SKapl/iStock via Getty Images

It’s been just under 4 months since I wrote my latest, bullish article on AMMO, Inc. (NASDAQ:POWW), and in that time the shares are down about 12.6% against a loss of about 10.2% for the S&P 500. I’m the proud owner of a large stake in this company, and they’ve released annual results since I last wrote about them, so I owe it to myself and to all of you to look in on the investment again. In case you’ve made it this far into my article, and you’re suddenly struck with a fear of future run on sentences, don’t worry. I’ll try to be as pithy as possible throughout. I’m going to have a look at these financials, and I’m going to look at the stock as a thing distinct from the business. Also, because I’ve done rather well on options here, I’m absolutely champing at the bit to brag about this performance. I wouldn’t be a Seeking Alpha contributor if I didn’t have an unhealthy drive toward braggartism.

I know that my writing style is, shall we say, an “acquired taste.” Some people never actually develop a taste for it, and that’s understandable. It’s for those people that I write a “thesis statement” paragraph. In this paragraph, you get the highlights of my thesis, while keeping exposure to the “Doyle mojo” to an absolute minimum. You’re welcome. I’m of the view that AMMO, Inc. represents a great investment at current prices. I think we would be wise to take advantage of the market’s sour mood and buy more of this fast grower. The recent financial performance has been spectacular, and the shares are trading at record lows. This combination can’t last and I think we would be wise to jump on it before it’s too late. For those who are comfortable with generating income by selling options, I really like the October puts with a strike of $5. In spite of the drop in stock price, the premia on offer remains virtually unchanged. While I’m going to simply buy some more shares at this point because I’m already short those puts, if you’re just joining us, I think these options are a great way to “play” AMMO, Inc.

A Note on Politics

If you’re reading this from within the “freest, most powerful country in the history of the World”, I’m a “foreigner” (Canadian-Irish) from your perspective, and I’m about to comment on domestic American politics. I know that some of my good friends across the Atlantic or South of the border get a bit…”prickly” when a non-American offers commentary of this sort. Please understand that I make these observations out of a sense of admiration for and love of the United States. Also, I’m neither making direct eye contact, nor am I making any sudden movements. I’m not threatening your troop, and I would certainly never attempt to eat any of your bamboo shoots or fruit.

With that out of the way, I’ll say up front that American domestic politics as it pertains to the back and forth about the Second Amendment is strange to me in many ways. There are a significant cross section of Americans who feel, for instance, that the Democratic party is “left”, and are about to shut down 2nd Amendment freedoms. Any day now. It’s finally going to happen. Even with the current makeup of the Supreme Court. It’s just over the horizon. Just wait for it. This is strange to me because there’s evidence that firearms sales have been relatively robust for decades. For instance, in 2011 Sturm Ruger’s revenue was about $328 million. By 2015, that figure had grown to $551 million. In 2018 it was $495 million. It seems to me that this is an industry that does well no matter which octogenarian crypt keeper is in power. I mean no offence, but from where I sit this “they’re about to place significant restrictions on the 2nd Amendment” idea reminds me a bit of Waiting for Godot. This seemingly constant, if low level, passion may come down to a misreading of history, and/or a misunderstanding of how hard it is for one party or the other to get things done.

To be plain about my own biases, I think one of the reasons the United States is such a success is for this very reason; it’s hard for some group of political half-wits to “get things done.” Anyway, I write about this strange artefact of American domestic politics because I think it’s potentially profitable. When large sections of the investing public stay away from an investment because they “just know” that “those radicals” are going to drive this company, or others out of business with their “radical leftist policies” that creates the opportunity to buy great assets at great prices. I’ve lived on three continents and traveled a few others, and this has given me a perspective on, among other things, exactly how politically crazy people can be. Please believe me when I write that if you think your democratic party are “leftists” on the subject of gun rights, you’ve never met an actual leftist.

