everythingpossible

A Quick Take On The Hackett Group

The Hackett Group (NASDAQ:HCKT) reported its Q2 2022 financial results on August 9, 2022, beating expected revenue and non-GAAP EPS estimates.

The company provides a range of strategic advisory and technology consulting services to Global 1000 companies.

So, while the firm’s topline growth results may become challenged by a slowing macroeconomic environment, HCKT is worth putting on your watch list for future consideration.

The Hackett Group Overview

Miami, Florida-based Hackett was founded in 1991 to help clients improve their operational results through benchmarking, performance surveys, business transformation services and various software implementation solutions.

The firm is headed by founder, Chairman and CEO Ted Fernandez, who was previously National Managing Partner at KPMG.

The company’s primary offerings include:

-

Strategic Advisory

-

Benchmarking Studies

-

Oracle & SAP Solutions

-

OneStream Platform and Market Place solutions

-

Business Transformation

-

Market Intelligence Service

-

Other services

The firm acquires customers through its direct sales and marketing efforts as well as through partner referrals.

The Hackett Group’s Market & Competition

According to a 2021 market research report by 360 Market Updates, the global market for digital transformation strategy consulting was an estimated $58.2 billion in 2019 and is forecast to reach $143 billion by 2025.

This represents a forecast CAGR of 16.2% from 2020 to 2025.

The main drivers for this expected growth are a large transition from on-premises, legacy systems to cloud-based environments with complex architectures.

Also, the COVID-19 pandemic has likely pulled forward significant demand to modernize enterprise systems resulting in increased growth prospects for digital transformation consultancies.

Major competitive or other industry participants include:

-

Globant

-

EPAM

-

Slalom

-

Accenture

-

Deloitte Digital

-

McKinsey

-

BCG

-

Ideo

-

Cognizant Technology Solutions

-

Capgemini

-

Company in-house development efforts

The Hackett Group’s Recent Financial Performance

-

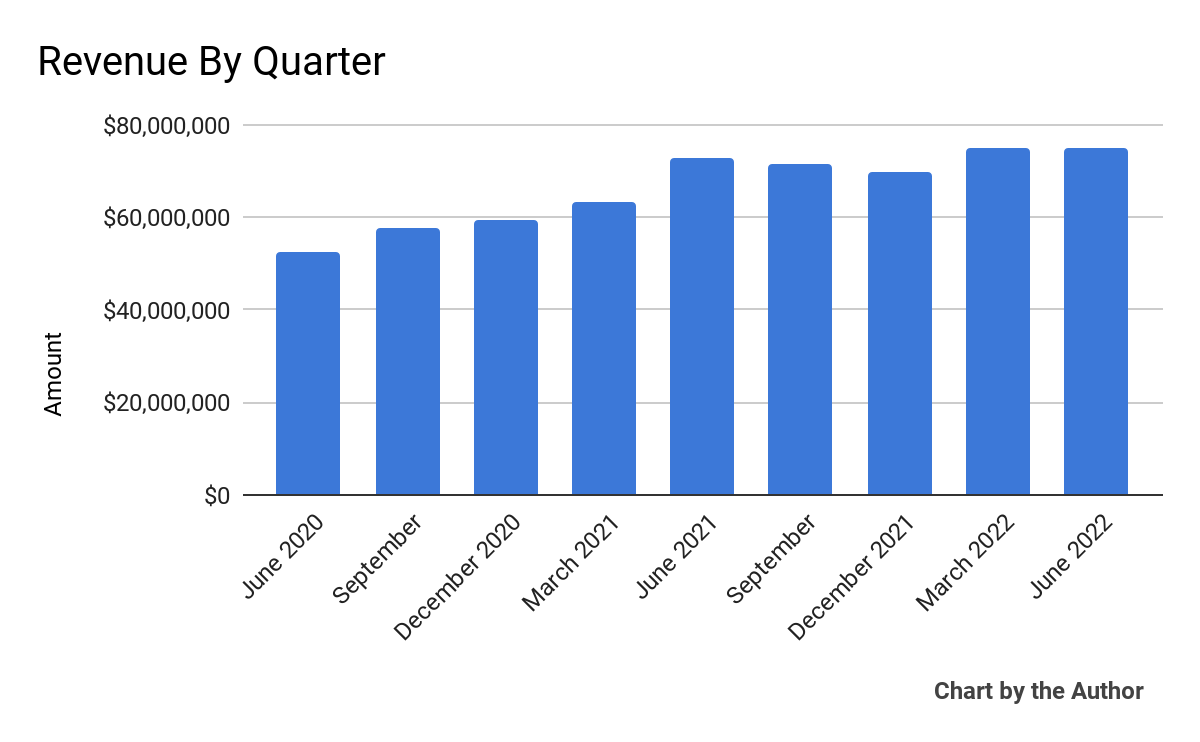

Total revenue by quarter has increased according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

