FatCamera

Innovative Industrial Properties, Inc. (NYSE:IIPR) is one of the rare breed cannabis real estate investment trusts (“REITs”) that can provide high revenue growth along with attractive dividend yields.

In this article, I’ll cover the important things you need to know about IIPR stock and share why I like this company in the long run.

Innovative Industrial Properties Business Update

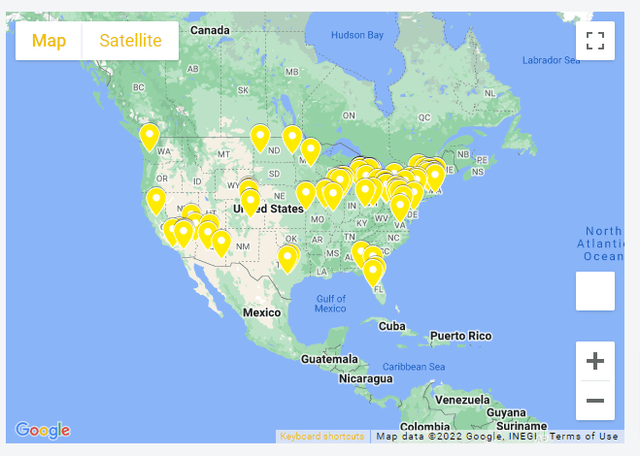

Innovative Industrial Properties acquires real estate properties, then leases them to state-licensed Cannabis operators for their growing needs.

The company owns 111 properties across America as of September 1st, 2022 and generates income using a triple net lease agreement.

IIPR Property Portfolio (innovativeindustrialproperties.com)

Q2 2022 revenues hit $70.5 million (Up 44% YoY) and net income reached $39.9 million. The company increased its quarterly dividend to $1.80 (Up 25% YoY) to shareholders on record as of September 30th, 2022.

Innovative Industrial Properties continues to collect rents from its tenants at a high rate despite all of the inflationary fears. Rent collection was 99% for the first 6 months ending on June 30th, 2022.

Cannabis use should remain consistent despite market ups and downs because consumers likely will continue spending money on medical and recreational Marijuana. This gives IIPR an advantage over other REITs such as Simon Property Group (SPG), a high-yield shopping mall REITs.

When core inflation continues to rise, consumers will stop shopping at boutique malls before they cut back on cannabis consumption, in my opinion.

During uncertain times, I believe investing in cannabis REITs is one of the safer places to earn dividend checks while banking on higher growth in the future.

The Power of Investing in Dividend Growth REIT Stocks

Growth stocks are always the most talked about on social media, but dividend growth stocks can make you a lot of money, too.

Over time, dividend growth stocks may increase the annual dividend, which means you get additional income for just holding the shares.

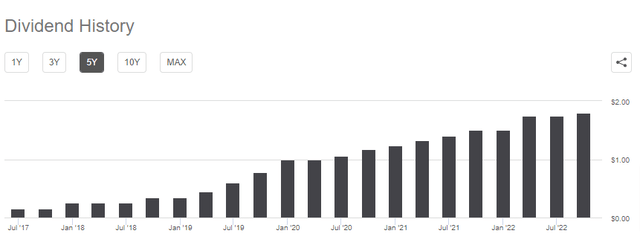

IIPR Quarterly Dividend History (seekingalpha.com)

For example, IIPR paid its first dividend of $0.15 on July 14th, 2017, and has increased its dividend annually each year since its IPO. IIPR stock is up 397% over the last 5 years but actually returned even more if you include dividend payments in the total return.

