DNY59/iStock via Getty Images

This is the second of my series meant to answer the most common bear arguments against investing in SoFi Technologies, Inc. (NASDAQ:SOFI). My first article addressed stock-based compensation and dilution. Today I will respond to a group I call “loaners.” Loaners argue that SoFi is reliant on student loans, and continued extensions to the student loan moratorium or any student loan forgiveness will derail the company’s revenues and profits.

I will take a comprehensive look at the student loan issues as they relate to SoFi and show why it should not deter anyone from taking a position. In fact, the incredible execution to replace their student loan revenue and the latent catalyst represented by the eventual end of the moratorium (whenever that may be) only strengthen the bullish thesis. My next two SoFi articles will take a closer look at SoFi’s moat and profitability, but for today, the focus is strictly on the student loan business.

SoFi Student Loans – From Hero to Zero

SoFi was created to address the student loan problem. In 2011, Mike Cagney, Dan Macklin, James Finnigan, and Ian Brady founded SoFi with a mission to provide more affordable options for students who were taking on debt to fund their education. Student loans were their first product, and the company has become synonymous with the student loan refinance business. They also provide in-school loans, but refinancing existing loans has made up the bulk of student loan originations since the company was founded. After Anthony Noto came on as CEO in 2018, SoFi began to significantly expand its offerings. In 2019, the company launched SoFi Money (now Checking & Savings), Invest, Relay, and Home Loans (a relaunch of their previous mortgage business) to supplement their core student loan and personal loan business.

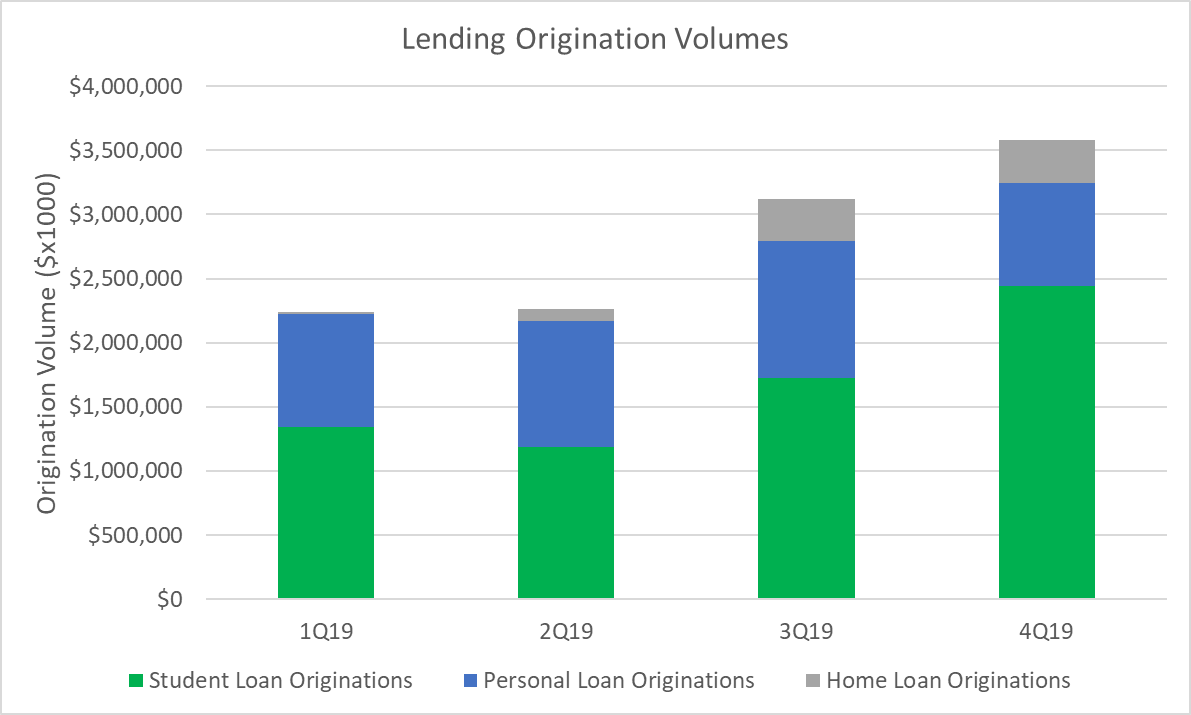

However student loans remained their hero product. In 2018, 99.5% of SoFi’s revenue came from lending, with student loans comprising 55.6% of their originations. In 2019, lending was still 98.9% of their revenue, and student loans had grown to 59.7% of originations. We don’t have detailed quarterly data from before 2019, but if you look at the data available, the trend is clear. Student loans were becoming an increasingly large piece of the SoFi lending pie, and therefore an increasingly large piece of SoFi’s revenue.

Breakdown of origination volume by loan type for 2019 (Author)

By the end of 2019, the lending business was firing on all cylinders and student loans were leading the way, representing 68.2% of all originations in 4Q19 and growing at a very fast pace. Then COVID-19 hit and the CARES Act paused all federal student loan payments and set interest rates to 0% effective March 13, 2020. This moratorium on payments and interest has been extended ever since, and federal student loan borrowers have not been required to make payments for over two years. The student loan refinance business decreased to $2.1B in originations in 1Q20 and predictably fell off a cliff thereafter.

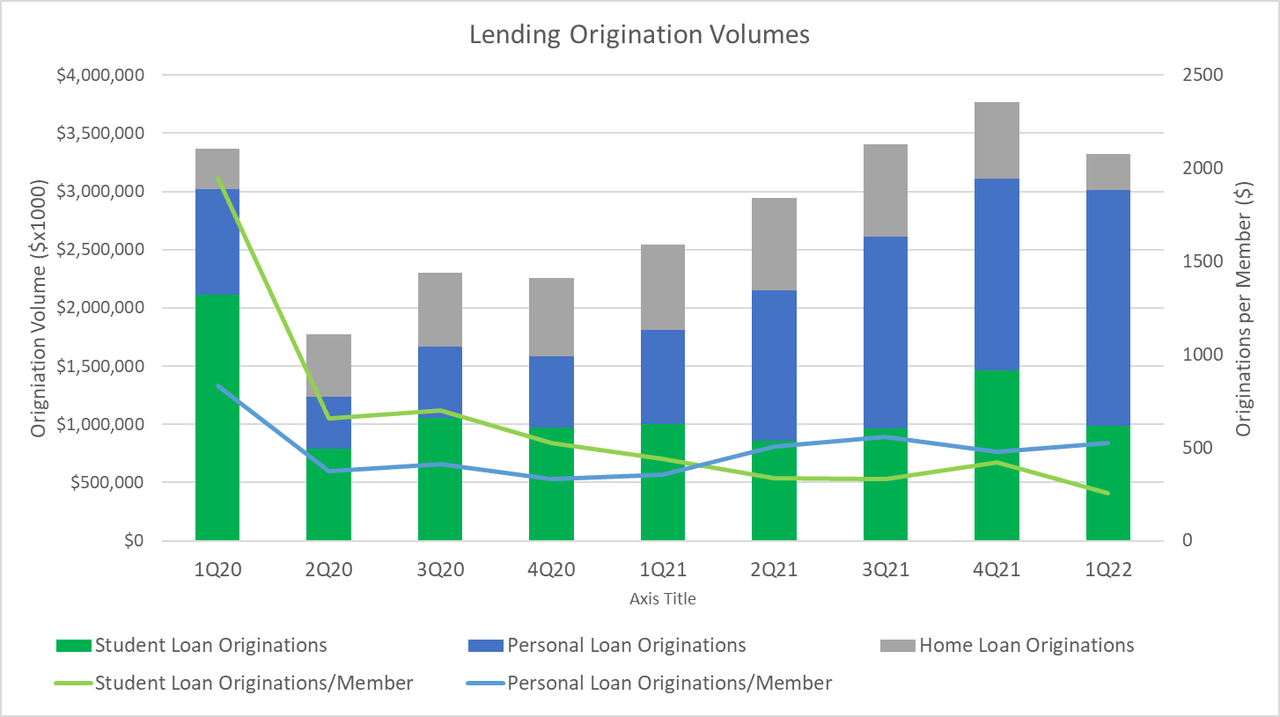

Breakdown of origination volume by loan type for 2020-present (Author)

Student loan originations have dropped 60% from the 4Q19 peak of $2.44B and are holding steady at around $1B in originations per quarter since then. The one exception was 4Q21, because the White House reiterated multiple times that they would in fact end the moratorium on January 31, 2022 as planned. This spurred refinancing until Omicron variant fears increased and the administration once again announced another 90 day extension on December 22, 2021, moving the expiration date from the end of January to May 1. The origination volumes for 2020 and 2021 tell a very different story for student loans from the 2019 numbers.

Two years of flat originations does not paint a pretty picture, especially when you consider that SoFi Members (what they call their customers) have almost quadrupled from 976M in 4Q21 to 3,868M in 1Q22. That means average student loan originations per member have gone from $2,501 to $254, just shy of a 10x drop. Some of that drop in originations per member is because they are diversifying their product offerings, but personal loan originations per member have only dropped from $820 to $524 in that same period, showing that the moratorium probably explains the bulk of lost originations.

