Jack Gao

Vornado Realty Trust (NYSE:VNO) is a New York-based real estate investment trust (“REIT”) that owns primarily office properties in and around Manhattan, and to a lesser extent, street retail properties. In addition, they own select assets in the Chicago and San Francisco markets.

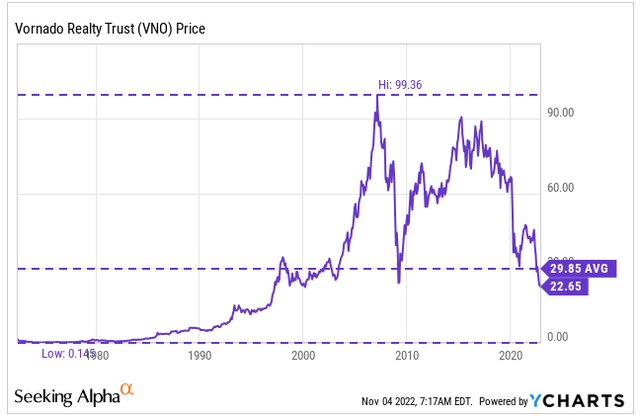

The company is a component of the S&P 500 and has been one of the worst-performing stocks in the index, down nearly 50% YTD. Presently, shares are languishing around their 52-week lows and at trading levels not seen at any time in recent memory.

YCharts – VNO Share Price History

Remote and hybrid working arrangements continue to pose a secular threat to not only VNO but to the entire office sector. Rising interest rates and a significantly challenged lending market are also a significant headwind for the company. And to top it off, the current dividend appears to be at risk, based on management’s comments during the Q3FY22 conference call.

With this in mind, one can understand why most investors have taken flight from the stock or have avoided it altogether. The current fundamentals, however, are significantly improved from prior periods. The company also has +$3.3B in total liquidity and was able to reduce their variable rate exposure during the quarter, despite tighter capital markets. A reduction in the dividend would be a major disappointment for income investors, but this would likely be offset by the upside potential in the stock, which I think is at least 25%.

Lower Leasing Levels In New York, But Pipeline Remains Robust

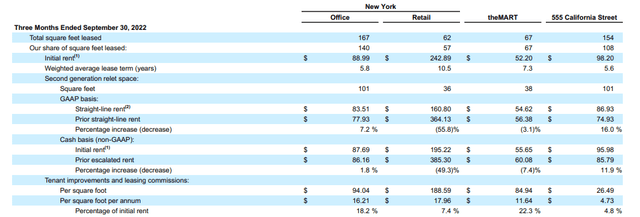

VNO signed a total of 450K square feet (“SF”) of space during the quarter, 250K of which was in their New York market, their primary operating region, representing approximately 85% of total net operating income (“NOI”).

Of the 250K SF signed in New York, 167K was attributable to office space, which itself accounts for over 60% of total NOI, and the remainder to retail space, which accounts for about 18% of total NOI. And regarding roll-ups, cash spreads on their New York office signings came in at a positive 1.8%, while retail experienced a dramatic decrease of 49.3%.

Compared to the prior quarter, total office signings in the New York market were down 134K. And though New York retail signings were up 54K, the spread differential was significant, with a 51.3% increase reported in Q2 versus the 49.3% decline in the current period. This is in contrast with the improvement experienced in their office signings from 1.7% growth in the prior quarter to 1.8% in the current.

Q3FY22 Investor Supplement – Summary Of Quarterly Leasing Activity And Related Spreads

When asked on the earnings call about the decline in retail spreads, management didn’t respond directly to the decline, preferring instead to provide a general assessment of the macroeconomic environment in the city, which is believed to have hit bottom on the retail side.

Though office activity in New York was down from the prior quarter, overall leasing volumes in Manhattan surpassed pre-pandemic averages. Additionally, there was approximately 1.5M SF of leases in advanced negotiation and proposal stages as of quarter end with primarily new and expanding tenants operating in non-tech sectors, such as Financial Services and Private Equity.

YTD, volume is up to 24M SF, which is 50% above where they were last year. And of the total signings during the current quarter, 16 of them were related to headquarter signings in excess of 100K SF, which is suggestive of their larger tenants’ commitment to quality New York office space.

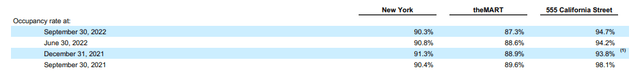

Though New York Occupancy Remains Above 90%, It Still Lags

Still, despite the solid leasing activity, occupancy still lags. In fact, it was down in both their New York and Chicago markets from the prior period. In New York, office occupancy declined 30 basis points (“bps”), while retail declined by a more notable 190bps.

Q3FY22 Investor Supplement – Summary Of Portfolio Occupancy By Quarter

In relation to the end of 2019, New York occupancy still has 640bps of opportunity. Though secular threats associated with hybrid working arrangements is certainly an impediment to returning to pre-pandemic benchmarks, the market is likely to provide a few tailwinds to improvement.

For one, employment prospects continue to improve. And as businesses reassess spacing requirements, they are increasingly prioritizing residing in the highest quality buildings with modern amenities and collaborative spaces. This bodes well for VNO, whose portfolio is largely comprised of these types of buildings.

