MarsBars

Bank of America (BAC) recently indicated the S&P 500 (SPY) valuation may revert from a 21st Century PE of 20x to a 20th Century PE of around 15x. The primary reason cited was because of higher inflation, which has resulted in re-pricing of stocks, with investors requiring a higher discount for risk assets such as stocks.

Today, investors can find even better values, especially after the recent market sell-off. This brings me to Omnicom Group (NYSE:OMC), which is now back in bargain basement territory while sporting an attractive dividend yield. This article highlights what makes OMC a great addition to a dividend growth portfolio, so let’s get started.

Why OMC?

Omnicom is a leading global marketing and corporate communications company, serving over 5,000 clients in more than 70 countries. It offers both traditional and digital advertising, as well as public relations services, and over 85% of its revenues come from developed regions like North America and Europe.

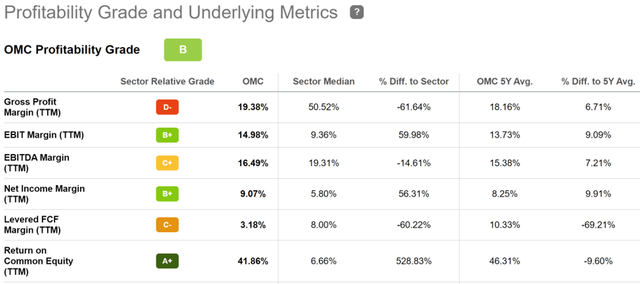

OMC also enjoys scale advantages as the second largest advertising conglomerate. As shown below, OMC achieves above average profitability, with Net Income Margin of 9.1%, sitting well above the 5.8% sector average.

OMC Profitability (Seeking Alpha)

Meanwhile, OMC performing well amidst current global volatility. This is reflected by the 11% YoY organic revenue growth it achieved during the second quarter, driven by strong showings across all of its segments and geography.

Also encouraging, OMC is seeing strong traction in its Precision Marketing segment, with this business seeing 21% organic growth, and rising from the 6th largest segment to now being the third largest. Furthermore, OMC has been able to keep costs in check, with Salary and related costs increasing by just 4.6%, which was outpaced by the organic revenue growth mentioned above.

Looking forward, OMC appears to be well-positioned for an increasingly digital landscape, as it has significant retail media and e-commerce partnerships with leading retail giants such as Walmart (WMT), Instacart (ICART), Amazon (AMZN), and Kroger (KR). OMC’s accumulated data knowledge and expertise give it valuable insights, as noted by Morningstar in its recent analyst report:

Omnicom holds valuable intangible assets, in our view, around the holding company’s brand equity and the strong reputations of its various advertising agencies around the world. We also think the firm’s continuing investments in consumer data accumulation and analysis give it a durable competitive advantage. We believe the utilization of the firm’s moat sources and overall execution will result in Omnicom earning excess returns on capital for at least the next 10 years.

We also expect Omnicom to make acquisitions within the growing and more competitive digital advertising segment. Clients of Omnicom and its peers are allocating more ad dollars toward targeted digital campaigns, creating growth opportunities. Like its peers, Omnicom has made headway in providing different components of digital advertising such as programmatic media buying and ad placement, along with data analytics and performance-measurement services.

Factors that could drive OMC’s share price down include the potential for a global recession, which result in companies slashing their advertising budgets. Fortunately for shareholders, this isn’t OMC’s first rodeo, as it’s paid an uninterrupted dividend for over 30 years.

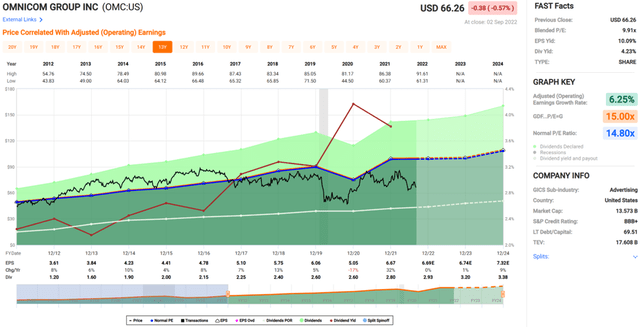

Stocks are forward looking, and I see a lot of global weakness as already having been priced into the stock at the current price of $66.26, with a forward PE of just 9.6, sitting well below its normal PE of 14.8 over the past 10 years. This has pushed the dividend yield up to an attractive 4.2%, and it’s well-covered by a 41% payout ratio, and supported by a BBB+ rated balance sheet.

OMC Valuation (FAST Graphs)

Furthermore, OMC has a solid track record of capital returns through share repurchases as well. The share count was reduced by 5% YoY during the second quarter, and see this as being a savvy move, considering the discounted share price with a 10%+ earnings yield. Sell side analysts have a consensus Buy rating and an average price target of $77.32, translating to a potential one-year 21% total return, including dividends.

Investor Takeaway

Omnicom is a large, global advertising conglomerate that’s seen significant success by continually evolving with the times. It generates above average profitability, and is seeing stable growth even in the current global economy. Looking forward, OMC is well-positioned for an increasingly digital landscape, and I believe the current share price presents an attractive entry point for long-term dividend growth investors.

Be the first to comment