sefa ozel/E+ via Getty Images

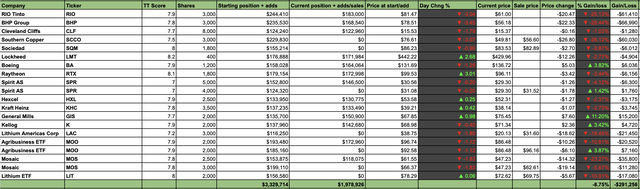

Markets concluded Q2 with another exciting week. After about a 10% countertrend rally, the S&P 500/SPX (SP500) stalled at critical resistance around the 3,950-4,000 level. From peak to trough, the bear market decline has been approximately 25% thus far. While another near-term countertrend rally is plausible, the ultimate low to this bear market will probably be below the recent “bottom.” In a base case scenario, the SPX will likely bottom around the 3,400 – 3,000 range, roughly 10-20% below current levels.

SPX 1-Year Chart

The most recent down leg was precipitous, and SPX may have put in a transitory bottom around the 3,600-3,700 support level. By transitory, I mean that this should be a level that we can trade from, and high-quality positions are good long-term buys here. However, 3,600 – 3,700 support is probably not the ultimate low to this bear market. We will likely see SPX 3,400 materialize and possibly lower support around 3,000. However, despite the likelihood of more declines in the coming months, we could see the countertrend rally continue from the recent lows.

In the first phase of the bear market rally, the SPX failed to move past the critical resistance level of around 4,000. However, if the 3,800-3,750 support zone holds up, the SPX should attempt to push through 4,000 and will likely appreciate to 4,200 or higher. Therefore, despite the probability of more declines in the current bear market, there is a likelihood of near-term gains.

Additionally, no one knows where the ultimate low in the bear market will be, and there is even a slight chance that the bottom is already in. Thus, the prudent approach may be to remain invested and to dollar cost average quality positions if stocks test lower support levels. Furthermore, it is crucial to stay defensive and well-diversified. Finally, hedging is essential, and effective hedging may not only soften the blow in a declining market but should offer significant income if stocks fall further.

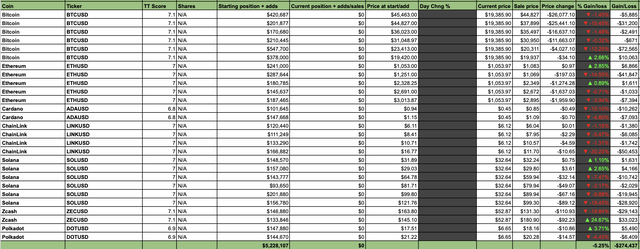

The All-Weather Portfolio – H1 Review

The All-Weather Portfolio (“AWP”) yielded solid results in Q1 2022, delivering a return of 18.31% despite modest declines in major stock market averages. Diversification, rotation, adjustments around peaks and troughs, and effective hedging enabled the AWP to maximize its returns in Q1. Unfortunately, Q2 proved more challenging. Bold positioning, the failure to realize profits at crucial instances, and insufficient hedging caused the AWP to lose ground in the second quarter.

The AWP declined by nearly 13% in Q2. While the AWP’s results were slightly better than the SPX’s 16.5% decline and the Nasdaq’s 22.5% drop in the quarter, a 13% loss is not exactly the result I am used to achieving. Nevertheless, due to the robust outperformance in Q1, the AWP returned 3% in H1, significantly bettering the SPX’s 20.5% drop and the Nasdaq’s 29.5% YTD decline. Now, let’s see which positions performed well and poorly and what could have improved portfolio performance in Q2. Also, let’s look ahead to Q3 and H2 to see what the rest of the year may have in store.

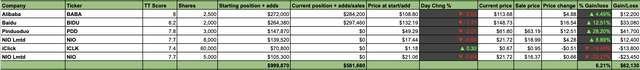

Q2’s Top Sector – China

Surprisingly, China, the worst-performing sector in Q1, was the top-performing sector last quarter. Alibaba (BABA) gained about 4.5% in the quarter, and Baidu (BIDU) appreciated by roughly 13%. Also, a temporary position in Pinduoduo (PDD) yielded nearly a 30% return. Alibaba and Baidu are amongst the heaviest stock holdings in the AWP, accounting for approximately 6% of the portfolio’s weight.

Q3: China

I’m keeping the BABA and BIDU positions steady here. Also, I added some PDD and NIO shares to start the third quarter. These and other high-quality Chinese stocks remain significantly undervalued and should appreciate considerably in the coming years. We also saw outperformance relative to many other stocks in the latest stage of the bear market. The Chinese names may have bottomed while their Western counterparts have not. Therefore, the downside in China names may be limited, and the stocks are also strong covered call and collar options plays candidates. Alibaba and Baidu account for about 6% of portfolio holdings, and the higher-risk NIO and PDD account for the remaining 2%.