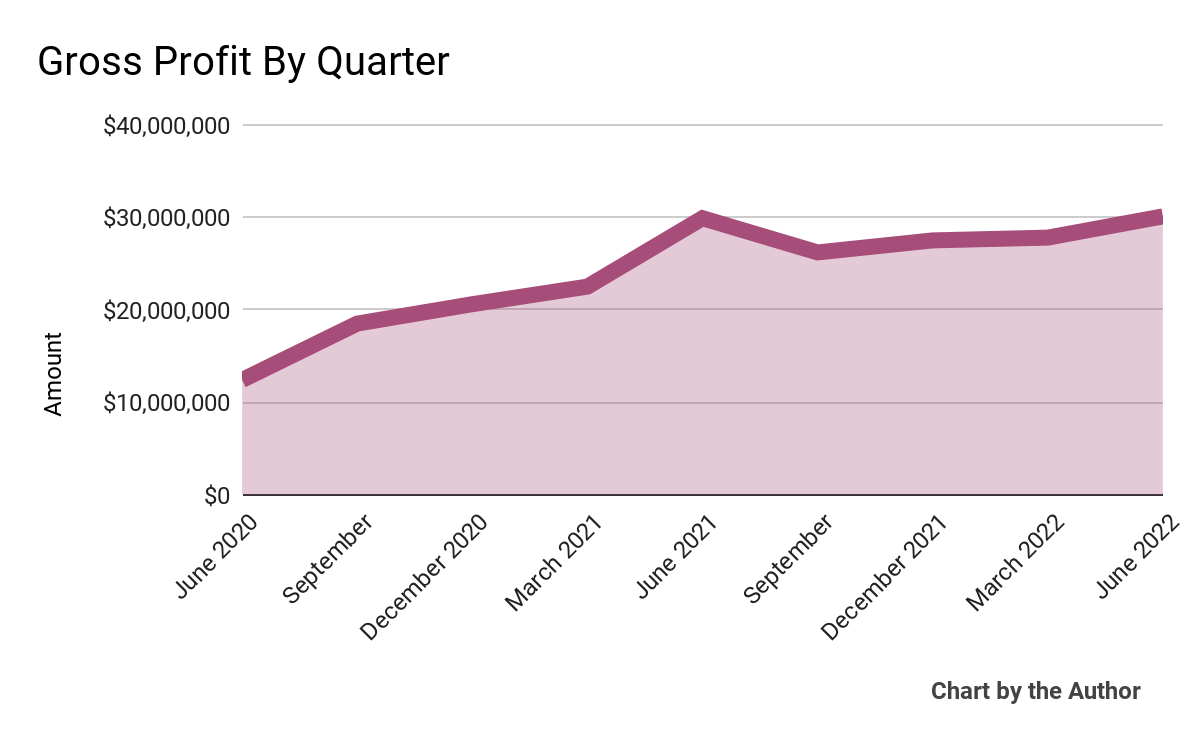

Gross profit by quarter has risen unevenly in recent quarters:

