ablokhin

Introduction

Thank you to @CaptainCapitalist for providing a comment that perfectly describes investing in Old Dominion Freight Line, Inc. (NASDAQ:ODFL):

Love the business, it’s always expensive. Just buy it and forget about it.

Old Dominion Freight Line is hands down my favorite less-than-truckload (“LTL”) company. Unfortunately, I don’t own it. In this article, we’re going to discuss the company’s strengths that make it a superior holding for people seeking cyclical industrial exposure. This includes my latest thesis, based on the return of supply chains in the United States. Moreover, the cyclical bull case (for lack of a better name) is starting to see cracks. The company is failing to grow tonnage as macro weakness is hitting customers. While pricing remains strong, the company isn’t growing its market share anymore.

If current conditions continue, we might be looking at an attractive entry in 2023, before the Fed is eventually forced to pivot for real.

At that point, we can finally put some serious money to work in ODFL, which almost certainly will continue to be a long-term total return dividend growth star.

Now, let’s dive into the details!

A Better Fright Line

I’ve never been a fan of trucking companies in the past. That’s mainly based on high capital expenses (a lot of equipment is needed), labor shortages, very low entry barriers for new competitors, and other inflationary factors like fuel and risks of shortages.

It’s why I have invested a big part of my capital in railroads. I always believed it’s a lower-risk alternative with better shareholder returns.

While I still believe that to some extent, I have changed my mind a little bit. At least when it comes to Old Dominion Freight Line, a trucking company that despite its name is not located in Virginia.

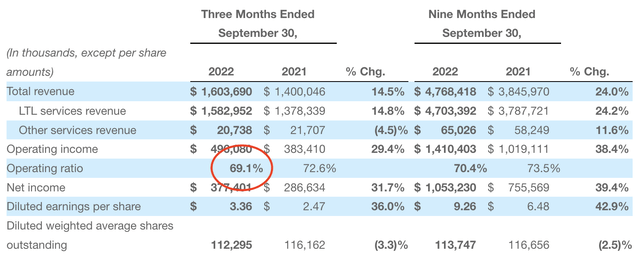

Founded in 1934 and located in Thomasville, North Carolina, ODFL has become the largest pure-play LTL trucking company in the United States. Not only that, but it is also the most efficient company with an operating ratio of less than 70%.

This means it costs less than 70% of total revenues to operate the company. That may sound like a lot, but it’s extremely low. Many strong competitors have ratios above 80% or even 90%. Most smaller operators struggle to be profitable. As a comparison, a lot of railroads are currently operating with ORs in the low 60% range. They will eventually move back to the mid-55% range, yet the fact that ODFL is coming so close is beyond impressive.

The question is, how does ODFL get it done? First of all, using close to 11,000 trucks, ODFL operates in 48 states, where it owns 255 service centers to connect customers. These service centers allow the company to offer a wide menu of services, including regional, inter-regional, and long-haul LTL, time-sensitive and appointment shipments, container drayage, truckload brokerage, and international LTL (Mexico and Canada).

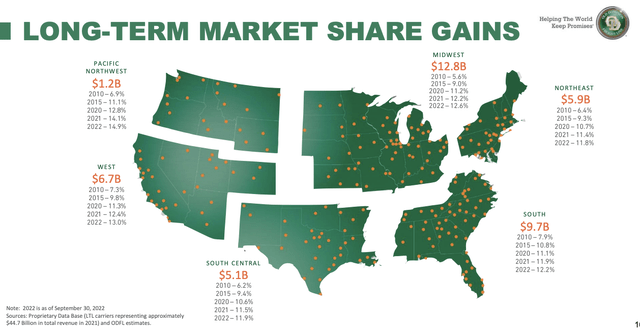

This has allowed the company to grow its market share in every region. In some regions, its market share has more than doubled since 2010. Note that this mainly happened organically, meaning not by simply buying competitors. That’s another reason why these numbers are so impressive.

To use the company’s own words:

We believe the growth in demand for our services can be attributed to our ability to consistently provide a superior level of customer service at a fair price, which allows our customers to meet their supply chain needs. Our integrated structure allows us to offer our customers consistent, high-quality service from origin to destination, and we believe our operating structure and proprietary information systems enable us to efficiently manage our operating costs.

The company is consistently investing as much in real estate as it invests in trucks and trailers, allowing it to run a highly efficient network of distribution centers.

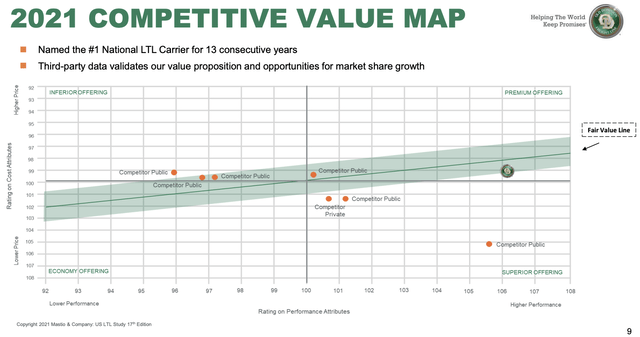

Using ODFL’s overview, the company offers the same price as most of its competitors, yet it can deliver a better performance. Hence, it explains high market share gains.

Moreover, the company’s on-time performance improved from 94% in 2002 to 99% in 2022. The cargo claims ratio declined from 1.5% in 2002 to just 0.2% in 2022. It has won the Mastio Quality Award for 13 consecutive years.

As I already briefly mentioned, this is bearing fruit.

In 2002, ODFL had a market share of 2.9% in an LTL industry worth $19.4 billion. That number has improved to 11.4% in 2021. The LTL market has grown to $46.1 billion. This also means that there is still a lot of room to grow organically.

With that said, all of these numbers translate into one major thing: outperformance.

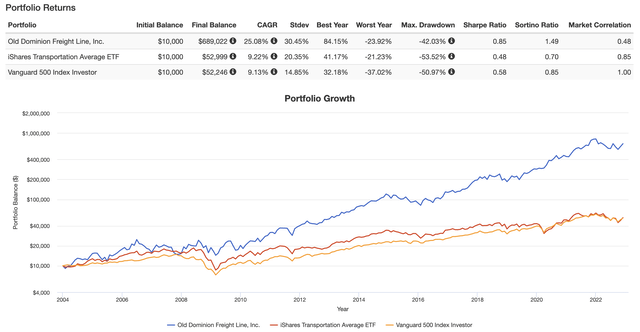

Going back to 2004, ODFL shares have returned 25% per year. That’s not a typo and it beats most well-known tech stocks. During this period, the S&P 500 returned 9.1%. The iShares Transportation ETF (IYT) returned 9.2%.

Despite a standard deviation of 30%, ODFL shares also outperformed the market on a volatility-adjusted basis (Sharpe/Sortino ratios).

Before we dive into current events, let’s discuss the dividend.

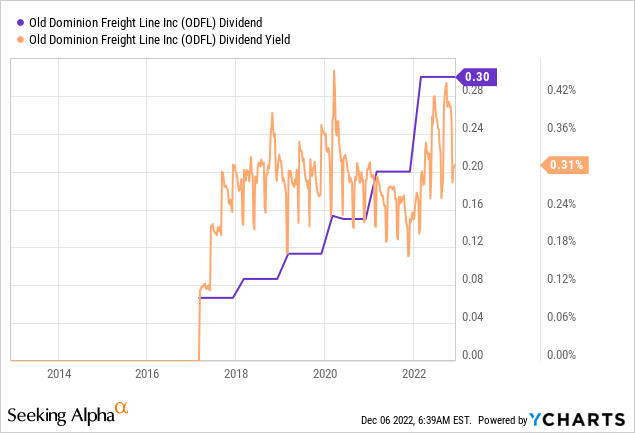

The ODFL Dividend

There’s good news and there’s bad news. The bad news is that ODFL’s dividend yield is very low. The focus is on dividend growth instead of a high yield, and sky-high capital returns have kept the dividend yield from rising.

