Roman Didkivskyi/iStock via Getty Images

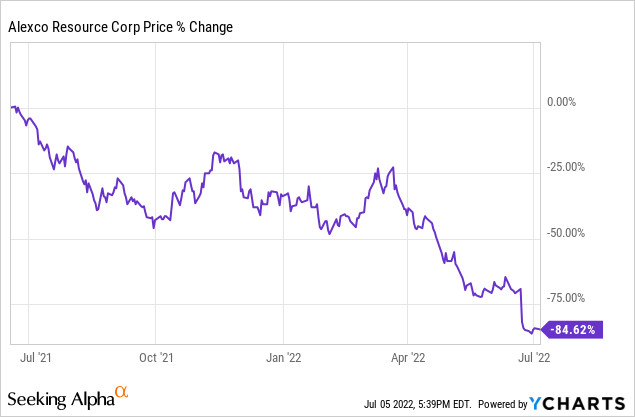

The decline in Alexco Resource (NYSE:AXU) over the last year is stunning; down 85% as its market cap has contracted to just over US$60 million versus ~US$400 million 12 months ago.

The problem, and something I’ve been warning subscribers of The Gold Edge about since last year, was the slow ramp-up at the company’s Keno Hill silver mine in Canada.

There were troubling signs early.

In August 2021, I discussed how Keno Hill was running about six months behind with the ramp-up and how my concern at the time was that it would extend well into 2022, or the mine would never hit targets. It wasn’t an impressive showing, and the company was being quieter than I felt it should, “Almost giving off an air of uncertainty.”

In early 2022, the struggles continued, and I thought the company would issue exceedingly weak 2022 guidance.

As it turns out, the guidance for the rest of 2022 is basically zero production, as Alexco announced two weeks ago that it was shutting down the mill because the amount of underground development isn’t enough to sustain throughput of 400 tpd. The company was only suspending milling operations until the end of this year, during which time they would “focus all efforts on advancing underground development.”

The mill operated for 16 days in May, with nine of those days above 400 tonnes per day. Basically, they were getting only 150-250 tpd of ore to the mill, which is a thoroughly unimpressive performance this far into the ramp-up. It shows that the mine was undercapitalized from the start.

Alexco just raised C$13.1 million in April but stated they would need additional financing as they had C$14 million of cash and negative working capital of approximately C$4.5 million, which included about C$6 million of short-term debt. The company doesn’t have any long-term debt, so bankruptcy was never a concern.

However, I believe the mine could call for US$50-$100 million (maybe more) to unlock its potential. AXU hasn’t scaled up this asset as they don’t have enough liquidity, and I’ve questioned whether the team could get the mine where it needed to be.

This is the second go-around for Keno Hill, as it was forced to shut down in 2013 after a brief period of production due to low silver prices, poor operational performance, and a hefty silver stream on the asset.

Which brings me to the other problem. Wheaton Precious Metals (WPM) owns a 25% silver stream on Keno Hill, and this stream has been an albatross for years.

As I said to my subscribers late last month:

Keno Hill should be in the hands of a larger mining company that can spend the amount required on the operation. I think now is an ideal time for somebody like Hecla Mining (NYSE:HL) or Pan American Silver (PAAS) to try and negotiate a deal on Keno Hill sans stream. The question is Randy Smallwood, CEO of Wheaton Precious Metals (the company that owns the stream), finally willing to relent? Smallwood and AXU have come up with many complex ways to make this stream work for both parties, but it’s simply too aggressive and was first conceived at the depths of the Great Financial Crisis in late 2008 when companies like AXU were desperate for liquidity.

One concern I’ve always had about Keno Hill 2.0 is the stream will still prove to be too costly even if the mine finally gets throughput to 400 tpd on a steady basis.

I believe that other companies in the sector see the worth and great potential of Keno Hill but have been reluctant to acquire the asset because of the amount of additional capital needed + the stream. If you remove the stream, interest would likely increase considerably.

