JHVEPhoto

Exxon was once Buffett’s favorite stock

With all the articles about Occidental Petroleum Corporation (OXY), and Warren Buffett buying shares hand over fist, let us not forget his last petro sweetheart, Exxon Mobil Corporation (XOM). Let’s take a trip down memory lane with the 2011 Berkshire Hathaway (BRK.A)(BRK.B) letter:

Today the world’s gold stock is about 170,000 metric tons. If all of this gold were melded together, it would form a cube of about 68 feet per side. (Picture it fitting comfortably within a baseball infield.) At $1,750 per ounce – gold’s price as I write this – its value would be $9.6 trillion. Call this cube pile A. Let’s now create a pile B costing an equal amount. For that, we could buy all U.S. cropland (400 million acres with output of about $200 billion annually), plus 16 Exxon Mobils (the world’s most profitable company, one earning more than $40 billion annually). After these purchases, we would have about $1 trillion left over for walking-around money (no sense feeling strapped after this buying binge). Can you imagine an investor with $9.6 trillion selecting pile A over pile B?- Warren Buffett 2011 Berkshire Letter

Both Buffett and the Bill and Melinda Gates Foundation were big on Exxon from 2011 until 2013 when they both exited. What gives? Exxon is at roughly par with Occidental based on book value and forward earnings. These are the two main components to the original Ben Graham advice on what constitutes a fair deal. The kicker is Exxon also pays a much heftier dividend at 4.1% vs .89% for Occidental.

The main thesis is Occidental Petroleum is small enough to obtain a controlling stake eventually, whereas Exxon is too large. I still believe Exxon and Chevron Corporation (CVX) are the best deals of the oil majors and Exxon remains my largest holding. Not only is the stock trading at a discount to fair value, but it is a dividend aristocrat to boot (as is Chevron). The thesis of this article is that Exxon is a buy and still one of the best values to hold for the long term in oil.

Buffett and seller’s remorse

I’ve been a Buffett follower since I invested my first dollar, hanging on his every word, reading every annual letter, and watching any available interview. Three holdings I followed him into were Walmart (WMT), Wells Fargo (WFC), and Exxon. He subsequently ditched those holdings at different intervals. Walmart was one that I also followed him out of and regretted; the sale came after Amazon (AMZN) entered the brick-and-mortar grocery with the acquisition of Whole Foods Market.

Buffett got back into grocery with The Kroger Co. (KR) when Walmart seemed to be a more obvious choice. Same when oil cratered, Exxon seemed to be the most obvious choice. Buffett, however, instead got into Chevron and now Occidental. Wells Fargo has been jettisoned in favor of Bank of America (BAC) (Charlie Munger was more forgiving). While psychologists debate whether the first choice is the right choice, I tend to believe it is when it comes to stock analysis. Narratives and numbers change, but if you believe the brand has a moat, better to stick with the moat than jump off the boat!

Buffett loved the dividends

While Berkshire never paid a dividend, Buffett loved to collect them himself and either compound or redeploy the capital into other favorable Berkshire holdings. Here’s a second excerpt about Exxon from the 2011 letter comparing gold to Exxon:

A century from now the 400 million acres of farmland will have produced staggering amounts of corn, wheat, cotton, and other crops – and will continue to produce that valuable bounty, whatever the currency may be. Exxon Mobil will probably have delivered trillions of dollars in dividends to its owners and will also hold assets worth many more trillions (and, remember, you get 16 Exxons). The 170,000 tons of gold will be unchanged in size and still incapable of producing anything. You can fondle the cube, but it will not respond.

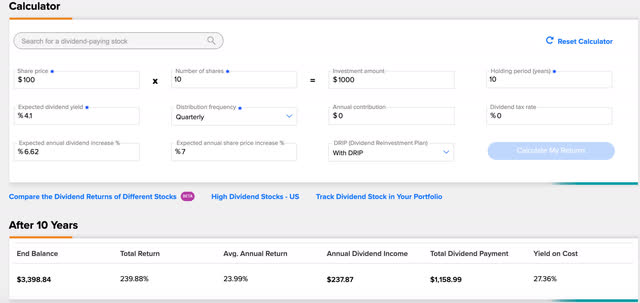

Exxon has paid a dividend for 60 years and 39 years without a cut, although it did freeze its dividend during covid. Over 60 years, the company has grown its dividend from .0187 cents a share to .88 cents a share, a CAGR of 6.62% per year. If we assume they can maintain this dividend increase for the next 10 years with a lower than average S&P500 appreciation rate at 7% per annum, let’s see our results of compounding the dividend over 10 years:

After 10 years at a starting dividend of 4.1% with DRIP, increased 6.62% per year with an annual appreciation in shares of 7%, a $1000 investment would become $3,398 in 10 years, a total return of 239%.

