BeyondImages/E+ via Getty Images

As Vladimir Lenin was often quoted to have said that: “There are decades where nothing happens and there are weeks where decades happen”. The quote hits home with shareholders of the Anglo-Russian steel and mining giant Evraz (OTCPK:EVRZF). The fairly simple and relatively uninteresting company that is operating within the commodity business has been quietly creating shareholder value and building wealth for decades.

However, events surrounding the Russian invasion of Ukraine and the subsequent unprecedented and never-before-seen sanctions have turned the company’s world upside down. As far as the shareholders are concerned, they had years when nothing was happening and they had the two last months when seemingly years have passed by. Instead of focusing on the fundamentals, Evraz shareholders find themselves more focused on the most recent war news and the results of the ongoing peace talks.

In my last article on Evraz, I have laid out several key reasons why I believed that the company will be successful in navigating the complex geopolitical environment and how that will ultimately benefit the investors who were willing to take what I have described as an “asymmetric risk”. The investment thesis holds for now, as early March investors stand to greatly benefit from the curious case of Roman Abramovich and Evraz. This is by no means a guarantee that the situation could not get progressively worse overnight within the increasingly complex geopolitical environment.

Beating heavily on the “Not Russian” drum

In general, we can conclude that management has done a fairly good job of keeping investors up to date on the state of things with regular updates, which is not something that can be said for the majority of the other companies affected by this situation. The sanctions have caught up with many of the better-known Russian companies such as Gazprom (OTCPK:OGZPY), Sberbank (OTCPK:SBRCY), Lukoil (OTCPK:LUKOY), Rosneft (OTCPK:RNFTF), and others.

Shortly after recovering from the initial shock, the company came out with a series of press releases tackling the question of sanctions. As speculated in my previous article, management was eager to point out that Evraz is technically not a Russian company and, as a result, could not fall under sanctions. This view is summarized well in the 9th of March press release.

The Company wishes to confirm the following points: For the purposes of The Russia (Sanctions) (EU Exit) Regulations 2019 (the “Regulations”), the Company does not consider itself to be an entity owned by, or acting on behalf or at the direction of, any persons connected with Russia and thereby caught by such legislation. In relation to certain shareholders of the Company (namely, Mr Roman Abramovich, Mr Alexander Abramov and Mr Alexander Frolov), the Company cannot be certain as to whether such individuals are “connected with Russia” for the purposes of paragraph 16(4D) of the Regulations, but has reached the above view based on the information it has previously been provided with. Nevertheless, the Company can confirm that it has not granted any loans or credits to such individuals after 12:01a.m. on 1 March 2022, nor dealt directly or indirectly with a transferable security or money-market instrument issued after 12:01a.m.

Evraz Board, Press Release – 9th of March

At the same time, the company acknowledged that they are in fact experiencing some friction in terms of logistics, supply, and financial flows, but that “there has been no material direct impact on day-to-day operations” in the end. After the government publication of the “Sanctions List”, the company followed up with another press release on the 10th of March.

Here is where another of my assumptions from the previous article came through. Evraz’s board sought to once again reiterate the fact that Abramovich remains only but a minority shareholder, considering that the sanctions list targeted only the oligarchs individually, this would mean “that the UK financial sanctions shall not apply to the Company itself”.

The Company confirms that Mr. Roman Abramovich is one of the significant shareholders of the Company with a direct holding of 417,767,314 shares, which constitutes 28.64% of the issued capital. Under the relationship agreement with Mr. Roman Abramovich, he is entitled to appoint up to 3 directors. The current composition of the Board is 11 members, among which there are 6 independent non-executive directors. Over the last 5 years, only 2 directors have been appointed by Mr. Abramovich. Having regard to the above, the Company does not consider Mr. Roman Abramovich as a person exercising the effective control of the Company as he: does not hold (directly or indirectly) more than 50% of the shares or voting rights in the Company; has no right (directly or indirectly) to appoint or remove a majority of the board of directors of the Company; is not able to ensure the affairs of the Company are conducted in accordance with his wishes.