ODFL shareholders currently enjoy a $0.30 per share per quarter dividend. That’s $1.20 per year, which translates to a 0.4% yield.

The good news is that dividend growth is high. Over the past five years, the average annual growth rate has been 43%.

The most recent hike was announced in February of this year when the dividend was hiked by 50%.

Moreover, the payout ratio remains extremely low. The non-GAAP payout ratio is just 9.4%. The sector median is 23%.

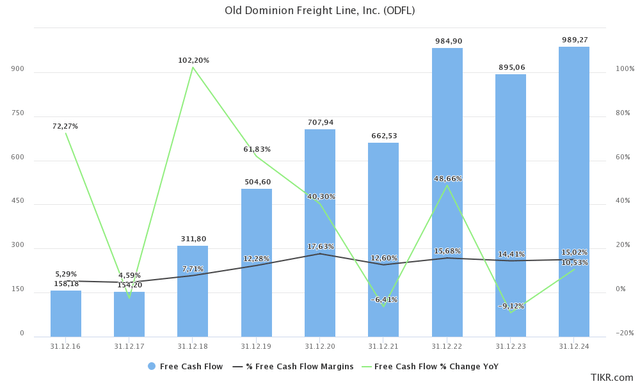

If the company is indeed doing close to $1.0 billion in annual free cash flow going forward, we’re dealing with a 3% FCF yield. This means the 0.4% dividend yield is covered and likely to continue to rise rapidly.

But then again, ODFL is a total return investment, it’s not great for investors depending on a decent yield.

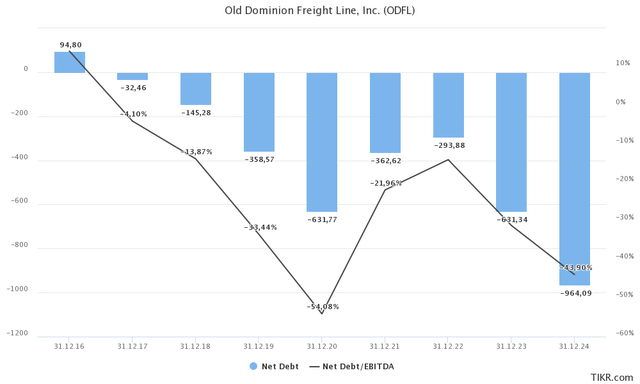

It also helps that the ODFL balance sheet is extremely healthy. The company has more cash than gross debt. It’s a core strength of ODFL. It generates high free cash flow, which it can invest in its company. The company is gaining an increasing competitive edge over companies that need to prioritize financial health and/or the ones that aren’t even profitable yet.

With that said, there are reasons to believe that we could get a better entry in 2023.

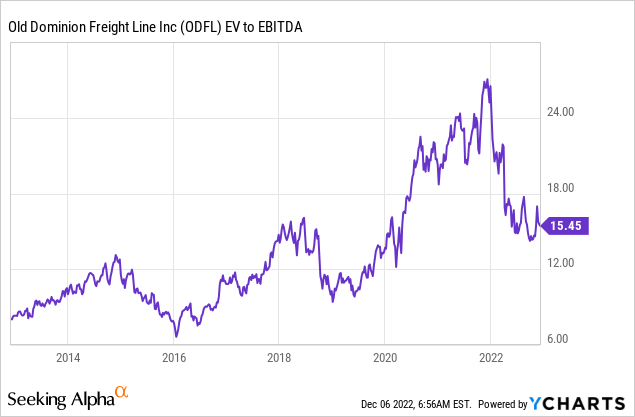

Valuation & Buying Strategy (Macro Update)

ODFL has never been really cheap (hence I started this article with a fitting quote). That makes sense, as the company has “never” disappointed. Even during the Great Financial Crisis, it made great progress.

