Edwin Tan/E+ via Getty Images

The accumulation stage is ‘easy’. Buy growth assets and invest within your risk tolerance level. At the core, you will own wonderful companies (stocks) and real estate. Take a total return approach as more money buys and creates more income. The retirement (decumulation) stage is more complicated, but a successful retirement can be attained by following some very simple suggestions. In retirement, we want to protect our wealth as we grow our wealth. We need to be ready for bear markets and any drastic shifts in economic conditions – see the unexpected stagflation of the day. You might consider the all-weather ETF portfolio for retirement.

I recently offered the stock portfolio for retirement.

We start with the all-weather portfolio concept, but types of stocks take the place of bonds, cash and commodities. The stocks are arranged for economic conditions – and we cover all of the bases.

Have a look at that stocks for retirement post, but here I will also give you the stock selection ideas for consideration.

At the core is a very defensive posture.

Defensive stocks

Utilities – 10%

NextEra Energy (NEE), Duke Energy Corp (DUK), The Southern Co (SO), Dominion Energy (D), WEC Energy Group (WEC), Alliant Energy (LNT)

Pipelines – 10%

Enbridge (ENB), TC Energy (TRP), Enterprise Products Partners (EPD), Energy Transfer (ET), ONEOK (OKE), Kinder Morgan (KMI).

Telecom – 10%

AT&T (T), Verizon (VZ), Comcast (CMCSA), T-Mobile (TMUS), Bell Canada (BCE), TELUS (TU).

Telco REITs – American Tower (AMT), Crown Castle (CCI).

Consumer Staples – 10%

Colgate-Palmolive (CL), Procter & Gamble (PG), Walmart (WMT), PepsiCo (PEP), Kraft Heinz (KHC), Tyson Foods (TSN), Kellogg, (K), Kroger (KR), Hormel Foods (HRL), Albertsons Companies (ACI).

Healthcare – 10%

Johnson & Johnson (JNJ), Abbott Labs (ABT), Medtronic (MDT), Stryker (SYK), CVS Health (CVS), McKesson Corporation (MCK), UnitedHealth (UNH), Merck (MRK), Becton, Dickinson (BDX), Cigna Corp (CI), Moderna (MRNA).

Canadian banks – 10%

RBC (RY), TD Bank (TD), Scotiabank (BNS), Bank of Montreal (BMO).

Growth assets – 20%

Consumer discretionary, retailers, technology, healthcare, financials, industrials, and energy stocks.

Apple (AAPL), Microsoft (MSFT), QUALCOMM (QCOM), Texas Instruments (TXN), NIKE (NKE), BlackRock (BLK), Alphabet (GOOG), Lowe’s (LOW), Amazon (AMZN), TJX Companies (TJX), McDonald’s (MCD), Tesla (TSLA), Visa (V), Mastercard (MA), Raytheon (RTX), Waste Management (WM), Berkshire Hathaway (BRK.A) (BRK.B), Broadcom (AVGO).

Inflation protection – 20%

REITs 10%

Agree Realty Corporation (ADC), Essential Properties (EPRT), Regency Centers Corporation (REG), STAG Industrial (STAG), Medical Properties Trust (MPW), STORE Capital Corporation (STOR), Global Self Storage (SELF), EPR Properties (EPR), Realty Income (O).

Oil and gas / commodities stocks 10%

Canadian Natural Resources (CNQ), Imperial Oil (IMO), ConocoPhillips (COP), Exxon Mobil (XOM), Chevron (CVX), EOG Resources (EOG), Occidental Petroleum (OXY), Devon Energy (DVN).

Agricultural

Nutrien (NTR). The Mosaic Company (MOS).

Precious and other metals

Teck Resources (TECK), BHP Group (BHP), Rio Tinto (RIO).

I also like the idea of playing the green energy commodities supercycle.

The ETF Portfolio For Retirement

While I like the idea and benefits of creating a portfolio of individual stocks, the retiree can certainly accomplish the all-weather task by putting ETFs to work.

Once again, at the core is a very defensive portfolio stance. The front line (and the portfolio) can be built around consumer staples (XLP), healthcare (IYH) and utilities (IDU).