Evraz Board, Press Release – 10th of March

The company was later hit with another piece of bad news as the London Stock Exchange has temporarily suspended Evraz’s listing. As a result, secondary and ADR listings have been suspended as well, which is the situation that remains as of today. While waiting on further clarification from OFSI, all Evraz non-executive directors, including Alexander Abramov, Alexander Frolov, Alexander Izosimov, Deborah Gudgeon, Eugene Shvidler, Eugene Tenenbaum, Karl Gruber, Maria Gordon, Sir Michael Peat, and Stephen Odell have decided to step down from the positions.

The dividend was canceled

Perhaps the most interesting development surrounding the entire crisis was the question of the $0.50 interim dividend that was going ex-dividend on the 10th of March. It is worth keeping in mind that the company has been selling for less than $0.70 per share depending on the exchange, given the fact that the shares of the company could have been purchased on the main London listing, the secondary Frankfurt listing, or as an over-the-counter stock in the US. After days of speculation, the company finally announced that they will not proceed with the payment of the dividend and that the dividend is going to be canceled.

In the current circumstances, the Board of Directors (the “Board”) no longer considers the payment of the Interim Dividend to be in the best interests of the Company and its shareholders. Although the imposition of international sanctions against Russia and the restrictions imposed by Russia to date have had no material direct impact on day-to-day operations, trading or the financial position of EVRAZ, given the uncertainties arising from the current situation in relation to Russia and Ukraine, the Board has nevertheless decided to cancel the Interim Dividend. The Board will continue to keep the payment of future dividends under review and will keep shareholders updated through further announcements as appropriate.

Evraz Board, Dividend Press Release – 9th of March

Considering that the company has been sitting on $1.02 billion in cash, I suspect that the main reason behind the cancellation was the attempt to avoid the PR disaster of handing out Roman Abramovich a US$208 million check in the middle of a huge public backlash. Such as decision would have been welcomed at gunpoint by both media and UK authorities alike. Furthermore, in fundamental terms, the US$729 million dividend could have bought back almost half of the company, given that the market cap of Evraz was only US$1.54 billion given the price before the trading was suspended. While the decision might be viewed as controversial by some, I would argue that is the best-case scenario given the current situation.

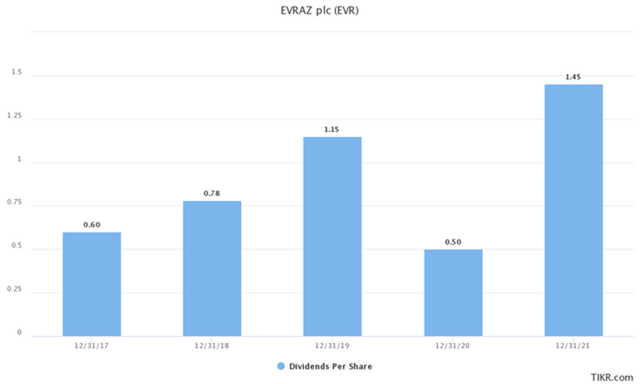

Dividend History (TIKR Terminal)

The company has long held a dividend policy commitment of paying out a minimum of $300 million annually, provided that the net leverage ratio remained below 3.0x. The actual payments were strongly dependent on the commodity prices throughout the years, as is the case with commodity businesses. Looking at historical data, Evraz maintained an average dividend of $0.90 per share in the last five years. If the company manages to keep up with the average throughout the years, it would effectively generate north of a 100% dividend yield, given the depressed prices of the early trading days of March. The suspended dividend alone would result in a dividend yield of 70%. The price of the stock is so depressed at this point, that even if the company ended up paying a dividend only in line with the dividend policy, it would result in a dividend yield of 20%. This explains the lucrative positions that late investors have found themselves in.

To default or not

A turning point of the entire crisis came on the 21st of March when a coupon payment of US$18.9 million for its 2023 notes has been blocked by Societe Generale of New York, the company’s correspondent bank. Considering that the company is highly liquid and well-capitalized, following through on its debt obligations should not have been an issue, at least speaking in strictly financial terms.

This serves well to highlight that “auto-sanctioning” by relevant institutions and companies alike could cause major harm to Evraz, even though the company itself does not fall under sanctions. If Societe Generale held on to the coupon payment, this would technically result in default. It would probably represent a historical precedent that a company with US$1.02 billion in cash defaults over a US$18.9 million coupon payment.

The Company understands that the situation has its roots in the recently emerged uncertainties…The Company continues to stand on the position that Roman Abramovich does not have effective control of the Company. This position was outlined in the press release published on 10 March 2022. Furthermore, the Company believes that it is neither designated nor sanctioned. The Company would like to highlight that apart from a malfunction of financial infrastructure, there are no reasons for a Potential Event of Default. The Issuer has sufficient liquidity to complete the coupon payments.

Evraz Board, Cupon Payment Press Release

In the end, the payment was released on the 22nd of March and was subsequently settled in the account of the Principal Paying Agent, laying rest on the situation. However, this remains a clear milestone as it establishes a precedent for processing financial payments by Evraz that is most likely going to be followed and respected by others.

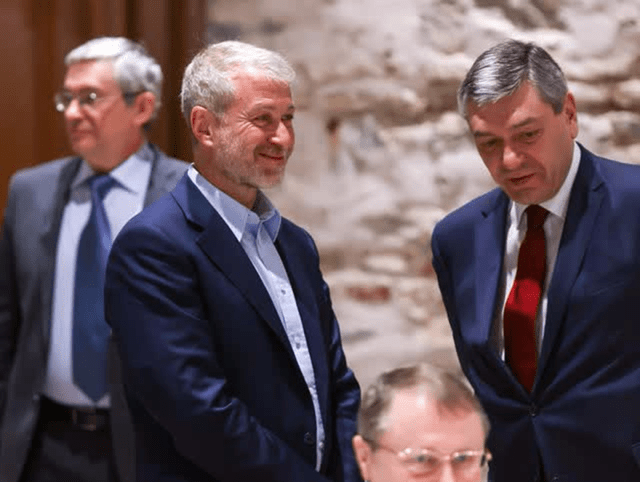

Abramovich at the negotiating table

Another major breakthrough in the saga came as the oligarch’s involvement in the Russia-Ukraine peace talks came to light. Abramovich was seen in public as part of the negotiation entourage in Istanbul. He was reportedly serving to establish a line of communication between the two governments as an independent voice in the room, trusted by both parties. Abramovich was reported to have been mainly involved in helping establish humanitarian corridors and secure civilian evacuations.

Roman Abramovich At Peace Talks (Forbes Magazine)

The Russian oligarch was reported to have had an early “change of heart” in relation to supporting the official Moscow politics. Most notable, Abramovich has decided to sell Chelsea and donate all of the proceeds to the victims of the war in Ukraine. Similarly, his daughter went on social to publically criticize the conflict in Ukraine and voiced her opposition to Vladimir Putin.

As a result of his involvement in the peace negotiations and his open support for peace, the Ukrainian president Zelensky urged his US counterpart Joe Biden not to sanction Abramovich. The United States, unlike the European Union and the United Kingdom, has still not announced any sanctions targeting Roman Abramovich. Abramovich’s vocal support and direct involvement in the peace process should be welcomed by the shareholders as it stands to greatly benefit Evraz’s uncertain position.

Going back to fundamentals

As stated in my previous article, Evraz is an endurable, well-structured, low debt, free cash flow dividend-oriented machine. The only real issue that the company is currently suffering from is the geopolitical exposure from the controversial ownership stake of the Russian Oligarchs.

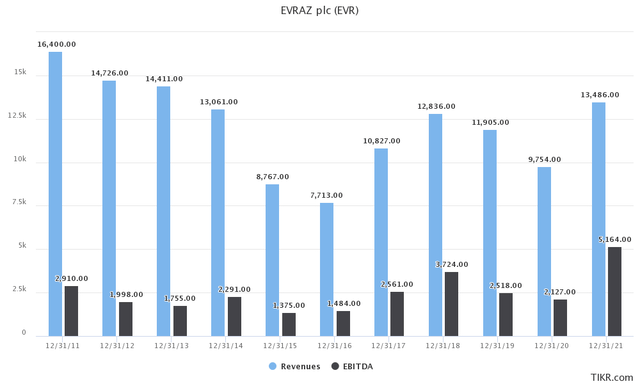

In my view, it is fundamentally a very strong company. Primarily as a steel and iron ore producer, it is highly dependent on commodity prices. However, it has been shown over the years that it is well-positioned to benefit when steel and vanadium prices are high. We can witness that from the 2021 results when the group delivered its best results in seven years.

