Jinli Guo/E+ via Getty Images

A Quick Take On Global Mofy Metaverse Limited

Global Mofy Metaverse Limited (GMM) has filed to raise $30 million in an IPO of its ordinary shares, according to an F-1 registration statement.

The firm provides 3D digital content generation technologies in China.

Given the risks involved, although the company is growing at a high rate of growth, I’m on Hold for the IPO.

Global Mofy Overview

Beijing, China-based Global Mofy Metaverse Limited was founded to develop a range of 3D content generation and related services for online and digital businesses in China.

Management is headed by Founder, Chairman and CEO, Haogang Yang, who has been with the firm since inception in 2017 and was previously co-founder of Hangzhou Shixingren Film Technology Co. and marketing supervisor of Shanghai Crystal Digital Technology Co.

The company’s primary offerings include:

-

Virtual Technology Service – 3D content production

-

Digital Marketing – Advertising production and promotion services

-

Digital Asset Development – 3D digital asset bank for different applications

As of March 31, 2022, Global Mofy has booked fair market value investment of $5.1 million from investors including James Yang Mofy Limited, Lianhe Universe Holding Group, New JOLENE&R L.P., and New Luyuchao Limited.

Global Mofy – Customer Acquisition

The company pursues large multinational clients as well as smaller firms through its in-house sales and marketing efforts.

Global Mofy positions itself in the market as a digital asset provider and enabler in the metaverse value chain.

Selling expenses as a percentage of total revenue have dropped as revenues have increased, as the figures below indicate:

|

Selling |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended March 31, 2022 |

0.8% |

|

FYE September 30, 2021 |

1.0% |

|

FYE September 30, 2020 |

2.1% |

(Source – SEC)

The Selling efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of selling spend, rose to 82.5x in the most recent reporting period, as shown in the table below:

|

Selling |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended March 31, 2022 |

82.5 |

|

FYE September 30, 2021 |

64.2 |

(Source – SEC)

Global Mofy’s Market & Competition

The term “metaverse” was first coined by Neal Stephenson in his science fiction novel Snow Crash.

Strictly speaking, the metaverse is a digital universe that is powered by blockchain technology and is home to decentralized applications.

It is a decentralized, persistent and secure online space where users can create avatars, buy virtual assets, and act in a digital space.

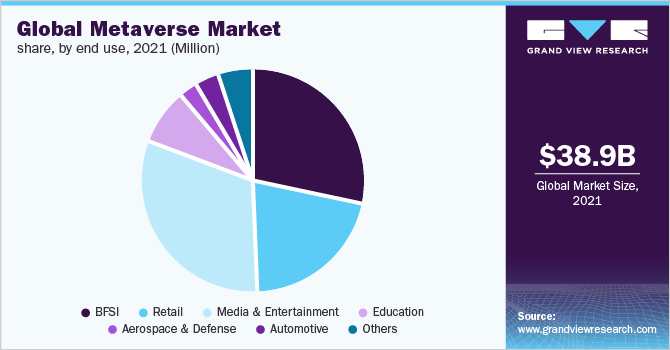

According to a 2022 market research report by Grand View Research, the global metaverse market was an estimated $38.9 billion market in 2021 and is forecast to reach $772 billion by 2030.

This represents a stunning expected CAGR of 39.4% from 2022 to 2030.

The main drivers for this expected growth are an increasing focus on the use of the internet to integrate digital and physical worlds, the growth of mixed reality hardware and software and the outbreak of the global pandemic.

As the COVID-19 pandemic has disrupted traditional methods of doing business, working, and socializing, there is an increasing demand for digital platforms that can provide realistic and immersive experiences.

The pandemic has also created a need for social distancing, which has led to the popularity of online games and virtual reality (VR) as alternatives to real-life social interactions.

This has all contributed to the metaverse lately becoming one of the hottest trends in tech and business.

Also, below is the global metaverse market breakdown by end use in 2021:

Global Metaverse Market (Grand View Research)

Major competitive or other industry participants include:

-

BaseFX

-

SVHQ Media

-

International media developers and providers

Global Mofy Metaverse Limited’s Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue

-

Increasing gross profit but lowered gross margin

-

Uneven operating profit

-

Variable cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended March 31, 2022 |

$ 11,236,223 |

182.8% |

|

FYE September 30, 2021 |

$ 14,268,184 |

183.0% |

|

FYE September 30, 2020 |

$ 5,042,521 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended March 31, 2022 |

$ 1,960,130 |

204.9% |

|

FYE September 30, 2021 |

$ 3,278,108 |

195.4% |

|

FYE September 30, 2020 |

$ 1,109,588 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Six Mos. Ended March 31, 2022 |

17.44% |

|

|

FYE September 30, 2021 |

22.97% |

|

|

FYE September 30, 2020 |

22.00% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended March 31, 2022 |

$ 413,573 |

3.7% |

|

FYE September 30, 2021 |

$ 1,396,164 |

9.8% |

|

FYE September 30, 2020 |

$ (518,315) |

-10.3% |

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

Net Margin |

|

Six Mos. Ended March 31, 2022 |

$ 456,838 |

4.1% |

|

FYE September 30, 2021 |

$ 1,417,891 |

12.6% |

|

FYE September 30, 2020 |

$ (541,313) |

-4.8% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended March 31, 2022 |

$ 455,092 |

|

|

FYE September 30, 2021 |

$ (1,473,281) |

|

|

FYE September 30, 2020 |

$ (1,104,232) |

|

(Source – SEC)

As of March 31, 2022, Global Mofy had $1.4 million in cash and $7.2 million in total liabilities.

