JJ Gouin/iStock via Getty Images

Introduction

The Andersons (NASDAQ:ANDE) is one of my best long-term investments for a number of reasons. The most obvious reason is that the agriculture bull market has accelerated going into this year. Every business aspect of this company is booming as fertilizer prices are high, storage and export demand is high, overall crop prices have accelerated, and ethanol prices and demand are up. In my most recent article written on March 28, I covered the additional layer to this bull case: the war in Ukraine. This war shifts demand to the US, supports fertilizer margins, and caused (global) energy prices to soar. While I did not expect to write an update so soon, it’s time to focus on one thing in particular: ethanol – as the Biden administration will use ethanol to keep fuel prices affordable.

Ethanol is the biggest source of income for The Andersons, which implies more upside in the current bull market. In this article, I assess the situation and explain how I would deal with this company at current prices.

Ethanol Is Back

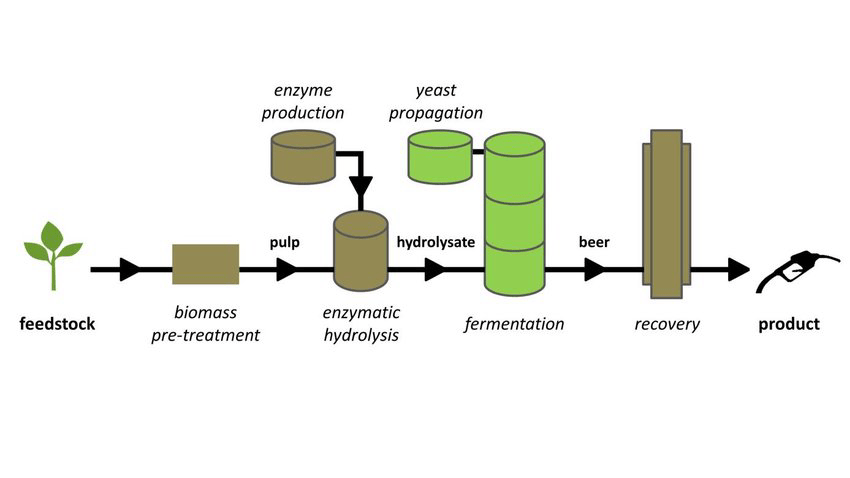

(Bio)ethanol is one of the most durable sources of energy on the planet for one reason: it’s made out of corn and related crops. It’s a relatively simple process that consists of grinding corn, mixing it with water, adding enzymes, fermenting, and recovering the final liquid. There’s a short and easy YouTube video made by IowaRenewableFuels on the matter in case anyone is interested.

ResearchGate

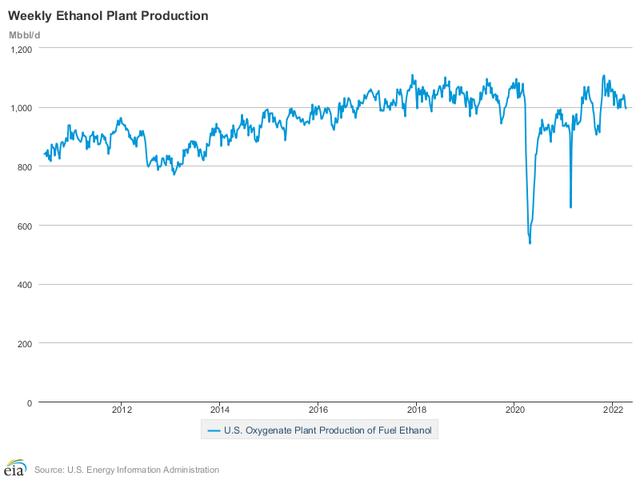

Roughly 25% of US corn croplands are used for ethanol production with 95% of all ethanol being produced from corn. Ethanol is mainly used in E10, E15, and E85 fuels. Ethanol is mixed into more than 98% of United States gasoline to reduce air pollution. In the US production of ethanol is currently running at 1 million barrels per day. Production has consistently increased between the Great Financial Crisis and the pandemic. The pandemic caused nationwide production shutdowns as fuel demand was down. “Nobody” was driving anymore. Airplanes were sitting on the runway and nobody knew how long lockdowns would last. Now, production is coming back roaring.

