Douglas Rissing

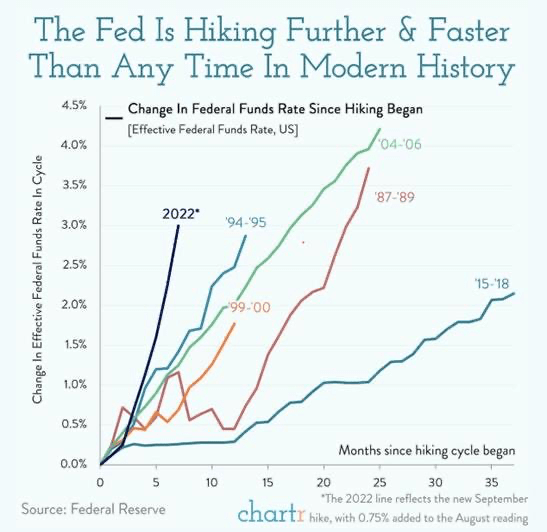

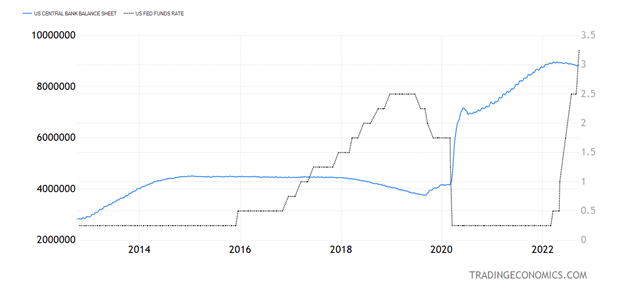

In overnight trading last week, the 10-year Treasury yield briefly traded over 4%, and 30-year fixed-rate mortgages went over 7%. Having oversold the “transitory” nature of inflation last year, the Fed kept full “pedal to the metal” on QE during the second half of 2021 and into 2022. Now it is reversing course at the fastest rate in history. The problem with extreme swings in monetary policy is that they cause extreme swings in markets. The relentless bid to record highs in the stock market in 2021 had a lot to do with Fed policy, and the relentless selling by investors in 2022 is a similar reaction due to the Fed’s other extreme.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

After the initial surge in March 2020 at the onset of the pandemic, the Fed’s balance sheet rose by $120 billion per month for 1-½ years. Now it is coming down by $95 billion per month. Both are extremes.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The other issue is that in every Federal Reserve tightening cycle there has been some type of blow up. So far, we haven’t seen any systemic issues, but they did have issues last week in the UK, which is why the BOE had to intervene – and now I am wondering what will blow up here. The U.S. economy is addicted to low interest rates and these quick spikes in rates – the quickest on record – will backfire, in my view.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Jerome Powell may be a very smart man, but I would feel a lot better if Ben Bernanke were Fed Chair now. I think he understands the mechanics of QE and QT better than any recent Fed chairperson and is better qualified to deal with this extreme situation. The job of the Fed is to lean against extreme outcomes, to smooth out market and economic outcomes. Generally, central banks have a countercyclical role, but this Fed is doing exactly the opposite, causing extremes on both sides of the market cycles.

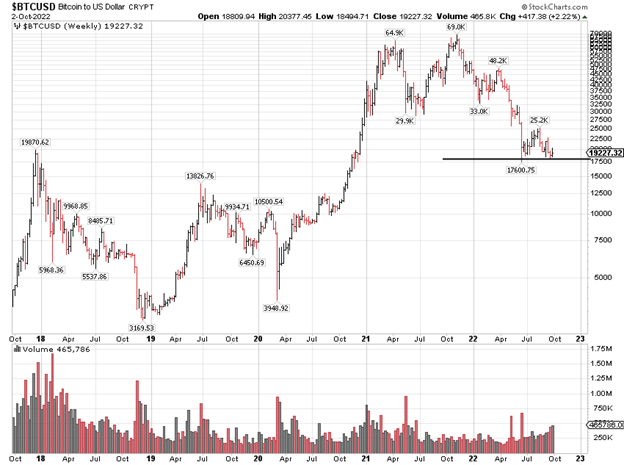

QE can create market absurdities like bitcoin, soaring to $69,000 and now near $19,000. The way to know that bitcoin is a bubble is that it can generate enough cash flow to justify tracking its “market cap,” which is an absurd term for a cryptocurrency. There is no legitimate calculation of market cap for cryptos, in my view. I don’t think all the cryptos are done falling, and I am not sure where they will stop, but for bitcoin I would not be surprised to see it near its pandemic low, which is quite a bit lower than $10,000.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment