pamspix

By Sean Freer

The days of Australian-U.S. dollar parity are becoming a distant memory, as U.S. dollar strength has seen the value of the Australian equivalent reach a recent low of just under 63 cents, a decline of over 13% from year-end levels.

The weakening of the Australian dollar could have significant implications for the share prices of companies within the S&P/ASX 200. While there are many idiosyncratic reasons for each company to thrive or struggle in the current economic environment, those with more earnings exposure to foreign markets may be at an advantage due to the increased value of their earnings when translated back into a weaker Australian dollar.

The S&P/ASX 200 Geographic Revenue Exposure Indices offer insight into the performance of Australian companies in periods of domestic currency strength and weakness. The S&P/ASX 200 Australia Revenue Exposure Index includes companies from the S&P/ASX 200 that have greater-than-average revenue exposure to Australia (compared to the benchmark). Conversely, the S&P/ASX 200 Foreign Revenue Exposure Index includes companies with greater-than-average exposure to markets outside Australia. The indices are weighted by float market cap.1

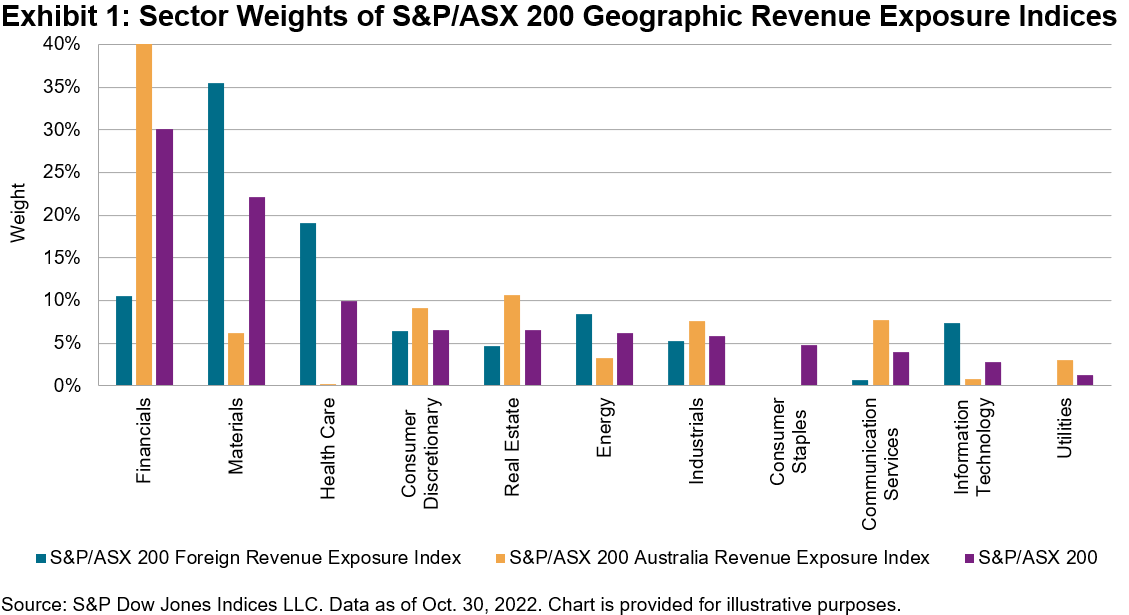

Before looking at performance, it’s important to see the makeup of each index relative to the broader market. As of Oct. 30, 2022, the S&P/ASX 200 Foreign Revenue Exposure Index was overweight in the Materials, Health Care and Information Technology sectors, while the S&P/ASX 200 Australia Revenue Exposure Index was tilted toward the Financials, Real Estate, Communication Services and Consumer sectors (see Exhibit 1).