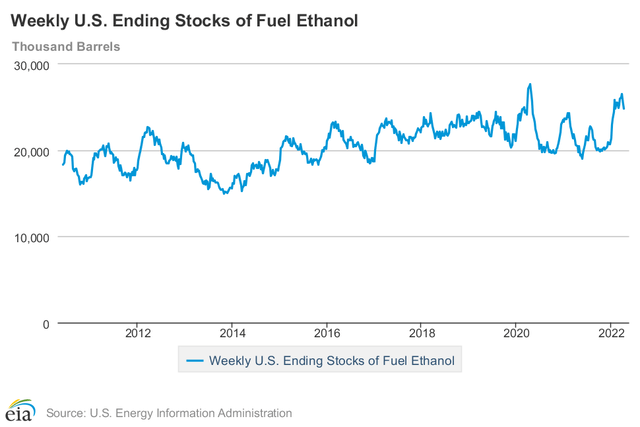

Right now, US fuel ethanol stocks are peaking close to 24.8 million barrels after falling to 20 million barrels.

I expect ethanol inventories to come down further as demand is accelerating. Refineries are running at high utilization rates, global demand is coming back, and the need for ethanol is further rising. The war in Ukraine is causing global oil prices to rise as a market that is already seeing a supply/demand imbalance could further suffer from lower Russian supply.

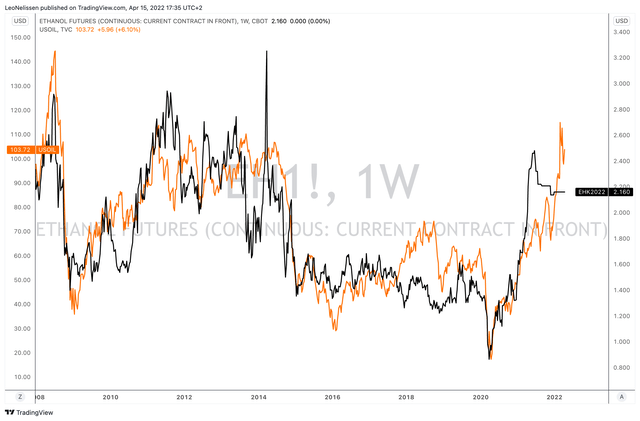

The graph below shows CBOT ethanol futures (black) and WTI crude oil futures, which are currently hovering close to $100 per barrel.

High energy prices are an issue for a number of reasons. First of all, it hurts people at the gas pump. The second reason is that energy inflation is everywhere and it works its way through the economy. It impacts transportation costs, prices of plastics and chemicals, fertilizer production, and eventually every part of every single supply chain.

It also hurts politicians in the polls, which is why we’re now seeing headlines like the one below:

Basically, it comes down to this:

The Biden administration said that increasing use of gasoline with 15% ethanol, known as E15, over the summer months would help lower consumers’ fuel costs, which have climbed following Russia’s invasion of Ukraine. The decision is seen as a win for corn growers and ethanol-producing companies, though some groups said they fear it could further inflate food prices by making grain more expensive.

Moreover:

Ethanol makes up 10% of the U.S. fuel supply, Poet said. The Biden administration’s move would allow gasoline with 15% ethanol to be sold between June 1 and Sept. 15. Typically, the federal government limits ethanol blends to 10% during summer months, to curb smog caused by the 15% blend’s higher volatility.

This move is expected to boost corn demand by 25 million to 45 million bushels with E15 consumption expected to increase by about 300 million gallons in 2022 from the 814 million gallons sold in 2021.

Additionally, the administration is killing two birds with one stone as it also supports farm income. According to this Wall Street Journal article, farm profits were set to decrease in 2022 by $5.4 billion, or about 5% from 2021 levels. Farmers are battling high equipment, energy, and input costs, which makes it impossible in most cases to grow income. Smaller farmers had to cut down on fertilizer usage to remain profitable.

This move boosts ethanol and corn demand and puts a bottom under prices.

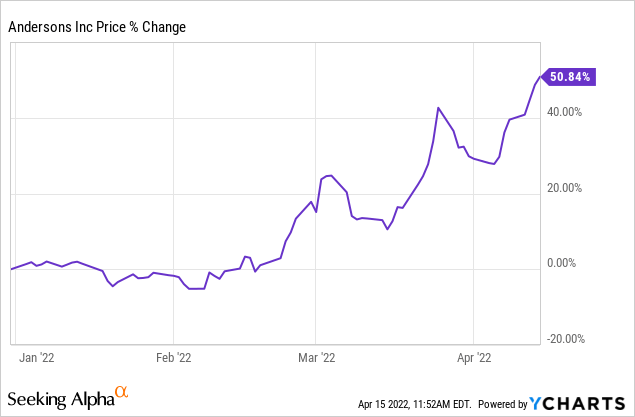

Right off the bet, it benefits every aspect of The Andersons, which made a new high as it’s up more than 10% from last month’s article, adding more than 50% year-to-date:

While this Biden admin decision benefits every aspect of this company from nutrients to trade and storage services, it most and foremost benefits its bread and butter: ethanol.

More Upside For The Andersons

The Andersons are very big in ethanol. In this case, the segment has been renamed to “renewables” as the company can use that name to include operations that go way beyond just ethanol. However, in this case, it’s basically ethanol.

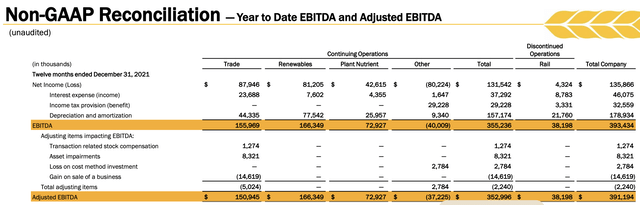

In 2021, the ethanol/renewable segment did roughly $166 million in adjusted EBITDA. That’s 47% of the total adjusted EBITDA. And again, other segments also benefit from strong ethanol production as it’s more or less the backbone of the US agriculture industry. This is what the company commented on that:

We think we can play an interesting position. We’re a little bit of a unique company in that we have a fertilizer business and we work closely at the farm with the fertilizer inputs with growers and our grain buyer and an ethanol producer, so we work across the whole chain to the end market. So we think there’s opportunities there.

The renewables group consists of a number of large ethanol facilities. Some as a result of a merger with Marathon Petroleum (MPC) ethanol assets. According to the company:

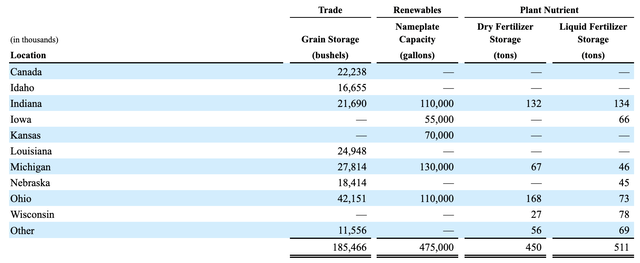

As a result of the merger, the Company and Marathon Petroleum Corporation (“Marathon”) own 50.1% and 49.9% of TAMH equity, respectively. The transaction resulted in the consolidation of TAMH’s results in the Company’s financial statements effective October 1, 2019. […] The four ethanol plants within TAMH are located in Iowa, Indiana, Michigan, and Ohio. These plants have a combined production capacity of 480 million gallons of ethanol, with a nameplate capacity of 405 million gallons.

The Company also owns 51% of ELEMENT, LLC (“ELEMENT”), and ICM, Inc. (“ICM”) owns the remaining 49% interest. In 2019, ELEMENT completed the construction of a 70 million-gallon-per-year bio-refinery in Kansas which began limited production in the third quarter of 2019. ICM managed the initial construction of the facility, while the Company operates the facility under a management contract, and provides corn origination, ethanol marketing, and risk management services.

The table below shows the company’s renewable locations including production capacity.

On a full-year basis, the company shipped 726.5 million gallons of ethanol, 41.6 million gallons of E-85, 286 million pounds of corn oil as well as 2 thousand tons of DDG, which stands for distillers dried grains. DDG is basically a valuable by-product that used to have its own CME futures listing until 2015. Until 2015, it was relatively easy to calculate ethanol margins based on the futures of corn, ethanol, and DDG with ethanol and DDG being “finished” products and corn being input. Now, people like me have to rely on third-party research in most cases – or company comments.

The biggest benefit ANDE has, right now, is that not only ethanol prices are high, but also that it benefits from high by-product sales prices as a result of the commodity boom. This is what the company commented on February 16:

We experienced good operational performance at our ethanol plants. Corn oil sales at record prices contributed to our performance and continuing high commodity prices also increased the value of our feed ingredients. Our ethanol and renewable feedstock trading team had a very successful quarter, nearly doubling our 2020 results.