Lost Revenue and Profits Are Gone And They Are Missed

The loaners do have one thing right. The loss in originations is a huge deal, and makes a big dent in SoFi’s top line and bottom line numbers. I won’t argue otherwise because I’d be lying. In the 4Q21 investor presentation, their own guidance says they would have had $30M-$35M in extra revenue and $20M-$25M in extra profits for 1Q22 if the moratorium ended as planned. In that scenario, the loan payments would have been restarting February 1, so only two of the three months would have had the full benefit of student loan refinancing.

Similarly, when payments were once again pushed back from May 1 to August 31, SoFi modified their full year guidance. Previously they included student loans restarting in May, but they made the strategic decision to remove all student loan revenue and profits from their full year guidance, assuming that forbearance will not end at all in 2022. This removed $100M in revenue and $80M in EBITDA from their guide. Using these two data points as a reference, my back-of-the-envelope estimates show SoFi has already lost at least $150M-$250M in revenue since the moratorium began until now. Their lending business operates at 40-50% margins, so that is somewhere around $60M-$125M of profits that are gone and never coming back. That is money they could have reinvested into the business, added to their cash reserves, used to hire more people, used to pay for part of their Technisys acquisition, spent on sales & marketing to grow their user base, or any number of other worthwhile endeavors.

Not only that, but their student loan business will remain muted until the moratorium is lifted. Currently, that is scheduled for August 31, but it will most likely be pushed back again (more on this below). Even with conservative estimates, every quarter the moratorium is extended means at least $40M in revenues and around $20M-$25M in profits that are not realized (revenues and margins should increase because of the bank charter which wasn’t included in the 1Q22 guidance or the original full year guidance). In fact, I think that’s hugely underestimating the impact student loans would be having right now, which I’ll break down in detail later. That revenue and profit stream is not coming back until September 1 at the earliest, and most likely won’t be seen in 2022 at all.

A Bullish Argument That Misses the Mark

When the subject of the moratorium comes up, I often see bulls comment that SoFi is a private lender, so their private loans are unaffected by the moratorium since they still accrue interest and still have to be paid. Private loans also cannot be forgiven through federal mandate. While both statements are true, it significantly downplays the lost revenue and profits discussed above. SoFi originates a loan, holds it on their own books while collecting interest for a number of months (about 3 months before the bank charter and now about 6 months), and then sells it on the debt market for a profit. Their revenues scale with originations because the more loans they originate, the more interest they collect in the holding period and the more loans they sell.

The moratorium significantly decreases the demand for student loan refinancing because people with federal loans are not worried about refinancing loans that they don’t have to pay. That is especially true if it means they are refinancing into private loans that will require payments starting immediately. Demand is dampened further by those hoping for forgiveness that they would not qualify for if they refinance from federal loans into private loans. These factors lead to less originations, meaning less interest revenue and less loans sold. SoFi’s top and bottom lines are significantly affected by a moratorium on federal loans even if the loans that they originate are private.

Status of Forgiveness and the Moratorium

I have no idea what exactly is going to happen with student loans. I do not believe that officials inside the administration or even the President himself can say definitively what the plan is. However, it is very important to understand the information that we do have about the moratorium and possible student loan forgiveness, as it has such a tangible and material affect on SoFi.

If Forgiveness Comes, It Will Most Likely be $10,000

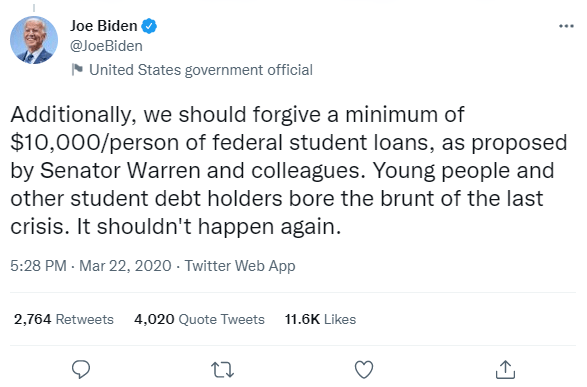

Biden has reiterated multiple times that if forgiveness comes, it will be in the range of $10,000 and not $50,000. On the campaign trail, he cited $10,000 at least three times. The first time was in a tweet on March 22, 2020, seen here.

Twitter

This was reiterated again in a piece that Biden published on Medium that included a proposal to “immediately cancel a minimum of $10,000 of student debt per person.” He repeated that same number again at a town hall just before the general election, saying it was his goal to “make sure everybody gets $10,000 knocked off their student debt.”