We can see that Exxon should be a dividend out-performer amongst the aristocrats. They sell a product that could be entering into a super cycle with a similar inflationary environment as the Jimmy Carter and early Reagan era.

Dividend coverage

Exxon’s forward dividend liability is $3.52 a share. Exxon currently has 4.167 Billion shares outstanding. This is a forward dividend liability of USD 14.66 Billion. Taking a look at the TTM free cash flow of nearly $50 Billion, this is a wide margin of coverage by the free cash flow of 3.4 X.

Exxon Free Cash Flow (yahoo finance)

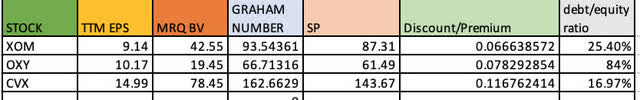

The Graham Number

Warren Buffett has quoted himself as being 85% Graham and 15% Phil Fisher. At the core of Buffett’s portfolio over the years, you will find a variety of bank stocks. There have been more than a few value-orientated discounted free cash flow channels on YouTube that question where the value in banks is and why the most famous value investor holds so many of them. The answer is simple: they almost always trade at a fair value based on assets and earnings. A threshold Graham advised in the Intelligent Investor for fair value is a stock’s P/E times its P/B should not exceed 22.5. To set a price target to find at what price a stock meets this threshold, you use the equation Square Root of (22.5) x (TTM EPS) x (MRQ Book Value per Share).

With the above in mind, let’s run the Graham number as it relates to Exxon Mobil. Exxon’s TTM EPS is $9.14 a share. Exxon’s MRQ book value is $42.55. Therefore, Square Root of (22.5) x (9.14) x (42.55)=$93.54. This is around a 7% discount on today’s price depending on the day you’re reading this. This formula is quite suitable for companies with large amounts of tangible assets that generate cash versus intellectual property, at which I would personally switch to the PEG ratio for price targets on companies with large IP portfolios.

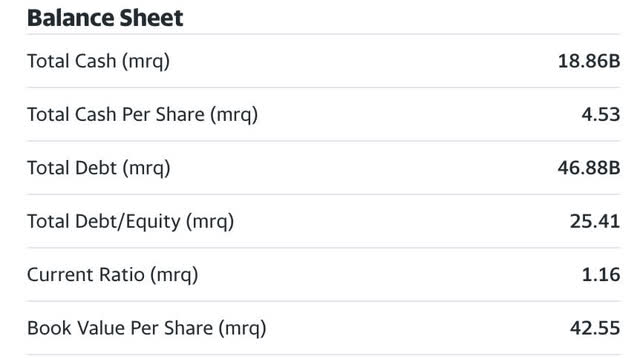

Exxon debt

Exxon Balance Sheet (yahoo finance)

Exxon, as well as the other oil majors, run a conservative balance sheet. This is due to the uncertainty of whether or not they can borrow to fund operations with new ESG restrictions abound. At a debt to equity ratio of 25%, this is an improvement over the middle of the Covid era. While I would normally say this is an ultra-safe ratio, things can turn in an instant with lockdowns and supply gluts in oil. With financing being both difficult and expensive for oil companies, they need to maintain low debt levels.

Graham number versus previous and current Buffett oil stocks

Graham Calculator (personal excel sheet created from data from yahoo finance)

Here we can see both Exxon and Occidental are trading at a 6-7% discount depending on the share price for the week. The debt-to-equity ratio is certainly in Exxon’s favor for an industry that needs to control its balance sheet diligently. The dividend is the kicker for me that makes Exxon the better deal, Buffett may see an opportunity to increase the dividend by a lot for Occidental if Berkshire gets a controlling stake. Chevron overall is trading at the biggest discount to the Graham number at 11% with a 3.9% dividend.

Both Exxon and Chevron are excellent choices. I am personally overweight Exxon from going all in at Covid lows when Exxon was trading well below book value for the first time since 1985. That was when all the 2011 Buffett opinions about Exxon hit me like a ton of bricks, that and the dividend being nearly 10%!

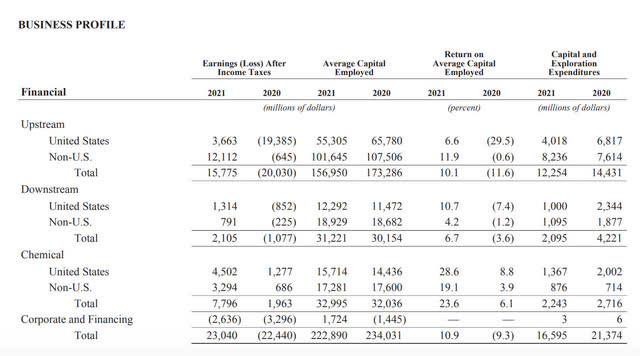

2021 Performance

Reduction of debt, increases in cash: these are all good things Peter Lynch looked for in a turnaround story. With all the oil companies coming out of the Covid doldrums now racing ahead as the top performing sector in a down market, the tables have turned. We can’t expect oil to perform this well forever, but those who manage their cash flows best and diversify their energy mixes to the right strategies will rule the day. With breakeven at $41 a barrel, I would bet my bottom dollar Exxon is profitable for years to come.