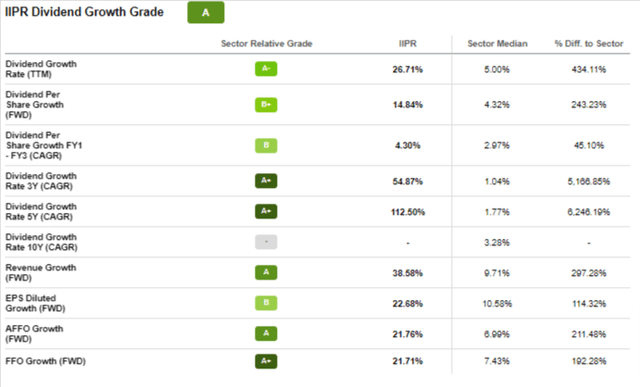

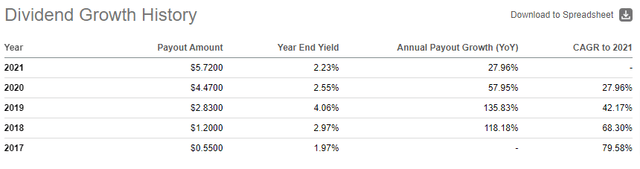

IIPR’s 5-year dividend CAGR is 112%, and Seeking Alpha gives IIPR an A dividend rating.

IIPR Dividend Rating (seekingalpha.com)

Many IIPR bears state that growth is slowing, plus more competitors could enter the cannabis REIT industry if the U.S. government legalizes cannabis on the federal level.

There are currently 38 states plus Washington, D.C., that have legalized cannabis for medical use, along with 19 states having legalization of cannabis for adult use.

Almost 80% of the United States has already legalized cannabis use on some level, so I don’t think growth will slow down even if U.S. federal legalization gets put on hold.

Why I Bought IIPR Shares

I normally ignore dividend stocks in this column because most investors get excited over high-growth stocks such as Tesla (TSLA), Amazon (AMZN), and Coinbase (COIN).

However, there is nothing wrong with adding some quality dividend growth stocks to your portfolio as you get closer to retirement. I turned 36 in August and realized that I’m too heavily invested in non-dividend-paying growth stocks.

Do you feel the same way? Perhaps you are getting tired of extreme volatility and want some passive dividend income coming into your portfolio every 3 months.

Well, you could certainly invest in dividend stocks like McDonald’s (MCD) or AT&T (T) and collect dividend checks until you reach retirement. These large-cap dividend stocks are safe, but how much will these companies grow in the future?

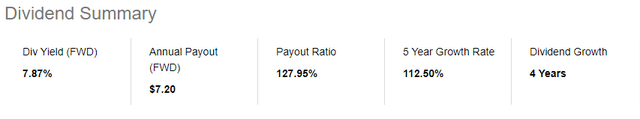

On the other hand, IIPR pays a fat 7.6% annual dividend yield plus could grow revenue 30% annually over the next 5 years.

IIPR Dividend Payout (seekingalpha.com)

Let’s assume revenue grows at 30% plus the annual dividend maintains its 27% TTM CAGR.

IIPR Dividend Growth (seekingalpha.com)

IIPR could pay an 11.17 annual dividend by 2025, more than double its current annual dividend.

That’s basically doubling your annual dividend income in just 3 years while the market sorts itself out. We don’t know where growth stocks will trade, but receiving dividend income is a slow and steady way to grow your portfolio.

Risk Factors

IIPR remains risky for several reasons, even though the dividend yield is extremely attractive.

- AFFO growth has been slowing and this could affect IIPR’s share price in the future.

- If the U.S. government legalizes cannabis nationwide, then a flood of new companies will enter the cannabis real estate leasing marketplace and place heavy competition on IIPR.

- IIPR shares are down 63% YTD and could fall further if higher interest rates make it more difficult for cannabis growers to make rental payments or increase output.

- Many dividend investors hold IIPR shares mainly for the high dividend yield and may dump the stock if management fails to increase the dividend each year.

Conclusion

IIPR is an exciting cannabis REIT that I have high hopes for. I normally don’t invest in dividend stocks, but I think REITs are looking like a solid investment if core inflation gets worse.

You might as well generate some income from your portfolio while we wait out the prolonged bear market. IIPR is one of the high-yield dividend stocks that could grow much larger in the future.

If you’re looking for high yield plus high upside, then give IIPR shares a serious look.

Be the first to comment