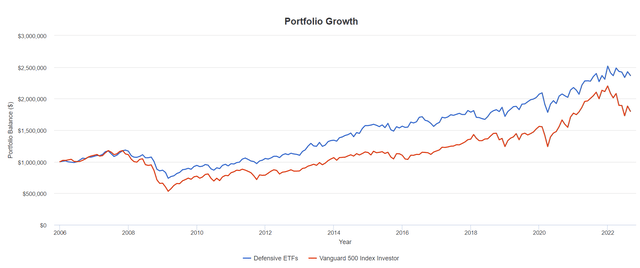

Here is the defensive ETFs vs the S&P 500 in a decumulation test. The spend rate is a somewhat aggressive 4.8%. That is to say each year, 4.8% of the total portfolio value is removed to fund retirement – there is an annual boost in income equal to inflation.

The period is January of 2006 through to the end of August 2022.

Defensive ETFs vs S&P 500 (Portfolio Visualizer / Author)

The defensive ETFs are essentially 30-35% better than the S&P 500. There is enough growth within the defensive ETFs, and we experience the benefit of less drawdowns in market corrections.

Drawdown comparison

The following is according to Portfolio Visualizer.

In the financial crisis of 2008-2009:

- Defensive ETFs down 33.5%

- S&P 500 down 51%

In the 2018 correction

- Defensive ETFs down 7.5%

- S&P 500 down 13.5%

In the COVID pandemic correction

- Defensive ETFs down 14.3%

- S&P 500 down 19.6%

In the 2022 rate-hike fear bear market

- Defensive ETFs down 5.8%

- S&P 500 down 20.0%

Note: Portfolio visualizer uses returns at each month’s end. Drawdowns can be more than shown. But the numbers and trend are still very relevant.

Add inflation protection and we’re done?

Considering that the defensive ETFs offer a slight beat of the S&P 500 on total returns, and does so with less volatility, you might forego any of the more growth-oriented ETFs (QQQ). In the all-weather stock portfolio, the defensive stocks were allocated at 60%, with 20% going to growth stocks.

Given that, some of the 20% growth allocation might be moved to the defensive ETFs. You’d have 75% in consumer staples, healthcare, and utilities.

25% inflation protection is added.

75% defense / 25% inflation protection

For inflation protection, energy stocks rule. REITs are a very useful runner up. You can include pipelines as well that offer the potential of inflation protection while delivering a very solid yield.

Heres’ the inflation protection line-up:

The ETF portfolio for retirement

- 25% Consumer staples (XLP)

- 25% Healthcare (IYH)

- 25% Utilities (IDU)

- 10% – Energy (XLE)

- 10% – REITs (ICF)

- 5% – Pipelines (TPYP)

Portfolio holes and considerations

The portfolio is light on international diversification. That said, many of the companies within the indices are international conglomerates. There is international exposure.

Investors could add modest exposure to an international ETF such as a core iShares (EFA) or on the potential of greater value the Schwab dividend offering (SCHY) or the Legg Mason International Low Volatility High Dividend (LVHI).

Also, consider the Canadian banks that were presented in the stock portfolio for retirees.

Cash and bonds

A cash wedge is not a bad idea. It helps your cause during stock market declines, stagflation, and deflation.

Given that, a retiree might go off the stock-only-script modestly with a 5%-10% weighting to cash and/or short term bonds (SHY) and (ICSH).

You might also consider an allocation to treasuries (IEF) that offer some more robust stock market correction insurance.

In my opinion, the optimal retirement portfolio holds retirement-friendly equity assets, but also includes modest exposure to cash and bonds.

90% retirement-friendly all-weather ETFs – 10% cash / bonds

Also, ensure that you understand all tax implications. And do consider obtaining a greater financial plan.

Please use this article as a strategy for consideration, not blanket advice.

Read. Decide. Invest.

Thanks for reading.

We’ll see you in the comment section. How will you position for retirement? And if you are in retirement. how is your portfolio holding up in the new stagflation regime? How did it hold up in the COVID correction?

Don’t forget to follow me on Seeking Alpha, or on my blog – Cut The Crap Investing.

Be the first to comment