ESG initiatives to enhance borrowing capabilities

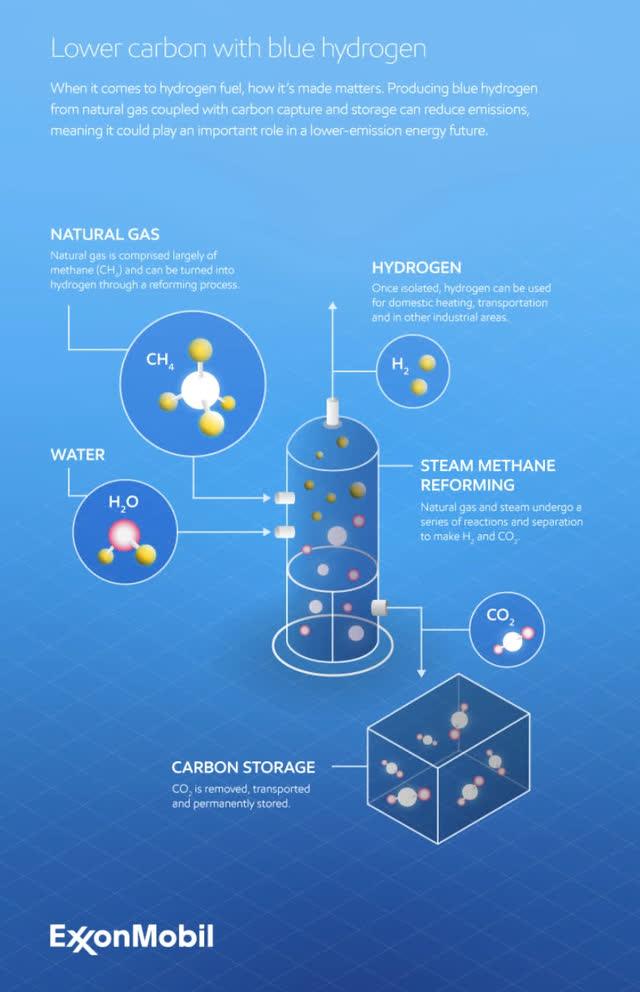

Exxon Hydrogen (exxonmobil.com)

To me, green energy initiatives are great for the oil majors. Not only are they a way to preserve the planet, but also access capital. Whether we like it or not, ESG scores are going to be part of underwriter software regarding energy and other companies with ESG risks. Exxon has some great projects and a lot of free cash flow remaining after dividend payments to put capital expenditures into hydrogen and biodiesel initiatives. Natural gas is also acceptable green energy in the EU. With the cut-off of the Russia-EU Nord Stream pipelines, possibly forever, Exxon’s natural gas portfolio will meet unlimited demand for LNG during the next decade.

According to Exxon’s liquified natural gas homepage:

We have made great progress and secured strong partnerships in the U.S. and around the world that will be critical to making our growth plans a reality. Efforts include a floating LNG plant that recently started producing in Mozambique, construction of a LNG terminal in Texas that will start producing in 2024, and expansion of LNG production in Papua New Guinea and Qatar. The U.S. terminal, at Sabine Pass on the Gulf of Mexico, will export 16 million metric tons of LNG a year, which is enough to generate enough electricity for nearly 10 million households.

This is the asset that will keep me invested in Exxon for the long haul. Liquid natural gas for export and domestic use will be critical. It is used in producing nitrogen-based fertilizer and is the main source of hydrogen. Hydrogen is a very sensible project to pursue because it will ultimately be blended with or become a substitute for natural gas, as explained by Kinder Morgan (KMI) on naturalgasintel.com:

Houston-based Kinder Morgan Inc., for example, said it has the technology in place to blend hydrogen with natural gas and move it via its pipelines, and the company views hydrogen production as a plausible future possibility. However, CEO Steve Kean said during the fourth quarter earnings call that it would take a combination of government support and major investments by energy giants to create the scale necessary to make hydrogen profitable.

“Hydrogen is promising,” Kean said. “It’s been the fuel of tomorrow for decades…It takes, I think, some subsidies to get it to a point where it’s really actionable. It’s $19/MMBtu today. Will it ultimately serve a compelling fraction of the energy needs? Yeah…but there’s a lot to be done there to make that a sensible thing to do” financially.

