Leila Melhado

MercadoLibre, Inc. (NASDAQ:MELI), often dubbed the “Amazon (AMZN) of Latin America,” is an Ecommerce company I have been following for many years. I recently wrote a post just last month (July 1st, 2022) titled “MercadoLibre: Value, Growth and Outstanding Execution.” The share price at post-publication was $659, and since then the stock price has popped by ~35%, or ~47% if we include premarket trading, so congratulations to those who invested.

In my prior post, I also mentioned the stock was “~30% undervalued” and it now looks as though that value gap has closed, which gives me faith in my current valuation system. However, this post isn’t about past triumphs, it’s about MercadoLibre’s blockbuster results which actually deserve an increase in my expectations for the stock. In this post, I’m going to break down the recent earnings report and revisit my valuation for the stock, so let’s dive in.

MercadoLibre (Author Rating (Ben Alaimo Motivation 2 Invest) July 1st 2022)

The Amazon of Latin America

MercadoLibre has two growth engines, its dominant Ecommerce business, and its relatively new but still thriving Fintech business. Starting with Ecommerce, the company has a dominant market share in some of the largest online shopping markets which include Brazil and Argentina, with a 27% and 68% market share, respectively. This is in addition to exposure to other markets such as Mexico and Chile.

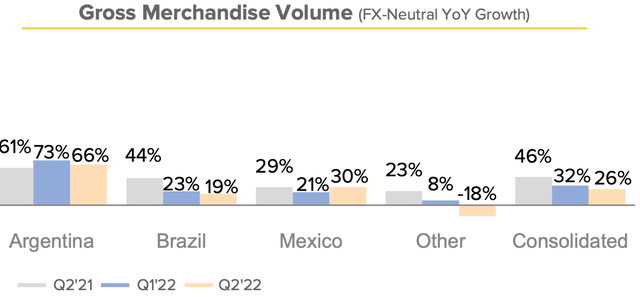

For the second quarter of 2022, MercadoLibre had over 41 million unique buyers and Gross Merchandise Volume (GMV) popped by a rapid 26% (on an FX neutral basis). This was driven by strong growth in Argentina (up 66% year over year) and solid growth in Mexico (up 30% year over year).

MercadoLibre GMV (Q2 Earnings Report)

Despite the economic uncertainty, the number of items per buyer in Q2 was at the same level relative to Q1, while GMV per unique buyer grew. Commerce Net Revenues popped by 23% to $1.4 billion on strong growth in the aforementioned markets. Although this growth rate has slowed down relative to prior quarters, it is still solid overall.

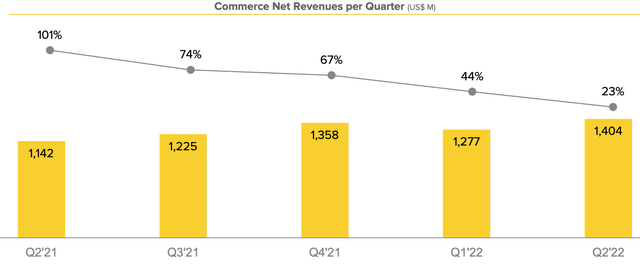

Commerce Net Revenue (Q2 Earnings Report)

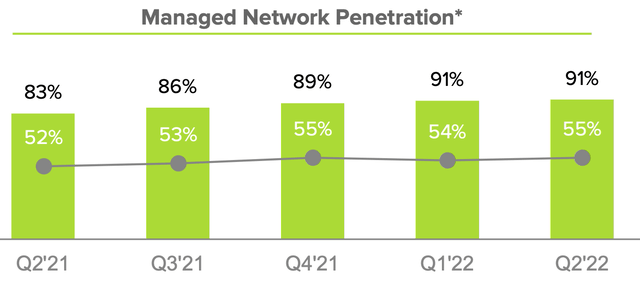

MELI has a vast logistics network (Mercado Envíos) which I believe gives the company a solid moat, against newer entries into the market. Over 264 million items were shipped via the network in Q2, with a network penetration of 91%, up 9% year over year but flat quarter over quarter. The company did see a 1% improvement in same day and next day delivery, which is now available across 55% of its network. Mercado Envíos Extra, which is the equivalent of the Amazon Delivery Service Partner (DSP) program, has “proven its operating model” according to the company and has already started to gain traction in Mexico.

Logistics (Q2 Earnings Report)

Fintech Engine

MercadoLibre’s Fintech segment consists of a variety of services such as a Digital Payment Network, Buy Now Pay Later (BNPL) services, pre-paid debit cards, P2P (Peer to Peer) payments and even Money Market Investment fund. Mercado even introduced a crypto wallet for Brazilian customers.