After winning the election, the message has been even more clear. Biden was asked in February 2021 how he would make $50,000 in forgiveness per borrower happen. His response was “I will not make it happen […] I am prepared to write off the $10,000 debt but not $50 [thousand], because I don’t think I have the authority to do it.” As recently as April 28, 2022, Biden again stated that “I’m not considering $50,000 in debt reduction, but I am in the process of taking a hard look at whether or not there will be additional debt forgiveness.” He went on to say that “I’ll have an answer on that in the next couple weeks.” A couple weeks stretched to 4 weeks, and on May 27, the Washington Post reported that the administration was leaning toward forgiving $10,000 in student loans per borrower with forgiveness phasing out as income increases above $125,000 for singles or $250,000 for married filing jointly. The article stated that the announcement was originally scheduled for his speech given at his alma mater, the University of Delaware, on May 28, but was to be delayed because of the Uvalde incident. The most recent news from the Wall Street Journal reports that Biden is now likely to announce his plans in July or August.

There was also a loud negative reaction by some parties to that Washington Post article. Thomas Gokey, the co-Founder of the Debt Collective said “It’s an absolute insult. This is less than what he promised on the campaign.” Meanwhile, NAACP President Derrick Johnson said, “Ten thousand dollars in cancellation would be a slap in the face.” It is possible that the visceral negative reaction could have prompted the decision to delay yet again.

Delays Most Likely Mean an Extended Moratorium

The student loan moratorium drama has played out multiple times and will most likely follow the same pattern again. The administration delays an announcement, the clock ticks toward the end of the extension, and the White House finds a reason to extend it further. With midterms approaching in November, it would be very unpopular and (I believe) highly improbable that the administration would choose to restart payments on September 1.

The only way to claim a political victory would be to grant loan forgiveness along with the restart of payments. However, I think the most probable outcome is that the administration keeps kicking the can down the road without definitive action. It’s also certainly within the realm of possibility to grant forgiveness and still extend the moratorium anyway, which would probably be the most popular course of action ahead of midterm elections.

None of That Matters Because SoFi has Moved On

That was a whole lot of necessary but slightly boring context about student loans to lay the foundation for me to justify the following claim: it does not matter which of the plausible scenarios happens, because SoFi has outgrown their reliance on student loan originations. This is completely obvious once you start looking at their key performance indicators (KPIs) and financial results. The main KPIs I track on the banking side for SoFi are total members, products per member, and sales & marketing (S&M) spend per new member. On the technology side, the only KPI that is publicly available is Galileo accounts (Galileo was acquired in 2020, but was founded in 2001 and 2019 account numbers are publicly available). Let’s compare the last three years and, where applicable, the guidance for 2022 for KPIs, revenue, and EBITDA (earnings before interest, taxes, depreciation, and amortization).

|

2019 |

2020 |

2021 |

2022 |

|

|

Members (in thousands) |

976 |

1,851 |

3,460 |

n/a |

|

Products/Member |

1.21 |

1.36 |

1.50 |

n/a |

|

S&M per New Member |

$824 |

$316 |

$265 |

n/a |

|

Galileo Accounts (in millions) |

25 |

60 |

100 |

n/a |

|

Revenue (in millions) |

$451 |

$621 |

$1,010 |

$1,508 |

|

EBITDA (in millions) |

-$148 |

-$45 |

$30 |

$103 |

There is not a single metric in that table that hasn’t improved substantially. Member growth is massive, they are paying less to acquire each incremental member, and each year their members are using more of their products. Galileo is showing accelerating growth in accounts. The combination of lower costs, greater cross buy, and hyper growth is leading to significant growth to the top and bottom line.

If you looked at SoFi the company in January 2020 and asked what one thing would be most detrimental to their future, the answer would unequivocally have been government policy that cuts into their student loan business. The absolute worst case scenario is exactly what happened. Not only that, but it’s still continuing over two years later and will most likely continue into 2023. SoFi, through no fault of their own, was cut off at the knees in March 2020. Now look at those KPIs and financials again. Assuming they come within 10% of their guidance (they have never missed revenue guidance since coming public) and they add at least 337k members each quarter this year (they have averaged 403k new members per quarter for the last 5 quarters), they will more than triple their revenue and quintuple their members in three years without their hero product. Just take a moment and let that sink in.

If anyone would have told me in March 2020 that student loans were about to see a payment pause with 0 interest accrual until 2023 and in the same breath told me that SoFi would nevertheless grow at an annualized CAGR of 49.6% in those three years, I would have laughed them to scorn. Name a single leadership team that has executed such an incredible pivot due to external forces in such a narrow time window. What they have accomplished is truly mind boggling.