Yesterday, Hecla announced that it’s buying AXU in an all-stock transaction at a 23% premium, and concurrently, Hecla has also entered into an agreement with Wheaton Precious Metals to terminate its silver streaming interest on Keno Hill in exchange for US$135 million of Hecla common stock.

So, after almost 15 years, Keno Hill will be unencumbered, and we can finally see what this mine is capable of. I believe this is a fantastic acquisition by Hecla and very low risk.

Let’s take a closer look at Keno Hill.

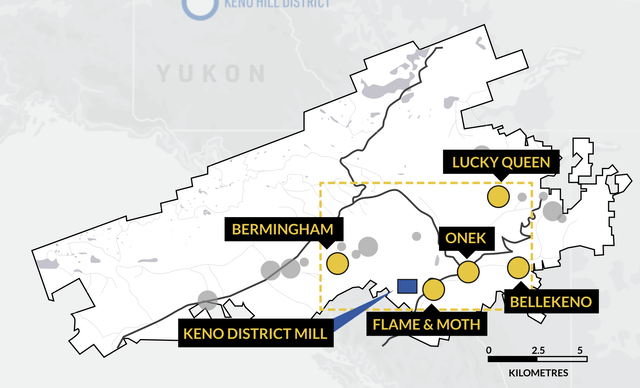

Keno Hill is located in the Yukon and rarely do you see primary silver mines in Canada. There are several mines in production on the property, with the two main deposits being Bermingham and Flame & Moth. There are 37.2 million ounces of silver reserves at Keno Hill at a stout grade of 804 g/t Ag, plus there are over 200 million pounds of lead and zinc reserves as a sweetener that can be used as by-product credits to drive down costs.

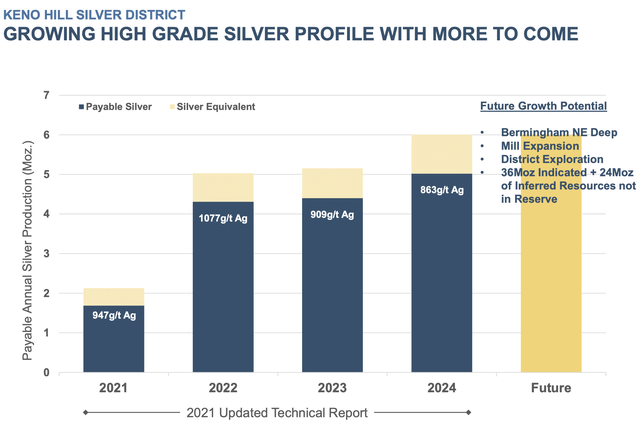

The 2021 technical report estimated that the mine would ramp up to over 4 million ounces of silver this year (or ~5 million ounces of payable silver equivalent production if you include zinc and lead output) and peak in year 4. The total mine life is 8 years, and the average AISC was under $12.00 per silver ounce over the LOM. As a side note, to show how much Alexco has struggled, Keno Hill only produced ~80,000 ounces of silver in Q1 2022, when it should’ve been at a run rate of ~1 million ounces of Ag per quarter. It wasn’t getting much better in Q2 as production was still well below plan. While the mine life seems short, the mine plan only contains a portion of the available resources that are near the current mine workings.

