Sascha Schuermann

When it comes to the medical industry, investors have a large variety of ways to play the market. But this shouldn’t be a surprise to anybody who understands just how large the medical space is relative to the U.S. economy. As one of the largest portions of the economy as measured by GDP, there must be many working parts and countless firms dedicated to providing the goods and services that make it operate. One company in this market that investors should at least be aware of is Baxter International (NYSE:BAX). These days, the company engages in a variety of activities, such as providing peritoneal dialysis and hemodialysis, as well as other dialysis therapies, solutions, and products. It’s also engaged in medication delivery activities and it even operates a chemical nutrition segment. From a purely fundamental perspective, the picture for the firm has been a bit volatile recently. Despite seeing revenue increase year over year, profits and cash flows have suffered. As a result, shares of the company have taken something of a beating. In the near term, I suspect that this could continue. But given where shares are priced, both on an absolute basis and relative to other companies in this market, I do think that now might be a good time to rate it a ‘buy’.

A tough time for Baxter International

The last time I wrote an article about Baxter International was in June of 2021. In that article, I lauded the company’s ability to grow, even during the worst of times. I felt as though it was a quality leader in its market and that the price of the stock was not necessarily unrealistic given the premium that investors would demand for such a high-quality business. But even so, I felt as though the stock was a bit too pricey for me, leading me to rate it a ‘hold’ to reflect my view that it would likely generate returns that would more or less match the broader market moving forward. Fast forward to today, and it seems as though I was a little too optimistic in my assessment. While the S&P 500 is down by 11.8%, shares of Baxter International have generated downside of 29.2%.

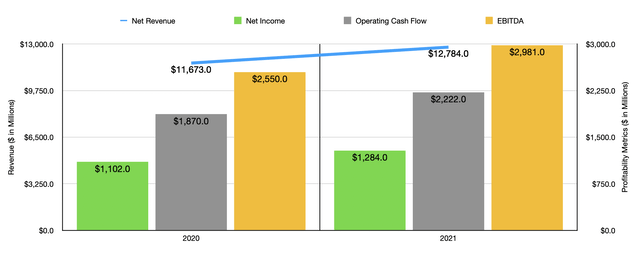

In order to understand why this return disparity exists, it’s imperative that we dig into some of the fundamental data regarding the enterprise. Given where the company was from a reporting perspective when I last wrote about it, we should begin with the 2021 fiscal year as a whole. During that year, revenue came in at $12.78 billion. That represents a sizable increase over the $11.67 billion generated in 2020. This roughly 10% increase year over year was driven by a variety of factors. For instance, foreign currency fluctuations helped to the tune of 3%. In addition to that, two different acquisitions the company engaged in contributed $320 million in all to the company’s top line growth. Strong demand for its offerings was also another key driver that varied in nature from segment to segment. As a result of the revenue increase, the company also saw improved profits. Net income rose from $1.10 billion to $1.28 billion. Operating cash flow rose from $1.87 billion to $2.22 billion. And EBITDA for the company improved from $2.55 billion to $2.98 billion.

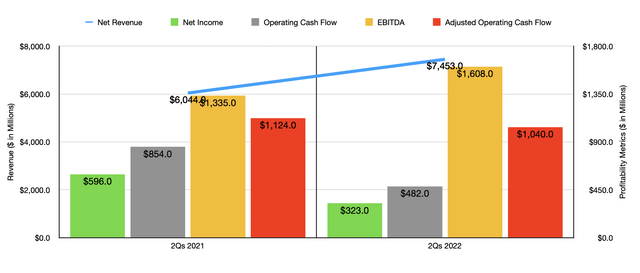

Heading into the 2022 fiscal year, the picture for the company changed even more, in some ways for the better and in other ways for the worst. From a revenue side, things went really well. Sales of $7.45 billion for the first half of the year came in 23.3% higher than the $6.04 billion generated in the first half of 2021. This increase came even as foreign currency fluctuations impacted sales negatively to the tune of 4%. And according to management, the vast majority of the improvement came from the company’s various acquisitions, most notably its $10.5 billion purchase of Hillrom, a move that on its own contributed about 24% to the company’s sales.