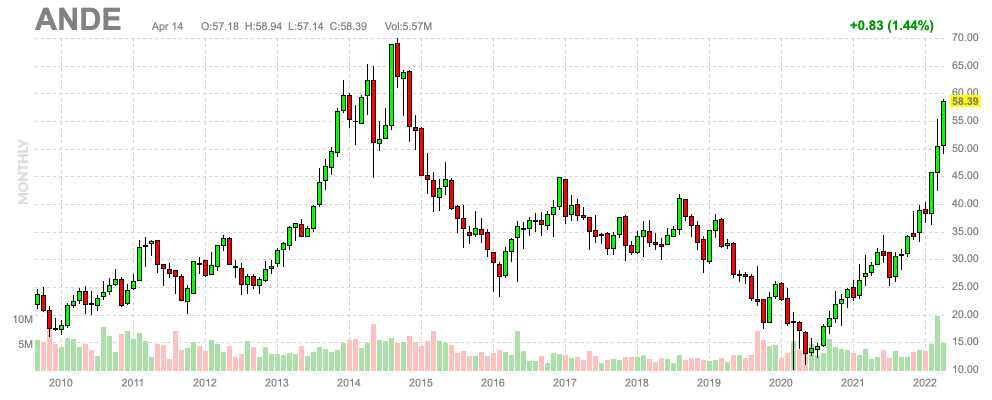

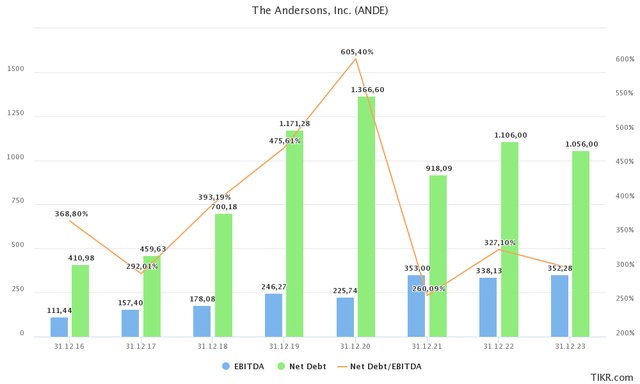

With that said, the company’s market cap has risen to $2.0 billion. Net debt is expected to average roughly $1.0 billion over the next two years. Minority interest is $235 million. That’s mainly the control of various ethanol plants it does not own, while it does recognize EBITDA. In other words, we need to account for its minority interest in the valuation calculation. The company also has $23 million in pension-related liabilities, which are almost neglectable. All of these numbers give us an enterprise value of $3.3 billion.

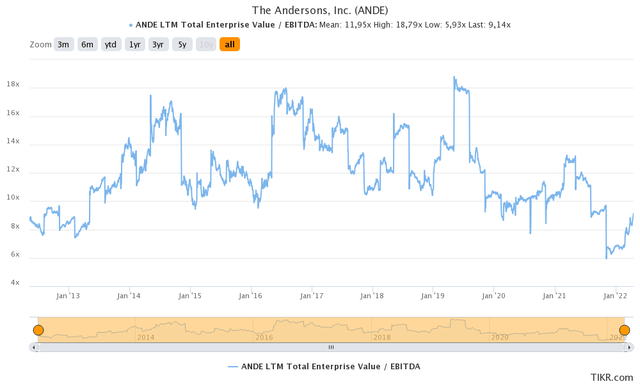

$3.3 billion is roughly 9.3x expected EBITDA of $350 million. In this case, I expect EBITDA to come in much higher than that as analysts have not priced in higher ethanol EBITDA, nor have they upgraded expectations after the war-related surge in i.e., corn prices. I would not be surprised if EBITDA would come in close to $380 million this year.

In this case, I’m sticking to what I said in my last article, this valuation is not deep value anymore. My price target is $70. I communicated this target when I first became bullish in 2020 and I mentioned the $65-$70 range again in my last article. From 2020 levels, this would imply a 4.6x return. Compared to current prices, it would be 20%, which is still decent, but the bare minimum a trade like this requires, in my opinion.

TIKR.com

So, here’s how I would deal with ANDE:

Takeaway

It just keeps getting better for The Andersons. This Midwest agriculture company is already one of the biggest winners, rising 50% year-to-date. Now, it gets support from the White House as Biden looks to reduce gasoline inflation by increasing the percentage of ethanol added to fuels. This is not just a move to pressure inflation, but also a way to help the American farmer in times of rapidly rising input inflation hitting fertilizers, related chemicals, and machinery.

I think that ANDE can reach and exceed $70 per share as I believe that its ethanol segment will fly this year. In addition to that, the company is well-positioned to benefit from growth in all other segments as well. Due to high crop prices, strong storage and export demand, and high fertilizer demand, the company is set to benefit from way more than stronger ethanol production and margins.

However, do not open a big position in ANDE. The risk/reward could be better and we’re not in the early stages of the cycle. If you’re long, enjoy the ride. If you’re not long, make sure to use weakness to open a “small” position. Do not go overweight at current prices. I don’t want people to “chase” prices up here, but to only use weakness to buy shares.

This is what I wrote in last month’s article, which I still believe makes sense:

Depending on your position, one can trim a profitable position to take some money off the table. I will remain bullish because I believe that the stock can move to $65-$70, yet the risk/reward does not warrant new, large positions. ANDE is simply too volatile for that and it needs high margins. Moreover, if energy prices come down a bit, the agriculture trade could see a mid-term setback, which offers buying opportunities.

On May 3, 2022, the company will report earnings, which will more than likely confirm my suspicion that earnings estimates are too low.

(Dis)agree? Let me know in the comments!

Be the first to comment