syahrir maulana

This ETF article series aims at evaluating products regarding the relative past performance of their strategies and quality metrics of their current portfolios. As holdings and weights change over time, updated reviews are posted when necessary.

VBR strategy and Portfolio

All small-cap value funds are designed on the same theoretical ground: size and value are two of the three factors of the original Fama-French model. The Vanguard Small-Cap Value ETF (NYSEARCA:VBR) has been tracking the CRSP U.S. Small Cap Value Index since January 2004. The fund has a portfolio of 880 stocks, a SEC Yield of 2.06% and a total expense ratio of 0.07%. Distributions are paid quarterly. It is the largest small cap value fund in assets under management. It is also available as a mutual fund (VSIAX).

As described by CRSP, securities “are made eligible for assignment to a growth or value index using CRSP’s multifactor model. Securities are scored and ranked for both Value and Growth factors, then ranked. CRSP employs a version of banding and migration between Value and Growth that can occasionally result in splitting securities between the two style assignments”.

This process is similar to S&P Value indexes, but the set of factors used for the value ranking is a bit different: book to price, forward earnings to price, past earnings to price, dividend yield and sales to price.

VBR is cheaper than the iShares Russell 2000 ETF (IWM) regarding valuation ratios. However, the difference isn’t impressive (see next table).

|

VBR |

IWM |

|

|

Price/Earnings TTM |

10.34 |

11.59 |

|

Price/Book |

1.71 |

1.91 |

|

Price/Sales |

0.91 |

1.15 |

|

Price/Cash Flow |

8.13 |

9.66 |

Source: Fidelity

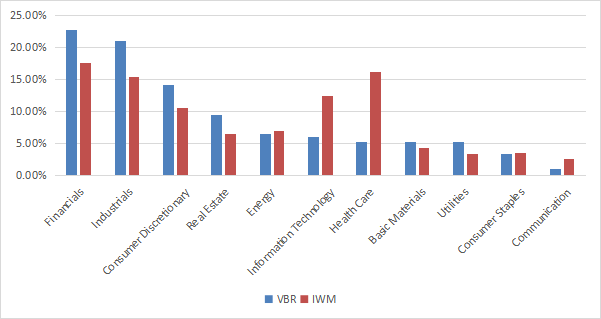

The heaviest sectors are financials (22.8%), industrials (21%) and consumer discretionary (14.1%). Other sectors are below 10%. Compared with the Russell 2000 index, VBR overweights these top 3 sectors, along with real estate, materials and utilities. It massively underweights technology, healthcare and communication.

Sector weights (chart: author; data: Vanguard)

VBR holds 880 stocks as of writing. The top 10 holdings represent only 5.46% of asset value, and the largest one weighs 0.64%, so risks related to individual companies is very low. The next table lists their weights and valuation ratios.

|

Ticker |

Name |

Weight |

P/E ttm |

P/E fwd |

P/Sales |

P/Book |

P/FCF |

Yield% |

|

IDEX Corp. |

0.64% |

30.44 |

28.49 |

5.65 |

6.22 |

57.19 |

1.04 |

|

|

Carlisle Cos., Inc. |

0.61% |

14.54 |

11.83 |

1.92 |

4.11 |

29.32 |

1.26 |

|

|

Atmos Energy Corp. |

0.60% |

19.58 |

18.53 |

3.72 |

1.66 |

N/A |

2.67 |

|

|

First Solar, Inc. |

0.54% |

170.70 |

N/A |

6.35 |

2.75 |

N/A |

0 |

|

|

Bunge Ltd. |

0.53% |

10.33 |

7.34 |

0.23 |

1.78 |

N/A |

2.46 |

|

|

Booz Allen Hamilton Holding |

0.52% |

26.31 |

23.28 |

1.56 |

11.31 |

68.56 |

1.66 |

|

|

First Horizon Corp. |

0.52% |

16.34 |

15.04 |

4.32 |

1.98 |

7.66 |

2.47 |

|

|

Steel Dynamics, Inc. |

0.52% |

4.27 |

4.43 |

0.77 |

2.20 |

5.77 |

1.41 |

|

|

Howmet Aerospace, Inc. |

0.49% |

36.75 |

26.75 |

2.89 |

4.89 |

46.65 |

0.43 |

|

|

Ovintiv, Inc. |

0.49% |

4.01 |

6.36 |

1.18 |

2.25 |

9.24 |

1.74 |

Ratios: Portfolio123

Since February 2004, VBR has outperformed IWM by about one percentage point in annualized return. It is almost on par with the iShares S&P Small-Cap 600 Value ETF (IJS), its most popular competitor.

