Ralf Geithe

Investment Thesis

Green fuels are in high demand right now, with governments and companies around the world instilling “green initiatives” into their core long-term plans. This is especially true of the Canadian government, which has pledged to reduce its carbon dioxide (CO2) emissions by 30% and asked utilities to convert their content ranging from 5% to 15%, to be renewable by 2030.

To achieve this, the Canadian government announced a range of important programs since 2015, including $13 billion to fight climate change and reduce greenhouse gas emissions. This indicates growing renewable energy market opportunities in Canada, plump for investing in renewable infrastructure projects.

EverGen Infrastructure Corp. (EVGN: CA) is a leading Canadian pure-play in the Renewable Natural Gas (RNG) space with significant growth prospects, including pumping up its EBITDA from $3 million to $50 million in the next 2 to 3 years with its ongoing project pipelines.

The stock’s upside potential is significantly higher than the downside risks because of the company’s stable long-term contracts of up to 20 years, ample liquidity, strong growth prospects, and discounted share price.

The Company

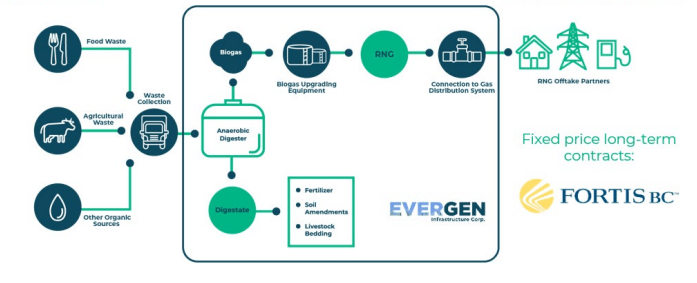

EverGen Infrastructure is a post-pandemic Canadian company that focuses on building reliable infrastructure to supply sustainable green gas originating from organic waste.

It acquires, owns, develops, and operates RNG infrastructure projects. These projects deliver green gas into the gas grid-like independent power producers deliver renewable content into the electrical grid, partnering up with utilities.

As such, the company has long-term off-take contracts with the gas utilities, which are an integral part of the company’s strategy to generate stable long-term cash flows.

EVGN Operations Portfolio

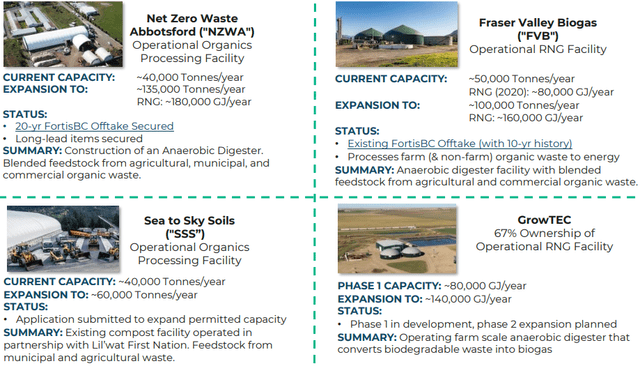

The Company operates four facilities through its subdivisions:

- Net Zero Waste Abbotsford Inc. (NZWA)

- Sea to Sky Soils and Composting Inc. (SSS)

- Fraser Valley Biogas Ltd. (FVB)

- Grow the Energy Circle Ltd. (GrowTEC)

NZWA and SSS Waste Conversion Facilities

NZWA and SSS are organic waste conversion facilities. The municipalities drop off organic waste, including yard waste and biosolids, at the front end of these facilities, which is processed and converted into organic compost sold at the back end, making it a closed-loop system.

It is a circular economy operation that allows the municipalities to not only process their waste efficiently but also to get back a product used in agriculture in terms of soil and residential development.

The NZWA facility is undergoing a planned expansion, which will add anaerobic digestion capabilities to produce biogas and then be upgraded to RNG to feed into FortisBC’s, British Columbian gas utility, gas network under an existing 20-year off-take agreement.

The FVB Project

The FVB project primarily produces RNG by converting agricultural waste from local dairy farms in BC, which is then sold under a long-term contract with FortisBC. The facility acts as a giant stomach that allows the waste to decompose quickly and the gas to be extracted and then taken and used in the natural gas pipeline network.

EverGen Infrastructure Corp.

In the process of creating RNG from organic waste, the company generates revenue through long-term contracts with municipalities and waste haulers, which dispose of the waste at landfills and collect a kit fee which is the revenue source of the landfills and the other 50% of the revenue is generated by long term contracts with the utilities, to which the RNG gas filled pipelines are connected.

FVB facility in Abbotsford, B.C (CTV News)

Project Pipeline

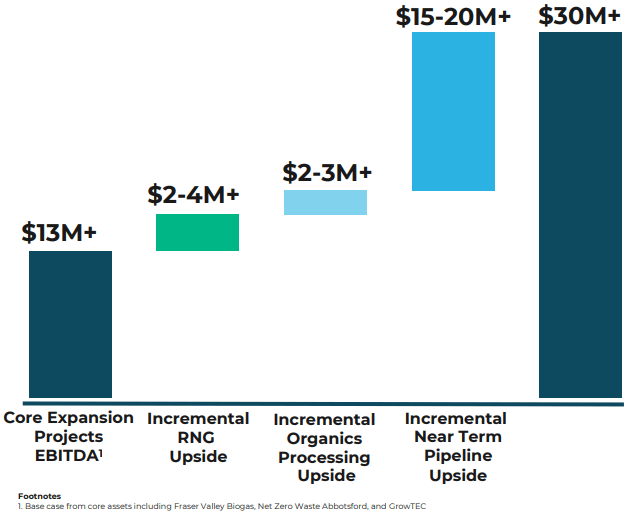

EverGen is proactively working to develop and expand its core RNG projects, doubling the capacity of RNG to 160,000 gigajoules per year in the FVB project and adding about 180,000 gigajoules per year capacity to its NWZA project.

The company is expected to complete the expansion of the FVB project by the first quarter of 2023 and commence the NWZA expansion project in mid-2023.

In July, the company acquired a 67% interest in GrowTEC, which has processed 15,000 tonnes of waste annually since 2015 to produce 80,000 gigajoules. The project is currently in the first phase of a core RNG expansion and is expected to be completed by the year-end. Phase 2 of the project will ramp up its capacity to about 140,000 gigajoules of RNG per year.

In May, EverGen also acquired a 50% interest in Project Radius, a late-development-stage portfolio of three on-farm RNG projects with a collective capacity of about 1.7 million gigajoules of RNG per year, expected to be completed by 2024.

A Solutions Provider

RNG is not the only revenue stream of the company. It’s also what the municipalities and commercial food manufacturers are looking for in the front end; i.e., to divert that waste.

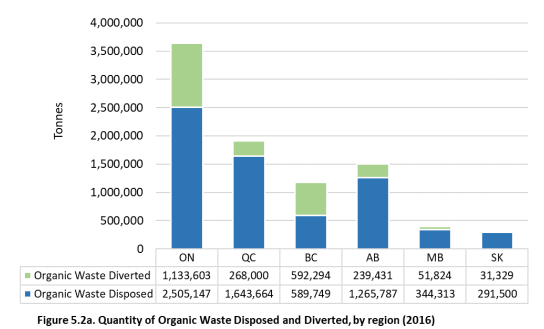

National Waste Characterization Report, CA

Organic waste is represented by food, yard, and garden waste. National Waste Characterization Report states that diversion rates across the country range from less than 1% in Newfoundland and Labrador to 80% in Nova Scotia.

One can see clearly that this is becoming increasingly prevalent in Canada, where the green bars represent the diversion of organic waste away from landfill. There hasn’t been a build-out infrastructure to take that organic waste to capture the energy or the emissions associated with that organic waste.

Between 2002 and 2018, solid waste diversion in Canada increased 48% to 9.8 million tonnes. Organic waste accounts for 65% of total solid waste diverted. We are seeing the growing trend of diversion and a growing requirement for infrastructure to be built.

The core RNG expansion project at NZWA, which is anticipated to commence construction in mid-2023, is likely to increase the facility’s inbound organic feedstock from 40,000 tonnes per year to about 135,000 tonnes per year, adding RNG production of about 180,000 gigajoules per year.

Since the company uses organic waste as the only feedstock for the production of RNG, taking into account the increasing trend of organic diverted waste and the company’s unique infrastructure to convert this organic waste into RNG puts the company in a very favorable position to acquire growth by fulfilling the modern utility needs of the society.

The company is also building natural gas capture infrastructure. The facility already has organic waste coming into it, capturing the gas that is released from organic waste decomposition.

This is one of the key drivers of renewable natural gas. A major benefit that it has as a green fuel is that the company is capturing methane emissions, that if the waste had gone to a landfill, would have been released directly into the atmosphere.

On an associated side note, Methane is 30% more dangerous than Carbon Dioxide (CO2). Landfills account for about 15% of global methane emissions, trapping over 80 times more heat than CO2, making companies like EverGen, a key player in reducing global warming.

This also carts the EVGN projects as absolute carbon negative. I’ve also discussed the growth of the renewable market in my KLXE article and find the U.S. Environmental Protection Agency’s statement especially relevant here:

Taking into account the previous 3 decades, the cost of this act is $65 billion, the savings acknowledged from less unexpected losses, lower well-being costs, and expanded efficiency will add up to $2 trillion.

Financial Prospects

Being a $42 million micro-cap company, EVGN is prone to significant financial risks and must have enough financial and other resources to complete its ongoing projects. However, despite the high short-term volatility, the risk-reward dynamic weighs heavily toward the upside scenario, given the significant discount on the share price and the long-term growth prospects.

The company reported a 23% lower YoY revenue in the last 6 months due to a 15% lower incoming organic feedstock volume and a seasonal impact of 57% on organic compost and soil sales. This was offset by a 38% increase in RNG production. Despite reporting a net loss of $765 thousand, this was a YoY improvement of $568 thousand or 43% in H1 2022, resulting in a 57% EPS improvement from a loss of $0.14 per share to a loss of $0.06 per share.

