Las Vegas is a major base for Southwest Airlines

rypson

Southwest Airlines (NYSE:LUV) has long been one of the most consistently profitable airlines in aviation history. LUV’s business model has focused on high efficiency, egalitarian and affordable air transportation and they have built a loyal customer following over the 44 years since the domestic airline industry was deregulated and they expanded beyond their original intrastate Texas routes.

Throughout the pandemic, analysts and airline industry pundits told investors that domestic discount airlines would have an advantage as international markets remained much more heavily impacted by Covid restrictions and business travelers shifted to remote work. Now that Covid reopening is nearing its conclusion and with recessionary and inflationary concerns growing even as the legacy carrier segment has reported strong third quarter 2022 financial results, it is worth asking how well Southwest will fare when it reports its results on Thursday, October 27.

In order to assess how investors should prepare for Southwest’s financial report, we need to examine results from the legacy airlines that have reported their third quarter results so far, LUV’s financial performance in the second quarter of 2022 and their performance in 2019 in addition to their guidance for the third quarter of 2022.

Legacy carrier earnings comparisons

Delta (DAL), United (UAL), Alaska (ALK) and American Airlines (AAL) have all reported their third quarter 2022 results over the past two weeks; all are considered legacy airlines, or those that operated interstate routes prior to deregulation of the domestic airline industry in 1978. All four offer premium cabins on most of their flights and all four also use regional jets to expand their hub and spoke networks into smaller cities which do not support large mainline jets. Three of those four carriers, excluding Alaska, operate widebody aircraft on long-haul international routes as does Hawaiian which has not yet reported its third quarter performance.

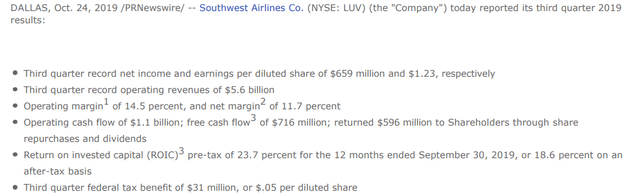

LUV 3Q2019 earnings summary (Southwest.com)

The overall takeaway from the big 3 global carriers was that revenue was very strong, led heavily by transatlantic demand and an increase in premium cabin sales. Delta and United reported nearly identical operating results although Delta’s revenue was significantly enhanced by its refinery and loyalty program while United saw the greatest overall increase in passenger and cargo revenues. Like Southwest, Delta and United continue to compare their current financial results to 2019, believing that the previous two years do not provide an adequate representation of the performance of their airlines; American is currently operating the most capacity but is providing year over year comparisons, making it harder to align the performance of itself to Delta, United – and Southwest. While Alaska reported very strong results, its more regional domestic network doesn’t provide as strong of a comparison to Southwest as Delta and United.

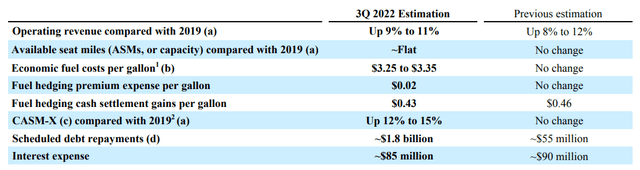

Southwest updated its investor guidance for the third quarter on September 15th, just a couple weeks before the end of the quarter, making it likely that its guidance is quite accurate.

LUV 3Q2022 guidance (Southwest.com)

The most notable difference between Southwest’s guidance and Delta and United’s actual results for the third quarter is that the global carriers are seeing larger increases in operating revenue. Southwest guided to an increase in operating revenues compared to 2019 of 9-11% which is, at best, only as good as Delta, which has said that its revenue this summer has been limited because a higher number of employees than average are not trained for the positions they are in, either because they are new hires or because they have changed positions. United, in contrast, reported a hefty 13% increase in operating revenue despite operating 10% less capacity. Delta’s capacity shortfall was even higher than United’s and it trailed United in RASM growth – but by just a few percent. The more notable revenue-related observation, though, is that domestic was the lowest RASM growth region for Delta and below United’s system average which was pulled up by its Pacific and European networks.

