Diy13

It’s a notable finding among psychologists that “gifted” children who have served the needs of their mentally disordered parents suffer from immense emotional burdens during their adult life. Gold, as the “gifted” child of the post-GFC monetary exuberance, may not be an exception to this rule. The yellow metal is about to bear the brunt of the fiercest interest rate and currency battle of the last 50 years, the brutal outcome of monetary “disorders” of the previous decade.

As the world’s central banks compete for the most aggressive interest rate increases in recent history, expected real interest rates begin their ascend into positive territory for the first time in years. And such a new uptrend in real rates poses a direct threat to the attractiveness of the yellow metal, as the price of gold moves in the opposite direction of ex-ante (expected) long-term real interest rates.

A New Era Of Real Interest Rates

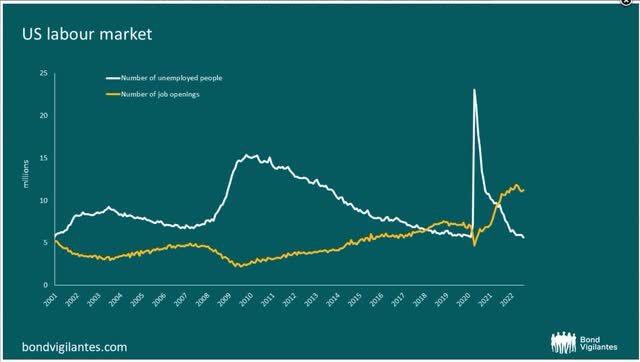

The global economy is silently entering a new era of positive return on cash, as inflation has proved to be non-transitory. For the first time in decades, the labor market leads the transmission mechanism to higher prices. Wage push inflation, as widely known, creates vicious feedback loops of cost pressures. US job openings, for example, have surpassed the number of unemployed people, reflecting an unprecedented excess demand for labor.

US job openings vs unemployed (Bond Vigilantes Blog)

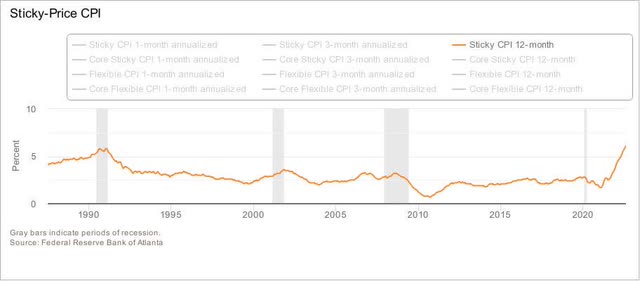

And this excess demand has already passed through to the other side of the economy, the retail sector. The Reserve Bank of Atlanta core sticky price index, i.e., excluding volatile food and energy components, has reached 6% surpassing even the dreadful inflationary highs of 1990.

Reserve Bank of Atlanta core sticky price index (Reserve Bank of Atlanta)

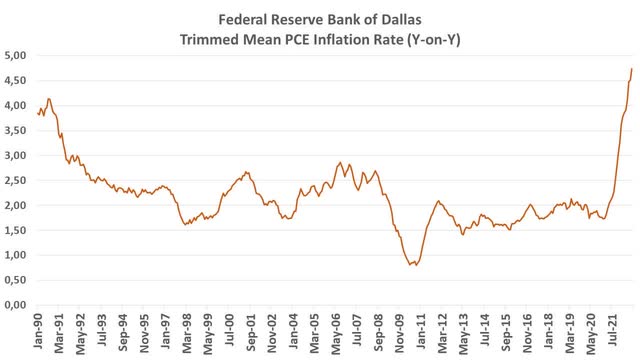

Dallas Fed trimmed mean PCE deflator, one of the Fed’s most closely watched indicators, confirms the obdurate persistence of inflation. The index has steadily climbed to the highest level in the last 40 years, with no sign of abating.

Federal Reserve Bank of Dallas Trimmed Mean PCE Inflation Rate (Y-on-Y) (Federal Reserve Bank of Dallas )

In this light, it is no surprise that the 10-year Treasury yield has broken out of its decades-long negative trend, reversing the previously established bull market in bonds. A breakout of such a magnitude indicates that something structural has changed, departing from the global ultra-low monetary conditions we have all gotten used to.

10 Year Treasury Yield (tradingview.com)

An analogous long-term technical reversal pattern has been documented in the 10-year bund and gilt (UK) yield, marking broadly based bear market dynamics for bonds across geographies and currencies.

