zimmytws/iStock via Getty Images

The market for high-growth companies not producing profits has collapsed this year, yet Flywire (NASDAQ:FLYW) is still aggressively priced. The company completed a hot IPO back in 2021 and this appears to account for the extended valuation of the stock this year. My investment thesis remains Neutral on the fast-growing payments company.

Large Untapped Market

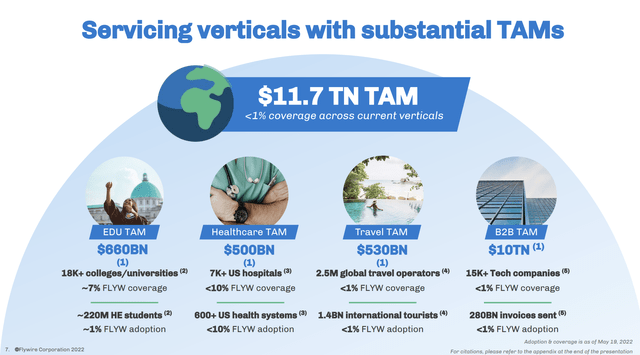

The digital payments company plays in markets with a TAM topping $11 trillion in annual payments. The primary opportunity is in the B2B payments sector where the TAM tops $10 trillion globally. Investors typically focus more on the global e-commerce payments opportunity, but the B2B sector is far larger.

Source: Flywire ’22 Investor Day

As a prime example of the untapped markets, Flywire has less than 1% coverage in most of the key verticals. These verticals have strong growth drivers with the B2B market shifting towards e-invoicing with a 20% growth rate.

Amazingly, Flywire forecasts the ability to grow revenues by at least 5x by expanding with existing customers and products. The massive opportunity comes from adding clients and building new verticals with scalable cloud technology and software tailored to specific use cases. The company offers the ability to offer payment plans to the education sector or multi-party payments for the travel vertical offering the flexibility to meet the requirement of the specific vertical.

In the last quarter, Flywire only processed total payment volumes of $2.9 billion, up from $1.9 billion the prior year. The paytech firm continued on a path of nearly 50% volume growth, but Flywire has a very small portion of the global payments volumes with the majority of the business focused on the cross-border education system. The company doesn’t forecast revenues from non-education areas topping 50% of total revenues for up to 5 years.

The sectors generally survived COVID shutdowns with even travel now back to pre-COVID levels. Like most sectors, COVID accelerated the need for finance automation and digitization offered by Flywire.

Still Priced Like An IPO

Similar to most stocks, Flywire has fallen from the highs last year. The stock trades below $25 now after soaring above $50 last October following the successful IPO priced at $24 last May.

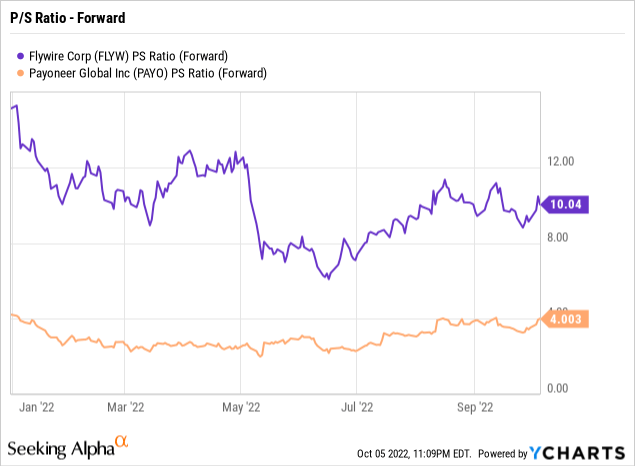

Even a year later and down 50% from the highs, Flywire still trades at a premium valuation. The stock valuation compared to Payoneer Global (PAYO) provides a great example of how the market has treated IPOs versus SPACs. Flywire still trades at 10x forward sales while Payoneer is at only 4x sales targets.

Keep in mind, Flywire reported an EBITDA loss of $6 million for Q2 and only guided towards a 2022 adjusted EBITDA of around $15 million. The market isn’t so impressed with companies struggling to reach just EBITDA profits preferring actual profits.

The paytech firm guided to 2022 revenue of ~$265 million for 45% growth. In normal markets, investors definitely love the consistent growth rates of global payment firms, but this isn’t a normal market.

The company focused on the education payments vertical has September quarterly revenues with outsized numbers. Sometimes this will confuse investors and cause weakness in a stock.

Flywire guided to Q3’22 revenues of at least $87 million, up from only $52 million in the prior quarter. Analysts forecast strong Q4’22 revenues of $67 million, but the number is huge sequential dip. Such a scenario can cause some confusion to the investment community seeing this sequential revenue dip as a warning versus normal seasonal trends.

Truist analyst Andrew Jeffrey recently started coverage of Flywire with a Buy rating with a $36 price target. The market is remarkably bullish on the stock despite the weak dynamics. Though, the upside target is only 44% above the current price and far below the highs following the IPO.

Takeaway

The key investor takeaway is that the stock just doesn’t offer much upside potential in the current environment. Investors should definitely keep Flywire on a watchlist due to the attractive growth rates and massive opportunity in their targeted payments verticals. The stock just isn’t cheap enough with what is normally seen as a premium valuation multiple to buy in a market where other stocks have been decimated.

Be the first to comment