jcrosemann/iStock via Getty Images

Introduction

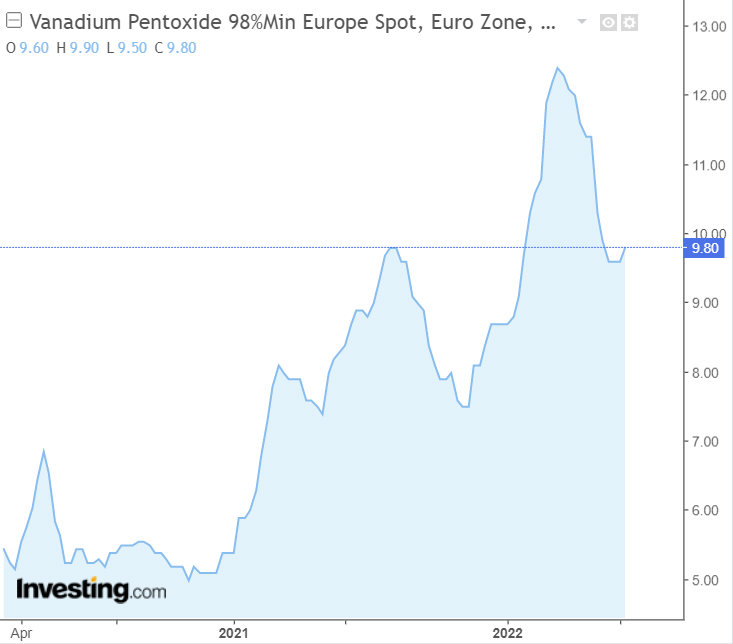

Largo (NASDAQ:LGO) is among the companies on my shortlist and its share price hasn’t been performing well over the past few months. In late 2021, the company released an updated life of mine plan for its Maracas Menchen vanadium mine in Brazil that showed an after-tax net present value (NPV) of $2 billion at $8.50 per pound of vanadium. Vanadium prices have been strong this year but Largo had underwhelming results in Q1 2022 due to maintenance and global logistical constraints as well as a strong Brazilian real. Yet, production is expected to improve over the remainder of 2022 and vanadium demand is looking strong which means that this could be a good time to open a small position here. Let’s review.

Overview of the recent developments

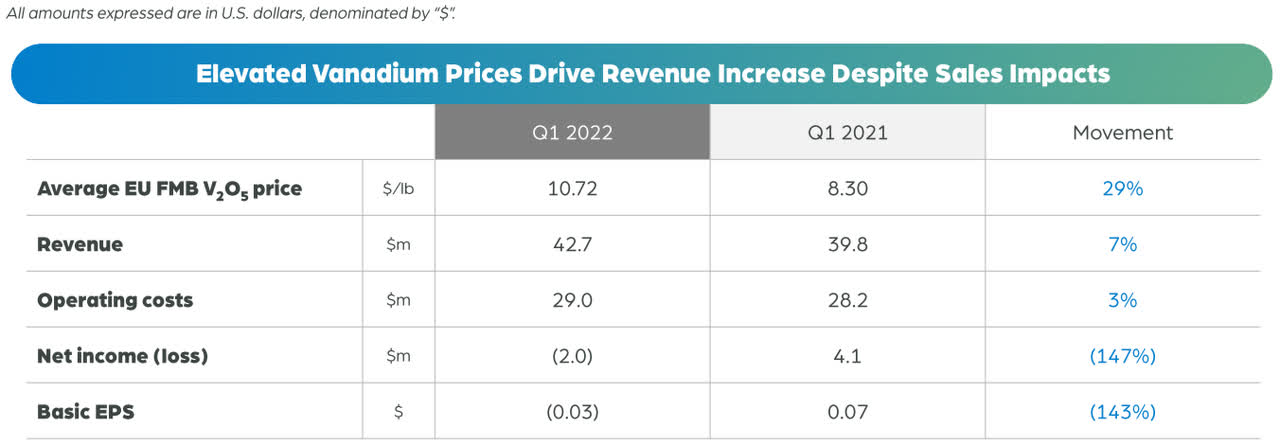

Largo’s main asset is the Maracas Menchen project in eastern Brazil, which is the highest-grade vanadium mine worldwide. In Q1 2022, vanadium prices soared by 29% year-on-year but Largo’s revenues rose by just 7% and the company swung to a $2 million net loss.