|

Total Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

VBR |

396.45% |

8.91% |

-61.82% |

0.45 |

19.92% |

|

IWM |

314.97% |

7.87% |

-58.26% |

0.41 |

20.31% |

|

IJS |

398.20% |

8.93% |

-59.83% |

0.44 |

21.19% |

Data calculated with Portfolio123

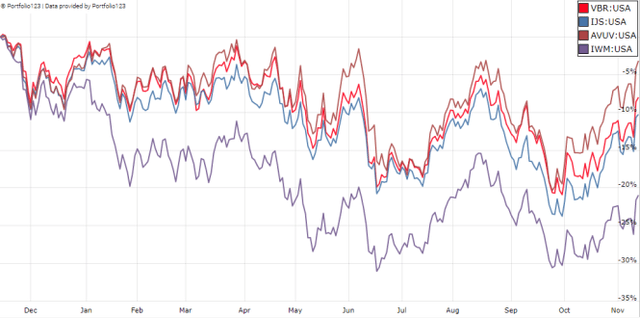

VBR has been quite resilient in this year’s downturn. It is down about -7% in 2022 to date, whereas IWM is at -16%. It is slightly ahead of IJS, but the difference is not really significant. However, the Avantis U.S. Small Cap Value ETF (AVUV) beats all of them this year.

VBR vs. IWM and competitors in 2022 (Portfolio123)

Comparing VBR with my Dashboard List model

The Dashboard List is a list of 80 stocks in the S&P 1500 index, updated every month based on a simple quantitative methodology. All stocks in the Dashboard List are cheaper than their respective industry median in Price/Earnings, Price/Sales and Price/Free Cash Flow. After this filter, the 10 companies with the highest Return on Equity in every sector are kept in the list. Some sectors are grouped together: energy with materials, communication with technology. Real estate is excluded because these valuation metrics don’t work well in this sector. I have been updating the Dashboard List every month on Seeking Alpha since December 2015, first in free-access articles, then in Quantitative Risk & Value.

The next table compares VBR since February 2004 with the Dashboard List model, with a tweak: the list is reconstituted annually instead of once a month to make it comparable to a passive index.

|

Total Return |

Annual.Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

VBR |

396.45% |

8.91% |

-61.82% |

0.45 |

19.92% |

|

Dashboard List |

703.78% |

11.74% |

-54.48% |

0.63 |

17.73% |

Past performance is not a guarantee of future returns. Data Source: Portfolio123

The Dashboard List outperforms VBR by 2.8 percentage points in annualized return and has slightly safer risk metrics (drawdown and volatility). However, VBR price history is real, whereas the model performance is hypothetical.

Price to Book: a risky concept of value

I like the idea of mixing various ratios to rank value stocks like VBR does. However, value indexes have two shortcomings in my opinion, and VBR is no exception. The first one is to classify all stocks using the same criteria. It means the valuation ratios are considered comparable across sectors. Obviously they are not: you can read my monthly dashboard here for more details about this topic. A consequence is to privilege sectors where valuation ratios are naturally cheaper, especially financials. Sectors with large intangible assets like technology are disadvantaged. To make things simple, companies with large intangible assets are those with a business model based on massive R&D, or a strong branding, or large user databases, or operating in a field where competition is limited by an expensive entry ticket. All these elements are not correctly reflected by valuation ratios.

The second shortcoming comes from the price/book ratio (P/B), which adds some risk in the strategy. Speaking probabilities, a large group of companies with low P/B contains a higher percentage of value traps than a same-size group with low price/earnings, price/sales or price/free cash flow. Statistically, such a group will also have a higher volatility and deeper drawdowns in price. The next table shows the return and risk metrics of the cheapest quarter of the S&P 500 (125 stocks) measured in price/book, price/earnings, price/sales and price/free cash flow. The sets are reconstituted annually between 1/1/1999 and 1/1/2022 with elements in equal weight.

|

Annual.Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

Cheapest quarter in P/B |

9.95% |

-72.36% |

0.48 |

21.05% |

|

Cheapest quarter in P/E |

11.25% |

-65.09% |

0.57 |

18.91% |

|

Cheapest quarter in P/S |

12.62% |

-65.66% |

0.6 |

20.46% |

|

Cheapest quarter in P/FCF |

12.23% |

-63.55% |

0.61 |

19.05% |

Data calculated with Portfolio123

This also explains my choice of not using P/B in my Dashboard List model (more info at the end of this post).

Takeaway

Small cap value strategies make sense in general: size and value are two factors of the Fama-French model. However, implementation matters. VBR is a small cap value ETF with a portfolio of 880 stocks. It is quite concentrated in 2 sectors: financials and industrials represent 43.8% of asset value. VBR has been a safer investment than the Russell 2000 in 2022, but it has outperformed the benchmark by only one percentage point in annualized return since inception. I see two shortcomings in its strategy. First, it ranks stocks regardless of their industries. This results in a relatively high exposure to financials and REITs, and a low weight in technology and healthcare. Value metrics work better to rank stocks in homogeneous sets (sector, industry). The second point is using the price/book ratio, which I consider a risky factor. My Dashboard List model uses three valuation metrics, but not this one.

Be the first to comment