Normally, you would expect to see profitability follow suit. But that was unfortunately not the case. Net income in the first half of 2022 totaled only $323 million. This was down from the $586 million generated one year earlier. There were multiple issues on this front. For instance, the company’s gross profit margin shrank from 39.3% in the first half of 2021 to 37.6% the same time this year. This decline, management said, was driven significantly by special items such as increased intangible asset amortization expenses, acquisition and integration expenses, regulatory issues, and product-related items. Similar special items were also instrumental in pushing the company’s selling, general, and administrative costs up from 21.5% of sales to 27.2%. It would be one thing if the only pain we saw was when it came to net income. But we also saw it with cash flow as well. In the first half of the year, operating cash flow was only $482 million. This was down from the $854 million reported one year earlier. Even if we adjust for changes in working capital, it would have fallen from $1.12 billion to $1.04 billion. In fact, the only profitability metric that improved year over year was EBITDA. According to management, that rose from $1.34 billion to $1.61 billion.

When it comes to the 2022 fiscal year in its entirety, management has offered some interesting input. Actual earnings per share should come in at between $1.82 and $1.92. But on an adjusted basis, this would be between $3.60 and $3.70. To be more cautious, I decided to use the official earnings per share when valuing the company. Based on this data, the company should generate net income this year of around $950 million. If we assume that other profitability metrics will change based on how they have been reported so far this year, then we should anticipate adjusted operating cash flow of $2.06 billion and EBITDA of $3.59 billion.

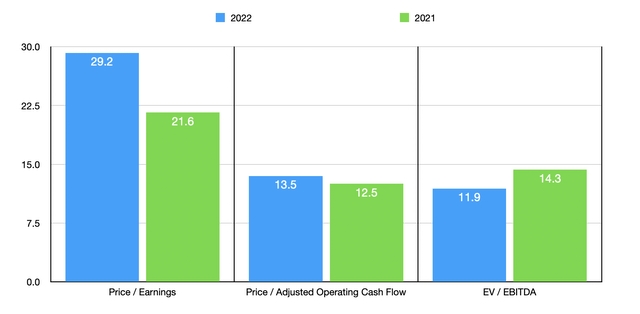

Based on these estimates, the company would be trading at a forward price-to-earnings multiple of 29.2. While that’s lofty, the other profitability metrics are more reasonable. The price to adjusted operating cash flow multiple should be 13.5, while the EV to EBITDA multiple should come in at 11.9. With the exception of the EV to EBITDA multiple, the pricing of the company does look more expensive than what it would if we used data from the 2021 fiscal year. As part of my analysis, I also compared the company to five other firms in this space. On a price-to-earnings basis, these companies ranged from a low of 33.2 to a high of 293.4. Using the price to operating cash flow approach, the range was from 22.3 to 125.3. And using the EV to EBITDA approach, the range was between 17.6 and 135.1. In all three cases, Baxter International was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Baxter International | 21.6 | 12.5 | 14.3 |

| IDEXX Laboratories (IDXX) | 76.5 | 75.4 | 54.4 |

| Olympus Corp (OTCPK:OCPNY) | 33.2 | 22.3 | 17.6 |

| ResMed (RMD) | 73.4 | 66.1 | 33.1 |

| Zimmer Biomet Holdings (ZBH) | 66.9 | 17.8 | 19.6 |

| DexCom (DXCM) | 293.4 | 125.3 | 135.1 |

Takeaway

Right now, it seems to me as though Baxter International is going through something of a rough patch. Having said that, I have no doubt that the long-term trajectory of the company would look positive. Sales continue to rise and many of the pains that the company is experiencing on its bottom line seem to be one-time in nature. I wouldn’t call the company a deep-value prospect by any means. But shares are definitely on the cheaper side of the spectrum, especially relative to similar firms. So for these reasons, I do feel comfortable increasing my rating on the company from a ‘hold’ to a ‘buy’.

Be the first to comment