Financial Update

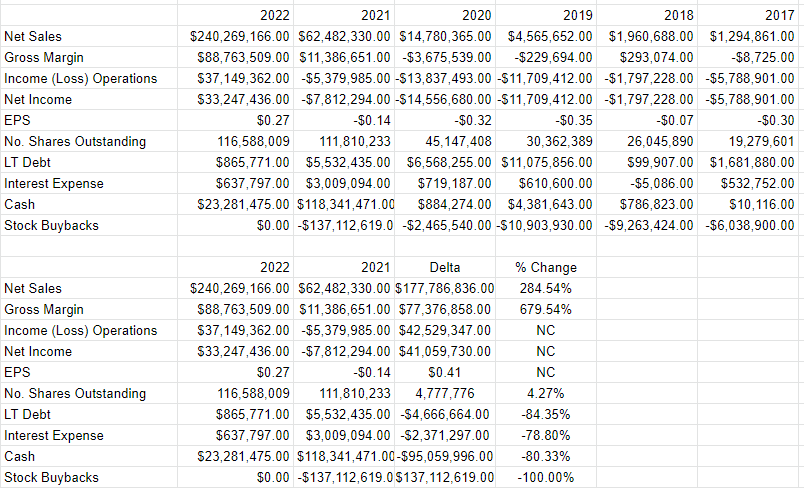

AMMO, Inc. has published annual results since I last reviewed the name, and I’m very impressed by the company’s performance. I’m disagreeable by nature, which means that I take some not so secret delight in criticizing every company I come across. I can’t do so in this case, though as this strikes me as a blemish free financial result. Specifically, revenue for the year exploded higher by about 285%, and net income swung from a loss of ~$7.8 million to a profit of about $33.25 million. Unsurprisingly, earnings per share improved from a loss of $.14 to a positive $.27.

More impressive still is the fact that the capital structure has improved dramatically, with a collapse in long term obligations. Specifically, the company’s long term obligations have dropped by about 84%, with the result that interest expense is down about 79% from a year ago. Cash is much lower now, down by ~$95 million, but this less of concern to me given that the company seems to be able to fund operations organically.

Given all of the above, I’d be very happy to add to my position at the right price.

AMMO, Inc. Financials (AMMO, Inc. investor relations)

POWW Stock

I’m about to tread over very old ground. If you subject yourself to my stuff regularly for some reason, you know that I think the stock is distinct from the business in many ways. If you’re a new follower, I should point out that I think a stock is very different from the underlying business. Further, the stock is often a very poor proxy for the business that it supposedly represents. A business buys a number of inputs, adds value to them, and then sells the results at a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for the company, beliefs about legislative hurdles etc.. The crowd changes its views about the company relatively frequently which is what drives the share price up and down. Added to that is the volatility induced by the crowd’s views about stocks in general. “Stocks” become more or less attractive, and the shares of a given company get taken along for the ride. Although it’s tedious to see your favourite investment get buffeted because the asset class of “stock” goes in and out of favor, within this tedium, we have opportunity. If we can spot discrepancies between the price the crowd dropped the shares to, and likely future results, we’ll do well over time. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name.

