Kevin Dietsch/Getty Images News

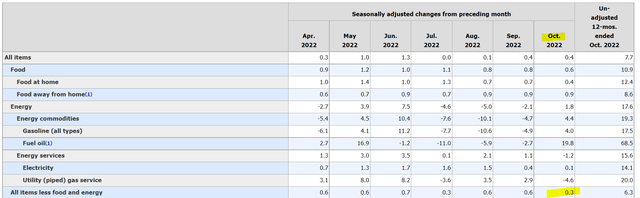

The market lifted with the last soft CPI, or Consumer Price Index, report. PCE, the Personal Consumption Expenditures Price Index, is the Fed’s preferred measure and reports in a couple of weeks. PCE, since it’s for the October period, usually follows CPI with a lag because CPI reports first.

But did you notice the CPI number didn’t budge the Fed so-so much? Ever wonder why? The Fed is focused on another number, 5-year inflation expectations. How that little number wiggles could have much more market impact than you think.

CPI Soft

Yes, this CPI sent markets off to the races. It made the market think that the Fed’s rate hikes are having their impact and the Fed’s probably going to “pivot.”

The market is hoping that rate hikes will cease and the Fed will start to cut rates which would further lift markets.

The market reaction to CPI is trying to predict that the Fed will do its job to turn markets around from this year long spill.

PCE-Price Reports December 1

PCE-Price (“PCE”) is the Fed’s preferred measure of inflation. CPI for October reported (I posted that above). PCE for October has not yet reported and typically is similar and lags the CPI report.

So even though the Fed primarily focuses on PCE, the market focuses on CPI, which hints to the Fed-focused PCE that reports with a lag.

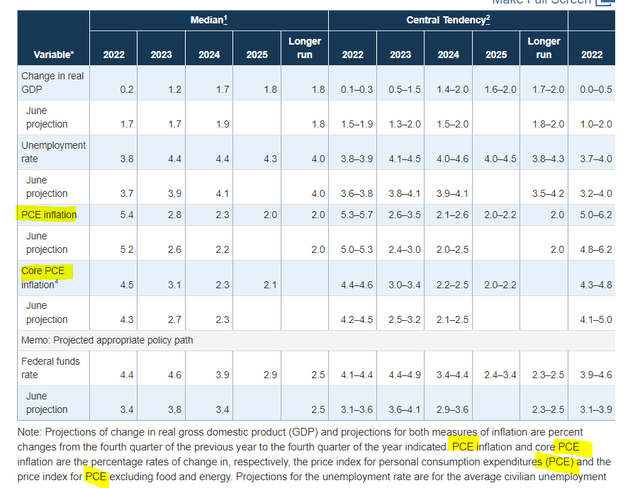

You’ll see in the Fed’s guidance to the Street the focus on PCE. This is from their bi-meeting forecasts that they issue roughly at every other Fed decision.

Fed’s forecasts (federalreserve.gov)

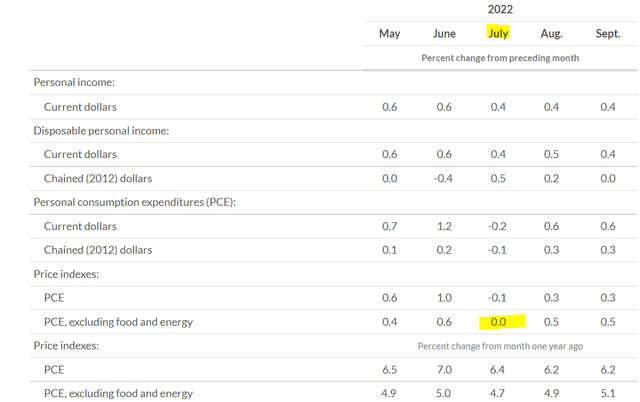

You see way above that the CPI took a dip in July.

PCE, remember, reports after CPI for the same month.

Here you see PCE also took a dip in July.

PCE Price September Report (bea.gov)

The hope on the Street is that PCE will come down in October when it reports December 1st, hopefully in the same way that CPI came down.

If it does, the market’s hope is the Fed will back off their rate hikes.

So when the Fed saw the CPI number, they should also have been doing a victory lap that they are making headway.

Even though they don’t yet know their core PCE outcome, they should be pretty confident that their hikes are working to tame inflation.

But that’s not really their messaging.

The Fed is not saying they are backing off. They are focused on a different number.

The Fed Is Not Backing Off Because Of This Annoying 5-Year Inflation Expectation Number

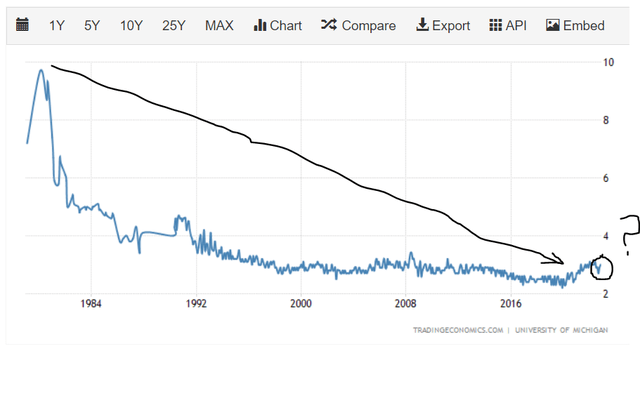

Michigan 5-year inflation expectations (tradingeconomics.com)

Notice something here. Above, you have 5-year inflation expectations as surveyed by the University of Michigan.

Even though PCE is the Fed’s main inflation measure and not CPI, really, really this 5-year number is their new main.

If you followed the Fed over the years and really decades you heard them talk about inflation expectations “being well-anchored.”

It means that the public bought into price increases moving up over time in a slow, steady, controlled, manageable trajectory.

The Fed cares about this maybe – most because if the public shifts to think inflation is no longer under control, they may change their buying habits. Consumers, in that scenario, might start buying now ahead of prices going up too much in the future. That rush of consumer buying ahead of further price increase in itself could spur faster inflation.

The Fed describes that scenario as being one of inflation expectations “becoming de-anchored.”

They don’t want that.

And if you notice in the chart just above, there was this annoying little tick higher in the last read of consumer’s 5-year inflation expectations.

In a similar NY Fed survey, it also ticked up a fraction of a point.

It’s bothering the Fed.

That’s why they are not so fast to think about stopping hikes and easing after seeing that amazing CPI print.

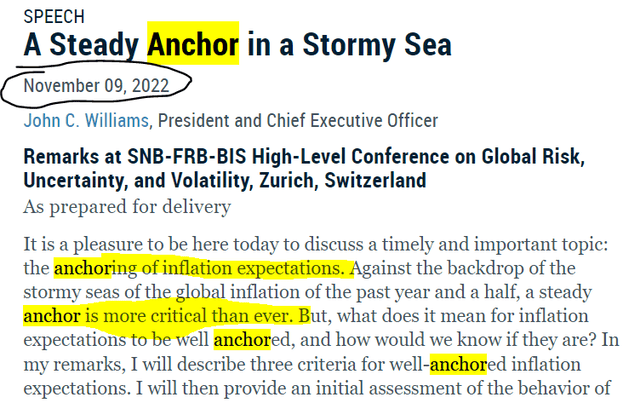

A top lieutenant of the Fed, NY Fed President John Williams, just gave a speech about keeping expectations anchored.

Fed Pres John Williams Speech (newyorkfed.com)

I would argue he cares most about this one number and not PCE or CPI.

The title, “A Steady Anchor In A Stormy Sea,” means even though inflation may run hot as long as 5-year inflation expectations stay low, they are ok.

If not, they are not ok.

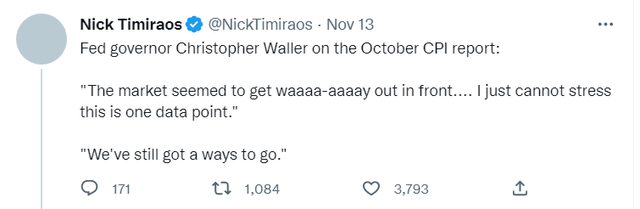

One of the Fed spokespeople of late has been Fed Gov Chris Waller.

After that November 10th CPI, he told the markets in no-uncertain terms that they were way ahead of themselves.

Fed Gov Chris Waller On Market’s Reaction (twitter.com)

Why did Fed Gov Waller say markets are “waaaa-aaaay out in front?”

Besides this only being one data-point, we still don’t know the results of the 5-year inflation expectations survey.

Same day…

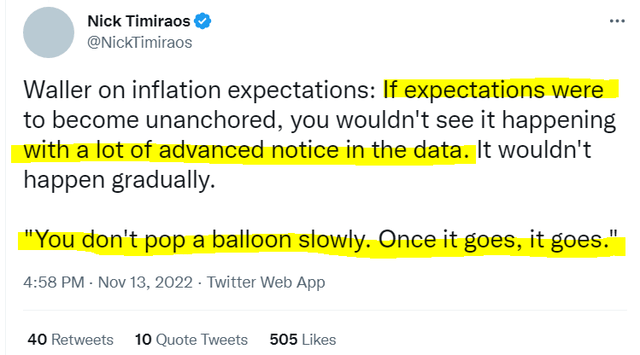

Waller on inflation expectations (twitter.com)

So even though CPI ticks up or down, that still doesn’t tell us if consumer inflation expectations are still in this anchored status or they have de-anchored.

And if they de-anchor, Waller compares it to an out-of-control popped balloon. They want to avoid that at all costs.

So a tiny .1 tick higher this time IS something to worry about. It could lead to a “pop” to a much higher tick next time. Again, they don’t want that.

A tick up in 5-year expectations is potentially that pin that sends that balloon spiraling out of control.

And that nasty, annoying, tiny little tick up in that 40+ year chart above is bothering the Fed.

And Here’s What To Worry About

If CPI and PCE were to drop but that annoying inflation expectation number ticks up, the Fed will likely remain tough on rates.

What do you think that would do to markets?

Down inflation and higher rates? What would that do to markets?

Uh, I’ll tell you my opinion. I think it would absolutely send markets into a tailspin tizzy lower.

Conclusion

That little annoying nasty little tick-up of a number gets updated on Wednesday. The Fed may care more about that than their beloved PCE measure itself. If that ticks up, it may not matter what PCE does. The Fed may have to stay tough. That would be bad for stocks.

Be the first to comment