Elen11/iStock via Getty Images

The eye of a hurricane is a deceivingly perilous place. Those lucky enough to enter it unscathed may enjoy a well-deserved respite, but the blue skies and calm winds also create a false sense of security and encourage complacency. Some people may even be convinced that the storm has passed. The truth, however, is that the eye offers only a brief intermission, and the worst is yet to come.

The US Federal Reserve raised the federal funds rate by 75 basis points on 27 July 2022. Many investors had feared a more aggressive 100-basis-point increase, so the relief was palpable. The very next day, the Bureau of Economic Analysis (BEA) issued its advanced estimate of second quarter GDP growth. The negative Q2 reading of 0.9% followed a Q1 decline of 1.6% and prompted a needless debate as to whether the US economy was in recession.

The combination of a less-than-feared interest rate hike and two consecutive quarters of negative economic growth sparked a strong rally in US equities and other risk assets. Implicit in this rally was the hope that the Fed may soon ease its monetary tightening and that the much-dreaded recession was already in the rearview mirror.

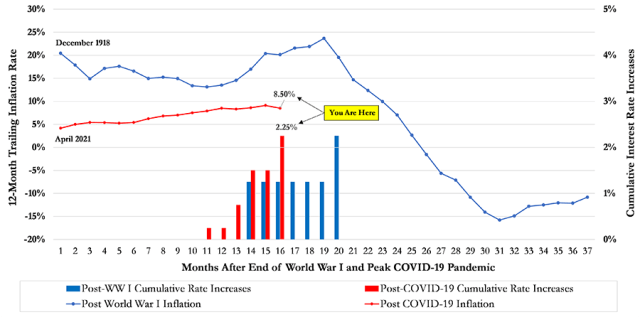

12-Month Trailing US Inflation and Cumulative Federal Rate Hikes: Post-World War I/Great Influenza and Post-COVID-19

Indeed, as July gave way to August, a surprisingly strong jobs report and lower-than-expected CPI numbers made investors even more bullish. One can hardly blame them for basking in the sunny skies and losing sight of the second hurricane wall that potentially looms on the horizon. While such optimism may be tempting, it is inconsistent with the lessons of financial history — especially the US experience in the years after World War I and the years preceding the Great Inflation.

The Fed is now battling inflation, not a recession, and it is too early to declare victory. The greatest blunder in Fed history was letting inflation fester for too long in the late 1960s. The Fed’s errors allowed inflation expectations to become entrenched, and the US economy paid a steep price in the form of more than a decade of stagflation. The Fed under Jerome Powell is unlikely to repeat this error, and taming inflation decisively will likely require more pain.

Beware the Ides of October

So when will the second wall of the monetary hurricane hit? It is impossible to tell. The Fed may even defy the odds and orchestrate a soft landing. But if the storm comes, beware the Ides of October 2022. Not only will the Fed’s tightening cycle be in its late stages, but October is a notorious month for financial panics. The 19th-century agricultural financing cycle first gave rise to periodic October panics, but even after the US transitioned to an industrial and consumer economy, the instinctive fear of October produced the occasional self-fulfilling prophecy.

Financial history suggests that more market volatility and economic pain are on tap before the Fed wins its battle with inflation. This does not mean, however, that investors should embrace tactical asset allocation — that would be speculation rather than investment. Rather, they must simply maintain their situational awareness, remain committed to their long-term asset allocation targets, rebalance to those targets as appropriate, and continue to steel their nerves for more volatility and price declines to come.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment