Bahobank/iStock via Getty Images

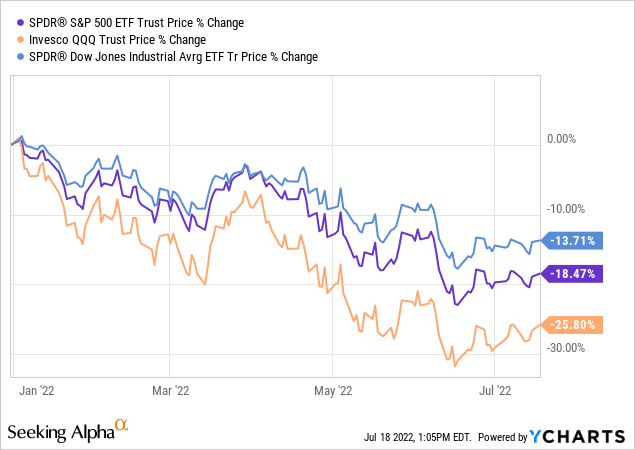

It is no secret that 2022 has been a rough year so far for the markets. The major indexes are all down significantly year-to-date. The S&P 500 (SPY), the Nasdaq (QQQ), and the Dow Jones (DIA) have all posted double-digit losses:

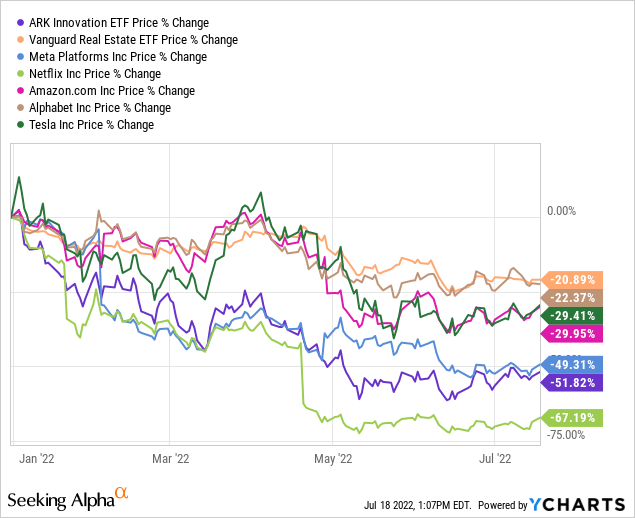

Meanwhile, several individual sectors have gotten crushed amidst the broader carnage and led the indexes lower, including high-growth speculative tech (ARKK), REITs (VNQ), and many of the mega-cap tech stocks such as Meta (META), Netflix (NFLX), Amazon (AMZN), Alphabet (GOOG)(GOOGL), and Tesla (TSLA):

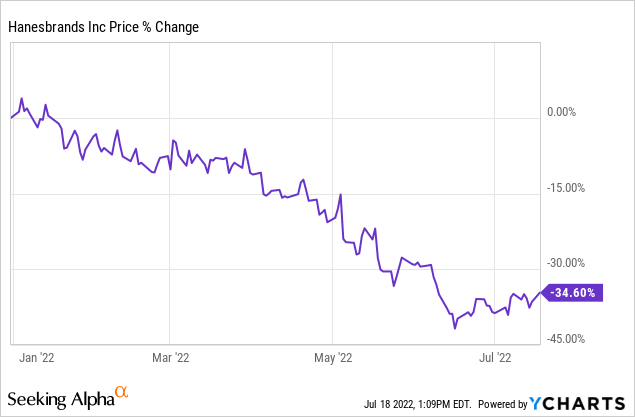

Our portfolios have not been immune either, with one of our more inflation-sensitive stocks Hanesbrands (HBI) being a huge loser so far this year:

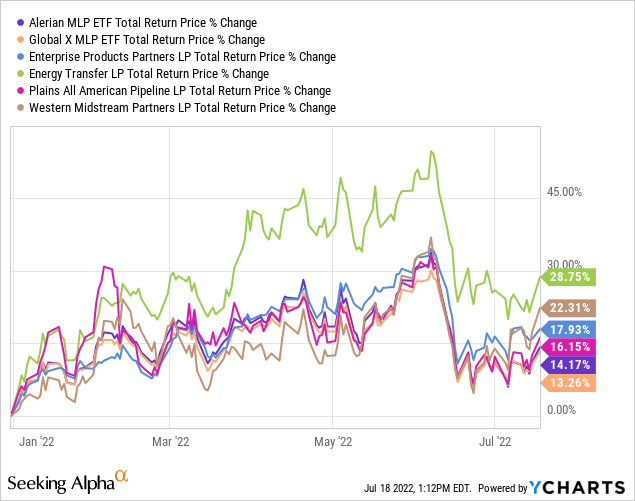

That said, our top pick for 2022 and largest position at 23% of our portfolio continues to win even as the broader market has crashed, delivering strong returns year-to-date in 2022. Back on January 4th, we published an article to the public titled Energy Midstream: The Best High Yield Opportunity Of 2022. In it we laid out our thesis clearly:

