Thinkhubstudio/iStock via Getty Images

Dear fellow investors and friends,

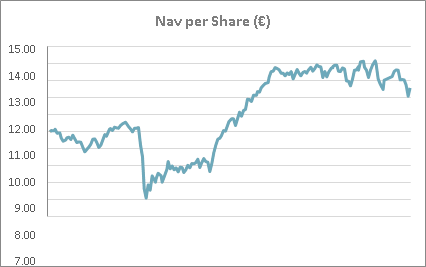

During the third quarter the fund lost 2.5% gross of fees[1]. We do not have a stated benchmark in our Key Investor Information Document (KIID) and therefore cannot comment on relative performance. We leave it up to you to decide. We note the above number appears better than European and somewhat below global benchmarks. We ended the quarter with a year-to-date performance of -11.4% (-12.5% on a NAV basis 29 September 2022). Inception to quarter end return was 23.5% or 6.25% compounded annual return.

Similarly, our last reported NAV at quarter-end was 12.08 (29/09/2022 -3.2% from the closest reported NAV at the second quarter end of 12.48). We are extremely optimistic about our portfolio’s prospects and believe we will reach our compound return aspiration over time. Our fund’s composition is unlike any index, and we are unlikely to perform in a similar manner.

The third quarter echoed the second quarter with a bear market rally followed by another sell-off. All of which was centered around a fixation on central bank policy with the monthly inflation and employment reports in focus. After ending the second quarter at the lows of the year, the market indices rallied in August and then quickly sold off again to new lows at the end of the third quarter. Our portfolio followed a somewhat similar pattern. The reasoning for this market move seems awfully circular.

The news cycle went from fear of inflation giving way to fear of recession. Oil and other commodities sold off on the fear of recession news. The market then said, well inflation will be lower as commodities are lower so the Fed can pivot, and we avoid recession. Of course, oil and other commodities then recovered as the globe is short oil, baring a recession. And then market fear of inflation re-emerged, making a Fed pivot impossible; market sells off. Rinse. Repeat.

The cause of inflation is complex, and each category has its own unique issues with supply and demand (including money supply / currency). Central banks raising rates is a blunt tool to withdrawal money from the system, in effect reducing demand. However, it does little to encourage the supply side of building more houses and providing more oil, gas and renewable power infrastructure not to mention solving supply chain issues and a retrenchment of globalization. Fiscal policy should drive this. However, it appears to be doing the opposite.

We sold our position in Motor Oil (OTCPK:MOHCY) during the quarter with a small gain despite having just written it up last quarter. Our thesis was working brilliantly. There was a shortage of refining capacity in Europe due to immense underdevelopment of European capacity. A shock to the system crunched supply and high prices were needed to bring more supply back to the system.

Motor Oil as a highly complex refiner was able to benefit from changes in supply and demand in various refined products. The company used its large cash flows to expand and fund much needed renewable capacity in Greece as well as upgrades to its own refinery so that Greece would be better prepared for the future. They were contemplating building an LNG import terminal. All was well.

Alas, in steps the Greek government. Instead of telling Motor Oil what an amazing job they were doing building out renewables in Greece and providing much needed energy supplies to the country, they decide to tax them. We all know that high, unpredictable, and randomly applied taxes are just thing to increase supply of much needed products and encourage investment. We are fairly sure we recall that from our economics’ 1o1 classes.

It is up there with price caps and quotas as methods to increase investment and supply of essential products. The Greek government decided, following plenty of discussion across Europe, to arbitrarily and retroactively apply a tax based on the “normal” profitability of the previous three years. This was particularly unhelpful, since those years included COVID-19, where government-imposed restrictions on free travel massively impacted demand for refined products and Motor Oil lost money hand over fist.

Those “normal years” are the basis of the tax of average profitability. Obviously, Motor Oil pays corporate tax as a percentage of earnings and thus taxes increase with earnings. The industry isn’t so lucrative, and it needs the good years to make up for lower returns in the bad years. We don’t recall the government giving refiners cash tax rebates for previous losses.