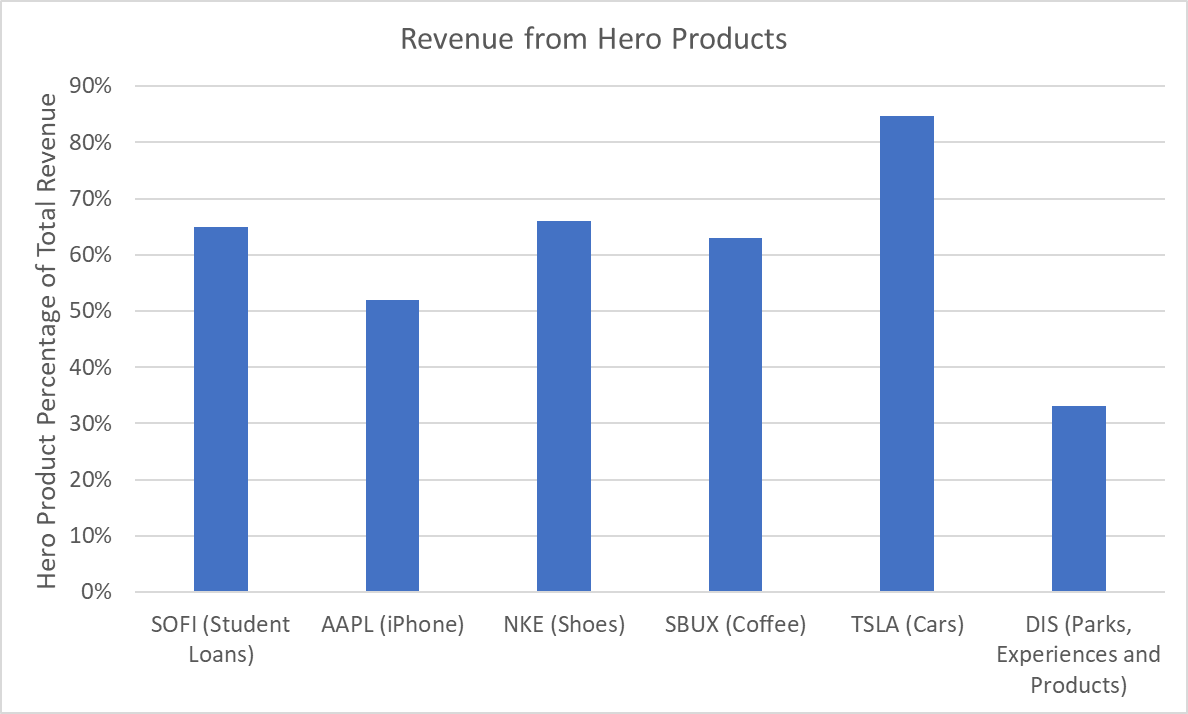

Remember, 99% of revenue in 2019 was from lending and 68% of originations were student loans in 4Q19. Imagine any other business with a product that represents ~65% of its revenue getting cut down 60% due to an emergency act of Congress, dropping to 40% of its previous level, and sitting there with no growth for 3 full years. This is the equivalent of Apple (AAPL) immediately losing 75% of their iPhone sales, Nike (NKE) losing 59% of their shoe revenue, Starbucks (SBUX) selling 63% less coffee, Tesla (TSLA) selling 46% less cars, or Disney (DIS) losing 100% of their Parks, Experiences and Products revenue and then another 6% of their total revenue from other sources. Then the business is forced to operate with those products at those depressed levels without growth until 2025. Now fast forward halfway through 2024 and you see that they are on target to triple their 2021 revenue. That is what SoFi just pulled off.

Percentage of revenue from best-selling hero products of well-known companies (SoFi is based on 2019 revenue share, all others are based on 2021 revenue share) (Author)

Now this is obviously an unfair comparison. I wanted to use examples of companies and products that everyone is familiar with, so all the businesses mentioned are well established. Tripling revenues that already measure in tens or hundreds of billions is different than tripling revenues of $451M. However, in terms of percentage of total revenue, it is not an exaggeration at all. The chart above clearly shows student loans were just as important to SoFi’s business as those products are to their companies. That SoFi made it through the last two and a half years at all is fairly surprising. The fact that they’ve thrived and excelled in these conditions says everything you need to know about the execution of the management team.