With inflation soaring, interest rates still stuck near historic lows, and macroeconomic and geopolitical uncertainties abounding, income investing is harder than ever. However, there are still a few small windows of opportunity remaining. [Energy Midstream] not only offers incredible value, but is also defensive in nature and is resistant to inflation.

Year-to-date, our bullish thesis on energy midstream (NYSEARCA:AMLP) has played out perfectly as the four primary concerns that have crushed the markets this year have been:

- Skyrocketing inflation that keeps getting worse month after month

- Mounting concerns of a recession

- Skittishness about market valuation levels in light of rising interest rates

- Increasing geopolitical risks, particularly surrounding the energy supply chain

Every single one of these catalysts plays right into midstream energy’s wheelhouse, driving ~14% year-to-date total returns for the sector. Even more rewarding, however, has been the fact that all four of our top midstream picks – Energy Transfer (ET), Enterprise Products (EPD), Western Midstream (WES), and Plains All American (PAA) – have outperformed the broader midstream sector, and WES and ET have done so by a wide margin.

Looking ahead, we are still bullish on all four of these picks and believe our bull thesis for the broader sector as embodied by the popular midstream ETF AMLP remains more viable than ever for the following reasons:

They Are Still Trading At A Deep Discount

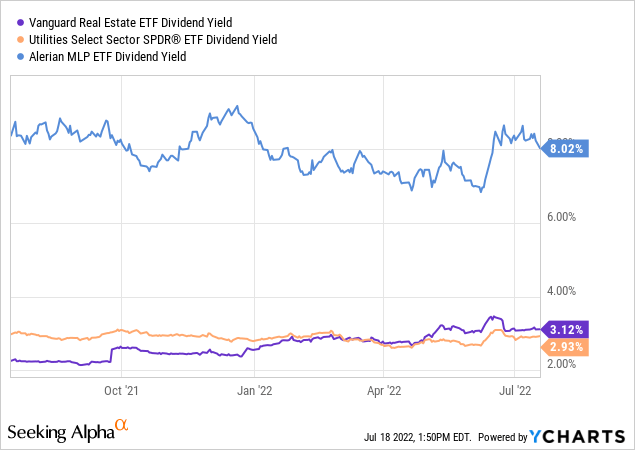

First and foremost, midstream remains deeply on sale, especially when compared to other yield instruments like REITs and utilities (XLU):

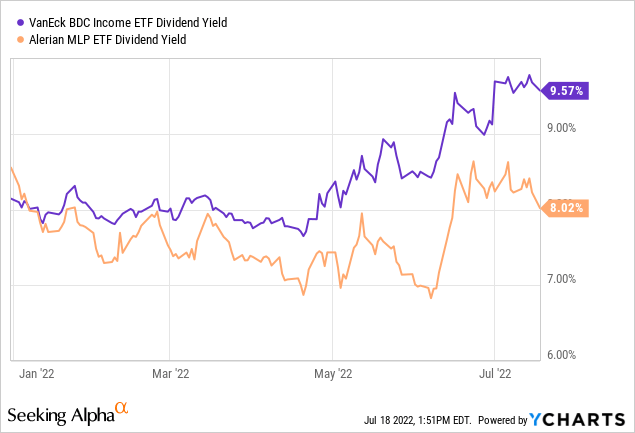

The only other sector that offers a higher yield at present than midstream is the Business Development Company (BIZD) sector:

However, it is important to note that BDCs are required by law to distribute at least 90% of their taxable income (which is virtually all of their cash flow given that their cash flow is primarily interest income) to shareholders, whereas midstream businesses are generally not. As a result, midstream businesses have much lower distributable cash flow payout ratios than most BDCs. This then gives them safer payouts and generally stronger balance sheets, much more robust equity buyback programs, and greater growth potential. Last, but not least, their contract counterparties are typically investment grade whereas BDC lending counterparties are virtually never investment grade.

