The light of day blowing the Bitcoin bluff away.

Evgen Zaitsev/iStock via Getty Images

NEW YORK (June 19)-As I write this, Bitcoin (BTC-USD) is struggling to stay above $19,000. It had sunk to around $17,700 last night. It’s doing what will probably be a “dead-cat bounce” this morning, what can I say? “Fools rush in…”.

Long time followers know me as a long-standing Bitcoin skeptic, first in comments and then in this first article from last March, as Bitcoin peaked, as I heard friends of my adult children fall for the ephemeral internet phenomenon. But something else happened around that time: Congress passed and the president signed H.R.1319 – The American Rescue Plan Act of 2021, that pumped $1.9 trillion into the U.S. economy that was already in recovery from the Covid 19 pandemic. (2021Q1 GDP printed at 6.3%; Q2 at 6.7%)

Bitcoin’s ultimate peak at nearly $67,000 came on November 10, 2021, in anticipation that the House of Representatives would pass “Build Back Better”, another planned $1.7 trillion stimulus. But when Sen. Joe Manchin (D-WV) and others effectively killed the stimulus in January, Bitcoin plunged, again, to its first quarter nadir of $35,047 on January 23rd.

Thereafter, Bitcoin bounced around a narrow range from around $30,000 to a high of around $47,000. Then, as talk of a June Fed rate hike accelerated, the Bitcoin bluff came into full view: if people have a place to put their money, they won’t put it on nonsense and hype. Bitcoin’s rapid appreciation was always a function of the Fed’s excess liquidity and easy fiscal policy. It was always a function of the Fed’s ZIRP or thereabouts.

Bitcoin’s collapse was always going to happen when the macro environment changed. It was a fool’s errand. But what about all the canards of the crypto cult?

- “Bitcoin is only available in a limited quantity, unlike fiat currencies.”

Except that it’s not. As I have related previously to critics on my previous Bitcoin articles, when you go to Baskin-Robbins and they’re out of Chocolate, most people will take Vanilla, or Strawberry or some other of their 31 flavors. If Bitcoin is too expensive, there is Dogecoin (DOGE-USD), Ethereum (ETH-USD), Solana (SOL-USD), ad infinitum to the 10,000+ cryptos currently available.

- “Bitcoin is a store of value.”

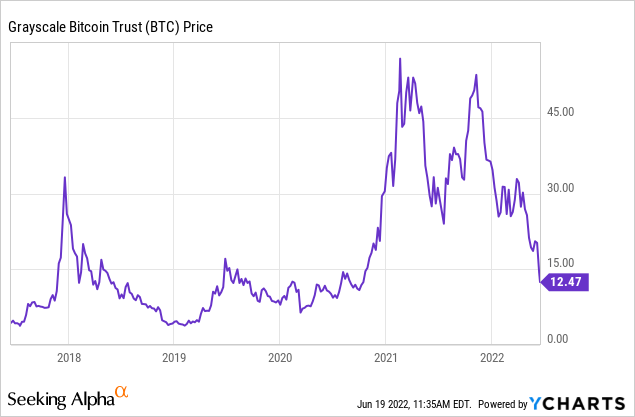

This canard is refuted by a simple glance at the chart above. But the Bitcoin cultists will almost always reply, with another canard:

- “it’s like gold or silver; it’s a commodity.”

Except that it’s not. It never was. It doesn’t even meet the definition of a commodity, save for some literary analogical definition (e.g., “the dearest commodity is time”). Investopedia defines a commodity as ” a basic good used in commerce that is interchangeable with other goods of the same type”, such as oil, lumber, potash, etc. Bitcoin isn’t a “good”; it’s ephemera; it has no use. Nobody’s going to give their spouse a pair of Bitcoin earrings or a Bitcoin necklace. Nobody’s going to have a cavity filled with Bitcoin.

- “Government doesn’t control Bitcoin.”

That is less a canard than a purported strength that is, in truth, a fatal flaw. It is a “strength” to something that aspires to be a currency the way that the Maginot Line was a “strength” against the Third Reich.

It’s true no government controls it, so no government supports it. That means when Bitcoin enters a free fall vis-a-vis real government-backed currencies, there is nothing there to support it. Of course, when real currencies collapse relative to their creditors, the central bank of the currency’s issuing country can decide – or not – to support it. For Bitcoin, there is no “trading band”; there is no “floating exchange” determined by a country’s fiscal policymakers. There is only the vagary of the market.

- “Bitcoin is gaining acceptance by Wall Street banks.”

Bitcoin is gaining acceptance by Wall Street banks because they are responsive to the desires of their clients. It’s like the latest skin treatment or fat-burning drug. A doctor may prescribe it because his patients want it; it’s not that the doctor thinks it’s good for the patient. This week will be telling for Bitcoin. Some may think that it is a good time to hodl. I can’t warn away from such thinking enough. You are better off in cash. Earning 1% in a savings account in an 8.5% inflationary environment so that you lose 7.5% in real dollar value is superior to losing far more when Bitcoin suffers its inevitable loss (which could continue at any time).

____________________________________

NOTE: Our commentaries most often tend to be event-driven. They are mostly written from a public policy, economic, or political/geopolitical perspective. Some are written from a management consulting perspective for companies that we believe to be under-performing and include strategies that we would recommend were the companies our clients. Others discuss new management strategies we believe will fail. This approach lends special value to contrarian investors to uncover potential opportunities in companies that are otherwise in a downturn. (Opinions with respect to such companies here, however, assume the company will not change).

Be the first to comment