Largo

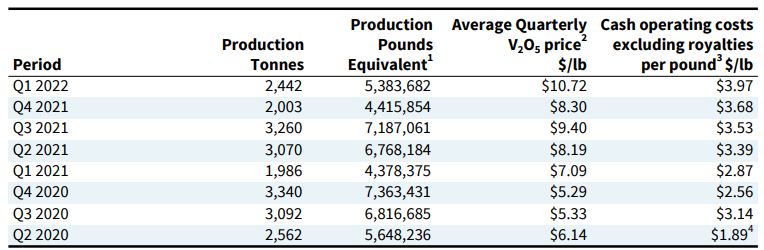

In Q1 2022, Maracas Menchen sold 2,232 tonnes of V2O5 equivalent, compared to 2,783 tonnes of V2O5 equivalent a year earlier. In January, production was affected by high rainfall levels from the end of 2021. In February, there was a shutdown for corrective maintenance on the cooler engine system and power substations. Production in Q1 2021 was also weak but combine low output with a strong Brazilian real and global supply chain issues and we get significantly higher cash operating costs per pound this time around.

Largo

However, Largo revealed in its presentation for the Q1 2022 results that the production rates are back on track and that Maracas Menchen sold 1,246 tonnes of V2O5 equivalent in April.

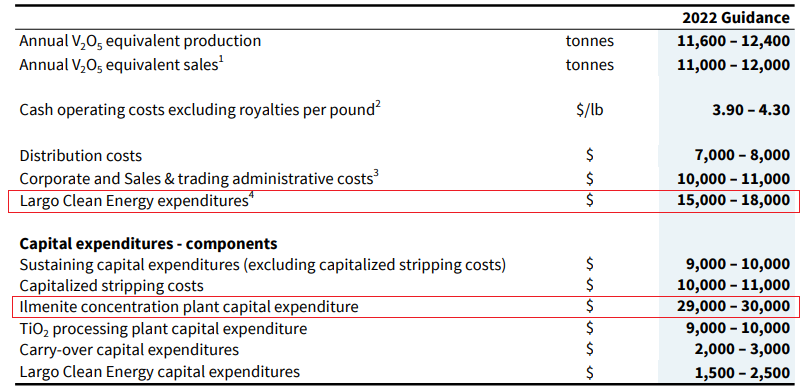

Unless there are any additional maintenance issues, I expect the mine to be producing about 1,000 – 1,100 tonnes of V2O5 equivalent per month over the remainder of 2022. However, I expect the Brazilian real to remain strong as the country is a major exporter of oil and the central bank is increasing interest rates rapidly. Also, it’s hard to predict when global supply chain issues will be resolved. Looking at Largo’s 2022 guidance, the company forecasts selling about 11,000 – 12,000 tonnes of V2O5 equivalent at cash costs $3.90 – $4.30 per pound.

Turning our attention to the balance sheet, the situation still looks good as Largo had over $78 million in cash and debts of just $15 million as of March. However, the company is investing a large amount of funds in 2022 in the construction of an ilmenite concentration plant as well as the setting up of its clean energy division.

Largo

I’m a little disappointed that the new plant will cost $29 – $30 million considering Largo said in 2021 that construction would cost about $25.2 million. This facility will have an annual production capacity of around 150,000 tonnes of ilmenite concentrate and it forms part of the company’s plans to produce titanium dioxide pigment as a by-product in the future.

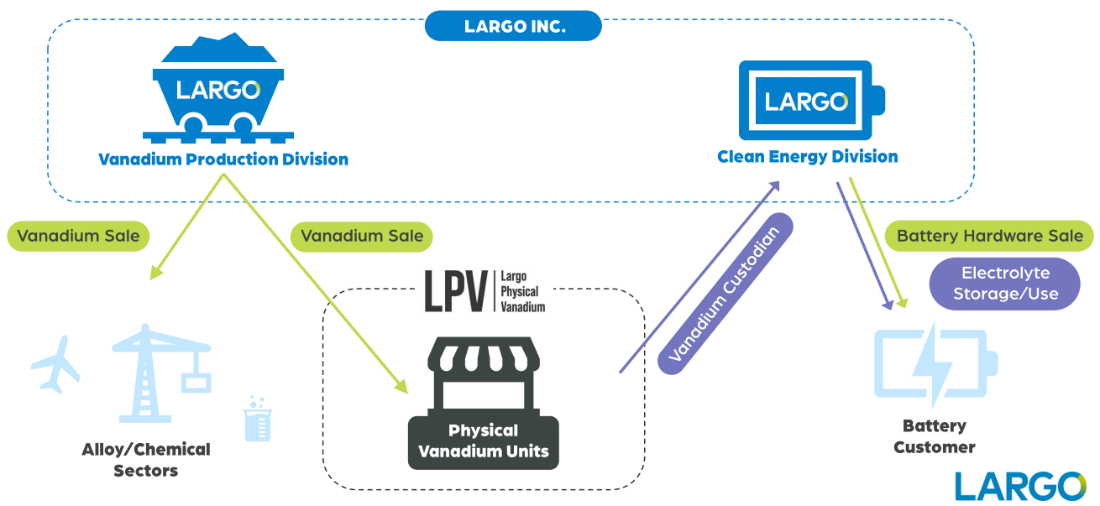

Turning our attention to the clean energy division, Largo recently began producing stocks and purifying electrolyte in its product development and stack manufacturing center in the US state of Massachusetts. In April, it announced plans to create a listed physical vanadium company through a reverse takeover with a firm named Column Capital. Largo will hold 50% of this company and said during its Q1 2022 earnings call that vanadium for its vanadium redox flow batteries will come from it, thus reducing their costs as the material will not be part of upfront installation capital taken on by its customers.

Largo

Overall, I think that this is an interesting idea, but it seems that Largo’s clean energy business is still at a very early stage, and I doubt it’s worth much at the moment. The focus of Largo is still on Maracas Menchen which means we have to talk about vanadium prices. At the moment, vanadium pentoxide prices in Europe are hovering near $10 per pound, which is lower than the levels reached in March but is still much higher compared to Q4 2020.

The vanadium market is expected to remain in a structural deficit over the next several years and this should support prices. In 2021, the supply deficit stood at more than 8,000 tonnes of V2O5 equivalent.

Looking at 2022, if vanadium prices average $9.00 per pound between May and December, Largo should generate free cash flow of around $20 million and finish the year with about $104 million in cash. And if vanadium prices average $12.00 per pound between May and December, the company is set to book free cash flow of about $41 million.

Overall, I think that Largo has had two consecutive weak quarters due to bad luck and that a return to profitability and normal production levels should provide strong support for its share price. I think that the share price could double by the end of 2022. The NPV of Maracas Menchen is $2 billion and the share price of the company usually performs well when vanadium prices are high. When V2O5 prices in Europe surpassed the $10 per pound mark in January 2018, Largo was trading just above $10 per share. When V2O5 prices in Europe surpassed the $20 per pound mark in September 2018, Largo’s share price was already at above $25. In my view, the company just needs to keep out of trouble so that vanadium price increases start become reflected in its share price performance once again. Even at a market valuation of $1 billion, Largo would be trading at only 0.5x NAV (and the technical report used an average vanadium price of just $8.50 per pound).

Looking at the risks for the bear case, I think the major one is lower vanadium prices due to a global recession. The vast majority of vanadium is used by the steel industry, and we are seeing more and more signs of stagflation around the world. This could severely impact steel demand in the near future, which could lead to a disappearance of the supply deficit in the vanadium market.

Investor takeaway

Production at Maracas Menchen was affected by strong rainfall in Q4 2021 and early Q1 2022 and then the mine had technical problems in February. Supply chain issues and a strong Brazilian real have pushed Largo’s financials in the red and the share price performance in 2022 has been poor so far.

However, vanadium prices are high, and it seems that production levels are back on track, so Q2 2022 results should be good. I expect them to provide a boost for Largo’s share price. The NPV of Maracas Menchen is $2 billion and I think that Largo’s market valuation could double by the end of 2022 unless vanadium prices decrease significantly, or Brazil gets strong rains in Q4 again.

Be the first to comment