Free cash flow during the twelve months ended March 31, 2022 was negative ($906,834).

Global Mofy Metaverse Limited’s IPO Details

Global Mofy intends to raise $30 million in gross proceeds from an IPO of its ordinary shares, offering 6 million shares at a proposed midpoint price of $5.00 each.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $123 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 20.0%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

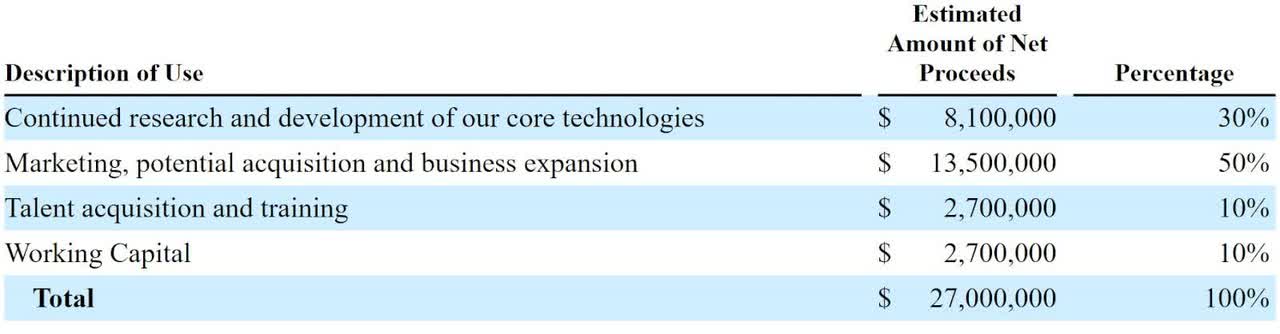

Management says it will use the net proceeds from the IPO as follows:

Proposed Use Of IPO Proceeds (SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is not currently involved in any legal or administrative proceedings that would have a material adverse effect on its financial condition or operations.

The sole listed bookrunner of the IPO is Maxim Group LLC.

Valuation Metrics For Global Mofy

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Market Capitalization at IPO |

$150,000,000 |

|

Enterprise Value |

$123,172,771 |

|

Price/Sales |

6.97 |

|

EV/Revenue |

5.72 |

|

EV/EBITDA |

61.85 |

|

Earnings Per Share |

$0.07 |

|

Operating Margin |

9.25% |

|

Net Margin |

9.42% |

|

Float To Outstanding Shares Ratio |

20.00% |

|

Proposed IPO Midpoint Price per Share |

$5.00 |

|

Net Free Cash Flow |

-$906,834 |

|

Free Cash Flow Yield Per Share |

-0.60% |

|

Debt/EBITDA Multiple |

0.76 |

|

CapEx Ratio |

-33.46 |

|

Revenue Growth Rate |

182.84% |

(Source – SEC)

Commentary About Global Mofy’s IPO

GMM is seeking U.S. public capital market investment for its various general corporate purposes and possible acquisitions.

The company’s financials have shown increasing topline revenue, higher gross profit but lowered gross margin, fluctuating operating profit, and uneven cash flow from operations.

Free cash flow for the twelve months ended March 31, 2022 was negative ($906,834).

Selling expenses as a percentage of total revenue have fallen as revenue has increased; its selling efficiency multiple rose to 82.5x in the most recent reporting period.

The firm currently plans to pay no dividends to public shareholders and to retain any future earnings for reinvestment back into the company’s growth initiatives.

The market opportunity for metaverse-related products and services is extremely large and expected to grow at a high rate of growth in the coming years, so the firm enjoys strong industry growth dynamics in its favor.

Like other firms with Chinese operations seeking to tap U.S. markets, the firm operates within a WFOE structure or Wholly Foreign Owned Entity. U.S. investors would only have an interest in an offshore firm with interests in operating subsidiaries, some of which may be located in the PRC. Additionally, restrictions on the transfer of funds between subsidiaries within China may exist.

The recent Chinese government crackdown on IPO company candidates combined with added reporting and disclosure requirements from the U.S. has put a serious damper on Chinese or related IPOs resulting in generally poor post-IPO performance.

Also, a potential significant risk to the company’s outlook is the uncertain future status of Chinese company stocks in relation to the U.S. HFCA Act, which requires delisting if the firm’s auditors do not make their working papers available for audit by the PCAOB.

Prospective investors would be well advised to consider the potential implications of specific laws regarding earnings repatriation and changing or unpredictable Chinese regulatory rulings that may affect such companies and U.S. stock listings.

Additionally, post-IPO communications from the management of smaller Chinese companies that have become public in the U.S. has been spotty and perfunctory, indicating a lack of interest in shareholder communication, only providing the bare minimum required by the SEC and a generally inadequate approach to keeping shareholders up-to-date about management’s priorities.

Maxim Group is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (67%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

Risks to the company’s outlook as a public company include its exposure to the Chinese market, which is subject to unpredictable regulatory actions, the government’s ‘Zero-COVID’ policies, and uncertain financial regulatory environment in China and in the U.S.

As for valuation, management is asking investors to pay an Enterprise Value/Revenue multiple of approximately 5.7x.

Given the risks involved, although the company is growing at a high rate of growth, I’m on Hold for the IPO.

Expected IPO Pricing Date: To be announced.

Be the first to comment