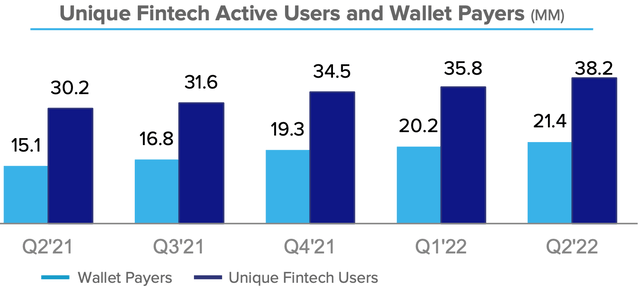

Unique Fin-tech users came in at 38.2 million, up 27% year over year.

Unique Fintech Users (Q2 Earnings Report)

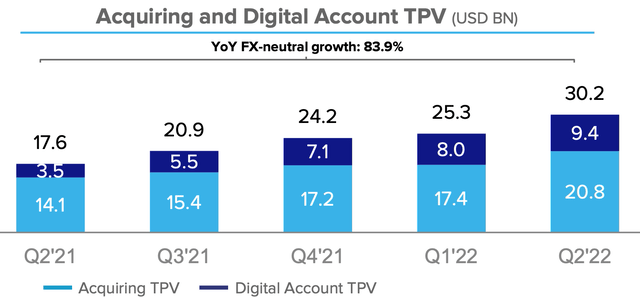

Acquiring TPV (Total Payment Volume), which includes the Marketplace (OnPlatform) and Merchant Services for Online Payments and affiliates, increased by a rapid 49% year over year to $20.8 billion. Digital accounts also expanded to $9.4 billion, up a blistering 169% year over year.

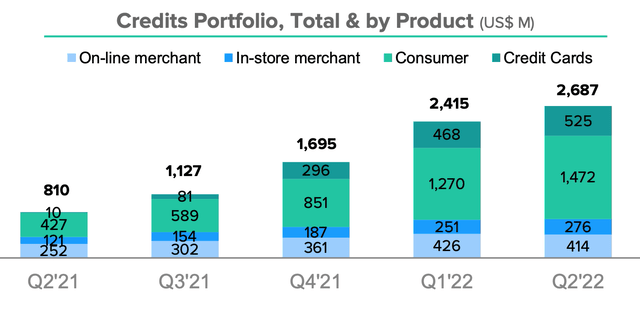

Mercado’s credit portfolio also showed strong growth from the “Consumer Book” subsegment, while the growth in credit cards started to slow down.

Meli Credit Portfolio (Q2 Earnings Report)

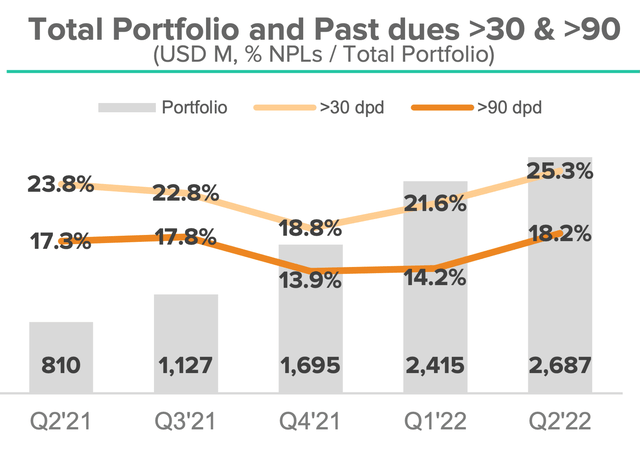

In my previous post, I highlighted an increase in “Non Performing Loans” as a risk to the company’s credit offering, especially as we enter a recessionary environment. This again started to increase with 25.3% of loans over 30 dpd (Days past due) and 18.2%, greater than 90 dpd (Days past due). However, again management reiterated this was due to a “product mix” from an increase in credit portfolio growth. This is not a major issue right now, but definitely a metric to keep an eye on.

Non Performing Loans (Q2 Earnings)

Consolidated Financials

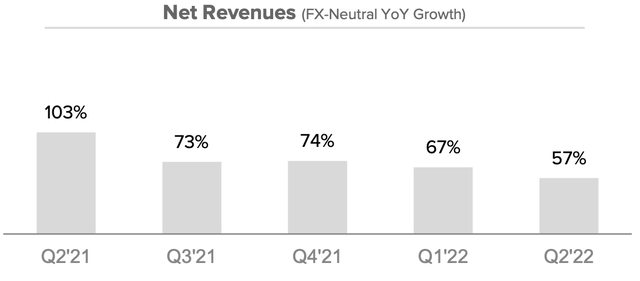

Bringing all the best segments together, consolidated net revenues were $2.6 Billion, up a rapid 53% year-over-year, or 57% on an FX neutral basis.

Net Revenue (Q2 22 Earnings Report)

Gross profit increased to $1.3 billion million dollars at a margin of 49.4%, which was 510bps higher than the 44.3% in the second quarter of 2021.

Operating expenses rose by 5.3pp to ~$1 billion, which was higher but not as bad as expected given the high inflation environment. The good news is the company has increased its efficiency in marketing spend which now is demonstrating operating leverage.

MELI’s operating margin was pretty much flat year-over-year, while its net income margin popped to 4.7%, higher than the 4% demonstrated in the same quarter last year.

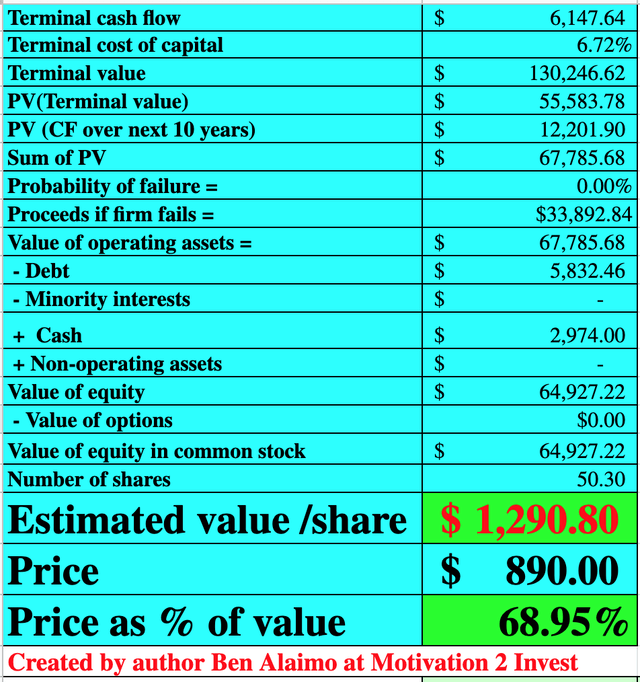

MercadoLibre is in a strong cash position, with $2.974 billion in cash and short-term investments. The company does have total debt of $4.9 billion, but this number may be skewed by the company’s credit portfolio, thus not a major issue right now.

Advanced Valuation

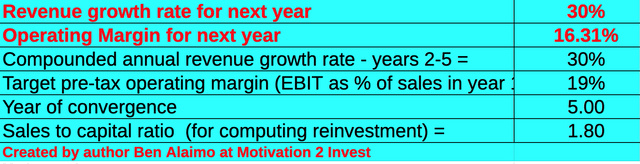

In order to value MercadoLibre, I have plugged the latest financial data into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted a conservative 30% revenue growth for next year and 30% for the next 2 to 5 years, which is lower than historic growth rates mentioned prior.

Meli Stock Valuation (Created by Author Ben at Motivation 2 Invest)

I have also forecasted the company’s margins to increase over the next 5 years, as the fintech portfolio grows and the company benefits from marketing spend efficiencies. Note, this operating margin also includes an adjustment for R&D expenses, which I have capitalized.

MercadoLibre (Created by Author Ben at Motivation 2 Invest)

Given these factors, I get a fair value for MELI of $1290/share, and the share price is $890 at the time of writing. Thus, the stock is ~30% undervalued. As the Father of Value investing Benjamin Graham would say, “intrinsic value can be elusive,” and thus my expectations are slightly higher now that the company is performing well. This value is predicated on the company growing at a 30% CAGR over the next 5 years, which is not impossible but still makes this a “Growth Stock.”

