buzbuzzer

The buy thesis

Despite similarly strong fundamental performance, Whitestone (NYSE:WSR) has not participated in the retail REIT rally. This leaves it opportunistic, as it trades substantially cheaper than its peers despite having among the best properties. I see continued growth ahead for WSR and at less than 10X FFO none of that growth is baked into the stock.

Left in the dust

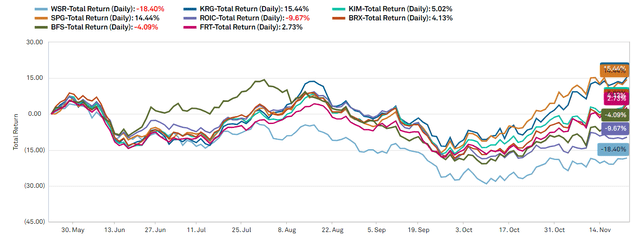

A company cannot control its market price, only its fundamentals. Despite fundamental strength, WSR’s stock price has languished, even in an environment in which most other retail REITs have recovered. In the past six months, WSR is down 18.4% on a total return basis.

S&P Global Market Intelligence

I think the company itself has done much better than implied by its price.

Fundamental improvements

Since James Mastandrea was ousted at Whitestone, they have been doing the right things for shareholders.

- Removal of poison pill

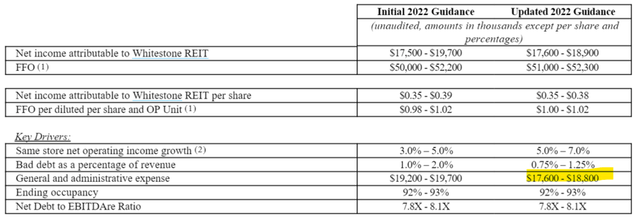

- Reduced G&A expense

G&A was cycling around $23 million a year and is now closer to $18 million.

WSR is also bigger now than it was, so as a percentage of revenue G&A expense has been reduced substantially.

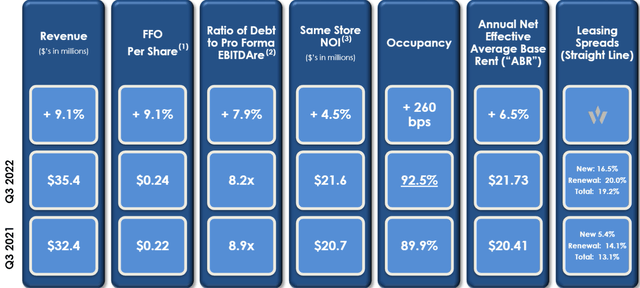

Operating metrics have also improved across the board.

These are some big changes. 4.5% same-store NOI growth, fueled by occupancy up 260 basis points and 19.2% positive leasing spreads. In combination with the G&A savings, it led to a 9.1% improvement in FFO/share year over year. Leverage is still high at 8.2X EBITDAre, but even that has improved from 8.9X.

Part of the growth can be attributed to a stronger retail environment, but I do think WSR is doing the right things operationally as well. One of the choices that I think separates WSR from their peers is the way they focus on ecosystem over rent.

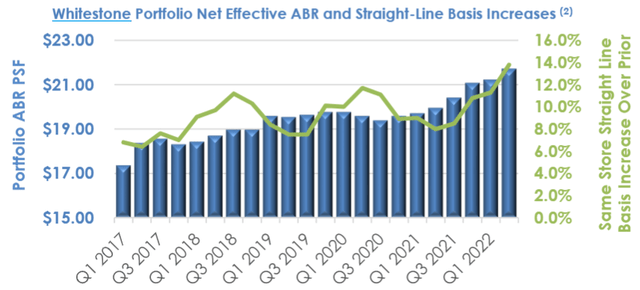

It can be tempting to sign the tenant that will pay the highest rent per square foot, but WSR specifically gives preference to tenants that improve the foot traffic of their shopping centers even if they are not the highest bidder. The idea is to build out strong anchor tenants, and then once those are in place, the small shops space in the rest of the center becomes more valuable. Their labor is starting to bear fruit as measured by the sharp uptick in occupancy and rental rates above, but it has been a long-term process.

Whitestone was even experiencing operational success before the shopping center industry rebounded at a broader level.

Superior locations

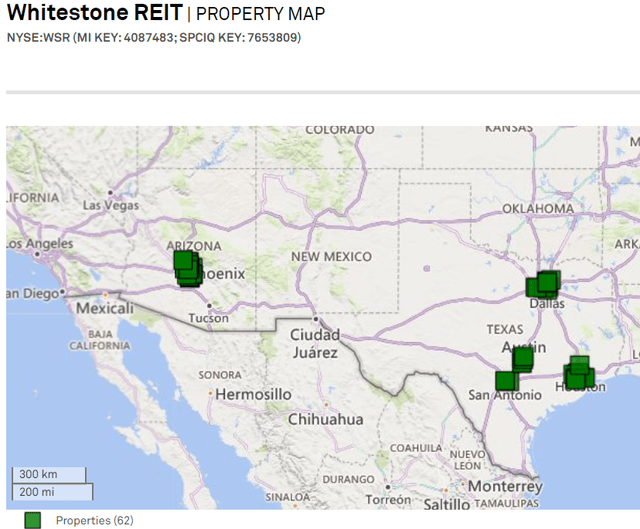

I think by now the market is well aware that Whitestone is concentrated in sunbelt markets with high job growth.