9 Quarter Gross Profit (Seeking Alpha)

-

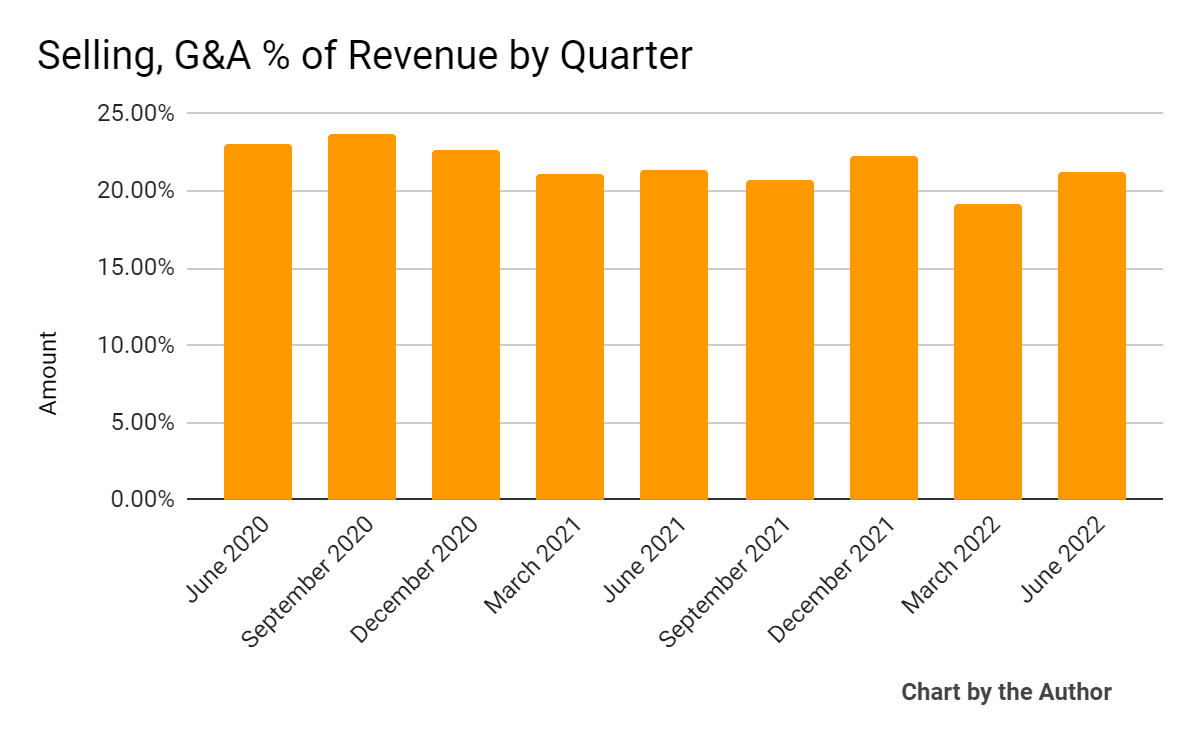

Selling, G&A expenses as a percentage of total revenue by quarter have trended lower as revenue has increased:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