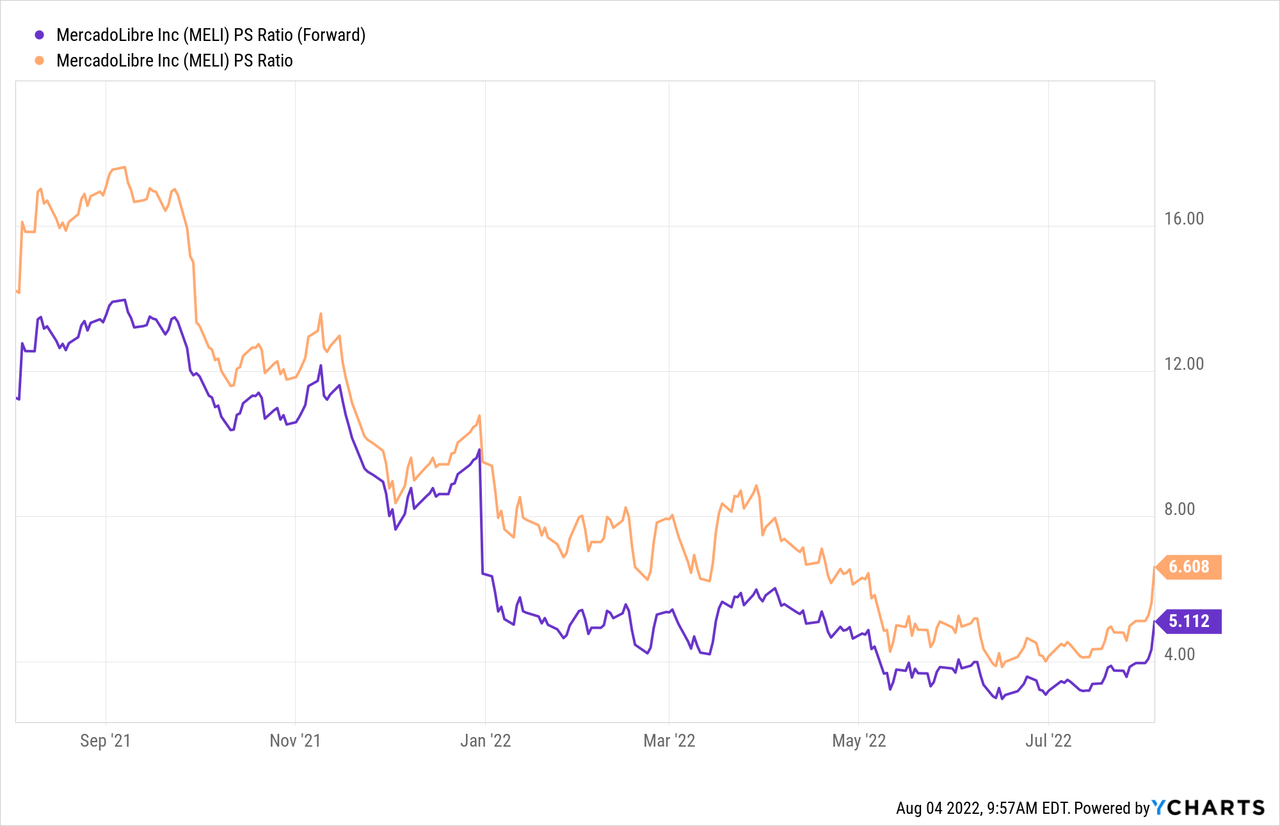

As an extra data point, MercadoLibre is trading at a Price to Sales (FWD) = 4.34 which is 61% cheaper than its 5-year average of 11.14.

Risks

Stagflation in Latin America

We all know inflation is bad in the U.S. and Europe, but Latin America is on another level. Argentina is currently firefighting an eye-watering 60% inflation rate, with an “iPhone reportedly costing months of rent,” according to Bloomberg. Argentina’s central bank has recently raised interest rates as they try to curb this enthusiasm. In addition, the IMF has forecasted slowing growth in Latin America with just 0.8 percent for Brazil in 2022, down from the 4.6% generated in 2021. Deloitte also forecasts the two largest economies, Brazil and Mexico, will underperform in 2022, as their growth is expected to be 0.7% and 1.8%, respectively. A scenario of low growth and high inflation is called “stagflation” and isn’t good for any business or consumer. Especially those in Ecommerce and Fintech. MercadoLibre’s non-performing loans will definitely be a figure to watch as the company navigates through this uncertainty.

Final Thoughts

MercadoLibre is truly the Amazon of Latin America, but instead of a thriving cloud business, the company has a Fintech growth engine. The company’s vast logistics network should act as a competitive advantage and help to keep competitors such as Shopee (SE) at bay. The stock price has responded positively on a strong quarter but is still undervalued. However, the increased inflation and forecasted slowing growth in Latin America could be a concern. Also, if you’re thinking of buying the stock now, you may wish to check the technicals, as usually stocks tend to pull back after a major bull run. Either way, MercadoLibre looks like a great long-term investment on the future of Ecommerce and Fintech in Latin America.

Be the first to comment