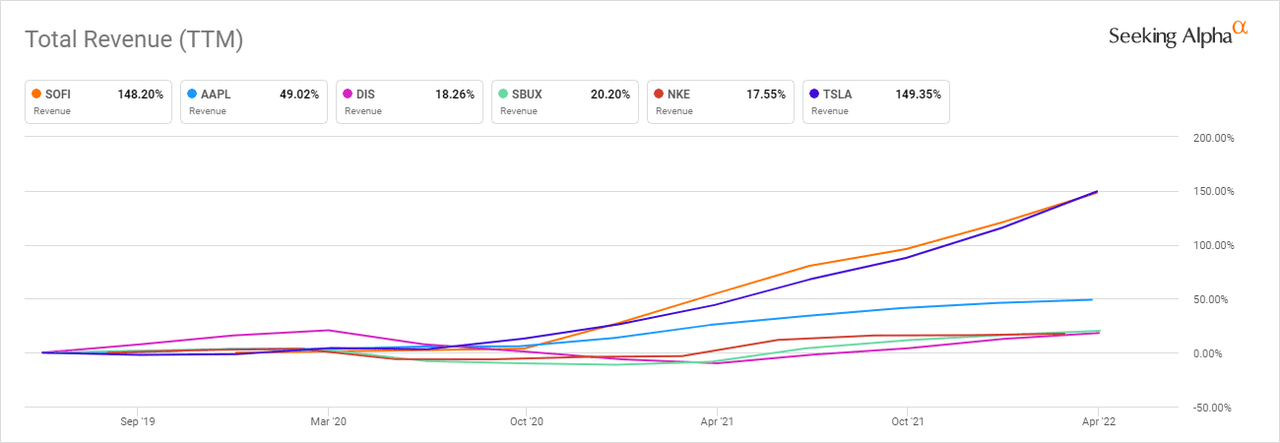

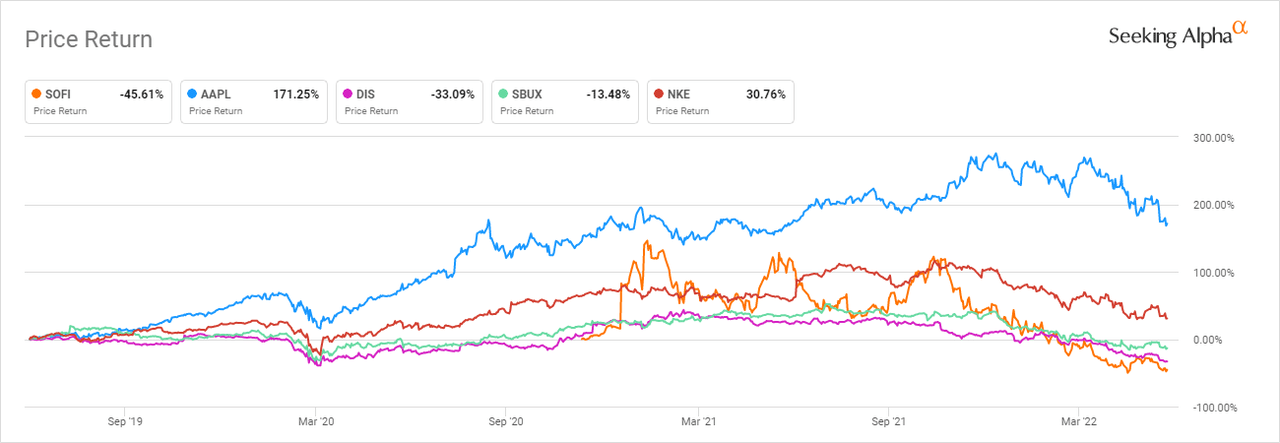

To further illustrate the point, let’s look at the revenue growth of these six companies over the last three years. Remember also that SoFi student loan originations dropped precipitously in March 2020. I also include price return over this time period (keep in mind that SoFi’s price return is compared to their IPO price of $10 from November of 2020). I have removed TSLA from the price return chart because their peak return is above 2,600% over this timeframe. That return is so high that it makes all the other lines look completely flat, so you lose all context of it’s included. It is interesting to note that while SoFi grew revenues at the same clip as Tesla over this time period, Tesla stock is +1,344% (even after its recent 47% drop) and SoFi is down -46% from their IPO price.

Total Revenue Growth of Comparison Companies (Seeking Alpha) Total Price Return of Comparison Companies (Seeking Alpha)

SoFi Now Has the Optionality to Thrive

SoFi managed this amazing feat by simultaneously executing on three fronts. First, they pivoted their lending business from student loans to personal and home loans. Second, they horizontally expanded their product offerings by launching an entire gamut of financial products, becoming a one-stop shop for their members’ financial needs. Third, they integrated vertically by acquiring Galileo and Technisys and acquiring a bank charter. This breadth of product offerings gives SoFi optionality to thrive in a vast number of economic environments. For example, home loan refinancing was strong when rates were low. The current aggressive rate hike environment decreases demand for mortgage refinancing, but acts as a tailwind for their personal loan business as members refinance variable rate debt like credit cards into fixed rate personal loans.

They now have the framework in place to drive business to whatever vertical best suits the current environment. Yes, they miss the student loan revenue and profits that could have been, but they aren’t losing sleep over it. They’re too busy building a robust, agile, and diversified business. Those lost dollars have been more than adequately replaced and SoFi is no longer reliant on any one product.

Student Loans Will be a Massive Tailwind Whenever they Do Return

At some point in the next few years, the moratorium on payments and interest for federal student loans will come to an end. In their 1Q22 earnings call, CEO Anthony Noto said “Our student loan borrowers weighted average income is $170,000 with a weighted average FICO score of 775.” He also stated that “Prior to the pandemic, our student loan refinancing business had an average loan size of about $70,000.” Biden has consistently reiterated that the amount of forgiveness he’s willing to endorse is $10,000. Furthermore, most of SoFi’s customers are above the $125,000 income threshold that the Washington Post article says would be the income cut off. Many of SoFi’s current members or targeted customers may not qualify even if there is forgiveness.

Even if we assume that all of them receive $10k of forgiveness, that means the average refinance loan size would still be $60,000. Noto addressed this very point in the same earnings call:

Once there actually is forgiveness, there is nothing to wait for anymore. You now know what the plan is, and you have to make a decision. Well, if you had $70,000 loans, which is our target market, and you get $10,000 forgiveness, you are still refinancing $60,000, but the number of people that we will be refinancing will be magnitudes greater than it was in the past because there is really no reason to wait any longer, especially with rates going up. I mean, there is likely not going to be a second wave of forgiveness.

How Will Student Loans Affect the Top and Bottom Line once they Return?

To get an idea of the type of tailwind we are talking about, let’s look at some numbers and generate an expected range of where originations will be once the moratorium is lifted. I previously mentioned that student loans have dropped on a per member basis from $2,501 to $254 (an 89.8% drop) compared to personal loans, which have only dropped from $820 to $554 (a 32.4% drop) as SoFi has pivoted toward more financial products.

Let’s assume that with the low estimate, SoFi will see double the drop for student loans than they have seen for personal loans from the 4Q19 peak. That would result in a 65% drop in originations per member. This should be a conservative estimate. The upper end of the range is to assume that student loans will drop 32.4%, exactly in line with personal loans. Then we can apply an additional drop in average originated loan from $70k to $60k (an additional 14%). Again, this is conservative, as forgiveness isn’t assured and there might be income limits applied. This would result in an average origination volume per member range of $752-$1454, moving their stagnant student loan origination volume from around $1B per quarter where it has held steady for two years to $2.91B-$5.62B per quarter. That seems a reasonable range considering that 4Q19 was $2.44B and they have quadrupled their members since then.

So what does that translate to in terms of revenue and profits? As mentioned earlier, revenue from loans comes in two varieties, interest income, and gain on sale. In 2021, SoFi’s weighted average interest rate earned on their student loans was 4.43%. However, in 2021 they were using warehouse facilities for their loans and holding the loans on the books for 3 months. Last week, on June 9, CFO Chris Lapointe stated at the Piper Sandler Conference that “the cost of capital savings that you’re seeing between our deposits and the warehouse facilities today is north of 150 basis points.” So their interest earned should jump from 4.43% to 5.93%+. Because of the changing rate environment, let’s be conservative and only assume they capture about half of that and earn 5.25% and have a holding period of 6 months.

The second revenue bucket is gain on sales. During the 1Q22 earnings call, Chris Lapointe said that student loan gain on sale margin (GOSM) is “north of 4%.” What this basically means is for every $100 of loans that they originate, they sell them on the debt market for $104. He further said that margins have “been relatively consistent […] over the course of the last several quarters, and we expect them to be able to maintain that.” So let’s assume a 4% GOSM. Finally, Chris Lapointe also reiterated that they seek to “stay within a 40% to 50% contribution margin range” in the lending segment. This range is backed by historical data, as their contribution margin from their lending segment was 45% in 2020 and 52.3% in 2021.

Crunching the numbers with these assumptions yields the following results. Note that all dollar amounts are in millions. “Low EBITDA” assumes 40% contribution margin and “High EBITDA” assumes 50% contribution margin.

|

Originations |

Interest Revenue |

Non-Interest Revenue |

Total Revenue |

Low EBITDA |

High EBITDA |

|

|

Baseline |

$1,000 |

$26 |

$40 |

$66 |

$27 |

$33 |

|

Low Estimate |

$2,909 |

$76 |

$116 |

$193 |

$77 |

$96 |

|

High Estimate |

$5,624 |

$148 |

$225 |

$373 |

$149 |

$186 |

You’ll recall their 1Q22 guidance with student loans was an extra $30M-$35M in revenue and $20M-$25M in EBITDA. At the time, I thought that was sandbagging, and I think these numbers confirm that suspicion. Even with the most conservative estimates I outlined above, revenue and EBITDA should increase by at least $127M and $50M per quarter against the baseline estimates of $1B per quarter. The high estimate increases revenue by an extra $307M (basically doubling their 1Q22 revenue of $322M) and improves EBITDA by $153M. While the high estimates are likely pie in the sky, these numbers should give a framework for anticipating what will happen to revenue and profits whenever student loans resume. The longer the moratorium extends, the bigger the jump will be as the user base grows.

