Giselleflissak

Consumer discretionary stocks have fallen off a cliff in recent months as investors weigh the impact of recession and inflation on earnings in the sector. Aggressive rate hikes by the Federal Reserve to fight inflation are expected to hurt consumer discretionary spending into 2023.

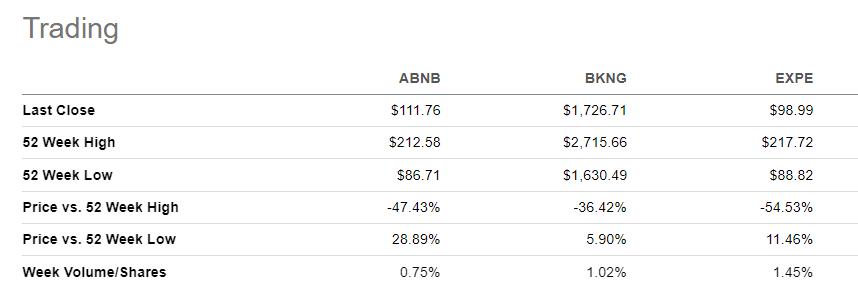

The travel and leisure industry has been particularly hard hit, with online travel agencies such as Airbnb, Inc. (NASDAQ:ABNB), Booking Holdings Inc. (BKNG) and Expedia Group, Inc. (EXPE) all posting massive declines of between 35% and 55% from their 52-week highs, as the chart below illustrates.

ABNB, BKNG and EXPE Trading History (Seeking Alpha)

Online travel agencies make for a potentially exciting investment following these massive declines. The sector is growing robustly, with all three highlighted names posting record earnings for most recent quarters. The weakness in these stocks is therefore a great discount from Mr. Market and a chance for bulls to profit from the next big move up.

The best time to invest in travel and leisure stocks such as hotels, airlines, and online travel agencies was in mid 2020 at the height of the Covid-induced panic prior to the vaccine coming out and prior to unemployment coming down from the mid-high teens levels. The second best time is now, when the mainstream view is that the Fed’s continued rate hikes will crash the economy and prompt a painful recession that will leave the travel and leisure sector with a nasty hangover. While this view seems logical, the fears are definitely overblown.

Time and again, the human need for adventure and new experiences has proven to be resilient amid different kinds of headwinds. Even though the economy seems to be terrible, there’s an old saying that people do not live to work, but work to live. And a big part of “living” is traveling, seeing new places and people, and enjoying new experiences. Consumers can and probably will cut down on travel during hard economic times, but they certainly won’t eliminate it altogether. In fact, when economic fortunes inevitably change for the better, consumers tend to splurge like never before, a concept industry pundits call “revenge travel.”

Online travel agency stocks are therefore a very exciting area to start a position given the strength and resilience of the underlying business and the sour investor sentiment exemplified by massive stock declines. Tellingly, even though expectations for consumer spending started declining months ago after the first few rate hikes by the Fed, online travel agencies have posted the best operating performance on record according to the latest earnings reports. This is true for both ABNB and EXPE which posted record revenues in the quarters ended June 30. ABNB saw quarterly revenues jump 57.6% year over year to $2.1 billion, while EXPE saw an over 50% leap in revenue from the prior year to $3.18 billion. BKNG guided for record revenues in Q3 after gross bookings rose 57% year on year to $34.5 billion in Q2.

Go with ABNB

In our view, ABNB stands out as compared to BKNG and EXPE, despite being the “new kid on the block” having only gone public in December 2020. Both BKNG and EXPE went public in 1999 amid the dot com hype.

We think ABNB has some clear competitive advantages in terms of its financial shape, business model, brand strength, and ability to successfully innovate at scale and pace.

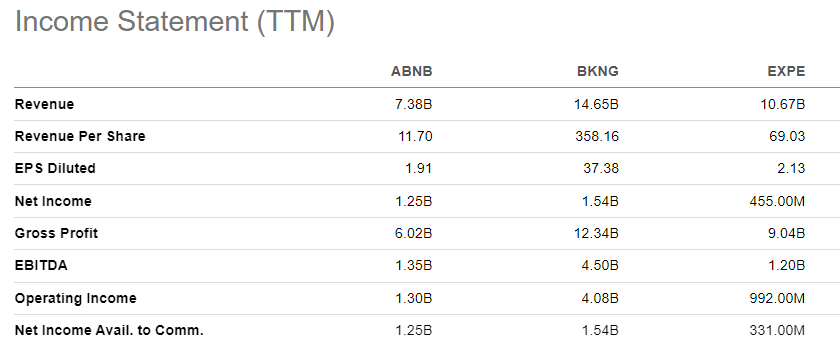

Let’s start with the financial shape. ABNB has the least revenue for the trailing twelve months compared with BKNG and EXPE, as the chart below illustrates.

