Petmal/iStock via Getty Images

This year was a tough one. Market turmoil gave no quarter to stocks, especially in the EV sector. I don’t know when the tide will turn, and the recovery will start its slow, uphill battle, but I want to be fully prepared for when it should come. Therefore, I have recently started to analyze all EV companies one at a time— whether interesting or boring— to find the right stocks for my portfolio. Some followers asked me to look at Electrovaya (OTCQB:EFLVF), a Canadian firm with outstanding battery technology. I couldn’t say no and spent one curiosity-fueled week investigating it. Even my wife was jealous of my attention to the stock. I was doing research, reading papers, and comparing it with other battery producers. Today, after hours of review, I am willing to share my analysis outcome with you.

Electrovaya stands out in the crowded EV field. Despite its small business scale, its gross margin is high. Listing took place a decade ago rather than a year ago, like most public EV companies. Management marketed its technology successfully and expected strong revenue growth this year. However, regardless of its traction among automakers, with its poor corporate governance, non-transparent reporting, lacking manufacturing capabilities, high reliance on debt, and potential raise in equity, the stock is not attractive to me.

A grownup dotcom baby

Electrovaya was founded in 1996 and went public in November 2000. It received a $250 million valuation at an IPO, while its annual sales from rechargeable laptop batteries— called Power Pad 160— reached only $152,000. That would correspond to a 1,644x sales/price multiple. Electrovaya’s story could not sound any more dotcom-like. Even the product’s name, PowerPad 160, represents the insanity of the era. You can already assume what happened with the share price after a successful listing… yes, it practically fell into the abyss, as you can see from the chart below.

Google finance

Despite a bumpy stock road for its stock over the last twenty years, Electrovaya is still alive and is positioned strongly for growth in the battery segment for EV vehicles. It focuses on advanced lithium-ion ceramic battery cells with a truly competitive lifespan. Its main product is marketed as Infinity Battery, though it also develops Steady State batteries, which are expected to roll out from 2024 onwards.

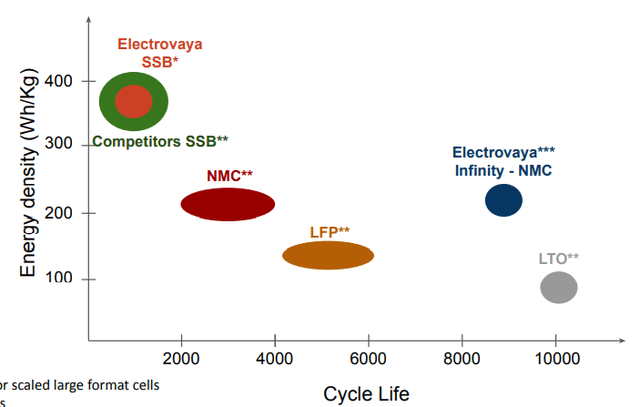

Before we look at Electrovaya’s positioning versus its competitors, let me briefly explain what differentiates a good battery from a bad one. Three factors determine the battery’s competitiveness: energy density, cycle life, and safety.

Energy density measures the energy a battery contains in proportion to its weight. High energy density is what allows for batteries thin enough to power the phone in your hand. Further technologic advances can expand the vehicle’s range and open new markets for electrification where the battery weight plays a crucial role. I can already imagine taking a zero-emission transatlantic flight.

Cycle life means how often you can recharge your battery without losing battery capacity. For example, I have a pretty old iPhone. Initially, I needed to charge it every other day, but now I’m doing it twice per day because, after 2000 charges, the phone battery lost its initial capacity. A similar logic can be applied to electric vehicles, although you would probably need a bit more powerful batteries.

The battery’s cycle life depends on how frequently you charge your battery. The more you charge, the shorter the lifespan. For lighter vehicles, though, the average lifetime of the battery does not pose an issue. On average, Americans buy a new car every 7-8 years, while one battery can last from 10 to 20 years. Conversely, for the commercial segment, battery life can be crucial as vehicles are operated in several shifts and must be charged several times per day.

Electrovaya produced the battery with practically the longest cycle life in the market, all while keeping a decent energy density. This is where the fitting name of “Infinity” comes from.

Company’s presentation

Additionally, Electrovaya developed a technology that achieves high safety standards confirmed by Underwriters Laboratory, a leading global certifier. The technology description is summarized extremely well by CEO Sankar Das Gupta in his April interview with the president of EnergyTech Investor LLC, Shawn Severson,

“Suppose there is some problem in a lithium-ion battery causing a slight temperature excursion of, say, 130 degrees centigrade. The Electrovaya separators will stay firm and ensure the positive electrode does not touch the negative electrode. In addition, we have some interesting electrolytes and components that add to the safety. It will stand out if you compare Electrovaya’s cells with those from the best automotive companies or the best battery makers in Japan, South Korea, or China.”