We believe the government must have analyzed every good solution to its energy crisis and then decided to choose the exact opposite. If the Greek government wants to starve its companies of capital and keep investors from helping companies build out essential infrastructure, they have certainly found the way to do it. Perhaps, we would be sympathetic if the company simply paid a large dividend to its shareholders (wait no we wouldn’t) but we don’t even need to consider it since they didn’t do that. They chose to invest! We have dutifully removed our capital.

Unfortunately, this isn’t isolated to Greece. Across Europe governments are imposing taxes and restrictions on the very companies they desperately need to be investing and building out energy infrastructure. They should be encouraging investment to build more power plants, power grids, renewables, oil and gas infrastructure. It is extremely rare to see any company distributing abnormally high profits to shareholders.

When prices are high, they are investing. Most even want to invest more but are stymied by government regulation and tedious bureaucracy. Governments could, of course, consider monitoring high payouts and softly discourage them. We suspect that if it is occurring it is in non-publicly held private equity assets.

On a related note, subsidizing energy consumption and blowing out your government budget – also bad policy[2]. Help those struggling indeed, but any functioning market needs a price mechanism to change consumption. Uniform government fuel subsidies will do nothing to lower demand or avoid blackouts. They will, however, seriously impair government budgets at a time when most can ill afford them and push up borrowing costs further in a rising interest rate world and have serious to dire fiscal consequences down the road.

We have yet to see governments make the case that we are in a war and need to act like it. We need to cut down on energy use. Why not reduce taxes on energy efficient house and office upgrades? Why not encourage lower temperatures in the houses and offices? For example, if the UK were to collectively move home thermostats from the average 22C to 19C, we could lower gas demand by more than 25%[3]. It seems extremely odd to be unmentioned by politicians.

Governments have not realized that excessive spending, bailouts, and unpredictable random taxes are not the way to grow economies and bring prosperity to the masses.

The United States is no better off with an “inflation reduction act” that is more or less doing the opposite of what it claims to. Let us not mention the plan to empty the strategic oil reserves at a time with oil is below $100 and trading inline with the 25-year average, while parts of the world are going into a recession and any enlargement of a war or economic upturn could drive a proper crunch with both high demand and no excess supply. This dangerously shortsighted view seems nothing but election pandering.

During the quarter, in addition to selling Motor Oil we sold our position in Boa Vista. We determined that a new competitor was acting to gain market share irrationally and pricing below cost. We decided to step out and wait for signs that the market is working as the oligopoly that it is. We added two new positions, which we will detail in future letters. We continued to trim positions that benefit from the current market and add to those we feel are being indiscriminately sold.

At quarter-end our portfolio had more than 130% upside to our estimated NAV and was trading at a weighted average P/E of 7x, FCF/EV yield of 20% and a return on tangible capital of 28%.

|

Contributors |

Detractors |

||

|

H&T Group plc |

+102 bps |

Unieuro |

-72 bps |

|

OCI NV (OTC:OCINF) |

+88 bps |

RHI Magnesita (OTC:RMGNF) |

-58 bps |

|

C Uyemura (OTCPK:CUYRF) |

+75 bps |

Bayer (OTCPK:BAYZF) |

-55 bps |

|

Grand Parade |

+43 bps |

Wickes Group |

-52 bps |

|

Ginebra San Miguel (OTC:GBSMF) |

+23 bps |

International Game Technology (IGT) |

-36 bps |

The largest contributor during the quarter was H&T Group, the UK high street pawnbroker, which we will introduce in this letter. The stock increased by 36% contributing 102 basis points to the fund. The company reported a very strong first half as it rebuilds its loan book after COVID led to its decline.

After many scandals in the high-cost short-term (“HCST”) market in the UK and subsequent regulatory clamp down, there are not many options left for small loans. The highly regulated pawn shop is one of the few options left. Unfortunately, as the economy slows down and food and energy inflation eat into consumers disposable income, the pawn industry is likely to do well over the coming months.