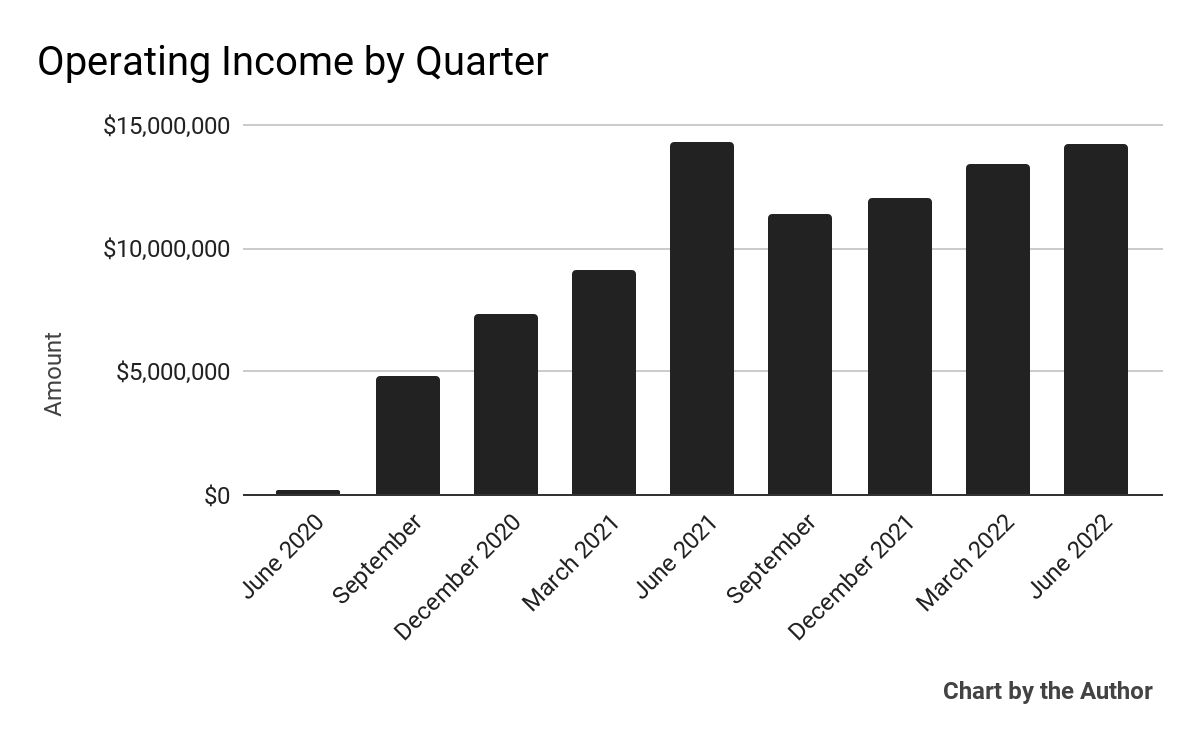

Operating income by quarter has risen substantially over the last 9 quarters:

9 Quarter Operating Income (Seeking Alpha)

-

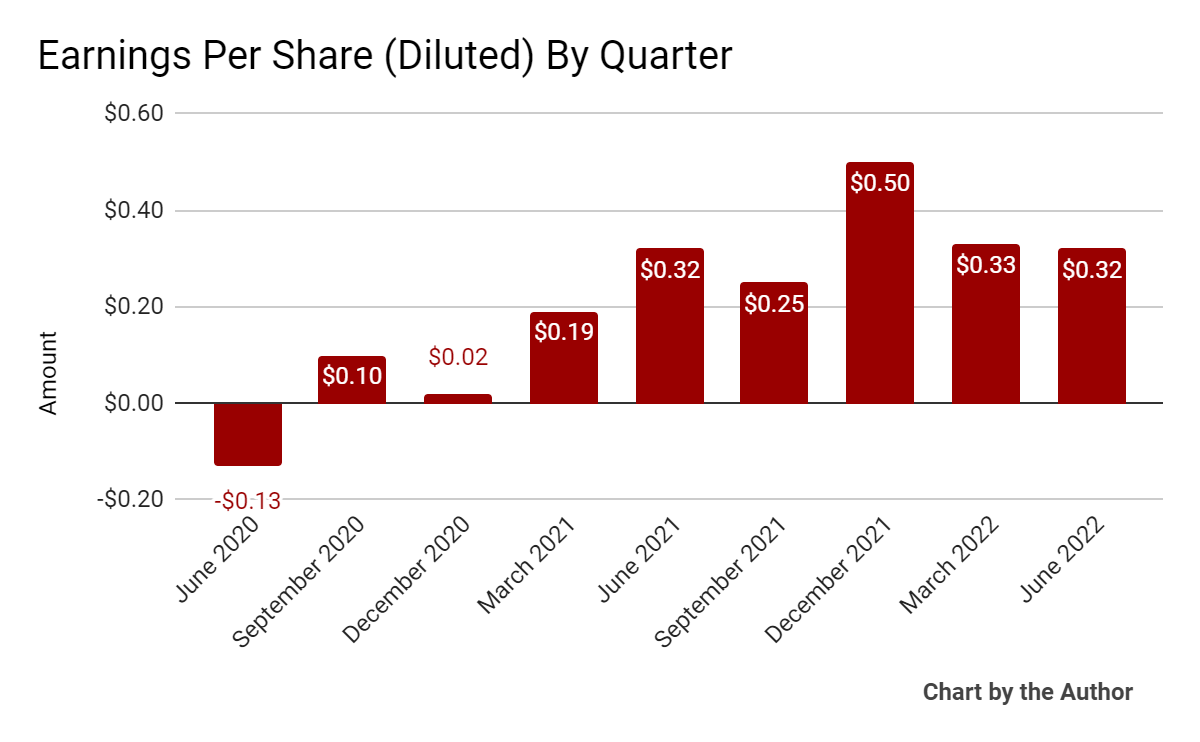

Earnings per share (Diluted) have also grown materially:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