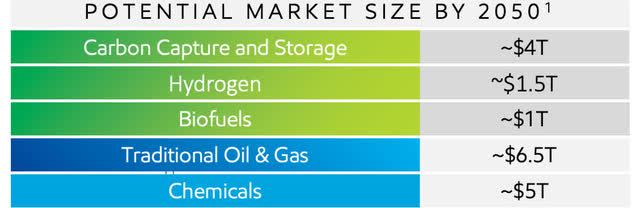

This is where it gets interesting. In pursuit of Hydrogen and other ESG-related technologies, fully integrated companies like Exxon and Chevron could receive tax credits to develop the projects and pay for the feedstock right out of their reserves with taxpayer dollars. As the feedstock for hydrogen is natural gas, this is a win-win situation. Exxon believes that many of its initiatives will have significant TAMs by 2050. Get access to debt now, and profit in the future:

2050 Tams (corporate.exxonmobil.com)

Energy mix

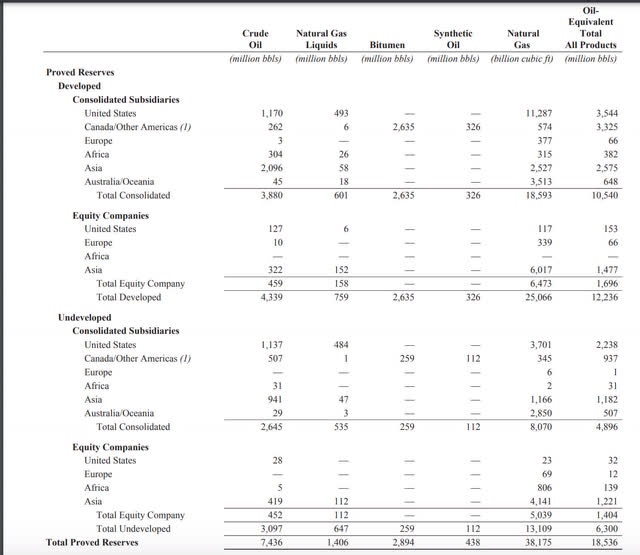

Exxon Energy Reserves Mix (Exxon 10K)

Here we can see the total reserves are 18.53 billion barrels of oil equivalent reserves. Let’s see where the majority of earnings came from last year:

Exxon earnings by segment (Exxon 10k)

- Upstream took home the lion’s share at $15.75 Billion in earnings

- Chemical production came next at $7.79 Billion

- Lastly was downstream refining at $2.1 Billion

I would expect in the face of lower oil prices than early 2022, and more demand for natural gas from the severing of ties between the EU and Russia, natural gas refining to LNG will begin to represent a larger and larger portion of the earnings mix than in 2021. If we look at their balance sheet of reserves, they had 1.4 billion listed as proven reserves in the natural gas segment, but 38 billion in proven total reserves either owned or jointly owned through ventures that need to be developed and then possibly condensed into LNG.

Catalysts

Natural gas is the biggest catalyst for me. If Exxon shifts a lot of its downstream focus to LNG, the demand for the product does not seem to have a limit at this time. The current earnings mix is 61% upstream, 30% chemicals, and 9% downstream. Downstream and LNG refining should aim to achieve at least 20% through next year and possibly as high as 30% by 2025. If they hit those numbers, I believe Exxon can keep the profit and cash flow rolling.

Risks

Any Graham number analysis can change pretty quickly if either assets are written off due to impairment or earnings significantly decline. Most models would take a hit on only the GAAP/non-GAAP earnings metrics if the numbers dived. However, in companies that produce much of their earnings from tangible assets, impairment of assets will have a real effect on earnings. Unless in the case of oil, an undeveloped project was seized by a country without recourse. This could produce a write-off in asset value without affecting the bottom line in EBITDA. Risks in oil both lie in the political realm and commodities market sphere. However, I believe well-run, fully integrated oil companies should be able to grow with inflation and population over time. They control assets necessary for the sustainment of life and business. Banks are similar.

Summary

Exxon is trading closely with Occidental using the Graham number valuation, Chevron still seems to be trading at the biggest discount. I wouldn’t argue that any of the three are bad choices. My personal preference is to go with Berkshire’s original due diligence pick from 2011 in Exxon. The infrastructure, and research and development department are very strong. This is also the largest oil major outside of Saudi Aramco (ARMCO). When it comes to pulling off great feats like supplying the European Union with liquid natural gas (if Biden doesn’t try to restrict them) and executing on ESG-related future initiatives, I believe size matters. Low debt and a nice 4% dividend with a historical 6+% dividend CAGR average. Exxon is a buy under $93.5.

Be the first to comment