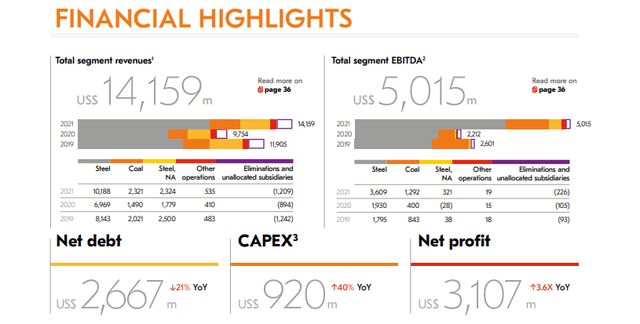

Financial Highlights (Annual Report 2021)

In 2021, Evraz’s total segment revenues climbed by 45.2% YoY to $14,15 billion, compared with $9.75 billion in 2020. The increase was caused primarily by higher sales prices for semi-finished and construction products, as well as greater volumes for vanadium products. This increase was also attributable to higher average realized prices and third-party sales for coal.

The Group’s total segment EBITDA amounted to $5,01 billion during the period, compared with $2,21 billion in 2020, boosting the EBITDA margin from 22.7% to 35.4%. The increase in EBITDA was primarily attributable to higher steel, vanadium, and coal product sales prices.

Revenue and EBITDA (TIKR Terminal)

One of the major changes since the last coverage is that the coal demerger has been canceled as a result of the ongoing situation. The demerger of the coal assets was supposed to be carried out by distributing the shares which Evraz directly holds in Raspadskaya, being about 90% of the total, to all Evraz shareholders in proportion to their existing shareholdings in Evraz. Coal revenues made up a total of $2.32 billion in revenues for 2021, which amounts to about 16% of total revenues.

In light of the unprecedented sanctions against Russia and Russian special economic measures in response to sanctions, which were outside of control of the Company, execution of the transaction became technically impossible and the decision has been taken not to proceed with the Demerger. As a result, EVRAZ Shareholders registered on the EVRAZ Share Register at the Demerger Record Time will not receive their RASP Shares, the RASP Group will not separate from the EVRAZ Group and will continue to form a part of the EVRAZ Group. As long as the RASP Group remains a part of the EVRAZ Group, the Company’s shares will also represent an interest in the RASP Group subject to the Company’s listing of shares being restored.

Evraz Board, Demerger Update

Raspadskaya has been providing approximately 70% of EVRAZ metallurgical coal supply requirements needed to support its operations. This made the initial demerge decision a significant impact on the business. As it stands, this decision is greatly beneficial to any “new shareholders” given that the market has already discounted the stock based on the demerger. Whether or not management will proceed with the demerger after this situation has been cleared up remains to be seen. However, in such a case, “new shareholders” would most likely be getting shares in Raspadskaya.

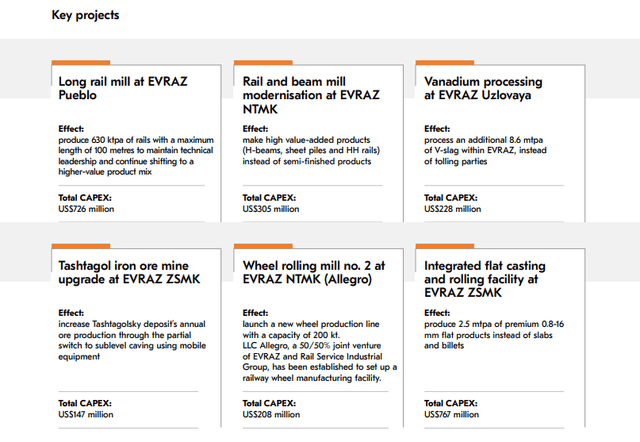

Planned Projects (Annual Report)

In the last year, the company invested a total of $920 million in CAPEX, of which $517 million was spent on maintenance projects and $403 million on development projects. Development CAPEX doubled year-on-year, mainly as a result of an increase in spending on key projects mainly focused on iron ore and steel production. Given the current political climate, it would be wise to point out that only the Evraz Pueblo project is a North America based project, while the other major steel and vanadium projects are all in various regions of Russia.