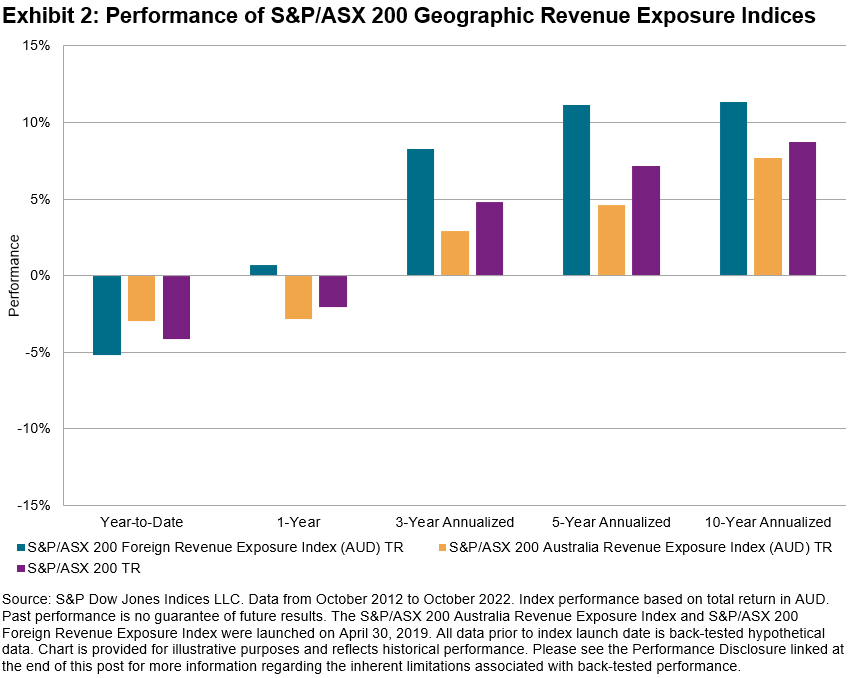

When looking at performance periods ending Oct. 31, 2022, the S&P/ASX 200 Foreign Revenue Exposure Index slightly underperformed YTD, with Information Technology companies notably weighing down performance (see Exhibit 2). However, the index outperformed over longer-term periods, with the aforementioned overweight sectors (Materials, Health Care and Information Technology) driving the stronger returns.

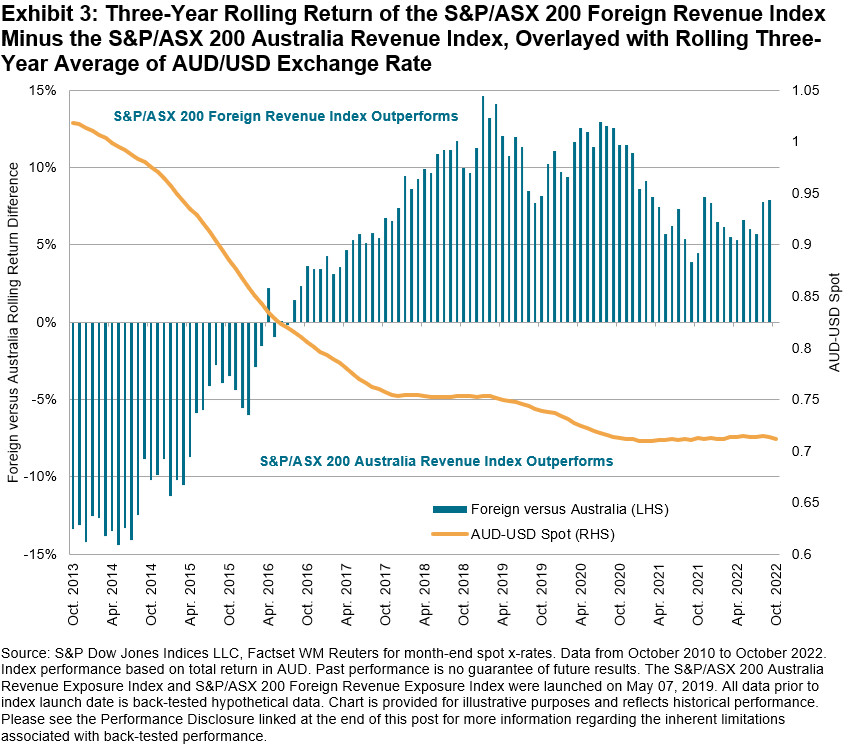

Exhibit 2 tracks performance to one point in time only. If we review rolling three-year periods, we can see more clearly times when companies with greater domestic revenue exposure outperformed and vice versa. When overlaying the 36 rolling month-end averages of the currency spot rate, a trend emerges. Since the Australian dollar dropped below 80 cents to a U.S. dollar, the S&P/ASX 200 Foreign Revenue Exposure Index consistently outperformed the S&P/ASX 200 Australia Revenue Exposure Index by more than 5% per year over rolling three-year periods.

As highlighted by the S&P/ASX Geographic Revenue Exposure Indices, exchange rate movements can have a meaningful impact on underlying Australian equity market performance. S&P/ASX 200 companies deriving greater revenue from foreign sources have typically outperformed the broad market during periods of Australian dollar weakness and underperformed during periods of strength.

1 Please refer to the methodology document for S&P Global Revenue Exposure Indices for more information.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI, please visit S&P Dow Jones Indices. For full terms of use and disclosures please visit Terms of Use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment