Kevin Dietsch/Getty Images News

Article Thesis

The EV industry is experiencing rapid growth as more and more players enter this market and since governments around the world remain supportive of the technology. Tesla (TSLA) is the clear leader by market capitalization, but BYD (OTCPK:BYDDY)(OTCPK:BYDDF) seems to be well-positioned to overtake Tesla sooner or later, thanks to higher growth, more broad-based exposure, and advantages in China — the world’s most important EV market and BYD’s home turf.

The EV Market Is On Fire, Especially In China

EVs aren’t a completely new phenomenon, but the technology has grown a lot in recent years. 2022 will be the best year for the global EV industry by far, driven to a large extent by the Chinese EV market. In August, new energy vehicle sales in China, which includes battery-electric vehicles, plug-in hybrids, etc. totaled 625,000, or more than 7 million annualized. That’s a new record and equal to around one-third of the total vehicle market size in China. In other words, one out of three vehicles sold in China is a new energy vehicle, one of the highest rates in the world. And it looks like that rate will continue to climb, as it has done in recent years, on the back of favorable regulation and a crackdown on pollution in China’s major cities.

The importance of China’s EV market is highlighted by Tesla’s exposure there, its plant in China is its most productive one by far, and arguably responsible for the majority of Tesla’s profits. But BYD, as a Chinese company, is even more favorably positioned in this core market. Chinese politicians have been pushing for a strong market position for their home-grown EV companies, as the country wants to avoid the mistakes from the past that prevented China from having a leading player in the ICE market — despite the fact that the Chinese market is so large. Companies from Japan, Europe, and the US dominate the legacy vehicle market, but China will do its best to avoid that when it comes to the new and fast-growing EV market. Chinese EV companies benefit from subsidies, favorable regulation, and so on. EV players from outside of China, such as Tesla, face more scrutiny from regulators and consumers. Since Chinese companies are also leading the world when it comes to battery development and battery manufacturing, it seems pretty likely that Chinese EV companies will do well in the country itself as well as on a global scale. BYD isn’t the best-known Chinese EV manufacturer, but it’s the largest one and should benefit from the massive growth in the Chinese EV market and from Chinese policies that seek to foster the country’s EV industry.

BYD Is Active Across The EV Value Chain

Tesla is the best-known brand in the EV universe, but it’s not the most complete player, I’d say. Its batteries are not produced by Tesla itself, even though some Tesla investors seem to believe that. In fact, Tesla buys batteries from a range of battery manufacturers — including BYD! Batteries generally are the most costly item in any EV, thus manufacturing and supplying these batteries to other manufacturers is a business with a lot of revenue generation potential. BYD’s technology is strong, showcased by its Blade batteries that use lithium iron phosphate technology.

Tesla makes money when Teslas are being sold, but it doesn’t benefit from overall market growth when it is driven by other EV manufacturers. BYD is different, as its battery manufacturing business allows the company to benefit from growing sales by other EV manufacturers as well. In fact, BYD can make money when Tesla sells cars, as it is one of the battery suppliers for Tesla — the reverse isn’t true, as Tesla does not make money when BYD sells one of its vehicles. That’s an important advantage for BYD, I believe, as it has more broad-based exposure to the overall growth of the EV industry — no matter what brands are in favor at any specific time.

Tesla’s Semi hasn’t been a success so far, even though CEO Elon Musk has made huge promises in the past. Recently, Musk stated that Semi deliveries will start later this year, but it remains to be seen whether that actually comes true. In any case, BYD is the clear leader in commercial EVs so far, as it produces and sells trucks, busses, and so on in a range of countries, including its home market but also in South America, Europe, and so on.

Compared to Tesla with its clear passenger vehicles focus, BYD is thus positioned more broadly and benefits from growth in other areas via its commercial vehicle business, its battery manufacturing business, and so on.