Moreover, Electrovaya managed to market its product successfully. In December 2020, Electrovaya signed an agreement with Raymond, a Toyota-owned leading lift truck manufacturer. Raymond tested Electrovaya’s batteries for two years before placing a rather large order. Raymond even went so far as to issue a white paper confirming the strong characteristics of Electrovaya’s battery versus its competitors. Should you want more details about Raymond’s review, you can find the paper here.

Bright future ahead?

At the beginning of this year, Electrovaya’s management expected $27 million in annual revenue and a breakeven EBITDA. At the Q2 earnings call the projections were decreased to $21-25 million. But at the recent earnings call, revenue projections were decreased further, below $21.0 million in revenue in fiscal 2022 (reporting date is in September). Despite the sluggish execution, the order backlog remains solid. On the 7th of July, the company announced an additional $11 million order that drives the total 2022 backlog to $40 million.

The current revenue forecast almost double the previous year when only a $12 million top-line was achieved. Wall Street analysts believe in the sustainability of the revenue growth and project a three-time increase by 2024. A recent article published by Stephen Tobin on Seeking Alpha also projects over $130 million in revenue by 2024. I would love to grab a coffee with the author and discuss the reasons behind such optimism in detail, but until then, I am not convinced by hopeful projections and am keen to add three measures of scepticism: one of doubt and half a standard of common sense to them.

The year-to-date performance showed that orders could be easily shifted. Electrovaya recognized only $5.5 million revenue in the first year-half, primarily due to delays of a $6 million order from a significant e-commerce player. In the third quarter the company generated $ 4.3 million revenue. Although it is in line with the previous quarter, the management tried to present it as a big success.

On a sequential basis, revenue in Q3 was flat to Q2 and 3 times out of Q1. The revenue for the month of June itself was over 50% of this quarter. This is when we really see the ramp-up in production.

In my opinion, such results mean that the company had serious issues in May and April and managed to partially solve them in June. If we extrapolate $2 million generated in June it for the entire quarter, then we reach $6 million for the quarter. It is below $11 million required in Q4 to reach the annual targets.

According to the Q3 report, the company representatives are strongly hoping for demand’s increase coming from the adjacent markets, for instance the bus market. The analysis of previous management’s statements shows that Electrovaya’s batteries received lukewarm interest in the bus market. At the end of the last fiscal year, management believed the following:

“There will be growing demand for our batteries in electric buses,”

While in Q2, they changed their wording to say that,

“Just today, the bus market, the electric bus market, is a very small market compared to the materials handling market.”

Subscribers sometimes criticize me for subjective interpretations of the management’s comments. That being said, such a drastic change in the management’s opinion strongly suggests that we should not expect much demand from the bus producers for Electrovaya’s products. I believe it can be difficult to win contracts with bus producers, especially when considering that Electrovaya only offers battery cells. Small bus manufacturers require a full-package EV solution, including a battery pack and drivetrain. Meanwhile, large bus producers have long-term contracts with the largest battery producers and are not in a hurry for a technological shift. You can read more about the bus market economics in my article about Proterra (PTRA), which gained traction among bus producers, providing the entire electric value chain to them.

No revenue track record and corporate governance issues

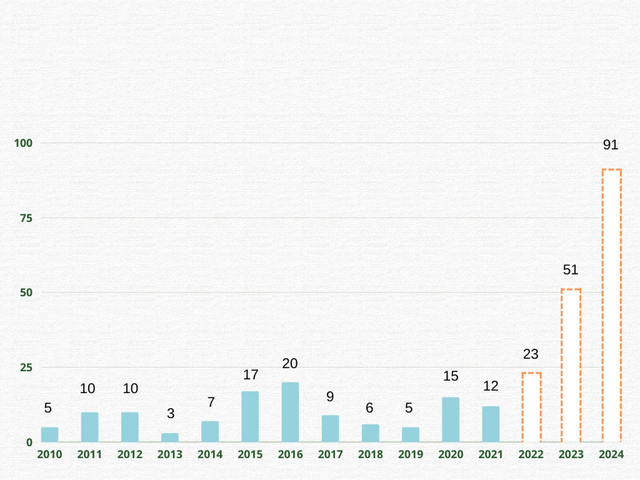

Company’s data

As you can see in the chart above, historically, Electrovaya has not achieved long-term sustainable revenue. It was only in 2010-11 when Electrovaya won the contract to supply batteries for the Chrysler Ram and Minivan, significantly increasing its revenue and sparking investors’ interest. But, just a few years later, in 2013, Chrysler cancelled the order due to safety issues. To address the problem, Electrovaya purchased the ceramic technology discussed in the first section. Large orders returned only in 2015 when Electrovaya started cooperation with Daimler, the principal company of Mercedes-Benz. It ended dramatically several years later, with delayed battery orders and an overall low demand due to non-competitive manufacturing costs. This led to a cash trap and a complete inability to pay leases for the manufacturing premises in Germany. As a result, the company had to start the insolvency process of its German subsidiary, which ended international expansion.