Now, the company is trading at 15.7x 2023E EBITDA of $2.0 billion. This is based on its $31.4 billion enterprise value, consisting of its $32.0 billion market cap and $630 million in 2023E net cash (negative net debt).

That valuation is not a dealbreaker. Especially for long-term investors.

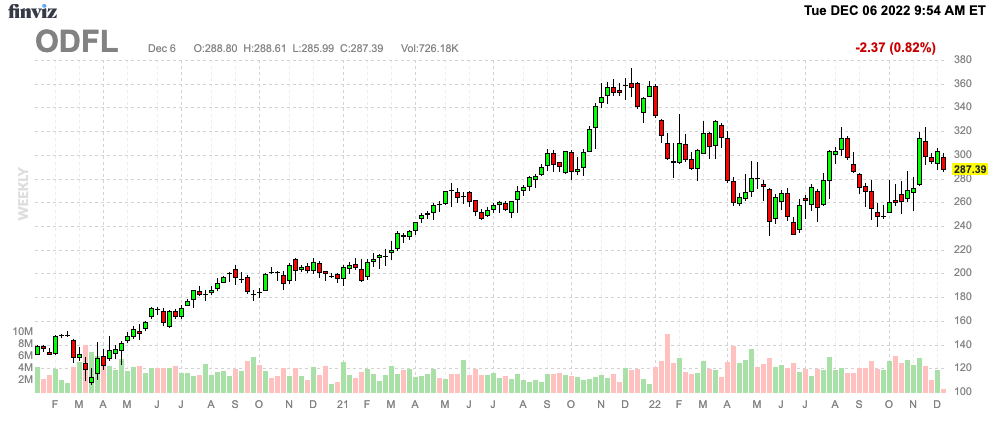

However, I believe we could get a better valuation. I’m looking to buy Old Dominion Freight Line below $240. I almost got the chance in September, yet the stock took off to $320. This shows how resilient the company is, even in the current business environment.

FINVIZ

That said, cracks are starting to appear.

On December 5, the company updated investors on its operations. In November, revenue per day increased by 7.3%. That’s a good result based on an increase in LTL revenue per hundredweight.

Unfortunately, total LTL tonnage was down 8.6%. This was caused by 7.3% lower LTL shipments per day and 1.4% lower LTL weight per shipment. Quarter-to-date, LTL revenue per hundredweight and LTL revenue per hundredweight, excluding fuel surcharges, increased by 17.3% and 8.6%, respectively.

While ODFL remains in a good spot to use pricing to its advantage, the economy is softening.

Greg C. Gantt, President and Chief Executive Officer of Old Dominion, commented, “Old Dominion’s revenue growth for the first two months of the fourth quarter reflects the ongoing improvement in our yield, which more than offset the decrease in volumes. We believe the year-over-year decrease in volumes is primarily due to continued softness in the domestic economy, as customer demand for our superior service has remained consistently strong.

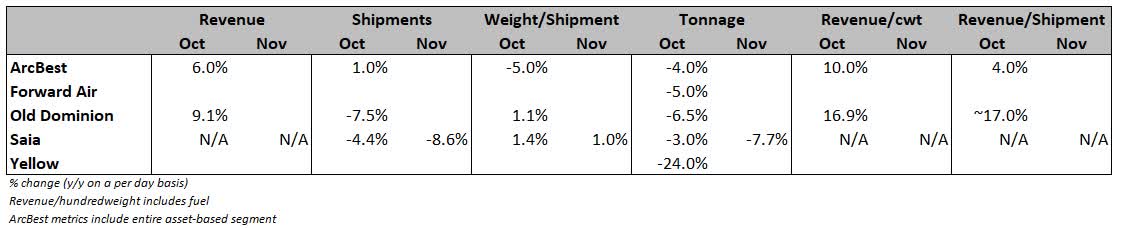

Moreover, FreightWaves highlighted the struggles when it comes to growing the market share.

On the third-quarter call in late October, Old Dominion’s management was optimistic that tonnage trends could reverse by the spring. It noted the company fails to take market share for three to five consecutive quarters during downturns and the 2022 third quarter was the third straight period in which the carrier missed its share-gain mark.

While this market environment is challenging, the company has roughly 25% excess capacity (as of the third quarter), which will allow the company to grow its margins as soon as demand rebounds.

For now, however, tonnage is down and pressure on pricing is rising. The table below shows tonnage data for the month of October. The latest ODFL numbers have not been included.

FreightWaves

I do not expect pricing and tonnage to bottom until the ISM index bottoms. That could likely be towards the end of the first half of 2023.

Wells Fargo

Now, there’s another thing I’m closely watching.

Supply Chain Reconfiguration

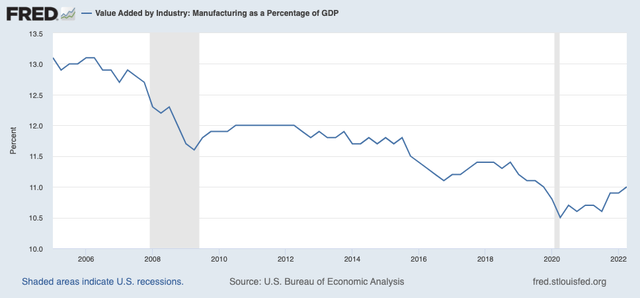

On December 5, I wrote an article focused on dividend stocks in a scenario where supply chains are coming back to North America. ODFL could have been included as a fourth stock as LTL plays a big role in everything related to industrial production, inventory management, and longer-distance transportation.

This is what Fool.com wrote last year:

We’re moving supply chains back in the country, so we’re not just talking about goods going to the end user but stuff needs to get to the manufacturing plant as well. Whether we’re talking about, semiconductors or building materials, chemicals, whatever. These companies are opening and Old Dominion has been a great stock to own and it’s really a best-in-class operator in its segment.

Manufacturing in the United States is poised to rebound as companies from Asia and Europe are relocating production back to North America.

What started with de-risking efforts in China after the pandemic is now turning into a big trend fueled by companies who want to be closer to the North American consumer, government initiatives to support semiconductors and EV production, and overseas issues like the European energy crisis and regulatory headwinds.

Also, once the ball starts to roll, the U.S. is in a terrific place to boost re-shoring benefits even more.

When you begin to nudge that a bit with industrial policy-as we are seeing with the Biden administration’s push around things like electric vehicles-suddenly you start to be able to connect the dots. An electric-vehicle production facility in South Carolina could perhaps connect with a textile maker in North Carolina, who then might be able to move from making clothing to making upholstery for an electric vehicle or, potentially, a cloth to cover wind turbines. I see a lot of potential there, and I think we’re only at the beginning of it being realized.

We’ll talk a lot more about this in the future, but for now, it’s definitely something that will benefit ODFL on a long-term basis.

Takeaway

Old Dominion remains one of my favorite dividend growth stocks. The company has figured out how to beat competitors in a highly competitive LTL market. The company is aggressively investing in capabilities that now come with strong pricing power and superior service quality.

As a result, the company has become a fast-growing company with high free cash flow, a healthy balance sheet, and aggressive dividend growth.

Unfortunately, its yield is low and the valuation is still somewhat lofty.

That could change as cracks started to appear. While ODFL continues to benefit from its superior business model, volumes are down as economic demand has gone soft. This could worsen going into 2023, pressuring margins and revenues.

If that happens, I’m happy to step up and buy. My target is a price below $240. *If* economic conditions continue to worsen, I would not bet against a decline to $220.

Looking beyond the upcoming recession, I have zero doubt that Old Dominion Freight Line will remain a highly attractive dividend growth total return champion. However, getting a good entry point for ODFL is key.

(Dis)agree? Let me know in the comments!

Be the first to comment