In addition to being the high yielding sector with the most attractive risk-reward in the market today, midstream businesses are generally trading at attractive levels relative to their own historical averages. Take for example our top picks:

| EV/EBITDA (Current) | EV/EBITDA (5-Yr Average) | |

| EPD | 9.36x | 10.94x |

| ET | 7.64x | 9.16x |

| PAA | 8.84x | 9.92x |

| WES | 7.73x | 9.89x |

They Are Still Ideally Suited To The Macro Outlook

Obviously, energy prices remain elevated relative to historical levels, which bodes well for midstream. That said, midstream cash flows are generally structured to minimize the impacts of short-term energy price volatility, so other than strengthening the balance sheets of and incentivizing increased production levels by their upstream counterparties, elevated energy prices have only a small impact on short-term cash flows.

However, a big reason behind the high energy prices bodes even better for our midstream picks: the energy insecurity of Europe. Russia’s invasion of Ukraine and the subsequent war of sanctions between U.S.-aligned Europe and Russia has exposed Europe’s Achilles’ heel: its dependence on Russian energy. As a result, demand for North American energy exports – which was already on the rise from growing demand in Asia – is surging. Energy midstream infrastructure plays a key role in facilitating those exports to meet European and Asian energy demand and therefore should receive a nice growth tailwind from this macro development.

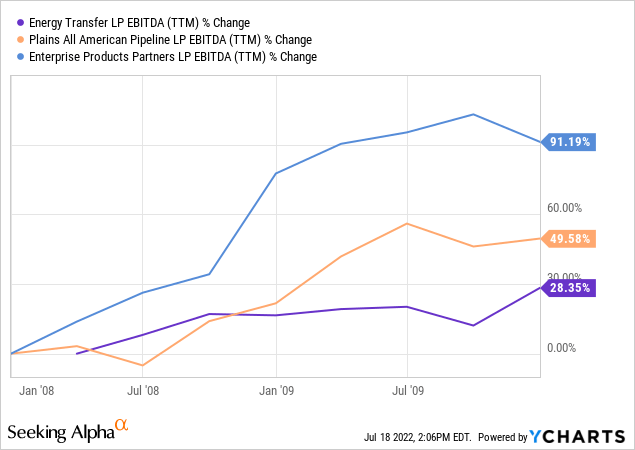

Last, but not least, the high likelihood for a stagflation economic environment over the next few years at least plays directly to midstream energy’s strengths. With much of its capital expenditures behind it thanks to most companies completing their ambitious infrastructure buildouts from the past half decade, the rising costs associated with inflation will only have a muted impact on midstream margins. Meanwhile, inflation escalators linked to virtually all pipeline contracts will benefit from rising inflation rates in the quarters and years to come. On top of that, the fixed fee, take-or-pay, long-term contracts that are so widespread in this industry should lead to a stable cash flow profile. For example, during the 2008-2009 Great Financial Crisis, all three of the four of our top picks that were publicly traded companies at the time saw EBITDA continue to grow at a rapid pace:

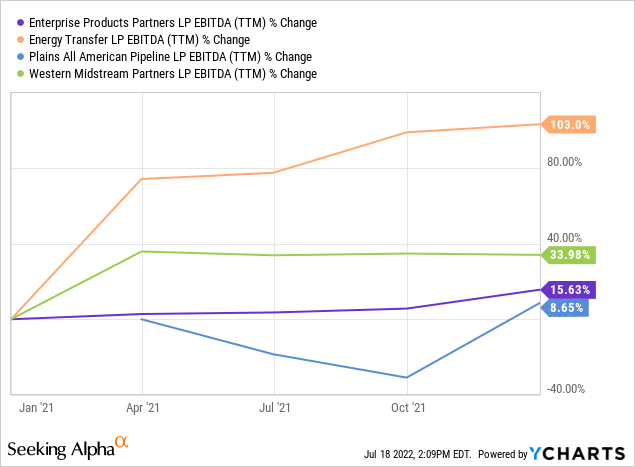

Meanwhile, during the COVID-19 lockdowns and energy market collapse of 2020 – arguably the most difficult environment in history for the energy sector – our picks held up quite admirably:

As a result – especially when you consider the fact that these businesses have been aggressively paying down debt and slashing capital expenditures for the past several years – we feel confident that these investment grade, free cash flow gushing midstream businesses will weather a recession with flying colors.

Investor Takeaway

Thanks to betting heavily on the midstream sector heading into 2022, our portfolio continues to meaningfully outperform the market. However, we believe that the bull story for midstream energy – a sector that has suffered material underperformance for years prior to 2022 – is just getting started and that the sector has plenty of room to run. With the macro stars finally aligning perfectly to highlight its strengths, we remain overweight investment grade midstream energy and believe we will be rewarded with a lucrative combination of massive income yields and outsized total returns for years to come.

Be the first to comment