ABNB, BKNG and EXPE Income Statement for ttm (Seeking Alpha)

If you zoom in and look at net income, ABNB’s stronger financial shape relative to BKNG and EXPE is immediately apparent. Its $1.25 billion net income for the trailing twelve months is more than double EXPE’s and just $250 million shy of BKNG’s, despite the latter two raking in between $3 and $7 billion more in top line.

The reason ABNB is making more money for its shareholders for every dollar credited into its accounts by its customers is because it has the best operating structure among the three. EXPE has 14,800 employees and BKNG 19,450 employees, as per data on Seeking Alpha. ABNB only has 6,132. ABNB is leaner and, therefore, more profitable.

ABNB also has a strong brand that reduces the need to “buy” customers through aggressive ad spending and other costly promotional activity. It converts customers at the fraction of the cost EXPE and BKNG do, and this is a key strength that not only gives it more profitability, but more financial stability during industry downturns, as the below example shows.

Commenting on how ABNB cut all its marketing to protect cash and survive through the early phases of the pandemic, CEO Brian Chesky noted in a recent Goldman Sachs (GS) conference that:

“What happens if you turn off all your marketing? You know what happened? Almost nothing. Google did not want anyone to know this. But our traffic came back to more than 90% of what it was after we turned off all of our marketing. And we learned a couple of things. The first thing we learned is that our brand is incredibly strong.”

ABNB has also proven that it can innovate at pace and scale. It has in recent months rolled out several interesting new products.

The first innovation worth mentioning is the AirCover feature for hosts and guests. The best way to understand this feature is as a form of insurance that embeds trust and accountability within the ABNB ecosystem. AirCover for hosts, which was first to launch, provides $1 million protection against property damage, $1 million personal liability coverage, so hosts no longer have to worry about strangers coming in and damaging their house. AirCover for guests, which launched this summer, basically provides a guarantee against the home not being as described, if you can’t get in or if the host cancels on you. CEO Brian Chesky noted in the Q2 earnings call that, since launch of AirCover for guests, the Net Promoter Score for guests that had an issue with their stay has already improved. He also noted that in cases where hosts cancel on a guest, AirCover for Guest has led to 10% more rebookings.

ABNB also this summer launched Airbnb Categories. The whole idea is to improve the search functionality beyond destinations to include unique experiences. Destinations are limiting as the top 100 cities will likely remain unchanged year over year. With experiences, such as tree houses, haunted mansions and other exciting categories, ABNB is bound to get more engagement and bookings as guests get a greater variety of options to choose from as opposed to a generic search like “top Airbnbs in New York.” New hosts are also likely to join the platform as categories catch momentum, focusing on lucrative niches. “Since launch, listings in the Airbnb Categories have been viewed more than 180 million times. Through Categories, we are distributing guest discovery across more destinations and dates,” said Brian on the earnings call.

ABNB’s management seems confident of the future. And no, we did not refer to upbeat comments in recent public communications by ABNB executives to arrive at this conclusion. There’s something more convincing than flowery words – capital allocation. The company’s management recently announced a $2 billion share repurchase program – an indicator that it believes its shares are still considerably discounted relative to the company’s long-term potential. It’s worth mentioning at this point that the company had total debt of $2.38 billion against cash of $9.9 billion in the most recent quarter, making the buy backs the best use of its capital in our view.

The risks to watch for

We are buying ABNB, but are also conscious of some risks which we feel our readers should also track. The first is the risk of underestimating the impact of the Fed’s rate hikes and fears of recession on investor psychology. The consumer discretionary sector moves inversely with interest rates. Even though we are of the view that travel and leisure is resilient, fear can lead to over-selling of even the best names such as ABNB. It’s therefore prudent for investors to manage their risk and be mindful of how they build their positions, i.e., don’t buy all at once and take advantage of dips to build a good average price. It seems obvious, but it never hurts restating.

ABNB also has a rich valuation. It is trading 51X P/E (fwd) in comparison to BKNG’s 23X and EXPE’s 31X. It is trading 23X EV/EBITDA (fwd) in comparison to BKNG’s 12X and EXPE’s 7.5X. The valuation could limit the upside and magnify the downside. However, when you think of ABNB’s business quality, a premium versus its peers seems justified. Moreover, ABNB is still at an early stage of growth relative to its peers and this obviously comes with a higher valuation as its full earnings potential is still far from being realized.

The last risk worth considering is regulatory risk. Some cities have laws that restrict your ability to host paying guests for short periods. These laws are often part of a city’s zoning or administrative codes. ABNB has had run-ins with several cities because of this, while other cities that don’t have these laws have been mulling introducing them after pressure from local hotels.

Despite these risks, we believe ABNB is a good buy. The weakness in the consumer discretionary sector has brought down its share price to a level we believe does not fully reflect the potential of the underlying business.

Be the first to comment