The second largest contributor was OCI NV, the Dutch nitrogen fertilizer and methanol producer, which we introduced in our second quarter 2019 letter and further updated in our fourth quarter 2021 letter. OCI added 88 basis points to the fund after reporting record second quarter earnings and announcing the payment of a €3.55 dividend for the results of the first half of 2022.

This brings the total distribution during 2022 to €5 per share (roughly 25% of our cost base). We expect nitrogen fertilizer fundamentals to remain strong due to favorable farm economics and low global grain stocks. OCI’s margins should benefit from its’ middle eastern gas sourcing as nitrogen fertilizers pricing remains elevated due to high gas prices in Europe.

The third largest contributor was C Uyemura, which we introduced in our third quarter 2021 letter. The stock contributed 75 basis points after reporting a record first quarter for both sales and operating profits. Against significantly increased raw material prices, the company managed to defend margins. Management reiterated the full-year guidance, repurchased shares and continues executing their strategy.

The fourth largest contributor was Grand Parade, a South African conglomerate which is currently liquidating. The company released a statement which implied that it was in a process which might lead to the sale of the company or its major assets.

The fifth largest contributor was Ginebra San Miguel, the Filipino gin company which we introduced in our second quarter 2021 letter. The company continues to execute well with strong topline growth and improving margins. The balance sheet remains robust in a net cash position, and they continue to pay special dividends.

The top detractor was Unieuro, the Italian electronics retailer, which we introduced in our third quarter 2020 letter. The company’s first quarter results are not very meaningful given it is the smallest quarter of the year. However, the company called out energy cost inflation, which, given online competition, is not able to be passed on to the consumer.

Demand for many categories, especially PCs, is lower, though still above pre-COVID levels as most consumers have already updated their products in the past two years. This was expected so we are surprised by the level of share price decline. The only surprise to us came at the end of the quarter when the CFO resigned after only a year on the job.

The second largest detractor was RHI Magnesita, the Austrian-Brazilian refractories company, which we introduced in our second quarter 2019 letter. It lost 58 basis points during the quarter after falling 16.5%. According to the management, customer demand remains strong with price increases offsetting cost increases. Management also reported market share gains in the steel segment and stable market share in the industrial segment.

Increasing net debt linked to the working capital remains a point of concern especially their use of working capital finance but an expected cash release should normalize both over the coming quarters. Our thesis was predicated on the company having pricing power and not beholden solely to commodity prices as well as being linked to rather stable steel volumes versus highly cyclical steel pricing.

Although they were a bit slow adjusting prices early on in this inflation cycle, they seem to have returned to normal margins and are maintaining them now. While we expect European steel volumes to perform poorly during this winter, other geographies such as India should partially offset this. We still believe the company is well positioned and poorly misunderstood by the market despite the stock being the largest inception to date detractor for the fund.

The third largest detractor was Bayer, the German pharmaceutical, agriculture, and consumer products conglomerate. The company reported mixed earnings and continued to disappoint the market with additional lawsuits. The market also questions the sustainability of agricultural earnings. While we believe glyphosate earnings will likely normalize, we believe most of their products will continue to sell well as the world is faced with declining global grain inventories and tougher growing conditions. With elevated farm incomes, we believe spending for Bayer’s products will remain robust.

The fourth largest detractor was Wickes, the UK home improvement retailer, which we introduced in our first quarter 2022 letter. Market expectations for slower housing transactions in an interest rate increasing environment has put pressure on the share price which now trades at severely depressed multiples.

As we expected the Covid boosted renovations and housing transactions have begun to normalize, however, we believe that the UK’s aging housing stock, housing shortage and housing energy efficiency upgrades provide a strong tailwind going forward. Excluding leases, Wickes remains net cash while completion of IT separation initiatives should allow for cleaner earnings reporting. We never anticipated an easy winter, but Wickes looks attractive on a normalized free cash flow basis. We will take advantage of panicked indiscriminate selling.