BYD Is Growing At A Rapid Pace

Tesla has grown at a compelling pace in recent years, and arguably faster than many bears thought. But its growth is still far below what BYD has been delivering in recent years. During the most recent month, August 2022, BYD managed to grow its NEV sales by an outstanding 185% year over year. That means that sales in August were almost three times as high as during last year’s August. Tesla, meanwhile, has grown its deliveries by 74% during the most recent month (in China, its biggest market). That’s still pretty strong and Tesla does not have to be ashamed of that growth pace at all — but still, BYD is growing at more than twice that rate right now. Tesla’s growth is strong, but BYD’s growth is even more massive.

And it looks like August 2022 was not an outlier. In fact, BYD will be ramping up its production at a hefty pace over the coming months, forecasting that its monthly sales will total around 280,000 by the end of the year, which makes for an annual pace in the 3.3 million range. Even more astonishing, the company forecasts that it will sell around 4 million NEVs (BEVs and plug-in hybrids) in 2023. That would easily make it the king of new energy vehicles, as even relatively bullish analysts see Tesla’s sales in 2023 at just half of that level, or around 2 million. That’s still pretty strong, considering where Tesla was a couple of years ago. But if BYD manages to hit its 4 million goal, that’s even better, of course.

And there are important hints that BYD may very well achieve that. Its current backlog stands at 700,000 vehicles, and delivery times for new orders are in the 4-5 months range (see Seeking Alpha article linked above). Tesla, by comparison, has recently been reducing its delivery times — some of its models are available for delivery in September, which translates into just a couple of weeks. To me, it looks like Tesla is not as overwhelmed by new orders, relative to BYD. Due to the high prices of Tesla’s model lineup that makes sense, as not too many consumers will be willing to spend massive amounts of money on a new car during an economic downturn. Tesla will still do well, I believe, and demand still is there. But it isn’t as overwhelming compared to what BYD is experiencing, with BYD’s lower prices and its advantages in its home market likely being key factors.

Profitability And Valuation

Tesla is clearly advantaged relative to BYD when it comes to profitability. Tesla is, by far, the most profitable electric vehicle manufacturer, although it is not the most profitable automobile company overall. Its profits in 2022 will likely total around $13 billion or so, which is a hefty net profit for sure. BYD will not be as profitable, but that might change soon. BYD is ramping up very quickly, as we have seen earlier, which should be highly accretive for its margins over time. R&D expenses, administration, etc. will decline as a portion of overall revenue as the company doubles or triples its sales during a single year. On top of that, its battery manufacturing business is growing and should become more profitable as well, thanks to scale advantages when it comes to sourcing raw materials, etc.

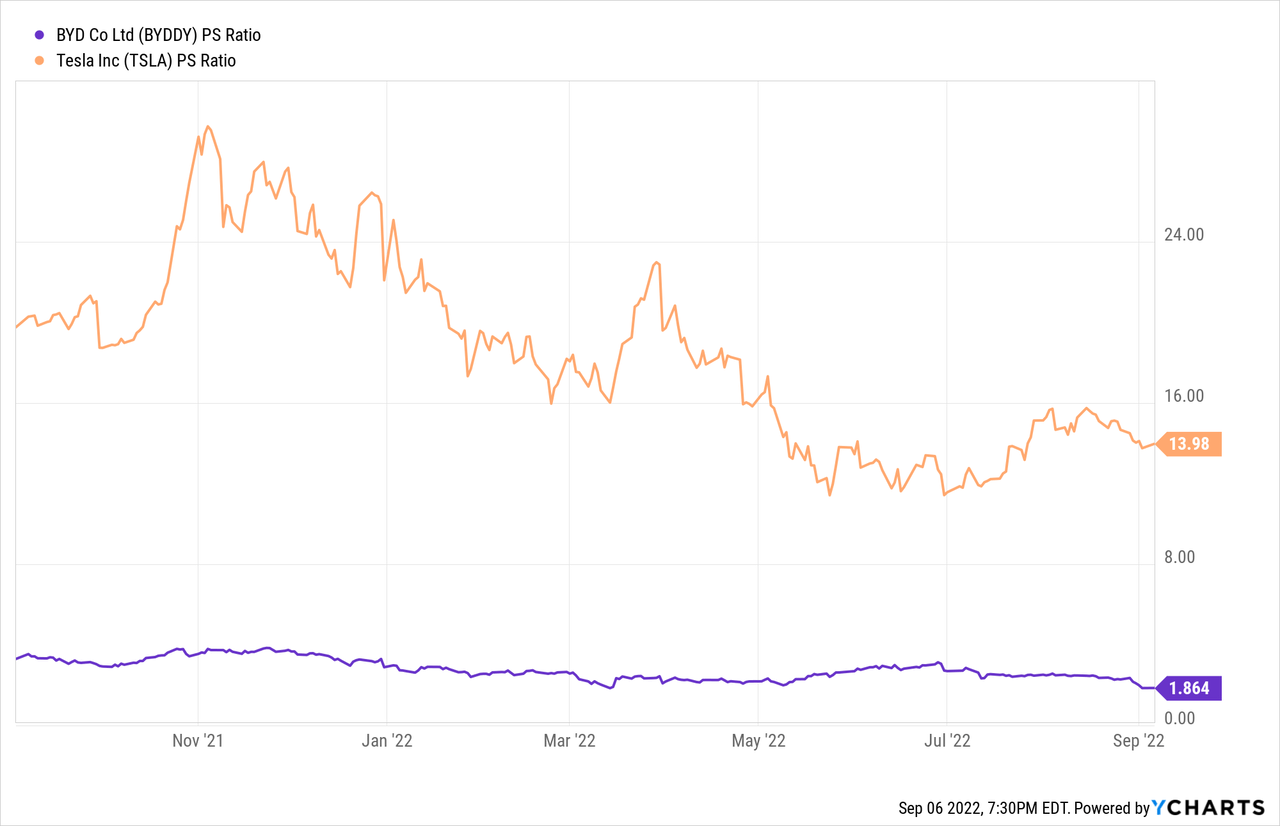

In order to account for the more pronounced margin improvement potential at BYD, we can look at the valuation of the two companies on a price-to-sales basis:

Tesla is trading at 14x trailing sales, while BYD is trading at less than 2x trailing sales. This might be a favorable comparison for Tesla, as BYD will grow its revenue faster than Tesla over the next couple of quarters — after all, its sales volumes are exploding upwards, whereas Tesla’s near-term growth is more moderate (but still attractive). When we look to 2023 and beyond, BYD thus seems even cheaper, both on an absolute basis as well as on a relative basis, compared to Tesla — and compared to all other relevant EV pureplays, including Lucid (LCID), Rivian, and so on.

Buffett’s Selling

Buffett is, via Berkshire Hathaway (BRK.A)(BRK.B) a long-term investor in BYD. Recently, BYD saw its share price drop as the market reacted to a news item related to that investment. Berkshire sold around 8% of its stake in recent months, but that means that the company still holds on to more than 90% of the shares it bought initially. Berkshire saw its investment rise 35-fold — I believe it’s far from dramatic when the company locks in some gains following these massive returns.

If Berkshire were to sell all or most of its shares, that could indeed be seen as a somewhat troublesome sign, but that’s not the case at all. Quite the contrary — Buffett continues to hold onto most of his BYD shares, even following a gigantic return since the first investment. Buffett owns BYD, but he doesn’t own Tesla — his endorsement is pretty clear, I’d say.

Things To Consider And Takeaway

Some bulls see a lot of value in Tesla’s self-driving technology. I personally do not agree, as others, including Waymo (GOOG)(GOOGL), seem to be ahead of Tesla in that regard. But still, if Tesla were to emerge as the leader in this field, it could generate massive profits via this technology, which might translate into hefty returns for shareholders. If that were to come true, Tesla could be a way better investment than BYD, thus investors should consider this scenario before making an investment decision here.

That being said, I do believe that there are good arguments to see BYD as the better investment at current prices. It is advantageously positioned in the most important EV market in the world, extracts value across the whole industry, including commercial vehicles and battery manufacturing, and most importantly, it is growing at an absolutely astonishing pace — way faster than Tesla, even though Tesla is growing at a compelling pace as well.

With BYD trading at a pretty low valuation relative to all other EV pureplays, I’d say it’s attractively priced right here. Tesla is a strong EV player, but it is currently in the process of being overtaken by Buffett’s EV favorite: BYD.

Be the first to comment