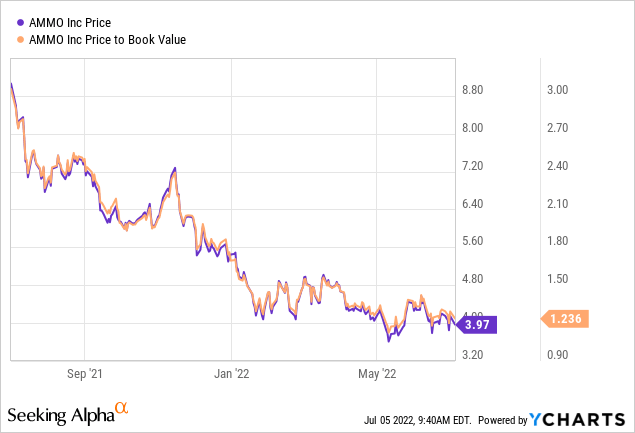

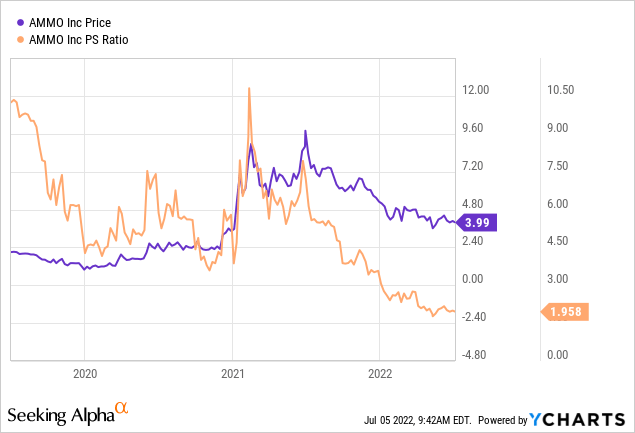

As my regulars know, I measure the relative cheapness of a stock in a few ways ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Once again, cheaper wins. I want to see a company trading at a discount to both the overall market, and the company’s own history. In case you haven’t got your ledger of “Doyle’s trades” open at the moment, I’ll remind you that in the previous article, I liked the fact that price to book was ~1.48, and price to sales was ~2.66. The shares are now between 17% and 27% cheaper per the following.

Since I liked the shares previously, I really, really like them now and will be adding to my position today.

Options Update

I’ve engaged in three options trades here that I feel obliged to write about. First, I wrote some puts with a strike of $5 for $.25 each. I considered this a great trade because it offered a 5% return for a few months of what can only be very loosely described as “work.” When the shares were put to me at a net price of $4.75, I wrote July covered calls with a strike of $7.50 for $.45 each, and these are about to expire worthless, so that worked out well. Finally, I wrote 10 October puts with a strike of $5 for $1.25 each. In spite of the fact that the shares have fallen fairly dramatically in price, these are currently priced at $1.20-$1.40, and I think that presents an opportunity to people just coming to this trade today. Although I’ll not place the trade myself because I’ve already done so, I think the options market offers a great “win-win” trade here to people just joining us. In particular, I think $1.20 is a very decent price for taking on the obligation to buy this great company at $5. If the shares climb from here and end up above $5, you’ll pocket a very healthy premium. If the shares remain below $5, you’ll be obliged to buy, but will do so at a record low valuation. This would also be a great outcome for this fast grower.

Now that you’re hopefully excited by the prospect of a “win-win” trade, we come to the portion of the article where I get to indulge in my semi-sadistic tendency to ruin the mood by writing about risk. This trade, like all others, comes with risk. I consider the risks associated with put options the way I trade them to fall into two broad categories: the economic and the emotional.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy, and at prices I’d be willing to pay. So, I would never advocate that people simply sell puts because they sport a high premium. This strategy leads to disastrous results. Take my word on this one, as it’s informed by some painful experience.

The two other risks associated with my short puts strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on upside. To use this trade as an example, let’s assume that AMMO’s stock price goes parabolic and hits $10 per share between now and the third Friday of October. Obviously, my puts will expire worthless, which is a great outcome in some ways. I will not catch any of the upside in the stock price from the puts, though. So, short put returns are capped by the premium received. This is emotionally painful for some more hopeful souls than me.

Secondly, it can be emotionally painful when the shares crash below your strike price as happened to me after shares were put to me at $5. As of this writing, whenever this has happened to me, things have worked out well over the long term, because I insist on only ever writing puts at “screaming buy” strike prices. That said, it has been emotionally stressful in the short term on occasion. If you’re going to sell puts, please be aware of the way that they can play with your emotions.

If you understand these risks, and can tolerate them, I would recommend that you sell the October puts with a strike of $5 here. Whatever happens you’ll collect a great premium, and you may have the benefit of buying a fast grower like this one at a price that I consider to be quite attractive.

Conclusion

I liked this company when the growth was less evident, and I really, really like this company now. Revenue has exploded higher, the firm is now consistently profitable, and the capital structure is much improved. In spite of all of this, the shares are trading at historic lows. We can thank the sour mood among investors for this gift. Finally, I think the options market is presenting a “win-win” trade at the moment, which is always compelling. While I won’t add to my existing short position here, I think people who are just joining us could do far worse than sell these puts.

Be the first to comment