Southwest is guiding to flat capacity which means its RASM would likely increase about 10%, below its CASM x fuel and special items for which they are guiding to a 12-15% increase. Its fuel costs are projected to increase approx. 59% or $1.23/gallon compared to 2019 even though it will gain benefits from its fuel hedge strategy. All told, LUV’s expenses are expected to increase far more than its revenues indicating that its income margin will contract not just from 2019 but also from the second quarter of 2022. Analysts are guiding to earnings of 42 cents/share, down from $1.30 in the second quarter. Southwest could see its margins contract even as the legacy carriers are seeing margin expansion and strong recovery.

Against a quarter when LUV’s legacy carrier competitors might have outperformed the Dallas low cost carrier, the legitimate question has to be asked about when this flipped script will change or if there has truly been a structural change in the airline industry that favors the legacy carriers for the first time in decades.

Capacity and network dynamics

The most significant dynamic that is favoring the legacy carriers is that all are operating lower percentages of pre-Covid capacity than Southwest. In the midst of very strong demand, the legacy carriers have very strong pricing control. Since Southwest directly competes with the legacy carriers in only a handful of airports, Southwest is less able to benefit from the strong legacy carrier pricing environment.

In addition, the long-haul international marketplace is proving to be a godsend for legacy carriers that have waited for more than two years for the return of demand where they received from 30-40% of their pre-Covid revenues, depending on the carrier. U.S. airlines have weathered the pandemic better than their global peers which means that the big 3 are set to expand their revenue growth in long-haul markets. In addition, a significant amount of foreign low cost long-haul international capacity has left the marketplace, leaving the U.S. big 3 in an even more advantageous position in the international arena to increase prices on top of the strong dollar which incentives Americans to travel the globe. Southwest, of course, does not compete in the long-haul international marketplace.

International recovery is proving to be an enormous advantage for the big 3 supporting my contention that I wrote multiple times during the pandemic that low cost carriers would not necessarily have an advantage once revenue recovery became well-established. Further, the big 3 are all seeing significant increases in the willingness of passengers to buy up to more premium classes and services, heavily offsetting the remaining amounts of business travel that has yet to return even though nearly all carriers are reporting high rates of business revenue return. Because Southwest does not offer a premium cabin, its revenue growth is likely being negatively impacted relative to the legacy carriers including Alaska.

Cost control and MAX woes

Low cost carriers including Southwest have long been able to offset their generally lower average fares by being more efficient and growing at faster rates than legacy carriers to keep cost growth at lower rates. However, Southwest’s ability to grow has been significantly impacted because of delays with the Boeing 737 MAX which is the only aircraft type that Southwest has on order. Southwest capacity growth was slashed during the two-year MAX grounding during which LUV held onto a number of older aircraft which it intended to retire. Southwest has been able to put more than 100 MAX 8 aircraft in service since the MAX grounding ending and deliveries resumed. Now, Southwest is waiting for certification of the MAX 7, the smallest member of the 737 MAX family which should be the most direct replacement for LUV’s 737-700 fleet which numbers more than 425 aircraft. Boeing has been struggling to get both the MAX 7 and MAX 10, the largest member of the MAX family, certified by the FAA which has taken a much more careful approach to certifying Boeing’s products in the aftermath of the two MAX crashes and production problems involving Boeing’s 787 widebody jet. While Southwest has been to convert many of its MAX orders to the larger MAX 8 which was certified before the two accidents, it still has MAX 7s on order which Boeing cannot deliver, not only limiting Southwest’s ability to grow but also forcing it to operate its older, more maintenance heavy and less fuel efficient aircraft for longer periods of time. A higher percentage of MAX 8s requires LUV to carry more lower yielding passengers in addition to operating fewer flights than if it generated the same amount of capacity over a larger fleet that included more MAX 7s. Southwest has 52 MAX 7s on order for delivery in the remainder of 2022 as well as in 2023 although it is very possible that Southwest will not receive its first MAX 7s until well into the spring of 2023. Southwest has ordered the vast majority of MAX 7s that Boeing is scheduled to build.