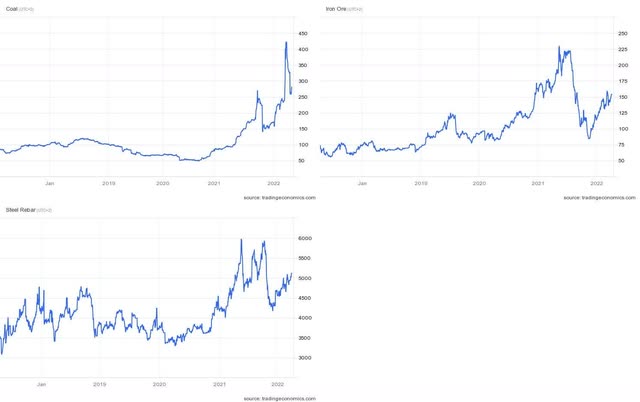

Commodity Prices (TradingView)

Commodity prices have been soaring for several months already over supply chain issues and general fear caused by the crisis. Such is the case with steel and iron ore prices. In normal circumstances, Evraz would be brilliantly positioned to take advantage of this.

However, with a large portion of its operations still remaining within Russia and currently under the impact of sanctions, the financial outlook does look bleak unless the crisis can be deescalated in the following weeks or months. Furthermore, it is likely that the Russian subsidiaries’ inability to do business is in part causing the supply chain issues.

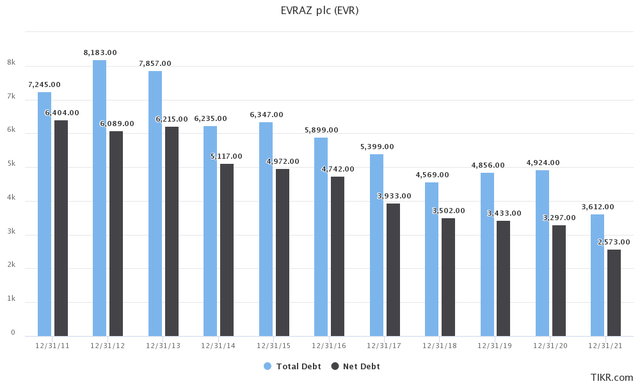

Evraz Debt (TIKR Terminal)

Currently, Evraz has $3.61 billion in total debt and $2.57 billion in net debt as they are sitting on some $1.02 billion in cash. We can see that the last decade has been marked with plenty of success in terms of deleveraging and that the company is finding itself in a very attractive financial position.

In 2021, the company has generated a solid free cash flow of $2,257 million. Coupled with the net debt/EBITDA ratio below 2.0x, which enabled EVRAZ to return $1,54 billion to its shareholders in the form of dividends for a dividend yield of 13%. Long term, the group is attempting to target a net debt level below $4.00 billion and a Net Debt/EBITDA ratio below 2.0x.

Final thoughts and conclusions

I find it very difficult to fundamentally analyze a company that has seen its share price decimated and is trading at one-tenth of the price from a point at which it was already considered a good value play. Evraz is an endurable, well-structured, low debt, free cash flow dividend-oriented machine that is only suffering from geopolitical tensions. However, the events over the last couple of weeks have shown that strong fundamentals mean nothing in the face of geopolitical risks and that emerging markets always carry a high level of political risk associated with them. As a result of “auto-sanctioning”, the company has already come under pressure over not being able to service its bond obligations. The real question here is if the company itself will survive the current geopolitical climate?

While this investment still remains highly speculative, It would seem the worst is now over for Evraz shareholders, at least given the recent inflow of good news. My investment thesis seems to have stood its ground over the course of the past month, even though a lot has happened. This is by no means a guarantee that the situation could not get progressively worse overnight. Still, Abramovich’s positioning in the peace talks and the ongoing aggressive PR campaign is standing to greatly benefit the company. It will be interesting to see how the situation will develop throughout the following weeks and months. From a personal standpoint, having already scored unrealized gains close to 50%, I would be forced to make a decision on whether or not I will sell when and if the trading is reenabled, as it remains suspended up until today. Given that the entire investment would be paid back with year’s worth of dividend payments, I would most likely look for ways to expand on my position if the opportunity presents itself.

Be the first to comment