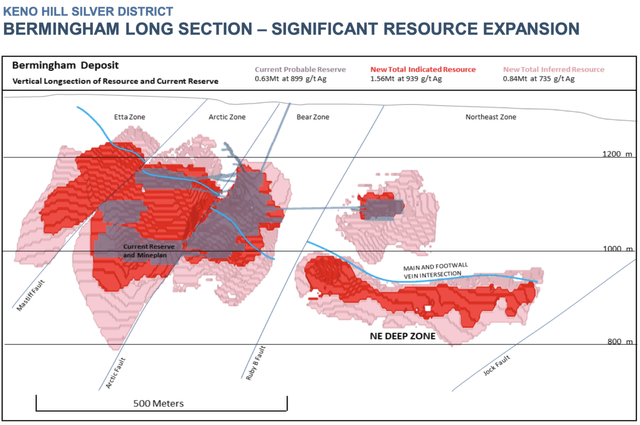

The following diagram is of the Bermingham deposit. Notice how the defined reserves (in taupe) that are part of the life of mine make up only a smaller portion of the overall indicated resources (in red). There are enough indicated ounces not currently in the mine plan to either double the mine-life, or double the production level, as an additional 29 million ounces of indicated resources are above the cut-off. But that’s just the tip of the iceberg. Alexco has hit bonanza grade intercepts at depth in the Northeast Zone at Bermingham, including hole K-20-0769, which intercepted 3,583 g/t silver over a true width of 8.76 meters and also included 0.46 g/t gold and extremely high-grade lead and zinc. This drill hole is close to the primary decline at Bermingham, and there were more bonanza grade holes drilled in this section, known as Bermingham Northeast Deep. To take a line from the company: “there is an ocean of silver at Keno Hill.”

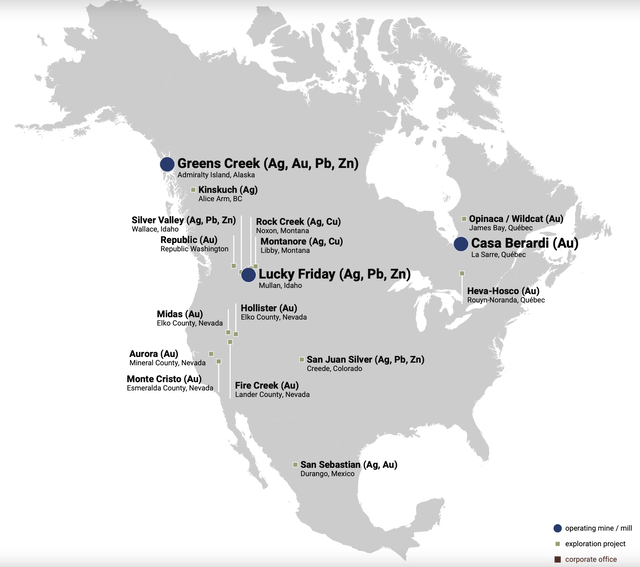

An asset like Keno Hill is a perfect fit for Hecla and right in their wheelhouse. Hecla’s Greens Creek (Alaska) and Lucky Friday (Idaho) mines are also high-grade underground silver operations that produce Au, Pb, and Zn as by-products. Keno Hill slots in nicely with this portfolio. I expect that Hecla will spend at least $50 million on Keno Hill once the acquisition is complete, as this mine can scale up much more than where AXU had it. Also, without the stream (and WPM taking a good chunk of the cash flow), HL can look to increase production and reap 100% of the benefits. The ounces are clearly there to get Keno Hill to the 6-8 million ounce per year range, but it requires significant development work and a small mill expansion.

I was already bullish on Hecla, and the addition of Keno Hill (sans the stream) makes the stock even more appealing. There is no guarantee of success, as again, Keno Hill has already failed once and was faring worse on the second go-around. However, HL only risked 8.6% of their stock on these transactions, and while the mine will require additional capital, the total spent to see what Keno Hill is capable of in the hands of an established producer is well worth the risk.

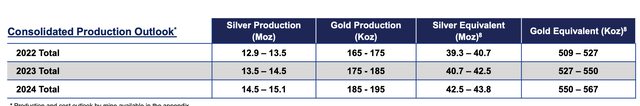

If HL is able to maximize the potential of Keno Hill, then the company’s silver production will be over 20 million ounces per year, or a 40%+ increase compared to the ~14.5 million ounces expected in 2023 and 2024. That’s low-cost, long-life Ag production from Canada and the U.S. No other silver company offers this compelling mix of grade+production+jurisdiction+LOM.

I’m out of HL at the moment, but I’m looking to buy the stock once I believe the sector is at or near a bottom. I believe we are close.

Be the first to comment