Fuel

Southwest is guiding to fuel costs that are significantly higher than they were in 2019. However, Southwest has had a significant advantage to its competitors because of its fuel hedging program. As recently as the most recent quarter, LUV’s hedges have delivered more than a 50 cent/gallon advantage compared to some airlines. However, for the third quarter, LUV’s hedges will deliver much less of a benefit, in part due to Administration releases from the Strategic Petroleum Reserve which has helped depress crude oil prices, the commodity which Southwest hedges. While lower fuel prices are good for everyone, the reduction in fuel prices for LUV’s competitors removes some of the advantage which Southwest has had. Jet fuel prices are still inflated in the northeast and on the west coast with the latter a major area of operations for Southwest. In both regions of the country, reduced refinery capacity is driving higher prices for all refined products. Delta’s ownership of a refinery has helped it gain an advantage in managing fuel prices. Although Southwest’s hedges are delivering greater savings than Delta’s refinery strategy, LUV’s advantage relative to Delta is likely to be cut to just over 20 cents/gallon.

Labor Costs

While labor costs are not immediately at risk of growing at Southwest other than because of hiring of thousands of new workers, the U.S. airline industry is beginning to settle new labor agreements in the post-Covid environment. Most U.S. airlines saw their labor contracts become amendable during the pandemic and the companies were justified in not moving forward on negotiations until revenue recovery began. Now that revenue is rapidly increasing, labor has been pressuring managements for large increases in order to keep up with near double-digit inflation. In addition, the pilot shortage is pushing pilot rates up at regional airlines which increases expectations for other pilots to see large increases. While most U.S. airlines spend roughly one-third of their labor budget on pilot expenses, they are careful not to increase pilot salaries beyond what they are willing to pay for other labor groups. Alaska is the only large jet airline that has had its pilots accept a new contract and that contract sees significant pay increases, although ALK pilots have long been some of the lowest paid among legacy pilots. Southwest’s labor costs are likely to see significant increases before it is able to add all of the aircraft it is due to receive from Boeing in the next year.

Stock Performance, Ratings and Valuation

On a year to date basis, LUV stock has fallen 24.8% which is more than DAL and UAL but slightly better than AAL. As international markets have reopened, DAL has retaken the position as having the highest market cap among U.S. airlines, a position that DAL and LUV have swapped over more than five years.

LUV chart YTD (Seeking Alpha)

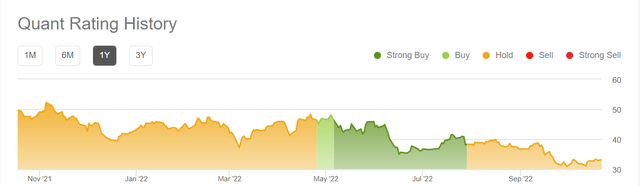

LUV’s Seeking Alpha Quant rating is much less flattering than Seeking Alpha authors or Wall Street analysts with the Quant Rating negatively impacted by reduced momentum and downward earnings revisions. LUV’s 3Q2022 EPS estimates have been revised down by 12 of 15 analysts while over half have reduced revenue estimates.

LUV Quant Rating (Seeking Alpha)

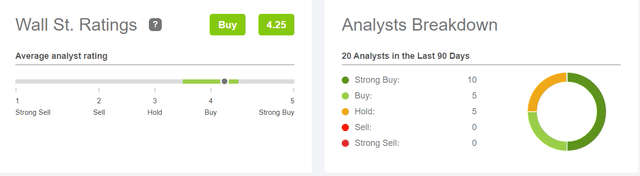

However, the average of Wall Street ratings is a 4.25 BUY with 10 out of 20 rating LUV as a strong buy. Average price target is $49.22 for a 48% upside.

LUV Wall Street ratings (Seeking Alpha)

LUV’s strongest case for higher valuation comes from its strong balance sheet and its prudent use of cash. LUV indicates that it has repaid $1.8 billion in debt during the third quarter, matching Delta for absolute amount of debt repayment but taking the top place as a percentage of outstanding debt. LUV is in the best position to pay off its Covid-related debt before other airlines, which could reopen the door for payment of a dividend as well as stock buybacks.

LUV remains a high quality airline and will get past yet another period of restrained growth, largely because of its singular use of the Boeing 737 and delays associated with the aircraft. Southwest has demonstrated that it can adapt to any number of situations but it is at a distinct disadvantage to control major parts of its destiny because of continued delays with MAX deliveries. Other factors are manageable and yet compound LUV’s financial challenges in coping with Boeing’s issues.

Be the first to comment