kevinjeon00/E+ via Getty Images

Cummins Inc. (NYSE:CMI) is an excellent industrial company that makes essential products for today’s economy. It will be hard to replace engines with batteries in heavy off-highway vehicles and trucks. Companies and industries worldwide will need Cummins’ products for a long time. The company is making sound investments in natural gas engines and is researching the use of hydrogen as a fuel in heavy vehicles. The stock is trading at a discount and offers a good dividend. My current average price is $208.78. I missed an opportunity to add to my holdings at $190, but the stock is still cheap at $211, and the investor gets a free option on hydrogen.

Cummins had an outstanding Q1 FY 2022 despite its suspension of operations in Russia which took a bite out of its profits. The company booked sales of $6.38 billion in Q1 FY 2022 compared to $6.09 billion in Q1 FY 2021. Even in these challenging times where every company is complaining about inflation eating into margins, Cummins was able to protect its gross margins. When you exclude the one-time cost of suspending operations in Russia, the gross margins came in at 24.9% in Q1 FY 2022, compared to 24.4% in the same quarter in FY 2021. If you include the one-time cost of $59 million due to the suspension of operation in Russia, gross margins would be about 23.97%, which would be a 43 basis point hit to the margin.

Is a Recession in the Near Future for the U.S. Economy?

There is much talk of a recession hitting the U.S. economy in 2022. The discussion of a recession coupled with hype about electric vehicles may be causing the stock to underperform in today’s market. I do not see a recession in 2022, partly because the consumer is still strong, has accumulated savings, and can help grow the economy for the rest of the year. There is a possibility that inflation will continue taking its toll, and the growth rate might slow down in the second half of the year. However, slowing growth is not a recession, although it may feel like one for many consumers. But, it is good to understand how a company’s revenue and profits are affected in a slowdown or a recession.

We had a deep recession between December 2007 and June 2009 [The Great Recession – Sub-prime Mortgage Crisis]. How well or poorly did Cummins fare during the Great Recession? The recession that started in 2007 did not impact Cummins until 2009. For example, the company bragged about how its geographic diversification helped its organic growth despite “softness” in the North American heavy-duty truck engine market in 2007. In its 2008 annual report, the company continued to see a strong performance with a fifth consecutive year of record sales and net income. The recession finally caught up with the company in 2009; the company stated the following in its annual report:

“The global economic downturn in 2009 extensively challenged most of our businesses and the markets in which they operate.”

The company’s revenue declined by 24% in 2009 [Exhibit 1]. All the company’s operating segments saw a double-digit decline in sales. The company saw revenue decline by 16% in the pandemic-induced recession of 2020, which, thanks to the fast actions of the U.S. Federal Reserve and the U.S. Congress, was the shortest in U.S. history [Exhibit 1].

Exhibit 1: Change in Revenue at Cummins Over the Past 14 Years [2007-2020]

Change in Revenue at Cummins Over the Past 14 Years [2007-2020] (SEC.GOV, Author Calculations)![Change in Revenue at Cummins Over the Past 14 Years [2007-2020]](https://static.seekingalpha.com/uploads/2022/6/5/saupload_d9Y5XATc7lw74RAXCDeD9Xwch893OD8o_ADF-xTAbto7x-7wPmicRRHYjWBKkEHpQXvkWXf2IArgKaC0ANNCgB6Dhkk0U6ao9Ge1kD9U7xiBCOITw-n5tQL-7A94gkoZvkJIupf6e-UG5wEZvw.png)

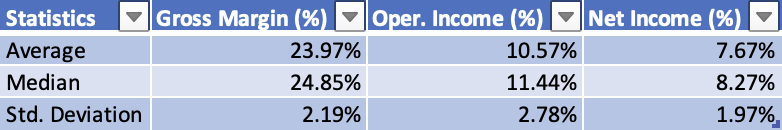

Over the past 14 years [2007-2020], the company’s average gross profit margin was 23.9%. In 2009, the gross margin was 20.08% [Exhibit 3]. Gross margins saw a decline of about 389 basis points in 2009 compared to the average [Exhibit 2]. The operating income margin declined by 426 basis points as lower sales led to selling, general, and administrative costs accounting for more of the revenue. But, the company remained profitable as measured by net income in the face of a recession in 2009 and 2020 [Exhibit 3].

Exhibit 2: Cummins Average Gross Margin Between 2007 and 2020

Cummins Average Gross Margin Between 2007 and 2020 (Author Calculations, SEC.GOV)

Exhibit 3: Cummins Gross Margin, Operating Margin, and Net Income Margin [2007-2020]

Cummins Gross Margin, Operating Margin, and Net Income Margin [2007-2020] (SEC.GOV, Author Annotation)![Cummins Gross Margin, Operating Margin, and Net Income Margin [2007-2020]](https://static.seekingalpha.com/uploads/2022/6/5/saupload_JHHjFRa9_ccNfeAdR9TFAZ2fW4qSaP7-8XkjLgR6_0NHyexDLrNaNiaVSuAD9Ou3-66CRrT22gDz3I1fewW64BFxqaR1N9u1epwyZ6FsHIeRT3LM35kKAtAEWpbEsepbyI0FPS2tzElk4AmIDA.png)

The lessons from this analysis are that no company is immune to a recession. No CEO is so brilliant and more intelligent than the competition that they can avoid missteps or negative impacts from a recession. When you hear a CEO brag about certain competitive advantages, for instance, geographic diversification, ask yourself what can blunt this advantage [a global recession in Cummins’ case]. In the past two decades, we have seen companies such as General Electric (GE), once the most valuable company in the U.S., fall from its perch. Companies have also risen from the ashes; Apple (AAPL) is an excellent example. We recently witnessed energy companies become market darlings after spending the past decade in the wilderness. But, as seen in the financial data, Cummins has held up reasonably well during recessions. It did see a decline in revenue but maintained its gross margins and overall profit margins.