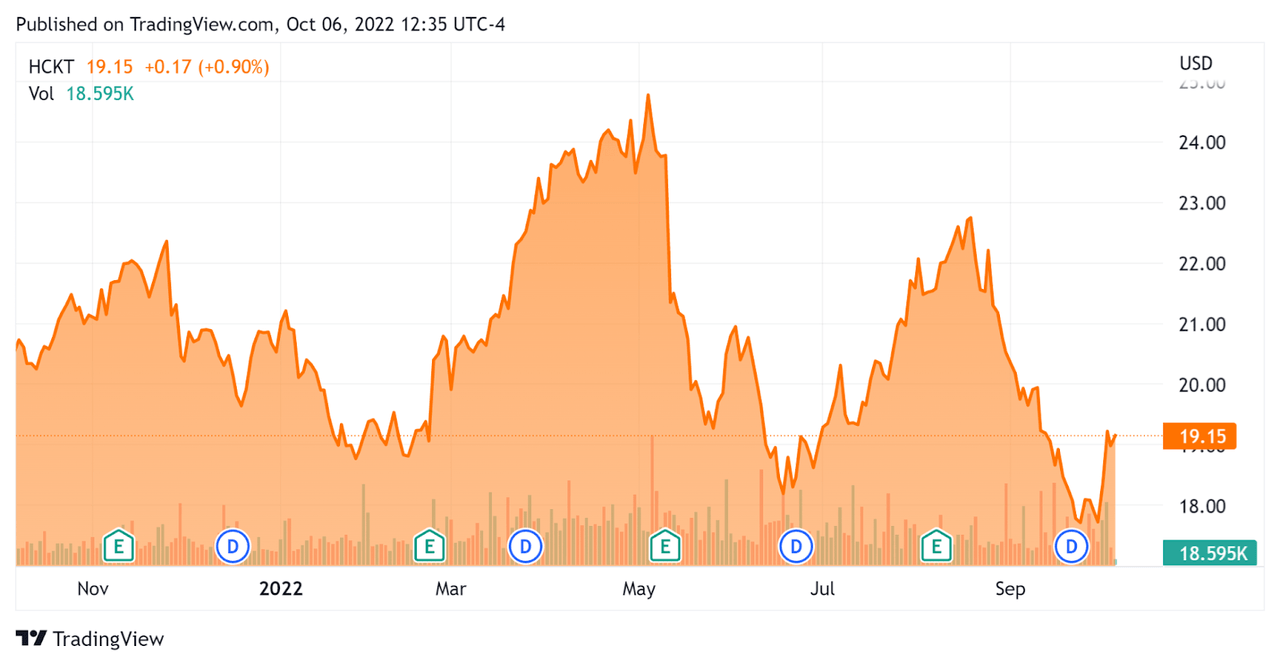

In the past 12 months, HCKT’s stock price has fallen 6.6% vs. the U.S. S&P 500 index’ drop of around 13.7%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For The Hackett Group

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.89 |

|

Revenue Growth Rate |

14.9% |

|

Net Income Margin |

15.6% |

|

GAAP EBITDA % |

18.9% |

|

Market Capitalization |

$608,950,000 |

|

Enterprise Value |

$549,790,000 |

|

Operating Cash Flow |

$50,990,000 |

|

Earnings Per Share (Fully Diluted) |

$1.40 |

(Source – Seeking Alpha)

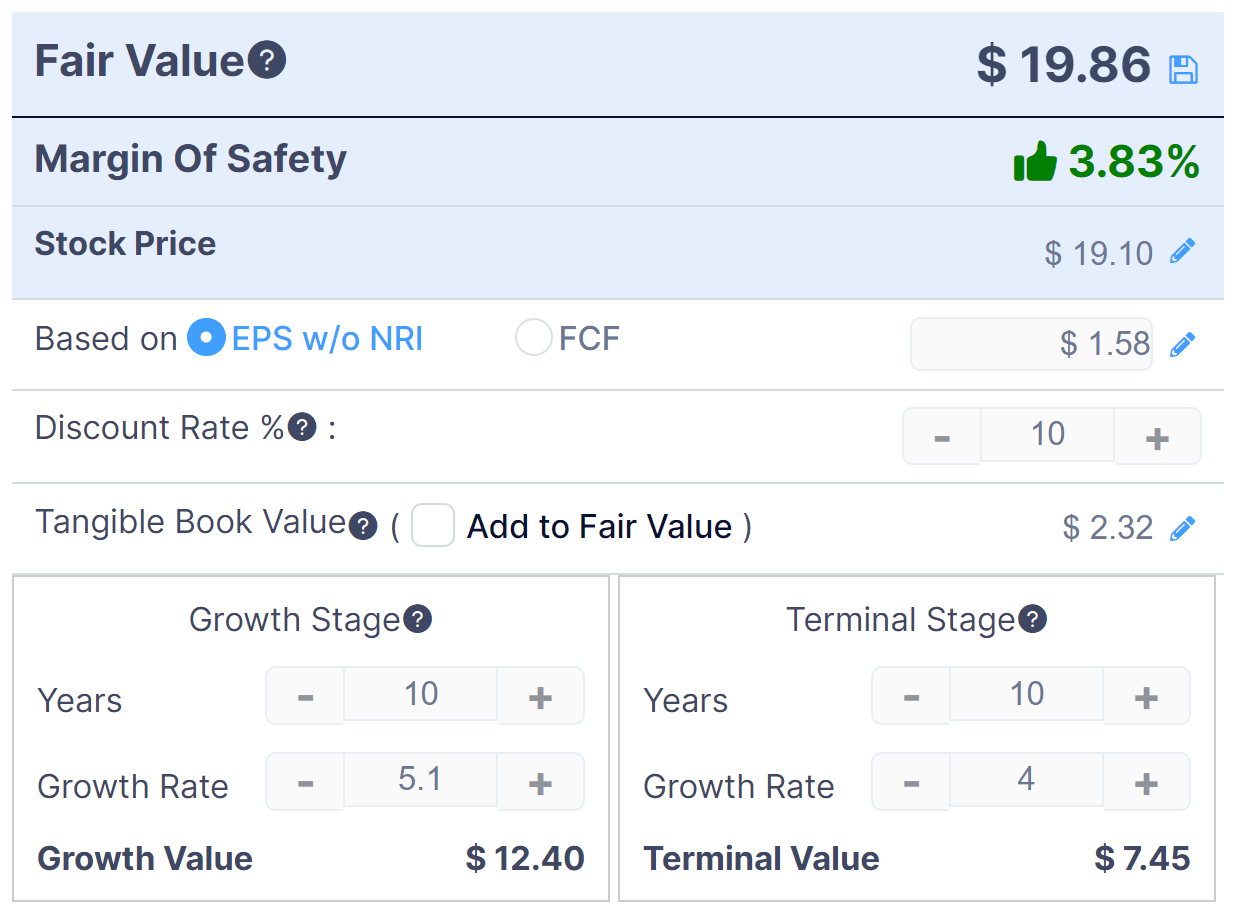

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Discounted Cash Flow – The Hackett Group (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $19.86 versus the current price of $19.1, indicating they are potentially currently slightly undervalued, with the given earnings, growth and discount rate assumptions of the DCF.

Commentary On The Hackett Group

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted continued ‘strong demand for all of [its] services.’

The firm continues to make investments in its intellectual property-enabled service offerings due to the higher margin generated from these and its research advisory services.

Leadership also noted the recent agreement with an Integration Platform-as-a-Service partner that it believes will be ‘transformative’ in a wide variety of ways.

As to its financial results, total revenue rose by 4% year-over-year. The prior year included a one-time software sales transaction.

Gross profit rose sequentially, but not by much year-over-year. Headcount continued to grow, rising by 10% year-over-year.

Operating income was slightly lower year-over-year, while diluted EPS was flat.

For the balance sheet, the firm ended the quarter with $61.7 million in cash and equivalents and no debt. Over the trailing twelve months, free cash flow was $46.9 million.

Looking ahead, management provided forward guidance for Q3 only and not the full year, expecting revenue to be negatively impacted by fewer working days due to increased time off during the summer period, especially in Europe.

Longer term, founder and CEO Fernandez believes that digital transformation demand by companies will continue to grow as the pandemic and subsequent inflation effects serve as a forcing function for companies to increase efficiencies wherever possible.

Regarding valuation, my conservative discounted cash flow analysis indicates that HCKT may be slightly undervalued at its current level.

The primary risk to the company’s outlook is slowing macroeconomic conditions and growing fears of a recession in the U.S. and Europe.

HCKT appears to be investing in proprietary IPO and related technologies and management believe it is positioned to ‘reach significantly beyond our current Global 1000 focus’ in an efficient manner, with the potential to produce new growth opportunities.

So, while the firm’s topline growth results may become challenged by a slowing macroeconomic environment, HCKT is worth putting on your watch list for future consideration.

Be the first to comment