24K-Production

Thesis

Leading middle market business development company Ares Capital (NASDAQ:ARCC) has seen its stock getting hammered from its February highs, even though it continues to benefit from a hawkish Fed.

Accordingly, ARCC has declined nearly 25% through its recent lows, as the market de-rated it to account for the value compression within its portfolio companies.

Management is confident that its relatively low leverage (targeted debt/equity: 0.9x to 1.25x) and its ample liquidity of $4.7B should proffer it more opportunities in the dislocated debt financing market. As a result, the company continues to expect robust opportunities in the private lending market, despite the looming global recession.

In addition, its focus on mainly less cyclical higher-quality companies that have demonstrated robust EBITDA growth should help assure the market of its value proposition through the cycle.

Given the marked collapse to its recent lows, we assess that its valuation has also been de-risked. Furthermore, its price action is also constructive, which could help ARCC form a consolidation zone at the current levels.

However, we believe caution is still necessary, as a worse-than-expected global recession could de-rate its valuation multiples further, in line with its historical averages. Therefore, investors considering adding exposure are encouraged to layer in over time.

With management committing to delivering its dividend strategy, we see an attractive reward-to-risk profile at an NTM dividend yield of 10%. Accordingly, we rate ARCC as a Buy.

Own ARCC Through The Fed’s Hawkish Posture

With the release of the closely-watched nonfarm payrolls report on October 7, the market has priced in a much higher probability (81.6%) of a 75 bps rate hike at the next FOMC meeting in November.

Therefore, it should provide more clarity over Ares Capital’s core EPS runway through H1’23 at least (the Fed’s current median terminal rate is 4.6%), as it benefits from the increasing base rate adjustment on its floating rate debt portfolio. Investors should note that its floating rate share was 74% in Q2, financed mainly by lower-cost, fixed-rate funding sources.

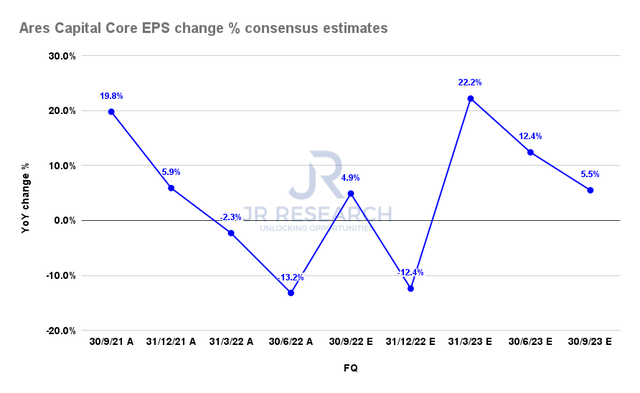

Ares Capital Core EPS change % consensus estimates (S&P Cap IQ)

However, there’s a bit of a lag time in its base rate reset on its debt portfolio. Management highlighted:

We expect continued increases in short-term rates to have a positive impact on the net interest earnings performance of the company. Given about 60% of the base rates for our floating rate loans currently reset every 3 months and the increase in base rates through these resets generally occurred in the latter part of the quarter, our second quarter earnings did not fully benefit from the increase in market rates reflected in our yields at quarter end. (Ares Capital FQ2’22 earnings call)

We believe the visibility through 2023 should help to mitigate potential earnings volatility through the coming recession. Consequently, it should provide greater confidence in Ares Capital’s earnings quality through its well-diversified portfolio. Hence, we are confident it could reduce potential volatility in ARCC from the current levels.

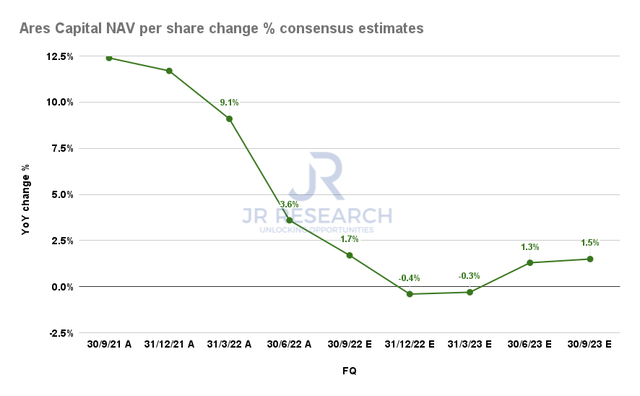

Ares Capital NAV per share change % consensus estimates (S&P Cap IQ)

Despite that, we believe the market justifiably de-rated ARCC in anticipation of its portfolio net asset value (NAV) per share impact.