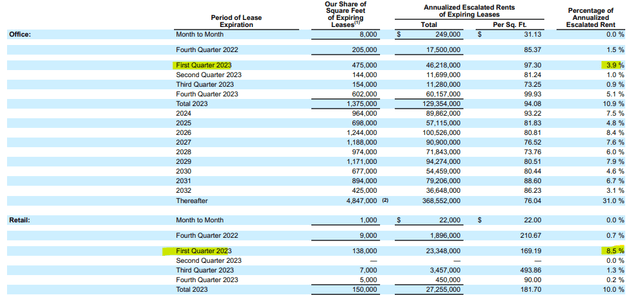

Manageable Near-Term Expirations In Office Portfolio

Though VNO’s leases have extended terms, with a weighted average lease term (“WALT”) of 9.2 years and 11.6 years in their New York office and retail portfolios, respectively, there are a few large expirations set for the first quarter of 2023, amounting to a total of about 12.4% of annualized escalated rent.

Q3FY22 Investor Supplement – Lease Expiration Schedule

Among the offices, the expirations are concentrated to four properties, which were noted to be among the highest quality of their buildings. As such, there was a more optimistic tone in being able to renew these properties.

Less confidence, however, was conveyed in the retail market. While all in the market could ultimately renew, it could be at lower spreads with a greater amount of concessions. Nevertheless, it’s unlikely to be any worse than the current quarter’s decline, which was about 50%.

The Looming Dividend Cut

One surprise out of the earnings call was the disclosure of an eventual rightsizing of their dividend payout in 2023 due to lower expected taxable income, resulting in part by the assumed lack of proceeds from asset sales. Currently, the quarterly dividend is $0.53/share, which represents an annualized yield of over 9% at current pricing.

For income investors, the payout has been one of the biggest, if not only, reasons for investing in the stock over the past year. And from a coverage standpoint, the payout appears to be adequately covered. As a percentage of current period funds available for distribution (“FAD”), for example, the payout was just 80.3%, which is down 520bps from last year. On a strictly FFO basis, the payout is even lower, at 65.4% versus 74.6% last year.

The issue, however, is not necessarily the coverage. Instead, it’s due to the lack of expected taxable income, which is the key determinant of their dividend payout. Contributing to the pessimistic outlook on taxable income is the lack of proceeds from asset sales, which is a market that is significantly constrained due to the hesitancy to lend in the current environment.

But taxable income is not the same as the income reported for financial statement purposes. As such, one cannot ascertain much from their current earnings release, other than management’s explicit acknowledgement of the need to cut. When pressed on what the cut may look like, they placed the onus on the Board and demurred accordingly.

CEO Steve Roth did allude to the 9-10% yield being too high for the stock. Looking back at years prior to 2020, one can see that the dividend generated a yield of between 3-5%. At current pricing, the dividend would need to be cut by over 50% to achieve yields in line with a target of 3.5%-4%.

Though this would be a major disappointment to income investors, it is still speculative, given the unknown of where taxable income will ultimately settle. And in later periods, there is always the possibility of a special dividend following any large asset sales or transfers of equity interests in any of their existing ventures. This would offset at least some of the losses incurred from any dividend cut.

The Upside Potential In The Shares Would Likely Offset Any Dividend Cut

VNO’s quarterly results were generally positive, with double-digit same-store cash NOI growth, positive leasing spreads in their office portfolio, and stable occupancy levels, all factoring into the continuing recovery in their operations. Strong leasing volumes in Manhattan, in addition to their robust 1.5M SF leasing pipeline, are also indicative of the staying power of their quality office properties.

Significantly tighter operating conditions, however, are pressuring several aspects of their business. Rising interest rates, for example, are providing a notable offset to otherwise robust FFO growth, and the inflationary environment is creating roadblocks in their development efforts. Lender hesitancy in the CMBS market is also hindering large asset sales to non-cash buyers.

The company does have a significant cash balance that is earning much higher interest rates. And this offsets some of the hit on the expense side. In addition, they took several steps in the current quarter to reduce their variable-rate exposure and to extend out their existing maturities. As a result of these actions, the company has now addressed all their significant maturities through mid-2024. This should, therefore, insulate them from near-term refinancing risks.

Despite the solid liquidity position and the continued improvements in the fundamental outlook for their offices, most investors have taken flight from the stock or have avoided it altogether. For those that remain, the high-yielding dividend payout was one of the few explicit draws to the stock.

The payout, however, appears to be at imminent risk due to management commentary that noted a rightsizing was in order due to lower projected taxable income. Though the size of any cut was not mentioned, one can surmise that it will be large enough to bring yields down to more historical levels.

While this would be a major disappointment, there is more than enough upside potential in the stock to overcome these losses. At just 7.3x forward FFO, shares are trading lower than the 13.9x they commanded at the end of 2020.

Granted, there was some hope at that time of a full return to the office at some point as opposed to the more consensus view on hybrid work at present. This would justify some compression in the multiple. But a 50% reduction seems overdone, considering large companies are still committing to long-term leases at positive renewal spreads despite the rise of hybrid working arrangements.

Even if shares were to track up to a 9x multiple, which is still significantly below where it traded in prior years, the stock would have embedded upside of about 25%. For opportunistic investors seeking to deploy capital into a sector that appears to have been abandoned by most, VNO offers an attractive risk/reward proposition.

Be the first to comment