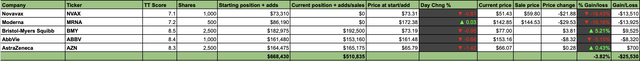

Q2 – Healthcare

The healthcare segment of the AWP portfolio declined by about 3.8% in the second quarter. Bristol-Myers (BMY) appreciated by approximately 5%, and AstraZeneca (AZN) finished Q2 slightly in the green. I ditched the higher-risk COVID-19-related holdings early in Q2. The primary reason I owned Novavax (NVAX) and Moderna (MRNA) was for options strategy, but due to the enormous volatility, holding these names is not worth the risk.

Q3: Healthcare

Quality healthcare should continue performing well as we advance here. Healthcare is relatively defensive, and we’ve seen many names doing well despite the bear market in equities. Therefore, I kept the AWP’s existing healthcare positions and added two stocks to the portfolio, Gilead (GILD) and Amgen (AMGN). The healthcare segment should continue doing well as the bear market persists, and we also benefit from a healthy 3-5% dividend here.

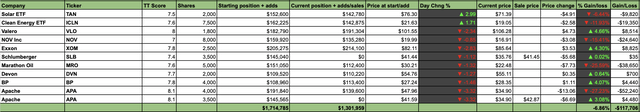

Q2 – Energy

With booming oil prices, the energy sector was hot last quarter. However, many energy names underwent a massive 20-30% correction. Unfortunately, most of the gains got wiped out. Moreover, I added Marathon (MRO) and Apache (APA) near the highs, which led to heavier losses. While oil stocks likely have more room to appreciate throughout 2022, I should not have been greedy. Instead of adding positions, I should have reduced or hedged holdings near the peak. However, I managed to snag BP (BP) and Devon (DVN) shares near the lows of the oil correction. The clean energy ETFs also declined modestly in the quarter. Overall, the energy sector fell by about 6.8% in Q2.

Q3: Energy

We had the correction, and it was massive. Most energy names got ahead of themselves, and as oil prices corrected, energy shares crashed. However, after the fall, many companies are 20-40% cheaper, and oil may not have peaked. Therefore, I continue to own energy here. About 8.7% of portfolio assets are diversified amongst high-quality oil names, and the remaining 2.9% is allocated towards clean energy names via two ETFs. Most of the AWP’s energy names are noteworthy covered call and collar options plays and offer significant dividends.

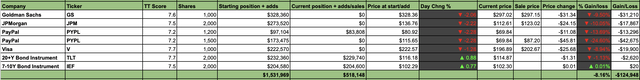

Q2 – Financials

The financial sector gave up about 8% last quarter. The big loser was PayPal (PYPL), but a collar option hedge mitigated much of the stock’s losses. I cut other financial holdings before the quarter ended. I also added a couple of defensive bond instruments to the AWP. While many quality financials may look cheap, they may be value traps while the bear market persists.

Q3: Financials

I’m keeping a small financial position going into Q3 here. The upside is probably very limited in the near term, and there could be more downside ahead as the bear market persists. The Fed may not raise interest rates as high as expected, and banks could face decreased earnings due to the slowdown and more defaults. Generally, I remain cautious here and choose to allocate more capital to different sectors now. PayPal remains very oversold and likely has substantial growth potential. PayPal is also a strong cover call option and collar option candidate.

Q2 – Metals and Materials

Metals and Materials (The AWP)

The “metals and materials” segment declined by 8.8% in Q2. However, this segment included stocks from defensive sectors like staples and defense. Some of the best holdings proved to be defensive staples and defense names. Conversely, most metals and materials holdings declined in the quarter. Moreover, I had the opportunity to realize significant gains intra-quarter but failed to pull the trigger at the right time on some names. I realized some profits and decreased losses in several positions, but not enough. Copper and other commodities tumbled, leading to losses instead of gains in many of the metals and materials holdings.

Q3: Metals & Materials – 6.6% of Portfolio Holdings

While I rolled the metals stocks over from last quarter, I trimmed positions. Holdings are still significant, but the effects should be limited if prices continue sliding during the bear market phase. Moreover, I added Sociedad (SQM) back to the AWP for lithium exposure. I also kept the Agriculture ETF (MOO) and Mosaic (MOS) for agriculture exposure. Agriculture could continue doing well due to inflation and the skewed supply/demand dynamic. Also, if inflation proves more persistent than anticipated, metals stocks should get a boost. We also have several stocks with monster dividends, and some metals/agriculture stocks make for strong covered call dividend and collar options plays.

Q2 – Technology Plus

Technology had a rough quarter, with the Nasdaq dropping by nearly 23%. The AWP’s Technology Plus segment declined by about 12%. Some of the worst-performing names in this segment were Warner Bros. Discovery (WBD), Netflix (NFLX), Meta (META), SoFi (SOFI), and others. Every stock has its story, but the overall image was bad as many tech stocks experienced some of their most significant drops last quarter. The only real outperforming AT&T (T), which surged following the WBD spinoff, is part of my Palantir (PLTR) position. Another positive factor in this segment was effective hedging. Collar hedges on (AMD), (PLTR), (SOFI), and other riskier holdings yielded significant income and helped mitigate losses in the tech space. Including hedges, the quarterly loss was only around 8% in this space, significantly better than the 22.5% decline in the Nasdaq.