10-Year UK Government Bond Yields (tradingview.com)

10-Year German Government Bond Yield (Bund) (tradingview.com)

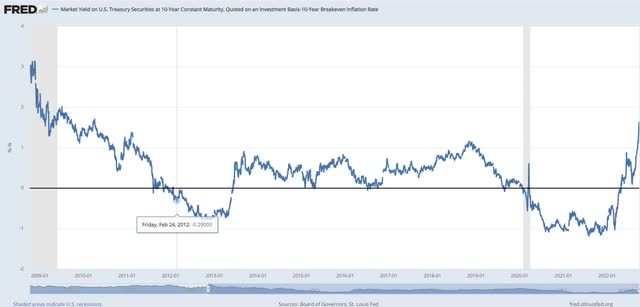

However, the increase in nominal yields does not threaten gold by itself unless real yields follow suit. So, we need to take a close look at the long-term bond yields after considering expected inflation. In this regard, a good proxy for the greenback’s long-term real interest rate is the difference between the 10-year US treasury yield and the 10-year breakeven inflation rate (the inflation rate implied by the TIPS market). This difference shows what bond investors believe the average inflation rate will be over the next ten years. It is a critical indicator that sophisticated gold investors constantly track to decide whether to buy precious metals over cash and near-cash assets.

As the following chart reveals, the 10-year expected USD real interest rate has recently turned positive, reversing a years-long downward trend that began in 2008 and ended earlier this year.

10-Year USD Expected Real Interest Rates (Fed of St Louis)

This downward trend assisted, among other factors, in elevating the price of gold up to $2,000 per ounce. As USD (and other major currencies) cash holdings produced negative returns after taking into account inflation, sophisticated investors had no choice but to turn to gold as a means of wealth preservation. Until recently, of course.

And this reversal pattern of the long-term downtrend in real interest rates is not confined to USD yields. It is taking place in almost all other currencies, as the world’s central banks, one after another, are engaging in a major monetary tightening cycle with no clear end in sight.

Which Gold Pair To Choose?

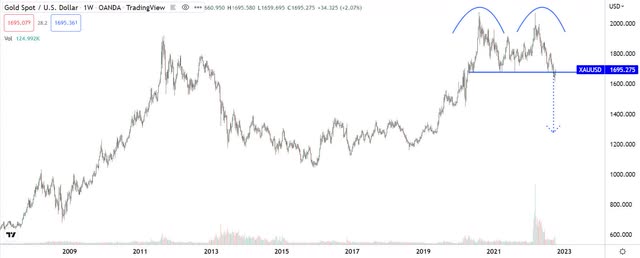

So, it should be no surprise that a short gold strategy comes to the fore in such a hostile financial and macroeconomic environment. Market technical dynamics support this premise. The price of gold has recently broken down the neckline of its 2020-2022 double-top formation, signaling a major bearish reversal with a projected move south of $1,300 per ounce. And while technical signals should not be taken at face value themselves, they nevertheless reflect the overall market feeling and the potential distribution of power between sellers and buyers. As such, this long-term technical formation confirms the macroeconomic troubles ahead for gold.

Spot Price of Gold in USD pre ounce (tradingview.com)

Ok but, against which currency to short gold should investors decide to do so? And given that the price of gold is quoted in USD, why not short gold directly against the USD and bother analyzing other currencies? The answer to the latter question is straightforward: the greenback doesn’t seem cheap enough to buy against gold.

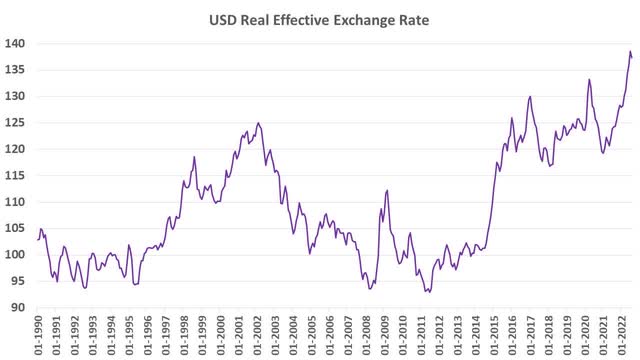

Although the US dollar still has upward momentum, it looks more overvalued than at any time in the last three decades, as shown in the following chart of its real effective exchange rate. In this regard, looking for another less overvalued currency to buy against gold would offer a better risk/reward profile. After all, there are many other highly liquid currencies that investors can freely choose to trade.

USD Real Effective Exchange Rate (BIS)

And, to jump to the first question, although the euro or the Japanese yen can be considered cheaper alternatives than the USD, they are not the cheapest or the ones exhibiting a potential buying reversal.

Thankfully, though, another major currency rests on the opposite end of the global competitive spectrum: the British pound sterling.

In the last 16 years, gold in GBP has appreciated almost three times as much as gold in USD terms, let alone gold denominated in EUR, JPY, CAD, or even AUD. In fact, the positive performance of every major gold/currency pair pales to the almost exponential rise in the price of gold in GBP terms (green line)!