Share Buybacks are a Form of Financial Engineering

It is easy to do buybacks; it is tougher to bring innovative products and services to the market. In the past decade, the easy-money policies in the U.S. and worldwide made even mediocre CEOs look brilliant. We have also seen record levels of stock buybacks over the past decade. Share repurchases can boost a company’s share price in the short term, but investors need to assess how the company is planning for the future in the long term.

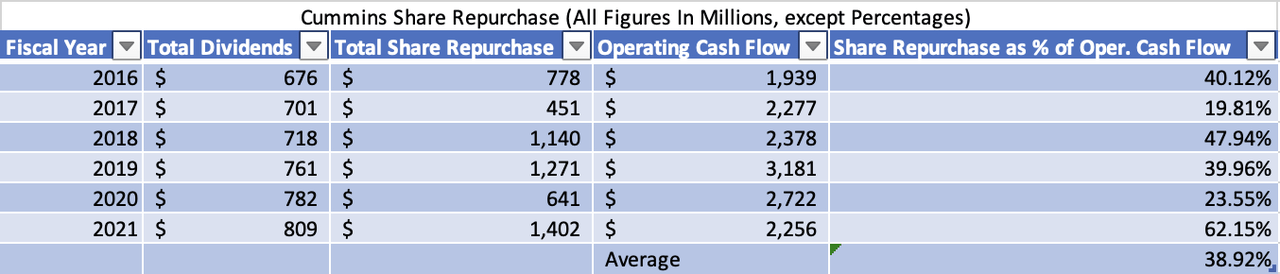

Cummins is spending and investing for the future. In the last six years, the company has spent, on average, about 38% of its operating cash flow on share repurchases [Exhibit 4]. This percentage of operating cash flows used for repurchases is slightly on the high side. But, I have seen companies that spend over 85% of their operating cash flow on share repurchases, so in that comparison, Cummins’ share repurchase does not seem excessive. I would like to see the company limit its share repurchases to 20% or less of its operating cash flow. But, CEOs are tempted to see their stock price rise quickly, so they tend to get lured into doing excessive share repurchases.

Exhibit 4: Cummins Share Repurchase, Dividends, and Operating Cash Flows 2016-2021

Cummins Share Repurchase, Dividends, and Operating Cash Flows 2016-2021 (SEC.GOV, Author Annotations)

2020s Belong to Industrials Involved in Sustainable Energy

There is a common thread that connects all SA subscribers. They are curious about the business world, looking for great investment ideas, and always looking to improve their investment skills. So, many SA readers would know that there has never been a decade in the U.S. economic history where companies that led in one decade also lead in the next one. So, in terms of driving double-digit investment returns, it may be over for Apple, Meta (FB), Google (GOOGL), and Amazon (AMZN). These companies may still be around and can generate positive returns, but their size and their market capitalization may limit further gains.

Software and high-tech dominated the past decade. This decade will most likely see the rise of industrial companies that can help the world transition to a green energy future. We may be transitioning from an investment world dominated by virtual services to one where we focus on manufacturing innovative products and services augmented with software that can improve productivity. This transition to a more sustainable future is why I have allocated nearly 18% of my portfolio to the industrial sector compared to 8% in the S&P 500 index.

Free Option on a Hydrogen Future

There are two areas in which Cummins is investing that bode well for its future. Natural gas engines and generators that Cummins is investing in hold promise. Natural gas engines can lower emissions and act as the bridge fuel before renewables take over. It is difficult to power off-highway vehicles used in mining, marine, oil & gas, agriculture, and other industries to be powered by batteries. Electric vehicles are not the answer for many off-highway applications across various industries. But, natural gas-powered vehicles may hold the solution in helping reduce emissions without compromising on performance.

For example, in 2021, Cummins introduced a 15-liter natural gas engine for North America [Exhibit 5]. The company is beginning to invest in hydrogen generation and fuel cell products. Hydrogen is still a long way from becoming the mainstream fuel, but it can be a game-changer in our fight against emissions. It was not until 2019 did Cummins start taking hydrogen seriously. In 2019, the company renamed its Electrified Power segment as “New Power” to represent fuel cell and hydrogen production technologies that were part of its acquisition of Hydrogenics Corporation.

Exhibit 5: Cummins’ Natural Gas Engine

Cummins’ Natural Gas Engine (Cummins)

The U.S. Congress has authorized $8 billion in funding to create “hydrogen hubs.” Cummins has recently partnered with Daimler Truck to experiment with hydrogen fuel cell powertrain for its Freightliner truck line. The New Power segment is currently a money pit accounting for just 1% of sales or about $116 million in FY 2021 and an EBITDA loss of about $223 million.

This New Power segment may take 5-10 years to have meaningful revenues, and profits may be even further away. But, if you buy into the investment thesis that heavy vehicles will need a clean power source other than batteries, then hydrogen may have to be part of that answer.

Conclusion

The company is trading at 12.5x, a 13% discount to its 5-year average forward P/E of 14.5x and the sector median forward P/E of 17.6x. The company is trading at a forward EV to EBITDA multiple of just 8x compared to the sector median of 10x. The stock offers a reasonable dividend yield of 2.75% compared to the S&P 500 dividend of 1.46%. The dividend payout ratio is a manageable 39%. Natural gas engines hold promise in helping reduce emissions in the short term, and hydrogen may be an option in the future for zero emissions. Cummins is an essential company in today’s world. It has successfully navigated recessions before and has fared well during turbulent times. The stock is trading at a discount and may make an excellent addition to a long-term portfolio.

Be the first to comment