Q3: Technology

I rolled most of the tech holdings over from Q2. Many quality tech names are deeply oversold, and even if there is downside ahead, it may be relatively limited now. Additionally, many tech names are great for covered call and collar option strategies. Therefore, if another leg lower materializes for tech stocks, we can hedge via options strategy. Lower-risk holdings like AT&T, Intel (INTC), and Google (GOOG, GOOGL) get the more significant allocations. While some of the higher-risk names like Palantir and SoFi have minor positions. Also, I am staying committed to the WBD investment, keeping it at around 2% of portfolio assets.

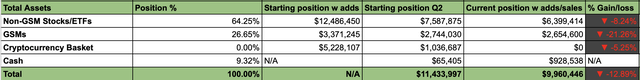

Q2 – Gold/Silver/Miners “GSMs”

The AWP has about a 6.6% allocation in physical gold and silver. Precious metals had a challenging quarter, with gold giving up about 7% and silver roughly doubling that with a 15% loss. However, the debacle occurred with gold and silver mining stocks. These equities got slaughtered, some falling by 30-50% in the quarter. The combined loss in this segment was a whopping 21% in Q2. The worst part is that we had an opportunity to realize substantial profits in early April, but the losses kept spiraling and spiraling. I was too bullish on this space going into Q2 and should have decreased holdings around the top or at least hedged to mitigate losses. The GSM segment was by far the worst-performing segment in Q2; without it, the AWP’s Q2 loss would have only been 8.7%.

Q3: GSMs

With 23% of holdings, I keep the GSM position quite large. Roughly 6.5% of assets is allocated to physical, and the rest is in quality miners. While I reduced several positions, I remain bullish on this space intermediate and long-term, especially after the recent correction. Many quality gold miners crashed by 30-50% quickly, leading to some spectacular deals in the market. The market does not like gold, which has made it a complex investment in recent years. However, with inflation moving higher, the Fed likely has a limit to how high it can increase rates. Therefore, the Fed may need to stop tightening or decreasing rates despite relatively high inflation readings soon. Thus, gold, silver, miners, and other commodities could take off if it becomes evident that the Fed cannot control inflation.

Q2 – Bitcoin and Digital Assets

Bitcoin and digital assets (The AWP)

Another trouble spot was the Bitcoin (BTC-USD) and other digital assets. There were few bright spots here last quarter, and primarily losses. I made several attempts to trade around the declines here, but it would have been better to stay out of this market for now. The overall loss came in at about 5%. The AWP benefited significantly from the Bitcoin/crypto bull run since 2018, and it is better to wait for a new bull market to begin instead of attempting to make money in a falling crypto market.

Q3: Bitcoin/Digital assets – 0% Portfolio Holdings

I am content to sit on the sidelines for now. It’s probably not a good idea to own Bitcoin and other digital assets in a rising interest rate environment. The current bear market likely has more room to run, and Bitcoin’s price could come in at about $10,000 before the ultimate bottom hits. Therefore, I’ll wait and start building positions at lower levels, likely around the time the Fed is ready to stop raising rates and considers performing a policy reversal.

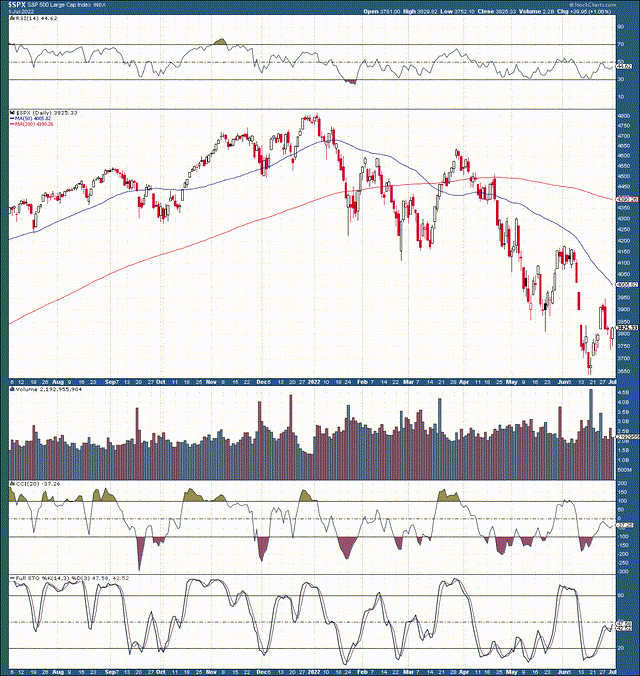

The Bottom Line

The AWP (The AWP – Financial Prophet )

The AWP finished the quarter with a loss of nearly 13%. The significant losses in the GSM space dented the performance in Q2. Additionally, crypto-related losses damaged the overall image as well. The non-GSM stock and ETF segment declined by 8% in the quarter. However, the stock/ETF segment fell by fewer than 4% once dividends, covered calls, collars, and put options premiums were factored in. Therefore, despite several setbacks, the core performance of the AWP was significantly better than the 16.5% decline in the S&P 500 and the 22.5% Nasdaq drop. In H1, the AWP grew by approximately 3%, and the portfolio is positioned to continue appreciating in the year’s second half.

Be the first to comment