The fifth largest detractor was International Game Technology, a world leading operator of lotteries and gaming machines, which we introduced in our first quarter 2020 letter. The share price decreased by 8.3% losing 36 basis points for the fund. Management tightened full year guidance to reflect currency movements and reconfirmed operating income margin as fundamentals remain strong.

IGT also announced a $270 million settlement related to Double Down Interactive which was higher than the $150 million which company set aside during the second quarter 2022. Despite foreign exchange headwinds from the weaker euro, we are optimistic that they will continue to delever and pay higher shareholder remuneration in the coming quarters as we believe the lottery business will remain robust even factoring in a recession.

H&T (LON: HAT)

H&T Group, founded in 1897, is one of the oldest and leading pawnbrokers in the UK with 261 stores across the country. A pawnbroking loan is a short-term secured loan (usually lent with a loan to value of 65%[4]), usually for six months in the UK, against something of value that customer owns. In the case of H&T, 99.2% of the collateral is composed of precious metals, diamonds and luxury watches. The pawnbroking credit agreement bears a monthly interest rate of 2-10%.

Short-term cashflow is the main reason why most people use a pawnbroker. Convenience and speed of service are unrivaled compared to traditional lenders as they do not need to verify affordability. Pawnbroking is regulated, governed by the terms of the Consumer Credit Act 2008, alongside banks and other lenders. The average loan is approximately £100-150 and the average term is only three and a half months with 85-90% of loans are fully repaid in that period.

Pawnbrokers do not face significant credit risk since in the case of a default they simply forfeit the asset. Customers expect to pay a higher rate than a bank loan but less than a payday lender. According to the National Pawnbrokers Association (NPA), a borrower of £100 for a month should return £108 to a pawnbroker, £155 to a pay-day lender and £200 to a bank for an unauthorized overdraft.

Additionally, unless the pawn is for less than £75 and a six-month contract, when all other unredeemed items are sold, any surplus is returned to the customer. We don’t promote pawnbroking morality here but feel it could be better than other alternatives including black-market loan sharks.

NPA[5] has 130 members which run 870 stores across the UK, accounting for 97% of the industry. The largest players are H&T with approximately 30% market share, Cash Converters with 22% and Ramsdens with 18%. The rest of the market is highly fragmented. The sector was much more competitive in the period following the great financial crisis in 2008.

Risk averse mainstream banks restricted lending to consumers hence people with lower credit scores shifted to non-traditional lenders for financing. HCST lenders, such as Wonga, Amigo and Provident, flourished on the back of low income, distressed households.

However, after a series of complaints and mistreatment reports, the FCA initiated an industry-wide investigation that resulted in the identification of serious non-compliance and unfair practices in all firms reviewed. The FCA came to regulate the sector while Provident went bankrupt and Amigo is barely surviving. The number of high-cost, short-term lenders in the UK fell by two-thirds between 2016 and 2020 while the size of their loan books tumbled by 85%[6].

We first became interested in H&T, when the share price was trading at depressed levels due to a combination of Covid lockdowns and an unsecured lending linked FCA regulatory investigation, both insignificant for the long-term prospects of the Group. The government deemed pawnbroking as an essential service hence stores were allowed to open quickly after the initial lockdown and the total fine for unsecured loans miss-selling was approximately £2.1m equivalent to 10-20% of one year’s operating profits. H&T has subsequently exited unsecured lending segment which was negligible in size. Pandemic and regulatory overhangs were replaced by booming pawnbroking activity as rapidly increasing living costs boosted demand for short-term borrowing. H&T’s pledge book reached £84m in June 2022, 75% higher than the pledge book in June 2021. and ahead of 2019. We are attracted to the countercyclical characteristics of this investment and low valuation.

As stated in our previous letter, we are currently not charging a management fee until the fund reaches a larger size. The founder’s class management fee will then be only 1% of assets under management.