As seen above, Ares Capital’s NAV per share growth is only expected to bottom in Q1’23, with the Street (very bullish) likely modeling a less severe economic downturn.

Hence, the risks of a significant economic recession could markedly affect its NAV per share recovery, leading to further value compression in its portfolio companies and ARCC’s valuations.

But ARCC’s Valuation Seems Reasonable

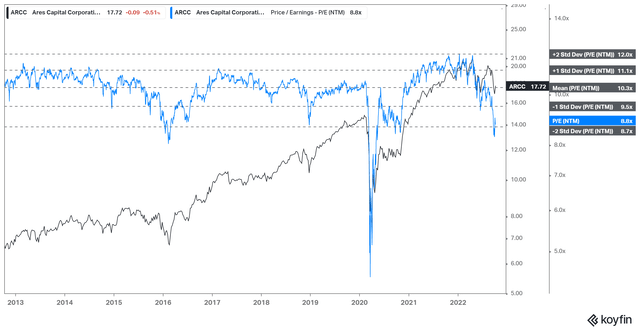

ARCC NTM Core EPS multiples valuation trend (koyfin)

We gleaned that the market had already de-rated ARCC, sending its NTM core EPS multiples spiraling down toward the two standard deviation zone under its 10Y mean.

However, we are confident that the company’s earnings visibility through the cycle, supported by the Fed’s hawkish posture, should undergird its valuation at the current levels.

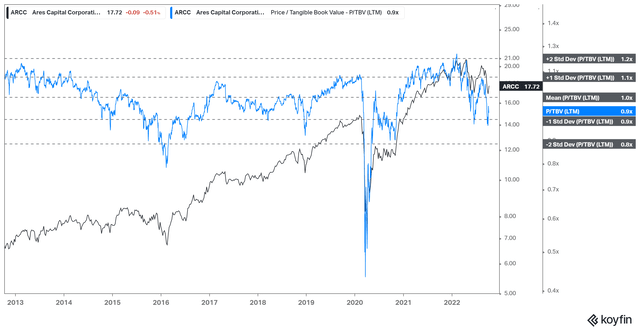

ARCC TTM P/TBV valuation trend (koyfin)

However, ARCC’s TTM tangible book value (TBV) multiples are still above the two standard deviation zone over its 10Y mean. Therefore, we postulate that the market had likely anticipated a less severe recession at the current levels, with a TTM P/TBV of 0.9x.

A worse-than-expected economic downturn could send its TBV multiples collapsing toward its 0.8x zone. Therefore, we urge investors to consider layering in their exposure over time, taking advantage of unforeseen downside volatility.

Is ARCC Stock A Buy, Sell, Or Hold?

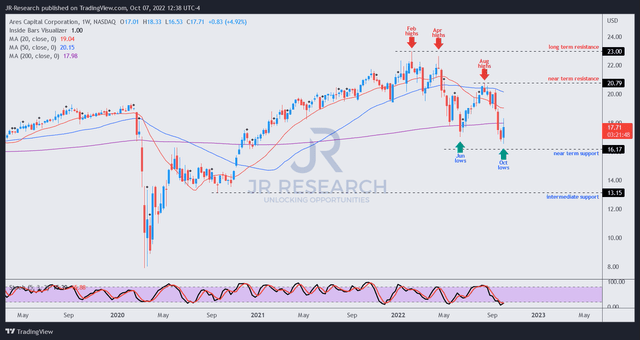

ARCC price chart (weekly) (TradingView)

We gleaned that ARCC has held its recent lows resiliently after it broke its previous June lows. As long as these lows hold robustly (our current view), ARCC should be able to consolidate at these levels.

Furthermore, the rapid selloff from its August highs is constructive for its bottoming process, as the market astutely digested the gains from the summer rally.

However, we encourage investors to consider its intermediate support as the next potential re-test zone if the market anticipates a more severe global recession, leading to a further de-rating.

We rate ARCC as a Buy.

Be the first to comment