As a growing company, EVGN’s investors would benefit from looking down the road at the company’s potential profit generation. The company has 20-year offtake agreements and other municipal contracts, up to $20 million of its project costs eligible for grant funding, the ability to produce over 30% in incremental RNG and sell at spot pricing, and a project pipeline with a potential to produce over 2 million gigajoules per year through 2024.

EverGen Infrastructure Corp.

If the company produces 2 million GJ/year by 2024 and sells it for $25 per GJ, it can generate $50 million in revenue. A 50% EBITDA margin conversion can translate to about $25 million in EBITDA. The company claims that its core projects and acquisitions have the potential to generate over $30 million in Adjusted EBITDA by 2024, an exponential growth from the current level of $3 million. This represents one of the best growth profiles in the renewable sector.

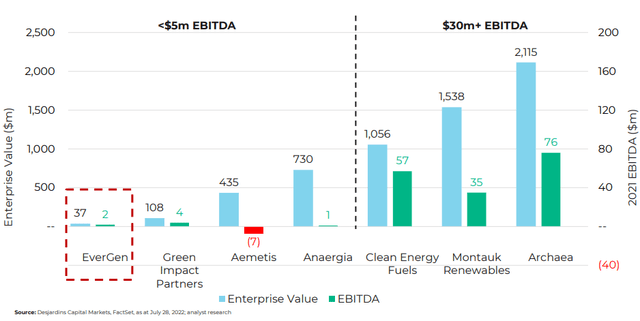

Accordingly, EverGen is trading at a fraction of its expected 2023 EBITDA, with the market pricing-in a significant execution risk and making the stock trade well below its peer average.

The company currently has $17.4 million in cash and about $6 million in debt. It signed an agreement for a $31 million senior term loan to fund its core RNG NZWA and FVB expansion projects in August. So liquidity-wise, the company is safe and has recently announced the approval of its NCIB program for up to 5% of its outstanding shares, allowing it to purchase its own shares during periods of heightened volatility.

Growth Opportunity

The company is headquartered in Canada, and most of the projects in Canada are similar to the projects that the inventors see in the U.S and European countries. However, Canada has large utilities like FortisBC that are willing to provide 20-year contracts, which are tremendous in terms of de-risking the future cash flows associated with any project. This will allow the company to take that investment into multiple projects across the country for business growth.

The company has no likewise competitors in Canada, but renewable energy competitors include RE Royalties (RE:CA) (OTCQX:RROYF), Solar Alliance Energy (SOLD:CA) (OTCQB:SAENF), Superior Plus (SPB:CA) (OTCPK:SUUIF), and CF Energy (CFY:CA) (OTCPK:CGFEF).

The other prospect of growth for the company is the feedstock profile. One can see increased regulation through landfill bans and tip fees, bolstering the economics associated with any project.

FortisBC has tripled its supply of RNG in 2021 and expects to at least triple its supply again in 2022, aiming to have about 75% of its total gas supply be renewable or low carbon by 2050 and meet the province’s 80% GHG reduction target.

Beware of the Risks

As with any micro-cap stock, certain risks are associated with investing in EverGen, especially as the company operates in an industry that has yet to blossom. Even though the market is investing in green initiatives and renewable fuels are in high demand, the industry has an uphill battle against the matured fossil fuel industry.

It should be noted that despite all the potential rewards of investing in this sector, the investments would be most fruitful in the long term because the industry is still too young to dole out material returns. The market could be timed to extract short-term profits. Still, any short-term trades will be highly risky because micro-cap stocks tend to be extremely volatile, fluctuating enormously based on positive or negative news about the company.

Another risk that must be considered is that it is one of the many suppliers of FortisBC. Even though it provides essential services to the utility, it does not have strong bargaining power because of its size, which can affect its future revenues and profitability. This forms part of the execution risk, likely the reason for the stock to trade at a discount despite its significant growth prospects in the upcoming years.

The company is still young and has an unproven track record. Therefore, there remains a major risk that if it fails to perform well in the short term, the market may reprimand the stock with a downward spiral.

Conclusion

There are other renewable energy sources like solar and wind. Still, these sources are intermittent energy sources, i-e, the energy isn’t available when the sun is not shining or the wind is not blowing. However, RNG can be an important renewable energy source because of its availability as per consumer demand. Waste material can be converted into energy 24/7.

As the world shifts to renewable energy sources to fight climate change and government officials spend billions of dollars on building this infrastructure, EverGen is poised to take advantage of these tremendous opportunities and become a long-term solution provider in terms of building out the required infrastructure to capture the organic waste and emissions that would have been dissipated, harnessing them into energy.

The company’s opportunities lie within North America, where the utility services will target the 5% to 15% transition of their content into renewable sources.

Additionally, the company’s decades-long off-take agreements provide a measure of safety and reliability that would otherwise have been lost on a new company, making me rate the stock as a buy.

Be the first to comment