Our focus is and remains the portfolio, but we do need to grow our assets to a sustainable level. Our fund can be invested through both European international central securities depositories: Euroclear and its FundSettle clearing platform and Clearstream through the Vestima fund clearing platform. Our fund is registered for distribution in the UK, Spain and Luxembourg including for retail distribution.

Currently the following financial institutions in Spain are distributors: Renta 4 (you need to contact them – it is not offered on the website yet), Ironia, Lombard Odier, Banco Alcala as well as many other institutions working through the main platforms in which the fund is available upon request: Allfunds Bank and Inversis.

In the UK we are offered on the AJ Bell low-cost platform ajbell.co.uk and can be part of an ISA or pension.

Our fund is also available on SwissQuote swissquote.com where almost any nationality (ex-USA) can open an account without local Swiss taxes being an issue.

If you have any issues finding our fund or you wish to get more information about us and our process, please contact us at IR@palmharbourcapital.com

Our fund is being offered as part of a Spanish pension value-orientated fund of funds. If interested in investing in a Spanish pension scheme, please contact us.

We thank you for your ongoing support. We continue to believe this is a great time to be a value investor and are very excited about the medium-term prospects for the current portfolio.

Yours faithfully,

Palm Harbour Capital

|

This information is being communicated by Palm Harbour Capital LLP which is authorised and regulated by the Financial Conduct Authority. This material is for information only and does not constitute an offer or recommendation to buy or sell any investment or subscribe to any investment management or advisory service. In relation to the United Kingdom, this information is only directed at, and may only be distributed to, persons who are “investment professionals” (being persons having professional experience in matters relating to investments) defined under Articles 19 & 49 of Financial Services and Markets Act 2000 (Financial Promotion) Order 2001 & Articles 14 & 22 of the Financial Services and Markets Act 2000 (Promotion of Collective Investment Schemes) (Exemption) Order 2001 and/or such other persons as are permitted to receive this document under The Financial Services and Markets Act 2000. Any investment, and investment activity or controlled activity, to which this information relates is available only to such persons and will be engaged in only with such persons. Persons that do not have professional experience should not rely or act upon this information unless they are persons to whom any of paragraphs (2)(A) to (D) of article 49 apply to whom distribution of this information may otherwise lawfully be made. With investment, your capital is at risk and the value of an investment and the income from it can go up as well as down, it may be affected by exchange rate variations and you may not get back the amount invested. Past performance is not necessarily a guide to future performance and where past performance is quoted gross then investment management charges as well as transaction charges should be taken into consideration, as these will affect your returns. Any tax allowances or thresholds mentioned are based on personal circumstances and current legislation, which is subject to change. We do not represent that this information, including any third-party information, is accurate or complete and it should not be relied upon as such. Opinions expressed herein reflect the opinion of Palm Harbour Capital LLP and are subject to change without notice. No part of this document may be reproduced in any manner without the written permission of Palm Harbour Capital LLP; however recipients may pass on this document but only to others falling within this category. This information should be read in conjunction with the relevant fund documentation which may include the fund’s prospectus, simplified prospectus or supplement documentation and if you are unsure if any of the products and portfolios featured are the right choice for you, please seek independent financial advice provided by regulated third parties. |

|

Footnotes [1] Our NAV is calculated weekly by FundPartner Solutions, a subsidiary of Pictet & Cie and does not align with monthly or quarterly reporting. The gross return stated is net of taxes and fees but before fund expenses, which are currently running at approximately 10 bps per quarter at current AUM. We project this to decline significantly as AUM grows. Please see our comment on management fees. [2] Edited from the original text for politeness [3] Pierre Andurand, Andurand Capital (redefining energy podcast episode 85) [4] H&T reports 60-70% loan to value as opposed to other pawnbrokers who used up to 90% and ran into problems with gold price fluctuations [5] National Pawnbroker Association [6] FT |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment