megaflopp/iStock via Getty Images

Thesis

A large part of my career involved high-tech R&D and consulting. And a fascinating topic always involves the so-called 10/10 rule, and especially, the exceptions to the rule. Breaking the rule probably is every high-tech R&D team’s dream in my experience. We may feel that technology innovation is accelerating and there are some truths to the feelings – in terms of the NUMBER of new technologies emerging every year (or even every quarter). But if you look a bit deeper, you will find that the PACE most innovations have followed and are still following the 10/10 rule: 10 years to build and another 10 years to find a mass audience. And here we are talking about innovations that are “obviously” earthshaking (that is, from hindsight) such as cell phones, personal computers, the internet, GPS, et al.

Next, we will see that Tesla, Inc. (NASDAQ:TSLA), no matter how disruptive it appears, is no exception so far. TSLA was founded in 2003 (19 years ago) and unveiled its first marketable products (if you consider their first Roadster a marketable product) back in 2006~2008. And it’s still debatable at this point whether TSLA electric vehicles (“EVs”) find the mass market penetrating yet.

However, the main thesis here is to consider the possibility for Tesla to deviate from the law going forward. I see areas (especially autonomous driving and robotics) where TSLA shares very fundamental similarities with YouTube (GOOG, GOOGL), the textbook exception to the 10/10 rule.

Tesla has obeyed the 10/10 rule so far

Here I am going to provide a brief timeline of Tesla’s history. Interested readers can find plenty of details on the Internet and most of my facts came from this link. TSLA was founded 19 years ago in 2003 by Martin Eberhard and Marc Tarpenning. Musk joined the company in 2004 with an investment of $30 million and became the chairman. Its original vision was to build an entirely EV sports car: the Roadster. And they successfully unveiled the prototype in 2006 and went for production in 2008.

So, it took TSLA alone about 5 years to develop the Roadster. But if you consider the time that others spent developing EVs before TSLA (e.g., General Motor successfully produced an all-EV car, EV1, during 1996 – 1999), the development time is safely longer than a decade. Of course, we all know that 14 years later, Roadster is still not finding a mass market – to say the least.

Also 14 years ago in 2008, TSLA decided to switch gears and focus on the Model S sedan, which arguably began the history of TSLA as we know it today. Things happened at a faster pace after that. Musk took over the business, TLSA went public in 2010, the company unveiled a prototype model S in 2011, and the car went into full production in 2012.

So 2022, give or take 1 year, marks exactly the 10th year of the new TSLA. And with TSLA’s market share, my opinion is that it is safe to say the TSLA has obeyed the 10/10 so far.

The exception to the rule – YouTube

Of course, the only reason we study any rule at all is in the hope to break it.

And YouTube is the textbook example (it is not just a figure of speech – YouTube has been included as case studies in textbooks) that broke the rule.

A super-brief recap of the case here. The three founders (Hurley, Chen, and Karim) raised less than $10 million and started YouTube in 2025. Within TWO years, YouTube was one of the top-ten most visited sites on the Web – safe to say that it has found a mass market. So here we have an exception beyond any doubt – it took YouTube only about 2 years, instead of the 20 stated in the 10/10 rule, to develop a product and also find a mass market.

So how did YouTube do it and why is it relevant to TSLA?

Reasons why Tesla could be another exception too

First and foremost, all the infrastructure was ready for YouTube in 2005. Therefore, it bypassed all the hardware development and accelerate both development and mass adaptation. Second, YouTube focused on software (or platform or network using the more popular and encompassing terminology nowadays). Therefore, it bypassed the production ramp-up phase (and most of the associated logistics such as inventory, sales, et al). Third, as a platform, it enjoys a superliner growth curve due to the network/platform effects. Every additional user or content creator on YouTube makes it more valuable, therefore creating a stronger draw to pull new users in.

TSLA has been obeying the 10/10 rule so far because it has none of the above traits so far. EV infrastructures (such as charging stations or even service shops) have to be built from scratch. It is a hardware business, and it has been taking years for TSLA to build each one of the Giga factories. And lastly, I am not seeing the snowball growth curve – at least not so far. Unlike YouTube, the fact that my friend brought a TSLA does not make a TSLA more valuable for me.

Although there is potential that TSLA could soon enjoy all three traits above to some degree.

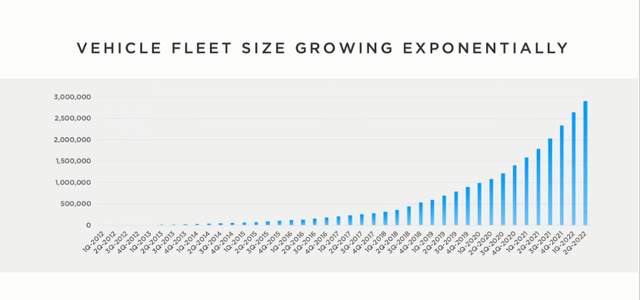

First, in the area of EVs itself, autonomous driving could create all three advantages that YouTube enjoyed. The technology is largely a platform/network and hence it bypasses all the limitations of hardware, and crucially important, it becomes more valuable as more users use it. For example, researchers at the Institute of Transportation at the University of California began to show that automated or semi-automated vehicles like those TSLA makes, when there are enough of them in operation, can lead to increased vehicle miles traveled (“VMT”). Musk said in the 2022 Annual Meeting of Stockholders (Thursday, August 4, 2022) that TSLA welcomed its 3 millionth car off the assembly line recently. Looking at the next 10 years, Musk believes that Tesla’s cumulative production of vehicles will reach 100 million.

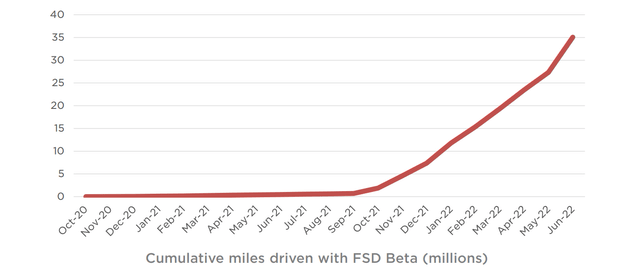

Meanwhile, Tesla’s autonomous driving technology is maturing and scaling up rapidly. As of Q2-2022, over 100,000 Tesla drivers in North America had access to Full Self-Driving Beta. And the accumulated miles driven by Full Self-Driving had been expanding exponentially and reached 35 million miles so far. Its autonomous driving technology, combined with this scale, could begin to accentuate the potency of the network/platform advantages.

TSLA 2022 shareholder meeting TSLA 2022 Q2 earnings report

Second, Tesla is not just a car company. Again, at the shareholder’s meeting, Musk stated that in the long run, the Optimus robot will be more valuable than its EVS business and will completely change the economy. Putting aside all the Musk marketing stunts, there are truths to this statement because, again, the robot business enjoys all three traits YouTube enjoyed – infrastructures are more mature, largely a software/platform, and more valuable with more users. Musk expected the humanoid robot will go into production and be available in 2023. The robot business could be an exception to the 10/10 rule, show an accelerated timescale, and cancel off Musk’s habitual underestimates of time.

Final thoughts and risks

In summary, for TSLA’s EV production and delivery, my view is that it has followed and will keep following the 10/10 rule. However, in other areas, I see the potential for it to accelerate its pace and reach a mass audience more quickly. These areas include its autonomous driving technology and Optimus robot. Both enjoy some or all of the key traits that YouTube enjoyed (more mature existing infrastructure, software- or platform-oriented, and increasing value with an increasing number of users).

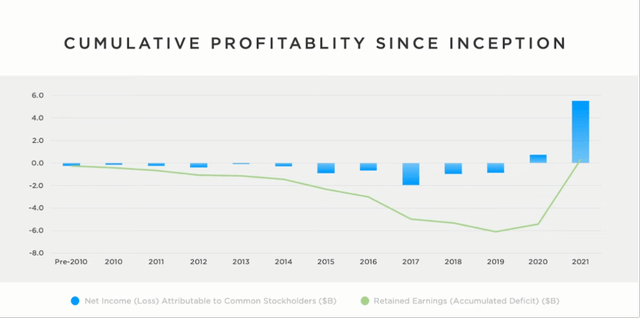

Finally, risks. The above analysis is all for the longer term, not the near term. In the near term, TSLA has just started “making more money than it spends” as Musk joked during the shareholder meeting. As you can see, the cumulative profit only turned positive in 2020 and is less than $6B, really a pocket change for a company with an almost $1T valuation. As such, TSLA’s current valuations are quite expensive and imply years of perfect growth. Furthermore, inflation, epidemic, and supply chain issues kept impacting its near-term profitability. These factors pressured its profit margin (gross margin in Q2 2022 declined to 27.9% from about 30% a quarter ago).

Be the first to comment