. During this time, the company benefited from a 4.1% rise in comparable sales, even as the number of comparable customer transactions dropped by 5.7%. The real driver here was a 10% surge in the average ticket price, climbing from $82.43 to $90.82. Of course, this is not to say that everything for the company was great. We did see some weakness not only in comparable customer transactions, but in total customer transactions as well. Likely because of inflationary pressures, the company saw the number of transactions completed at its stores drop by 5.5% from 928.9 million to 878.1 million. Although I cited inflationary pressures as a problem, management stated that the decrease was driven largely by the impact of cycling favorable weather and the absence of government stimulus in 2022 compared to 2021. On the positive side here, the firm did benefit from a 7.9% increase in online sales. That’s always great to see for any retailer.

For the most part, bottom line results for the company were also solid. In the first half of 2022, net income came in at $9.4 billion. That represents an increase of 5% compared to the nearly $9 billion reported in the first half of the 2021 fiscal year. Operating cash flow did weaken, dropping from nearly $10 billion to $7.2 billion. But if we adjust for changes in working capital, it would have risen from $10.6 billion to $11.1 billion. Meanwhile, EBITDA for the company also improved, rising from $13.8 billion in the first half of 2021 to $14.6 billion the same time this year. Management seems to be happy enough with these results because, in the second quarter of this year, the firm announced a $15 billion share buyback program.

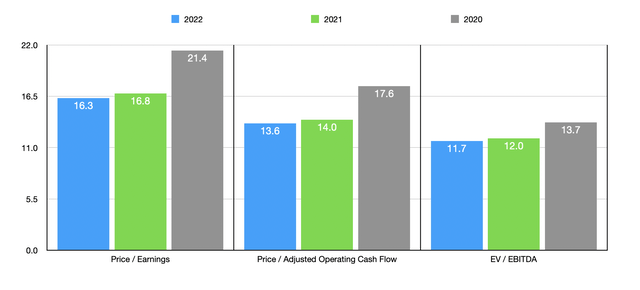

When it comes to the 2022 fiscal year as a whole, management seems pretty optimistic. They currently see comparable sales increasing by 3%. A good approximation based on other guidance would be for net income of around $16.9 billion this year. No guidance was given that would allow us to easily figure out what other profitability metrics might be. But if we assume that they would increase at the same rate that net income should, then we should anticipate adjusted operating cash flow of $20.3 billion and EBITDA of $27 billion.

Using these figures, I calculated that the company is trading a bit lower than what it would be trading at if we used data from 2021. The price-to-earnings multiple would be 16.3. The price to adjusted operating cash flow multiple would be 13.6. And the EV to EBITDA multiple for the company would come in at 11.7. Even if we assume that financial results will weaken from here, the stock doesn’t look all that bad. As you can see in the chart above, even a return to levels of profitability seen during the 2020 fiscal year would result in the company trading at respectable levels. As part of my analysis, I also compared the company to the largest competitor in its space. This is Lowe’s Companies (LOW). Comparing data for it from the 2021 fiscal year to the data from Home Depot’s 2021 fiscal year, we end up with our prospect being cheaper across the board. This can be seen in the table below. In the event that Home Depot would trade at a higher multiple that matched the multiples that Lowe’s it’s trading for, we would see upside from today’s pricing of between 20.3% and 51.4%.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| The Home Depot | 16.8 | 14.0 | 12.0 |

| Lowe’s Companies | 22.5 | 21.2 | 14.2 |

| Upside if Trading at Lowe’s Multiples | 33.8% | 51.4% | 20.3% |

Takeaway

Although I understand that investors are cautious about the current economic environment, the important thing is to focus on the long haul. At this moment, Home Depot seems to be a really solid operator and is the true industry leader in its space. Shares of the company, while not dirt cheap, are cheaper than the stock of its largest rival. And the quality of the business suggests to me that the long-term trajectory of it should be positive. And because of that, I still feel comfortable rating the company a ‘buy’ like I did previously.

Be the first to comment