sturti/E+ via Getty Images

I came across Kinsale Capital Group, Inc. (NYSE:KNSL) while looking for stocks that continue to trade near their 52-week highs while the market is down more than 20%, indicating strong relative strength. While Kinsale is a very impressive underwriter with industry-leading growth and profitability, I find the stock too richly valued with no margin of safety. Therefore, I would not recommend investors commit fresh capital to Kinsale at this time.

Introduction to Kinsale

Kinsale Capital Group is a property and casualty insurer focused exclusively on the excess and surplus lines (“E&S”) market in the US. Kinsale writes business in all 50 states and territories using a network of independent brokers.

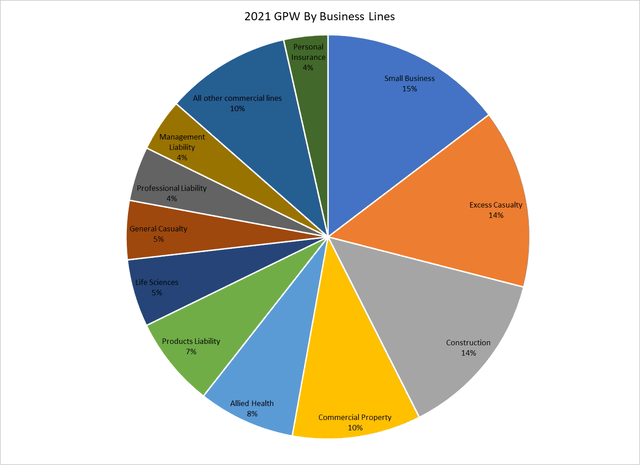

Kinsale writes a variety of business, with no single business line comprising more than 15% of total gross premiums written. Figure 1 details KNSL’s GPW by business line. Interestingly, KNSL does not disclose net premiums by business line, so we are not able to determine whether the company reinsures certain business lines more than others.

Figure 1 – Kinsale GPW by business line. (Author created with data from Kinsale 10-K reports.)

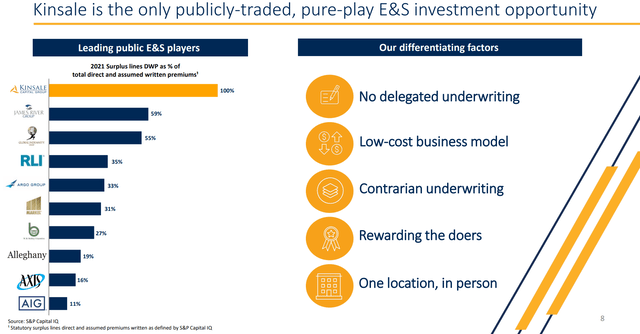

Kinsale is the only publicly-traded pure-play E&S insurer (Figure 2), and management believes its differentiating factors are its “no delegation” underwriting policy and its proprietary technology platform that allow Kinsale to respond to the majority of broker quotes within 24 hours.

Figure 2 – Kinsale is only pure-play E&S insurer; differentiate on underwriting and technology (Kinsale investor presentation)

What Is E&S Insurance

Simply put, Excess & Surplus lines (“E&S”) is a specialty market that insures things standard carriers won’t cover. Think of E&S as ‘non-prime’ when it comes to the insurance market, where ‘prime’ insurance is standardized risks that major carriers will underwrite. Typical E&S risks include newly established companies or industries, high-risk operations or companies with poor loss histories. For example, Kinsale offers insurance from seed to sale for cannabis businesses.

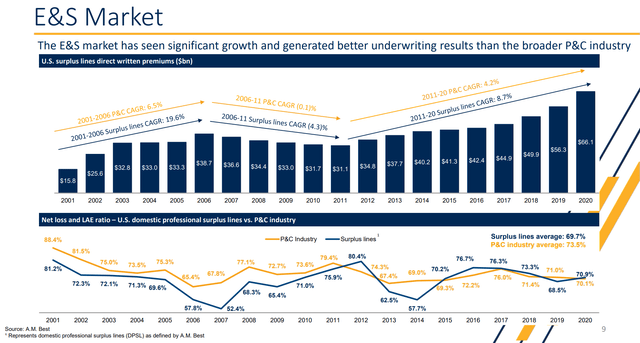

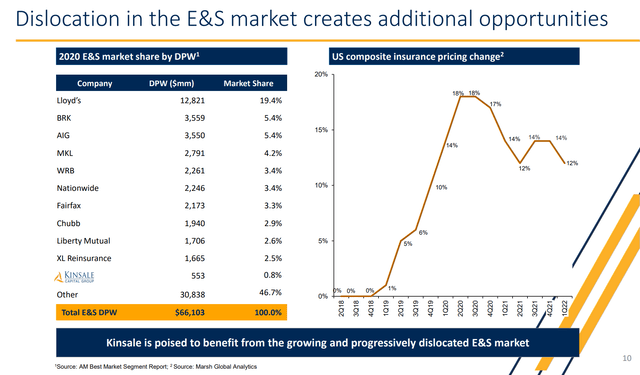

E&S Insurance has seen strong growth, with total E&S insurance premiums growing from $16 billion in 2001 to $66 billion in 2020, or 7.8% CAGR (Figure 3) over the 19-year time span.

Figure 3 – E&S insurance market is attractive (Kinsale investment presentation)

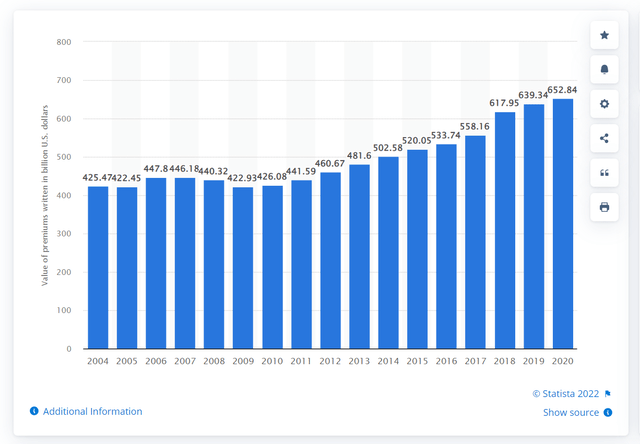

This is far above the industry as a whole, where we see P&C insurance premiums have only grown at a 2.7% CAGR from 2004 to 2020 (Figure 4).

Figure 4 – P&C insurance premiums over time (Statista)

Also, as we can see from Figure 3, E&S insurance tends to have better underwriting results than the P&C industry, with average loss ratio of 69.7% vs. 73.5% for the P&C industry. This is because E&S risks are those that the standard carriers have rejected, hence pricing tends to be better than standard risks.

Kinsale Financials

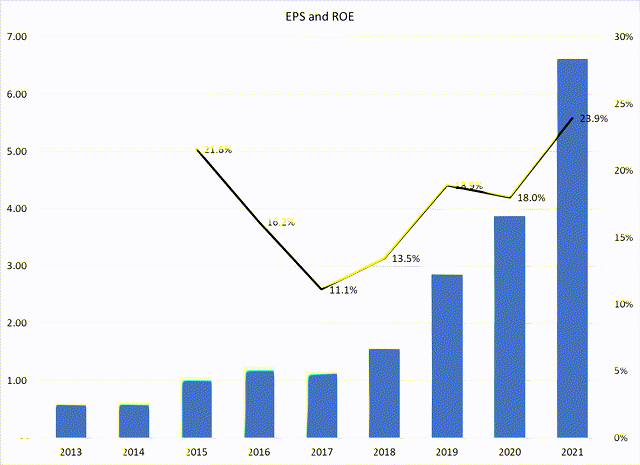

Looking at Kinsale’s financials, we can see it certainly has been an outstanding performer. Since going public in 2016, consolidated diluted EPS has increased from $1.24 to $6.62 (40% CAGR), and ROE has been strong, improving from the teens to 23.9% in 2021.

Figure 5 – KNSL delivered strong EPS and ROE (Author created with data from roic.ai)

Impressive Underwriting Performance…

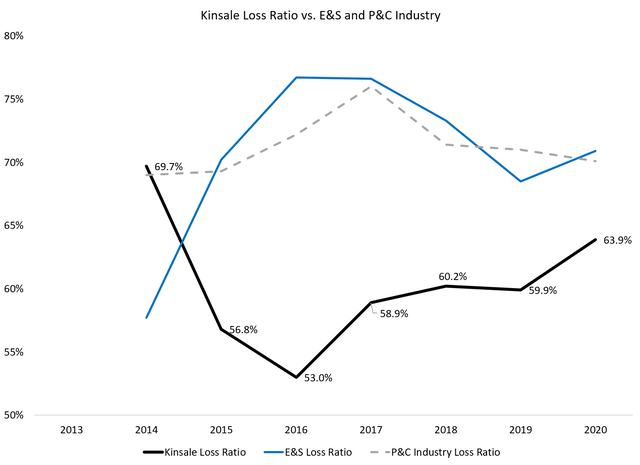

Beneath the surface, Kinsale’s performance is even more impressive. Comparing the data available, Kinsale averaged a 60.3% loss ratio from 2014 to 2020 while the E&S average was 70.6% over the same time frame, and the P&C Industry average was 71.3%. The fact that this underwriting profitability occurred while net premiums earned grew from $59 million in 2014 to $413 million (38% CAGR) is even more impressive.

Figure 6 – Kinsale loss ratio vs. industry (author created with data from Kinsale 10-K and investor presentation)

In an article that I wrote recently on United Fire Group, Inc. (UFCS), I laid out my thoughts on P&C insurers in the section titled P&C Insurance 101. Essentially, pricing is the key lever that P&C insurers use to control their underwriting business. Price too cheaply, and premiums grow rapidly, but at a loss. It is extremely rare for an insurer to be able to grow rapidly like Kinsale with 39% NPE CAGR while maintaining underwriting discipline in terms of loss ratio.

Results so far certainly corroborate management’s assertion that Kinsale has a long runway to grow profitably in the E&S market, with only ~1% market share as of 2020 (Figure 7), and 1.2% market share using 2021 GPW of $764 million.

Figure 7 – Kinsale market share (Kinsale investor presentation)

…Combined With Exception Cost Control

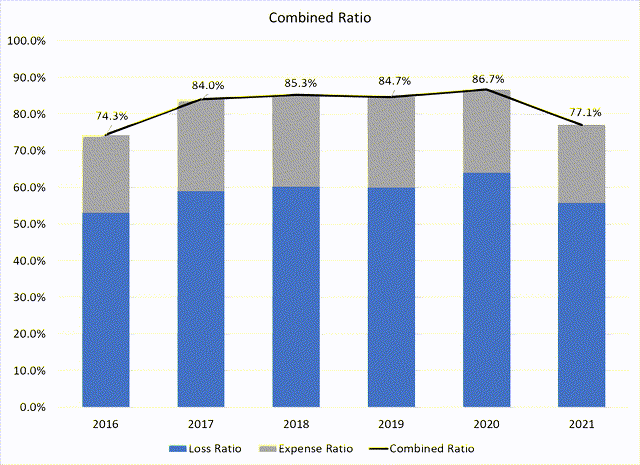

The other piece of the Kinsale story is its extremely low expense ratio. From 2016 to 2021, Kinsale’s expense ratio has averaged 23.4%. Industry average expense ratio is normally closer to 30%.

Management credits its low expense ratio to a proprietary technology platform that drives a high level of efficiency and automation. This allows Kinsale to provide best-in-class service to customers (majority of quotes are returned within 24 hours versus days for legacy insurers) while reducing human error in underwriting and improving efficiency in policy and claims processing and other workflows.

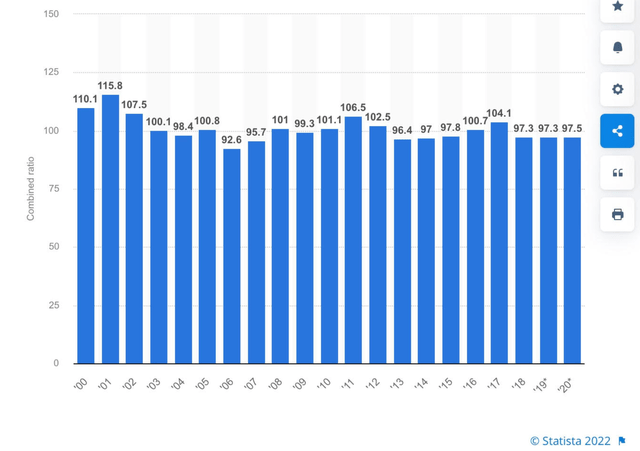

The end result is industry-leading combined ratios that have averaged 82% in the 6 years as a public company (Figure 8), significantly outperforming the P&C industry that averages close to a 100 combined ratio over time (Figure 9).

Figure 8 – Kinsale Combined Ratio (author created with data from Kinsale 10-K) Figure 9 – P&C Industry combined ratio (Statista)

Valuation Priced To Perfection

The analysis to this point shows that Kinsale is a very impressive P&C insurer, with industry-leading combined ratios driven by strong underwriting and cost controls. But what about its valuation?

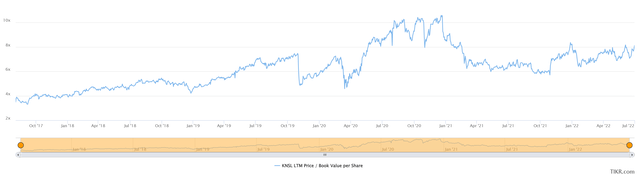

Unfortunately, valuation is where I struggle with the Kinsale story. Since going public in 2016, Kinsale has consistently traded at a premium multiple, from 4x Price-to-Book value in 2017 to over 8x currently.

Figure 10 – Kinsale trades at significant premium (TIKR.com)

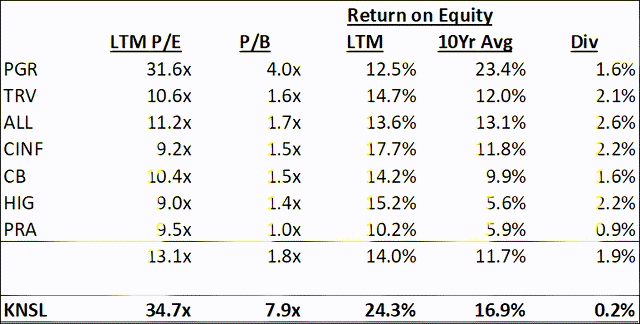

Figure 11 summarizes Kinsale’s current valuation relative to some P&C insurance peers. The only company with comparable valuation is Progressive Corporation (PGR) that trades at 4x Price-to-Book, still only half of Kinsale’s. To Kinsale’s credit, its 39% growth rate is far higher than Progressive’s 12%, but it is also from a much smaller base while PGR has been a public company for over 50 years.

Figure 11 – Kinsale versus P&C insurance peers. (author created with data from TIKR.com)

As long as Kinsale can continue to grow at nearly 40% topline while delivering a combined ratio in the 80s and ROE above 20%, current valuation should be sustainable. The problem is that at 8x P/B, it would not take a lot for the valuation multiple to contract. For example, during the COVID-19 crash in March 2020, valuation contracted from 7.2x P/B to 4.6x in a matter of weeks as investors stampeded out the door. If the economy slows down or goes into recession as many economists are predicting, will KNSL be immune?

Or think of it another way. At 8x P/B, an investor is paying $8 for every $1 of book equity. Even if the current LTM ROE of 24% is sustainable (24% ROE is the highest the company has ever recorded), the investor is only earning $0.24 on his $8 investment, for a 3% yield.

For valuation reasons, I cannot recommend investors put fresh capital to work in KNSL, despite its outstanding business fundamentals. I think a safer course of action would be to watch the stock closely and buy shares on any external shock events like the COVID-19 crash.

Risk To Kinsale Story

E&S Insurance Highly Cyclical and Higher Risk During Economic Downturns

One underappreciated risk by current investors in Kinsale is the cyclical nature of E&S Insurance. Since the company went public in 2016, we have only been in a hard market in standard insurance (higher insurance premiums and more stringent underwriting standards) as seen in Figure 3. When the standard insurance market hardens, the E&S market typically hardens more, as E&S insurers have pricing power. However, when general insurance markets soften, many customers that were driven into the E&S market may return to the standard markets, which could exacerbate the effect of rate decreases in E&S lines.

Moreover, as mentioned in the above section on E&S Insurance Overview, the insured businesses in E&S tend to be small businesses and those with poor loss histories. If the economy does go into a recession, insurers solely focused on E&S lines could be more negatively impacted as the underlying insured businesses suffer or go bankrupt.

Market Volatility Could Negatively Impact Investment Portfolio

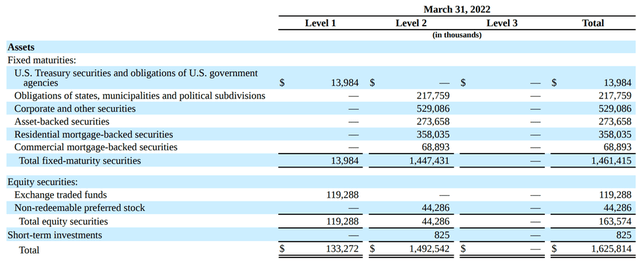

Figure 12 summarizes Kinsale’s investment portfolio. Like most P&C insurers, Kinsale primarily invests in bonds as they need to pay out claims from this portfolio and cannot bear the higher volatility from equities.

Figure 12 – Kinsale investment portfolio. (Kinsale Q1/2022 10-Q)

However, given the recent market volatility and rise in bond yields, it would not be surprising for Kinsale to show large mark-to-market losses in the upcoming quarters. In fact, in the Q1/2022 10-Q report, Kinsale reported a sharp increase in unrealized loss in the fixed income portfolio from $9.8 million as of December 31 to $66.5 million as of March 31. With interest rates up sharply in Q2, the unrealized loss should be up significantly in Q2 as well.

Conclusion

Kinsale is a very impressive insurer focused on the attractive Excess & Surplus (“E&S”) lines. It has industry-leading premium growth of almost 40% CAGR and combined ratios in the low 80% range, leading to 20%+ ROE. However, even with such impressive fundamentals, I find the stock too richly valued with no margin of safety. True, the company can continue to execute, and the valuation multiple can remain high, however, at 8x P/B, any hiccup, either internal or external, can lead to a dramatic decrease in the stock price. Therefore, I would not recommend investors commit fresh capital to Kinsale at this time.

Be the first to comment