With such a tumultuous past, I am concerned that history will only repeat itself. Management has no prior production experience. Besides, there are no sufficient manufacturing facilities to support the planned business expansion. From the balance sheet, we know that Electrovaya does not own its property; instead, it leases all its fixed assets. Such an asset-light business model can work when you are in a start-up phase, but while in the scale-up phase, you must invest a lot in the production. Cash flow from operations was harmful and could not sustain investments, while the cash position was limited. So far, Electrovaya has relied heavily on the debt and equity mix, which only led to a non-sustainable debt burden. Interest payments were $2.7 million in 2021, while EBIT was $4.3million. The only way to finance expansion would be via equity raises.

The company’s corporate governance procedures need to be drastically changed to attract investors. As stated in the 2021 annual report Electrovaya leases its lab premises for $25,000 per month from “An investor group controlled by the family of Dr. Sankar Das Gupta, Electrovaya’s CEO.” Such a business practice allows for decreased Capex in the financial statements and distorts investors’ perception of the company. On the positive side, in the recent call, management finally communicated to investors concerning manufacturing capacity, disclosing that the “current infrastructure can support $60-70 million [revenue] on an annual basis“. Still, such poor transparency and third-party-related transactions are a clear red flag for me.

I hope under the new CFO, John Gibson, the company will provide more details on its production capacity and business drivers. However, a quick look at his biography shows his background in private business and he has no experience working for listed entities. Additionally, the new CEO, Dr. Raj S. Das Gupta, appeared to be the son of the previous CEO, Dr. Sankar Das Gupta— another glaring red flag for me:

Most importantly, I would like to thank Sankar Gupta, my father and the company’s founder, for leading Electrovaya through thick and thin and guiding the company to its current sure footing. He remains our chief, our Executive Chairman.

Q2 positive news on the backlog development led to a substantial share price movement, with an almost 20% price increase on the announcement day. However, over two weeks before the announcement, the share price doubled. No comments here. It’s definitely a red flag for me as a minority investor. What will happen before any bad news announcements? Will I be the last man standing on the Titanic?

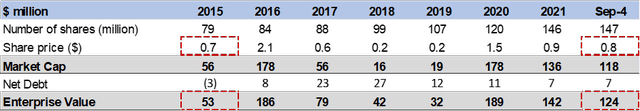

Valuation and equity raises

Historically, Electrovaya has pursued continued equity raises. Over the last seven years, the number of outstanding shares doubled. Enterprise value has been increasing, even while share value remained essentially flat.

Company’s accounts. Prepared by author

Electrovaya will need to tap equity liquidity to finance its expansion plans. Let me try to estimate its funding needs: The company’s main competitor, Microvast (MVST), generated $80 million in sales and spent $20 million on Capex per annum in 2019. A slightly lower figure like, say, $15 million should be a good proxy for mid-term Capex requirements. As Electrovaya’s negative operating cash flow was about $4-8 million per year, a $20 million cash burn is a reasonable estimate. To attract the necessary financing at the current market price, Electrovaya will likely need to increase its outstanding shares by 20%. It is difficult for me to imagine that the share price can sustainably grow to such a necessary extent, especially given dilution and poor corporate governance.

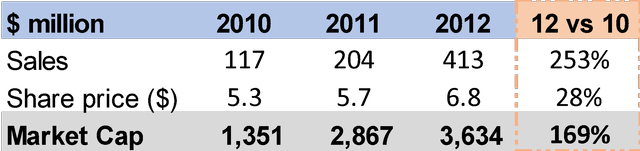

The situation when the market capitalisation grows but the share price stagnates is quite common in the industry. Let me show you Tesla’s stock performance over 2010-12, i.e., the development period before strong revenue catalysts came into effect. To support revenue growth, Tesla continuously issued new equity. It led to a significantly higher market capitalisation, while the stock’s performance was sluggish. If Electrovaya secures recurring orders with its key customers, its stock could follow a similar “no-growth” pattern, despite rising market capitalization.

Tesla financials

View of Electrovaya through a bullish lens

Bulls would say that Electrovaya is well-positioned for sustainable revenue growth. It has solved safety issues and learned a lot from its past manufacturing failures. The new CEO and CFO will improve the corporate governance and reporting procedures, which would allow them to attract institutional money (less than 5% currently) and finance future growth. If the company achieves sustainable revenue growth over the next couple of years, it would be a strong catalyst for the stock and will increase its valuation multiples.

Conclusion

Despite the promising technology and a strong R&D team inside the company, I still see significant risk for investors. In my view, the company is being managed like a family business despite being a public company. In the past, management could not achieve sustainable revenue acceleration due to lack of manufacturing expertise and poor liquidity management. I have no confidence in investing my money in Electrovaya at the current stage.

Be the first to comment