S&P Global Market Intelligence

However, I don’t think market participants have yet realized the affluence of WSR’s catchment radii.

In 3-mile radius household income, WSR appears near the top of the list, but those charts are always in raw dollars. Thus, big city companies like Federal Realty (FRT) and Urstadt Biddle (UBA) come in at the top, but if you adjust for the cost of living, WSR’s catchment areas would be number 1 in discretionary household income.

$100K in Phoenix goes significantly further than $105K in NYC.

Valuation

Over the past few weeks, it has become clear that there is a substantial resurgence in retail. Spending in stores has risen and the majority of retailers have reported good numbers. As the market caught on to this news, retail REITs rose nicely.

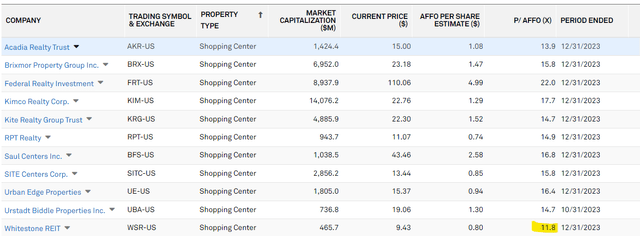

Whitestone seems to have been forgotten in the frenzy, resulting in a significantly discounted relative valuation. At 11.8X forward AFFO, Whitestone is the cheapest and about three turns below the average.

S&P Global Market Intelligence

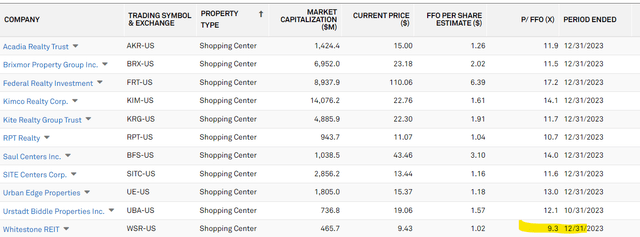

It is also the cheapest of FFO at 9.3X 2023 estimated FFO.

S&P Global Market Intelligence

Where should WSR trade relative to peers?

There are quite a few quality metrics that go into relative valuation. Whitestone has both advantages and disadvantages that should be taken into account.

On the positive side, property location and newness indicate Whitestone should trade at a slight premium to peers.

However, there are two aspects which would tend to result in a discount:

- Small size. At sub $500 million market cap, Whitestone lacks efficient scale. Generally, a REIT would need to be at least $1B to trade near full multiple and often over $2B.

- Leverage. Higher multiple peers have Debt to EBITDA between 5X and 7X, so Whitestone’s just over 8X should result in a discount.

Netting the aforementioned pros and cons, I think WSR should trade about two turns below the sector median. This would imply a fair value of about $11.25 or about 20% upside to today’s market price.

Asset values back up this assessment as Whitestone is currently trading at 70.2% of Net Asset Value (NAV).

Overall, the combination of favorable valuation and strong operating performance make Whitestone opportunistic. I think buying around this price will result in outperformance.

Risks to thesis

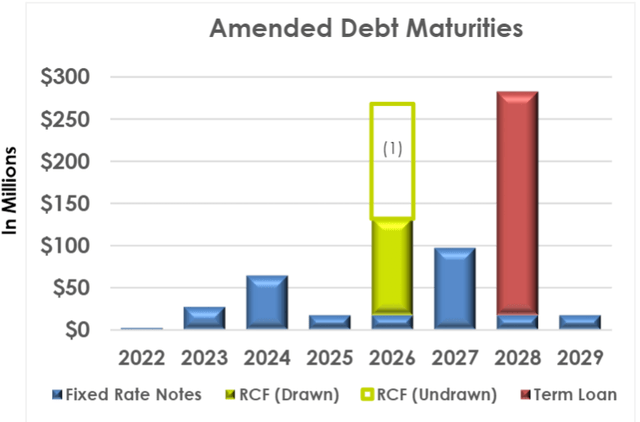

I always try to give equal thought to what can go wrong, and in Whitestone’s case, the biggest risk seems to be its debt levels.

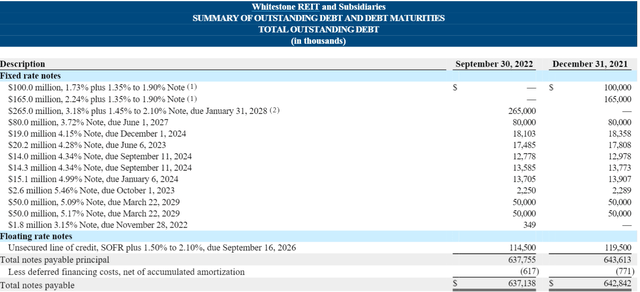

They have made some progress in terming out the debt such that near-term maturities are quite manageable.

They have also swapped the term loan so that it is functionally fixed rate through 2028. This leaves the credit facility as the source of variable interest rates at $114 million.

While I don’t think rates will increase that much from today, they have increased a fair amount since 3Q22 when they last reported interest expense.

As of 9/30/22, SOFR was 3.07%, and today, it sits at 3.80%, so current interest expense on the $114.5 million is about 73 basis points higher than at the close of the quarter.

Thus, I anticipate a headwind of about $835K in extra interest expense annually or about 1.6 cents per share. Not a huge deal, but a good thing to keep an eye on.

Be the first to comment