Relative Perfomance of Gold in Various EM currencies (tradingview.com)

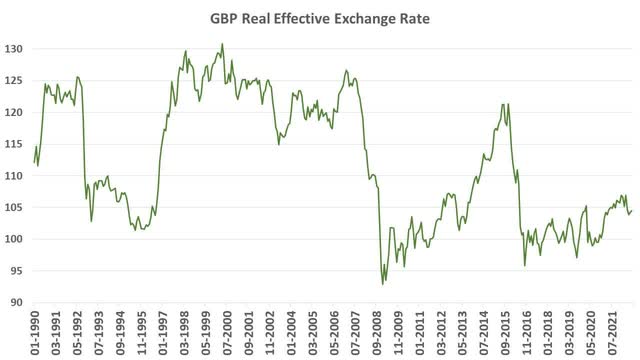

More importantly, the British pound sterling looks substantially undervalued against its major trading peers, as the GBP’s real effective exchange rate hovers around its three decades low.

GBP Real Effective Exchange Rate (BIS)

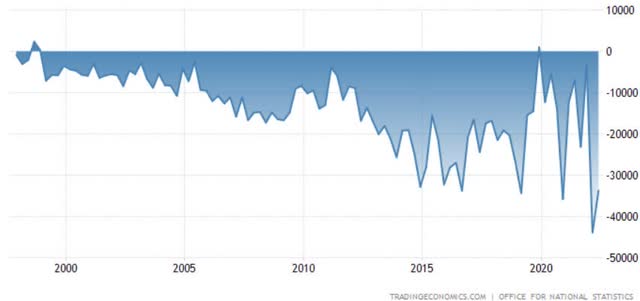

The fact that the UK inflation rate is among the highest and stickiest in the world makes real interest rate dynamics for the UK economy extremely ominous. Unless GBP real interest rates climb substantially from their current zero level, capital will continue fleeing the UK, and sterling will struggle to find buying support as the current account dynamics of the British economy remain extremely weak.

UK current account (tradingeconomics.com)

And the latest incident with the gilt market implosion that prompted the BoE to intervene by aggressively buying long-dated UK bonds to cap the rise in yields throws more gas on the fire. This unsterilized intervention corresponds to plain quantitative easing, as an enormous amount of money was injected into the UK financial system, potentially triggering secondary inflation effects. This new and unexpected inflationary spiral makes the need to increase real interest rates in the UK even more pressing further down the line to defend its currency.

Sooner or later, after stabilizing the gilt market, the UK monetary authorities will have to engineer substantially higher real rates both on a short-term and long-term basis to control the exploding inflation rate. And higher real rates will eventually provide lasting buying support to the beleaguered sterling, something no unilateral FX intervention can achieve.

In simple terms, the UK economy has an urgent and unfulfilled need for materially higher real interest rates. The country can spare no time for further fiscal experimentation and credibility loss unless, of course, an unexpected systemic financial accident happens, kicking the can down the road for more aggressive interest rate increases later.

At the same time, such an upward reversal of the UK real interest rates will add to the mix of rising expected real interest rates worldwide (except for China), weakening the overall investment case for gold.

The Execution

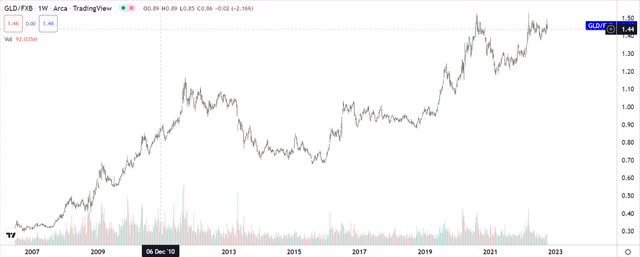

Investors can execute this short gold/long sterling strategy via the ETF market by selling the gold ETF (NYSEARCA:NYSEARCA:GLD) short and, at the same time, initiating a long position on the sterling ETF (NYSEARCA:NYSEARCA:FXB) of equal nominal value. As the following chart shows, the ratio of the gold ETF over the sterling ETF trades around its historical highs.

The ratio of SPDR Gold ETF over Invesco CurrencyShares British Pound Sterling ETF (GLD/FXB) (tradingview.com)

And there are three possibilities through which this strategy could bear fruits: either through an outright fall in the gold price quoted in USD (as technical charts suggest), or through a generalized sterling appreciation, or even through the realization of both moves simultaneously.

In all, there is no doubt that gold, as the “gifted” child of post-GFC monetary order, will sooner or later come to grips with its “trauma”, eventually managing to free itself. In the meantime, it will most certainly experience a bumpy and painful transition, with sterling playing the role of dreadful childhood emotions previously kept unconscious. Just ask your psychotherapist.

Be the first to comment