There are three things to keep in mind with these estimates. First, this analysis assumes steady originations, but you won’t see this kind of immediate jump in revenue and profits as soon as the moratorium is lifted and originations rise. Loan revenues lag originations by approximately 6 months because that’s how long it takes for them to capture the interest and sell the loan. So this extra revenue and EBITDA will ramp over 2-3 quarters. Second, as mentioned by the CEO, there might be an initial spike in demand as those who have been waiting for forgiveness now have clarity on the issue and will look to refinance their loans without the possibility of missing out on future forgiveness.

Third, consider that SoFi reported net income loss for last quarter of $110M and they are expected to trim those losses substantially in the back half of 2022 to around $60M or less. Given that student loans would be worth at least $60M in EBITDA, it is well within the realm of possibility that they could have had positive GAAP EPS by the end of 2022 if the moratorium had been lifted in January or May as originally scheduled. Analysts currently do not estimate that full profitability will occur until 2024. Whenever student loans return, it will probably pull forward their profitability and earnings by at least one full year. This will be a huge catalyst whenever it comes. It certainly is not priced in based on analyst estimates, and might not even be recognized by the market immediately since the financial benefits will lag the news.

Risks

$50,000 in Forgiveness Would Take Away the Extra Upside

It’s important here to highlight that if the administration forgives $50k in student loans, it basically eliminates this catalyst. Decreasing the average loan size to $20k (from the pre-pandemic average of $70k) would put the low and high estimates generated above for originations at $970M and $1.87B, respectively. This also highlights, however, that even if they forgive $50k per borrower across the board regardless of income, it should not have a material negative effect on SoFi’s current revenues and earnings, as they are already operating at or below this level right now. I also think it is highly unlikely that the administration forgives that amount, as Biden has completely ruled it out as an option on several occasions, but I try to be thorough in my analysis.

Rising Rates Decrease the Number of People Who Profit from Refinancing

It is also important to realize that as rates rise, it decreases the pool of people with student loans who benefit from refinancing. I do not have the data to be able to assess how much each rate hike affects the potential refinance market. SoFi has that data, and at the Piper Sandler conference less than 2 weeks ago, CFO Chris Lapointe addressed this exact question, saying:

There’s about $1.7 trillion of debt outstanding today with hundreds of billions of dollars of debt outstanding that’s priced at a level that’s far north of where we’re able to price our student loan refinancings right now.

There are undoubtedly people whose rates are low enough that each rate hike removes them from the ranks of those who would save money by refinancing their loan. However, there remain millions of people with hundreds of billions in debt that would save money by refinancing their loans. The pie may shrink as rates move up, but it is still so gigantic that SoFi is in no danger of struggling to find potential customers. And as long as the cost of education remains high, the total addressable student loan market will grow.

Conclusion

As 2020 arrived, SoFi was heavily reliant on student loans. Their whole business revolved around that product. Their marketing, growth vectors, and focus was mostly geared towards young high-income individuals who would refinance their student loans with SoFi. That all changed in March 2020 when the student loan payment and interest moratorium was passed with the CARES Act. While the USA has closed the book on virtually every other pandemic relief program, the student loan payment and interest pause is still going strong and will most likely continue at least until the midterm elections in November.

In spite of SoFi’s previous reliance on the income from student loan refinancing, SoFi has significantly increased revenues and profitability. The company is on pace to 5x their user base and more than 3x their revenues from the time the moratorium was put in place until the end of this calendar year. They have outgrown their previous hero product. No matter what happens with forgiveness and even if the moratorium continues for another year or two, SoFi will thrive.

When the moratorium is eventually lifted, the increased origination volume will act as a major catalyst for both the top and bottom line of SoFi’s business. It will more than likely springboard them to profitability significantly ahead of schedule.

SoFi’s book value is $5.69/share, and as of the time of writing, it is trading at $5.70. I am convinced that accumulating now, while SoFi is trading near or under its book value despite its incredible growth, expanding prospects, and exceptional execution, will result in outsized gains over the long term.

Be the first to comment